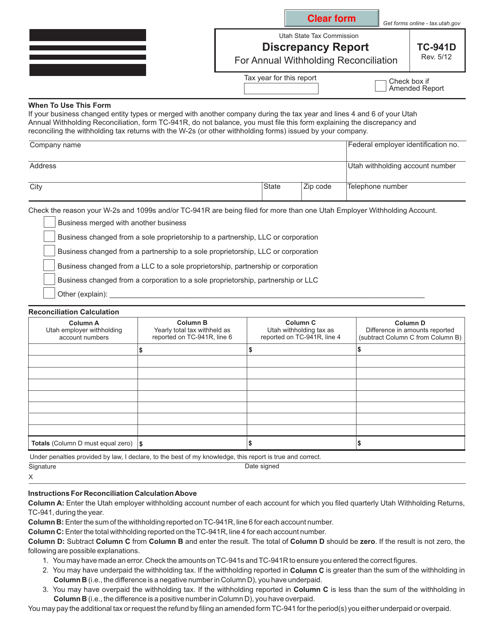

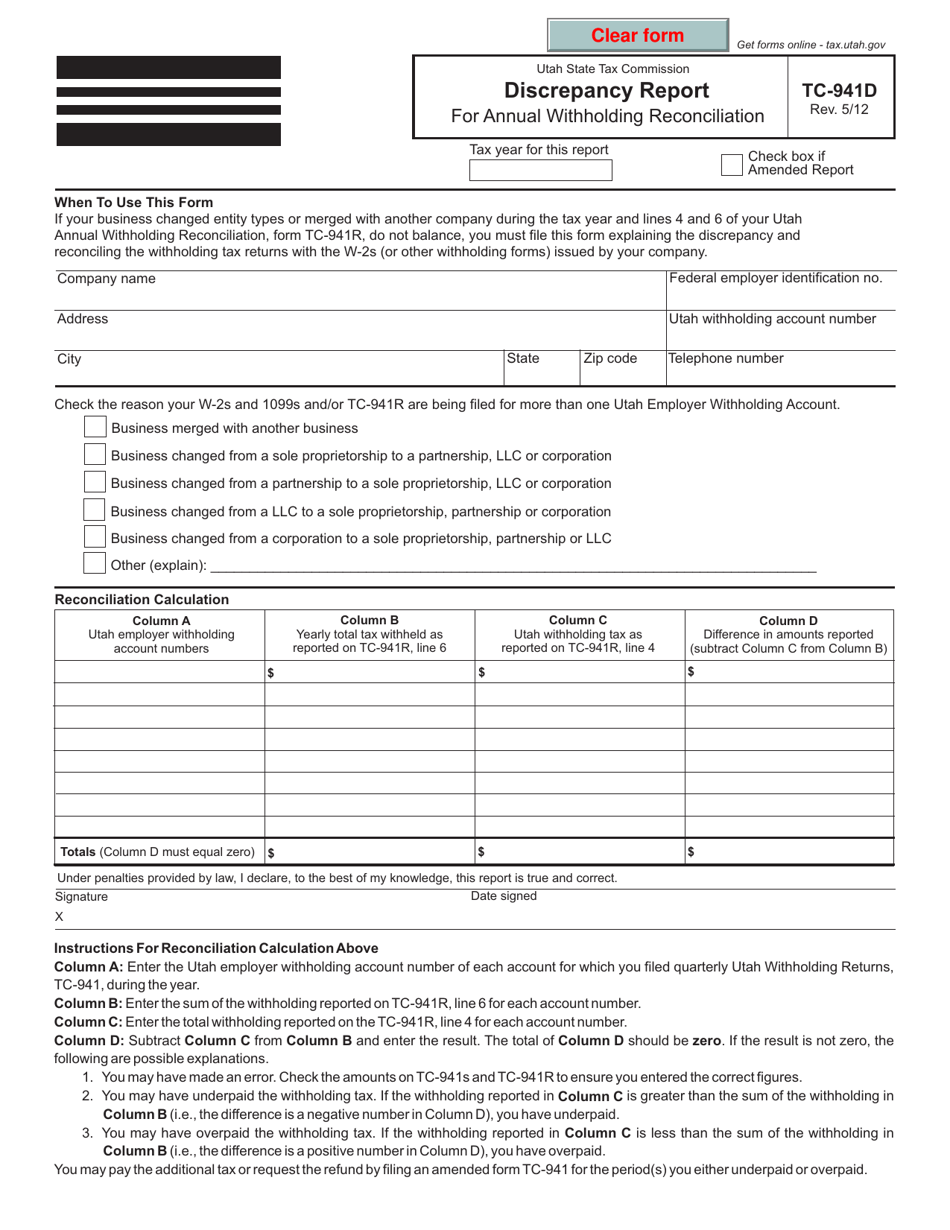

Form TC-941D Discrepancy Report for Annual Withholding Reconciliation - Utah

What Is Form TC-941D?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-941D?

A: Form TC-941D is the Discrepancy Report for Annual Withholding Reconciliation for the state of Utah.

Q: What is the purpose of Form TC-941D?

A: The purpose of Form TC-941D is to report any discrepancies found during the annual withholding reconciliation process in Utah.

Q: Who needs to file Form TC-941D?

A: Employers in Utah who have discovered any discrepancies in their annual withholding reconciliation must file Form TC-941D.

Q: When does Form TC-941D need to be filed?

A: Form TC-941D must be filed by the last day of February following the calendar year in which the discrepancies were discovered.

Q: Are there any penalties for not filing Form TC-941D?

A: Yes, failure to file Form TC-941D or filing it late may result in penalties imposed by the Utah State Tax Commission.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-941D by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.