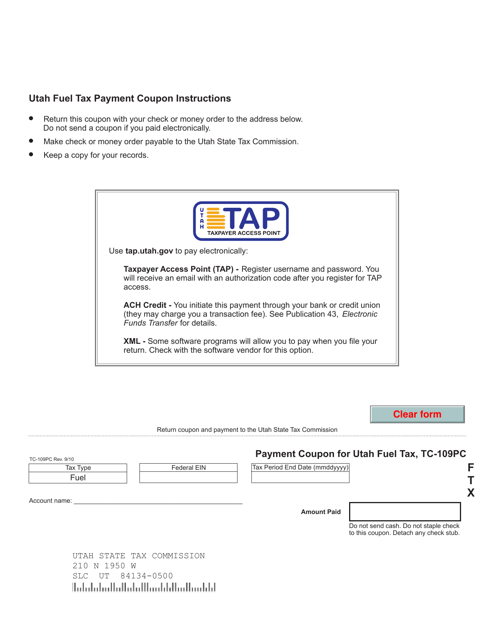

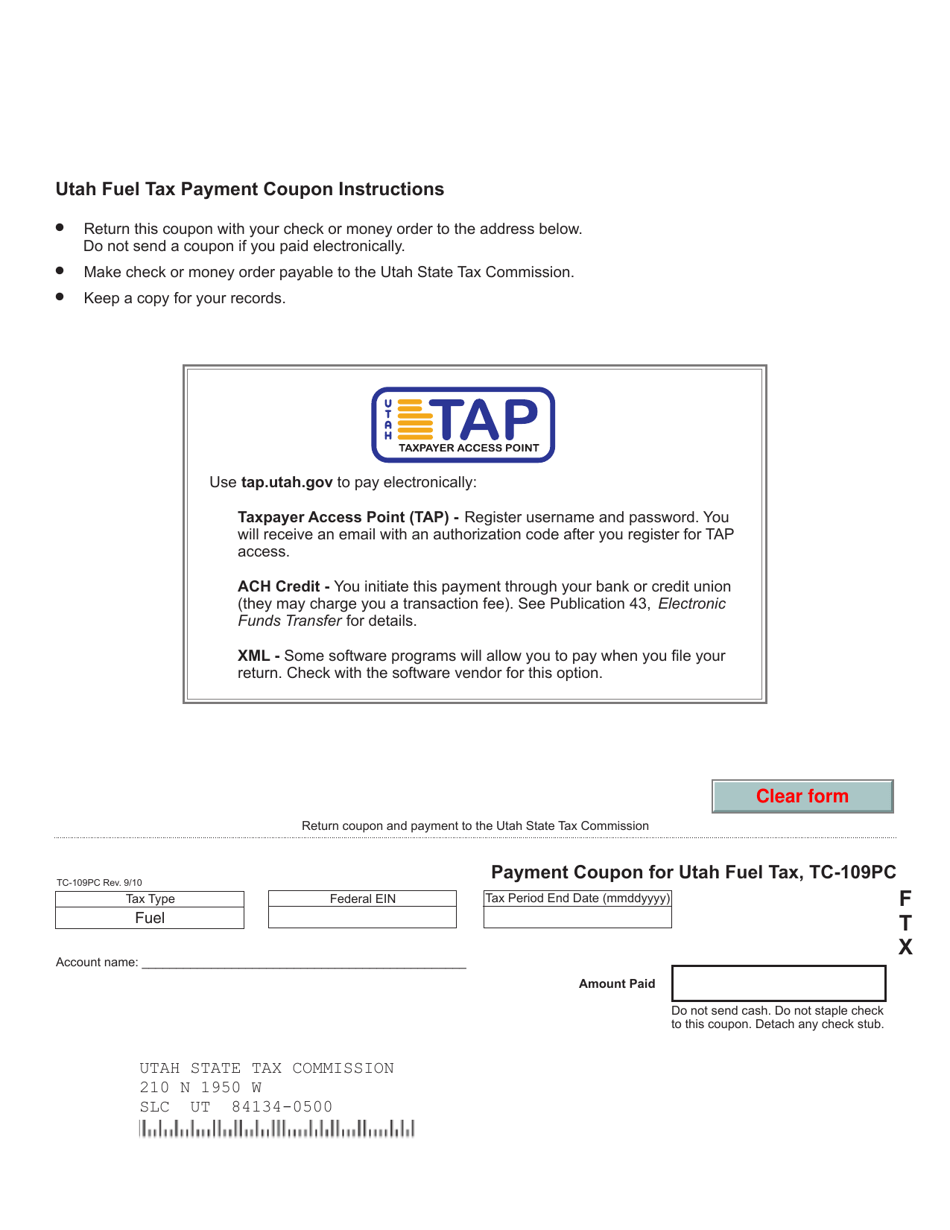

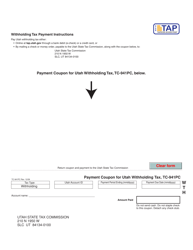

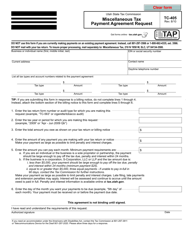

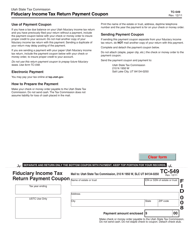

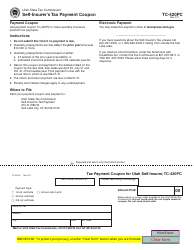

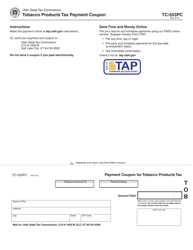

Form TC-109PC Payment Coupon for Utah Fuel Tax - Utah

What Is Form TC-109PC?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TC-109PC?

A: The Form TC-109PC is a payment coupon specifically used for Utah Fuel Tax.

Q: What is the purpose of the Form TC-109PC?

A: The purpose of the Form TC-109PC is to make payments for Utah Fuel Tax.

Q: Who needs to use the Form TC-109PC?

A: Anyone who is liable for paying Utah Fuel Tax is required to use the Form TC-109PC.

Q: How do I fill out the Form TC-109PC?

A: You need to provide your account number, reporting period, and payment information on the Form TC-109PC.

Q: When is the deadline for submitting the Form TC-109PC?

A: The deadline for submitting the Form TC-109PC depends on the reporting period and is specified by the Utah State Tax Commission.

Q: Are there any penalties for late submission of the Form TC-109PC?

A: Yes, late submission of the Form TC-109PC may result in penalties imposed by the Utah State Tax Commission.

Q: What should I do if I have questions or need assistance with the Form TC-109PC?

A: If you have any questions or need assistance with the Form TC-109PC, you can contact the Utah State Tax Commission for support.

Form Details:

- Released on September 1, 2010;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-109PC by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.