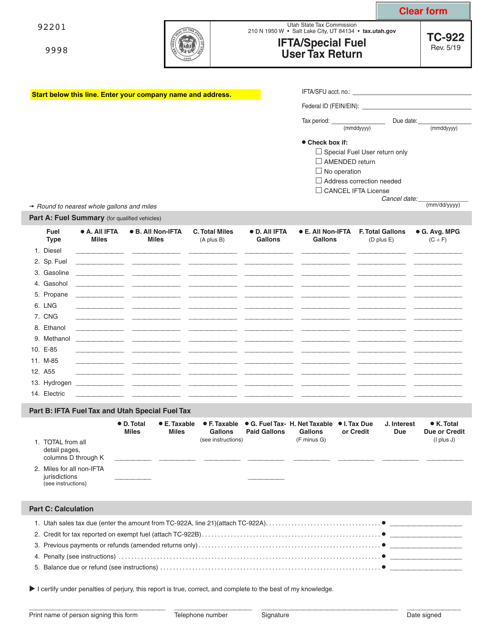

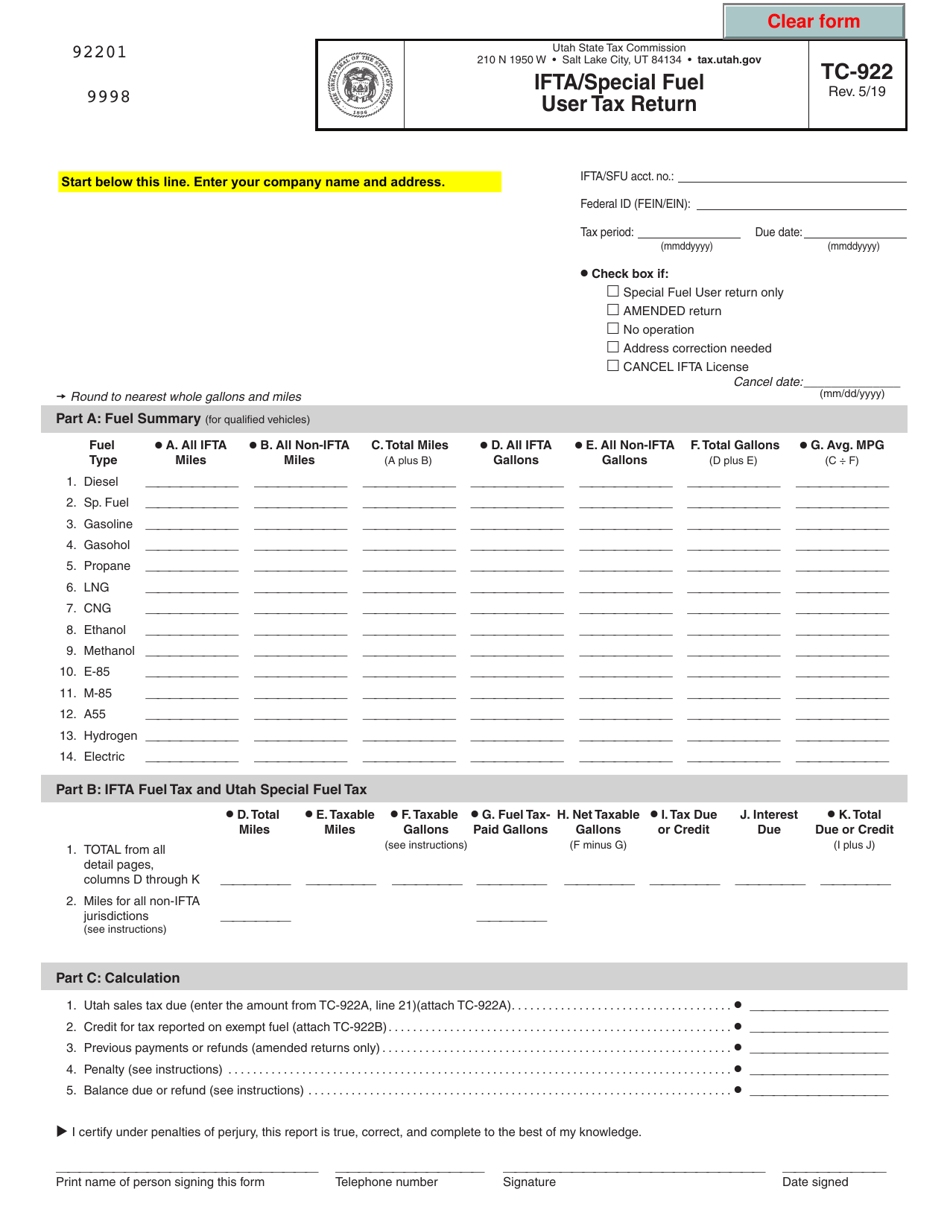

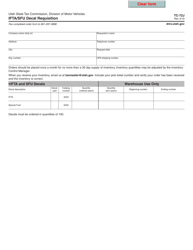

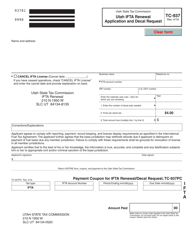

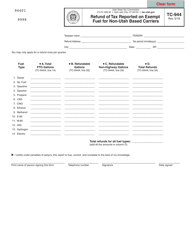

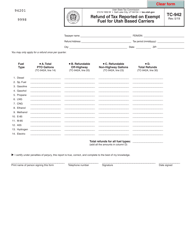

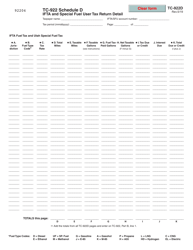

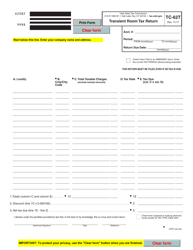

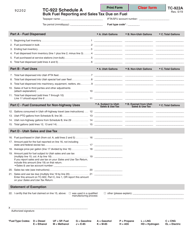

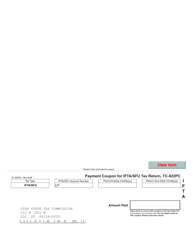

Form TC-922 Ifta / Special Fuel User Tax Return - Utah

What Is Form TC-922?

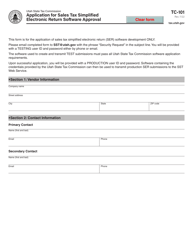

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form TC-922?

A: Form TC-922 is the IFTA/Special Fuel User Tax Return for Utah.

Q: What is IFTA?

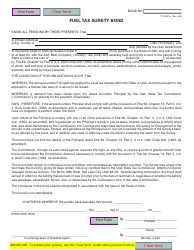

A: The International Fuel Tax Agreement (IFTA) is an agreement among US states and Canadian provinces that governs the reporting and payment of fuel taxes by motor carriers operating in multiple jurisdictions.

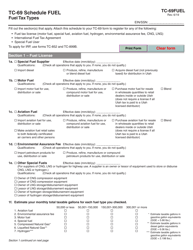

Q: What is Special Fuel User Tax?

A: Special Fuel User Tax is a tax imposed on the consumption, sale, or use of special fuels such as diesel fuel and alternative fuels.

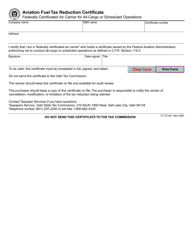

Q: Who needs to file Form TC-922?

A: Motor carriers who operate qualified motor vehicles in Utah and are subject to the IFTA/Special Fuel User Tax requirements need to file Form TC-922.

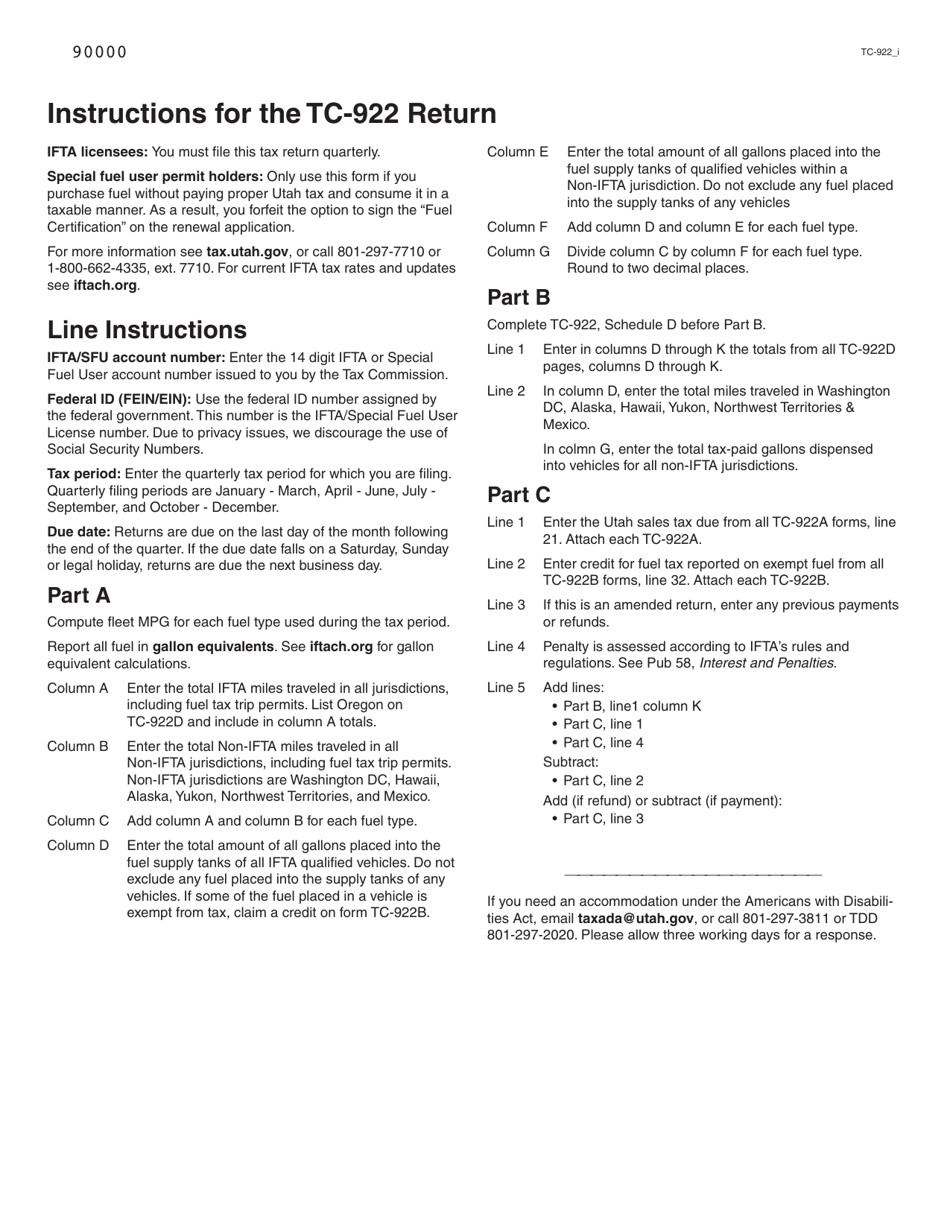

Q: When is Form TC-922 due?

A: Form TC-922 is due quarterly, on the last day of the month following the end of the quarter.

Q: What information is required on Form TC-922?

A: Form TC-922 requires detailed information about the motor carrier's miles traveled, gallons of fuel consumed, and taxes paid in each participating jurisdiction.

Q: Are there any penalties for late or incorrect filing of Form TC-922?

A: Yes, penalties and interest may be imposed for late or incorrect filing of Form TC-922. It is important to file the form accurately and on time to avoid these penalties.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-922 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.