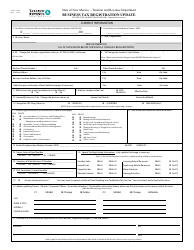

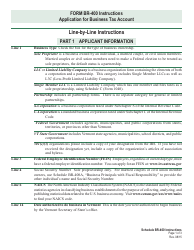

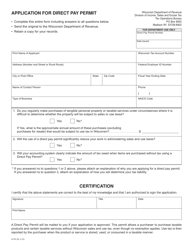

Instructions for Form BTR-101 Application for Wisconsin Business Tax Registration - Wisconsin

This document contains official instructions for Form BTR-101 , Application for Wisconsin Business Tax Registration - a form released and collected by the Wisconsin Department of Revenue.

FAQ

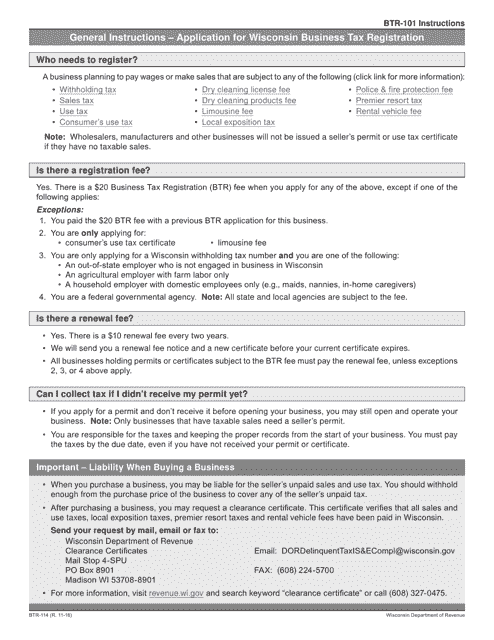

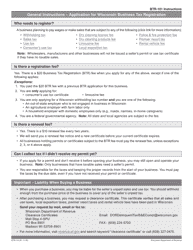

Q: What is Form BTR-101?

A: Form BTR-101 is the Application for Wisconsin Business Tax Registration, which is used to register your business for various tax purposes in Wisconsin.

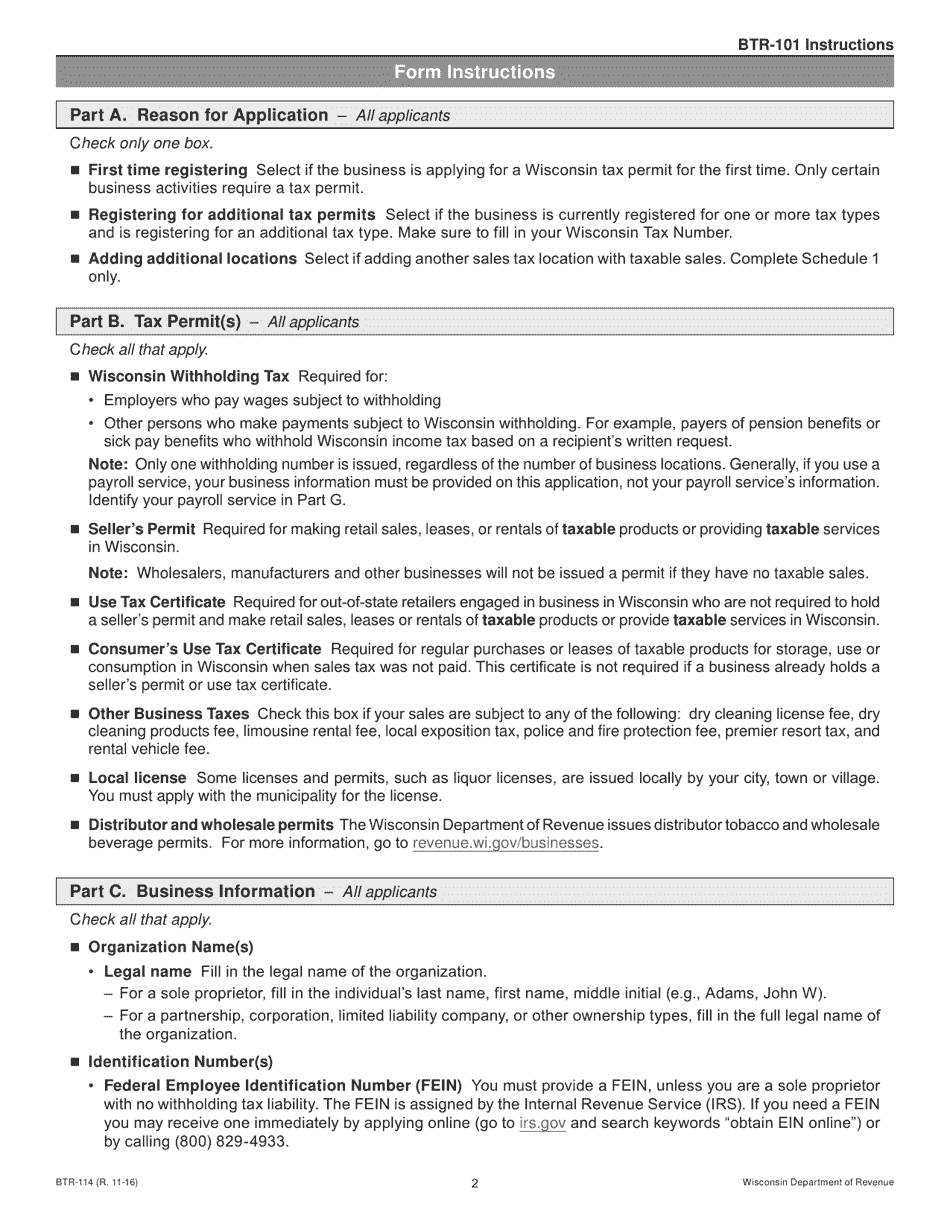

Q: Who should use Form BTR-101?

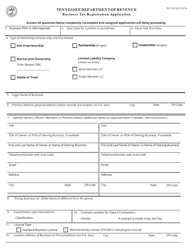

A: Form BTR-101 should be used by businesses that are required to register for taxes in Wisconsin, such as sales tax, use tax, withholding tax, and other taxes administered by the Wisconsin Department of Revenue.

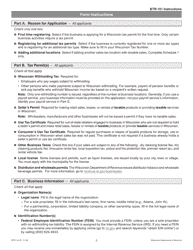

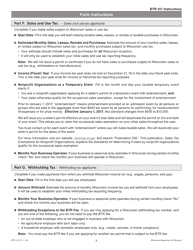

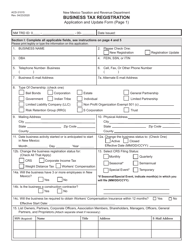

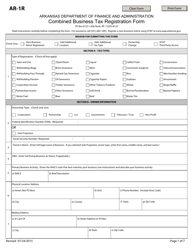

Q: What information is required on Form BTR-101?

A: Form BTR-101 requires information about your business, including the legal entity type, federal identification number, business name and address, and details about the nature of your business activities.

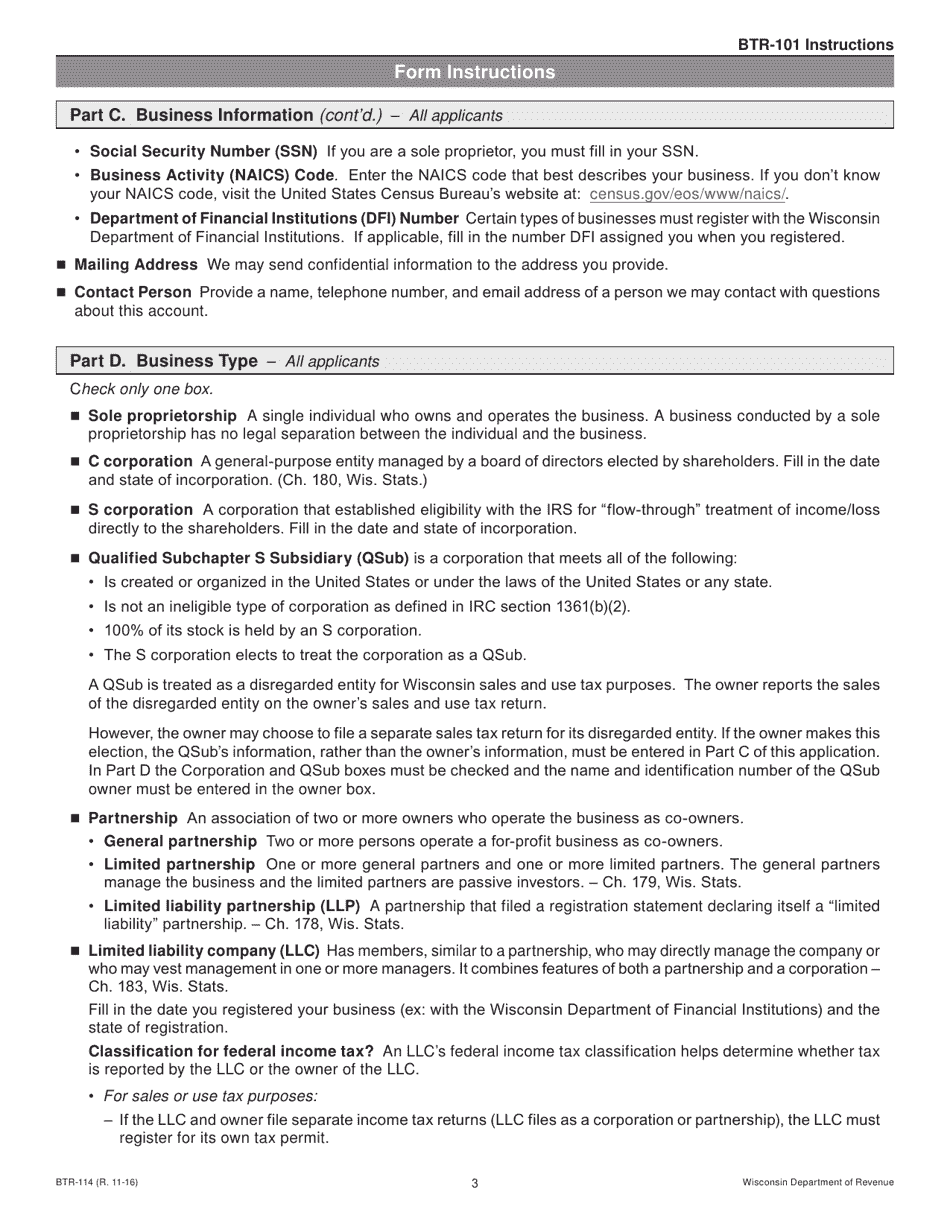

Q: Are there any fees associated with filing Form BTR-101?

A: There is no fee to file Form BTR-101. However, depending on your business activities, you may be required to pay various taxes and fees to the Wisconsin Department of Revenue.

Q: Are there any deadlines for filing Form BTR-101?

A: There is no specific deadline for filing Form BTR-101. However, you should register your business for tax purposes as soon as you start conducting business in Wisconsin.

Q: What happens after I file Form BTR-101?

A: After filing Form BTR-101, you will receive a Wisconsin tax registration number, which you will use to report and remit taxes to the Wisconsin Department of Revenue.

Q: Can I make changes to my business information after filing Form BTR-101?

A: Yes, you can make changes to your business information by submitting an amended Form BTR-101 to the Wisconsin Department of Revenue.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.