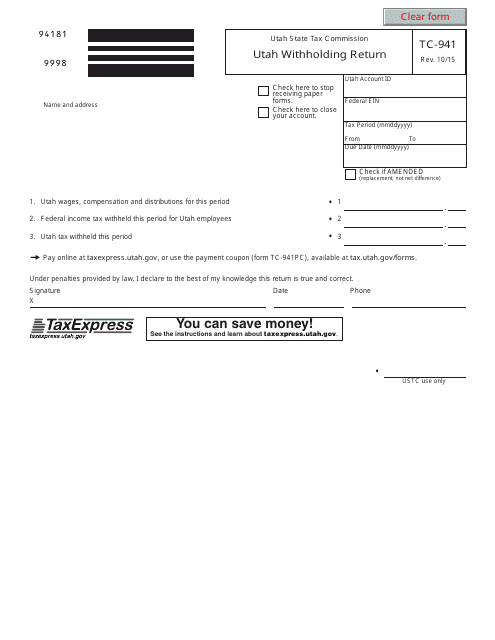

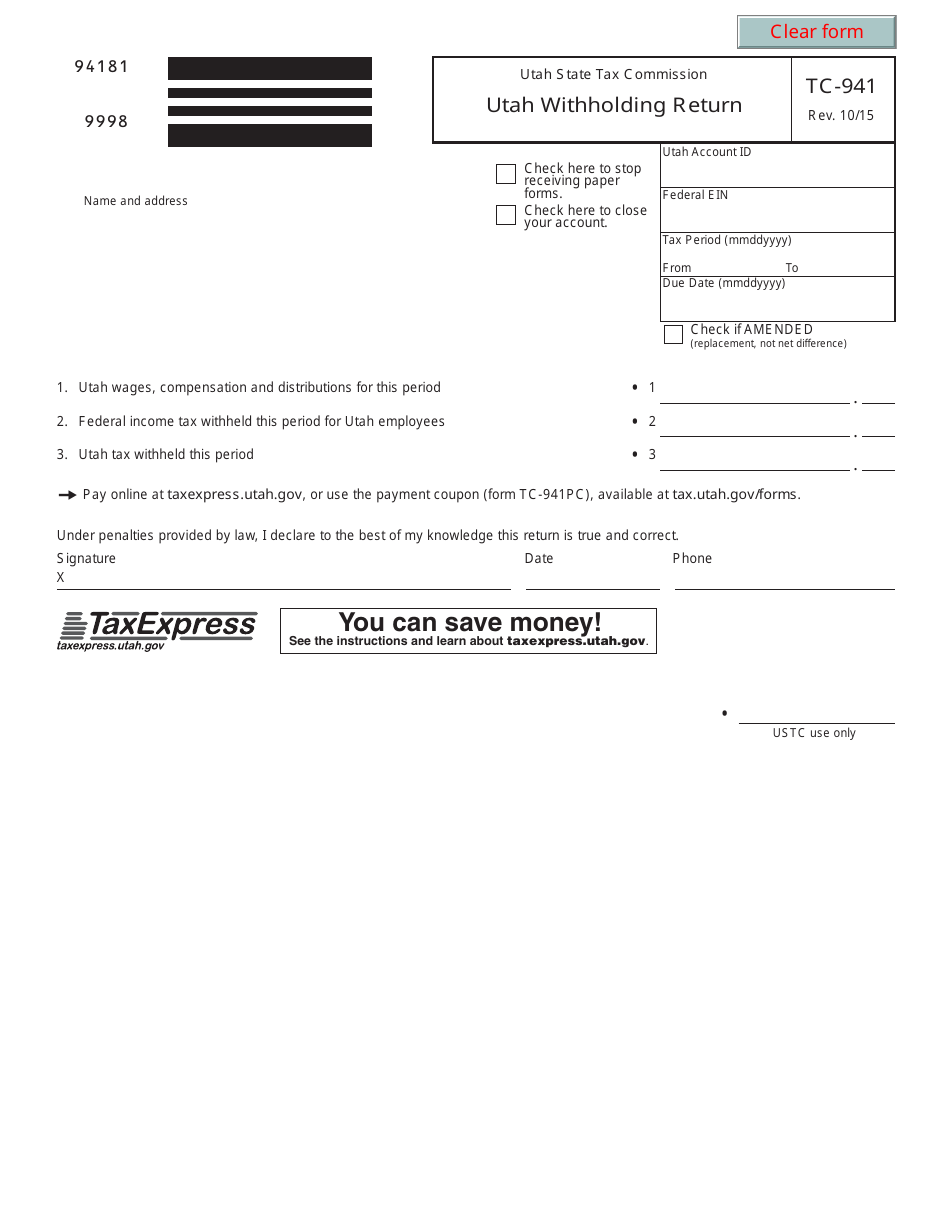

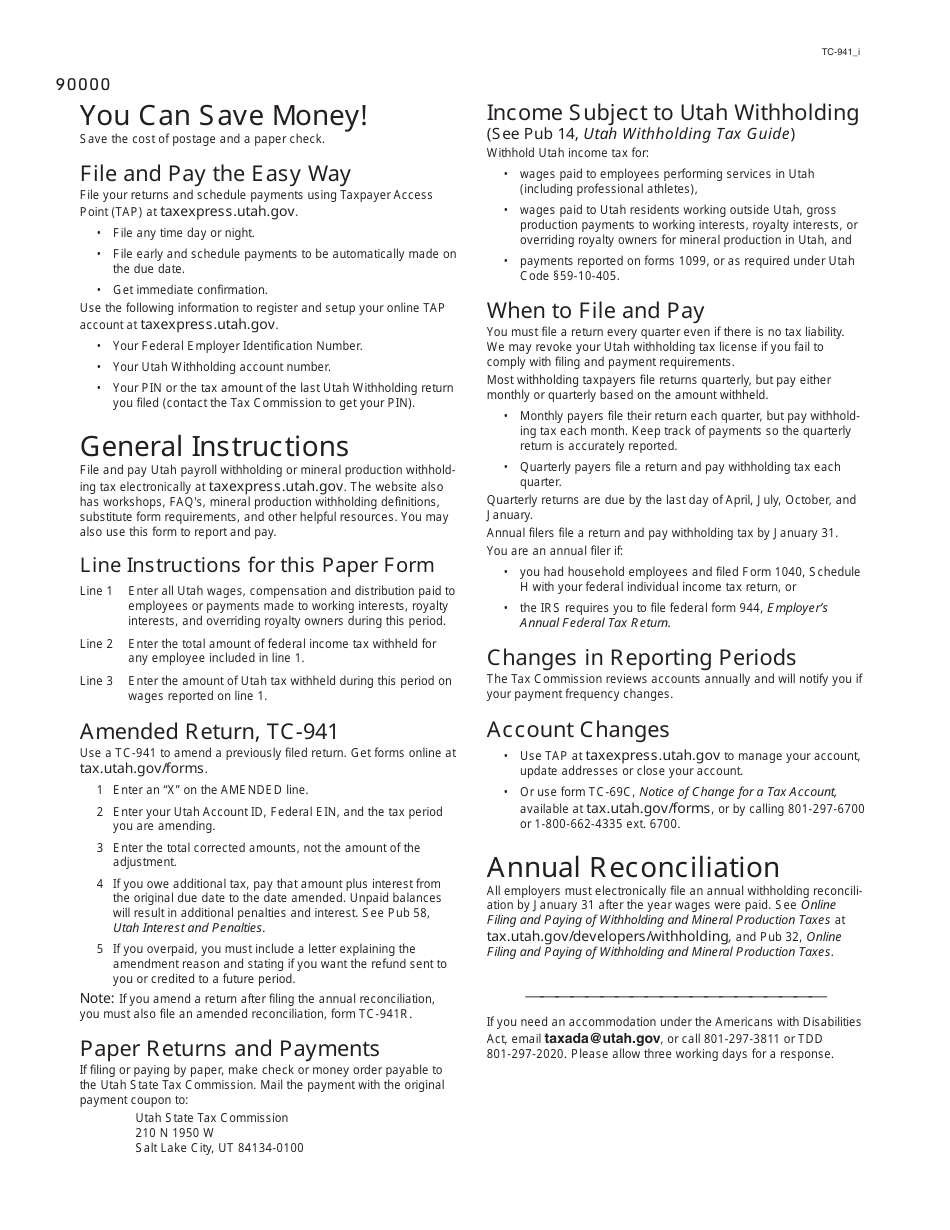

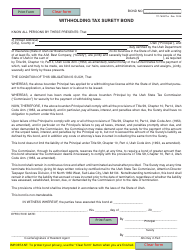

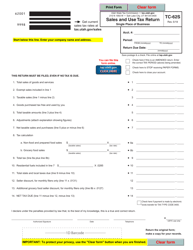

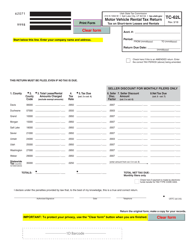

Form TC-941 Utah Withholding Return - Utah

What Is Form TC-941?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TC-941?

A: Form TC-941 is the Utah Withholding Return.

Q: Who needs to file Form TC-941?

A: Employers in Utah who have employees subject to income tax withholding must file Form TC-941.

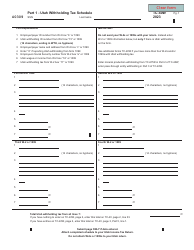

Q: What information is required on Form TC-941?

A: Form TC-941 requires employers to provide information about their business, including details about the employees and the amount of withholding tax.

Q: When is Form TC-941 due?

A: Form TC-941 is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

Q: Is there a penalty for not filing Form TC-941?

A: Yes, there is a penalty for not filing Form TC-941 or for filing it late. The penalty amount depends on the amount of tax due and the length of the delay in filing.

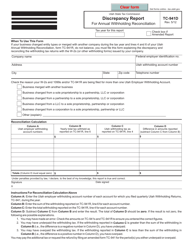

Q: What should I do if there are errors on my filed Form TC-941?

A: If you discover errors on a previously filed Form TC-941, you should file an amended return using Form TC-941X to correct the errors.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-941 by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.