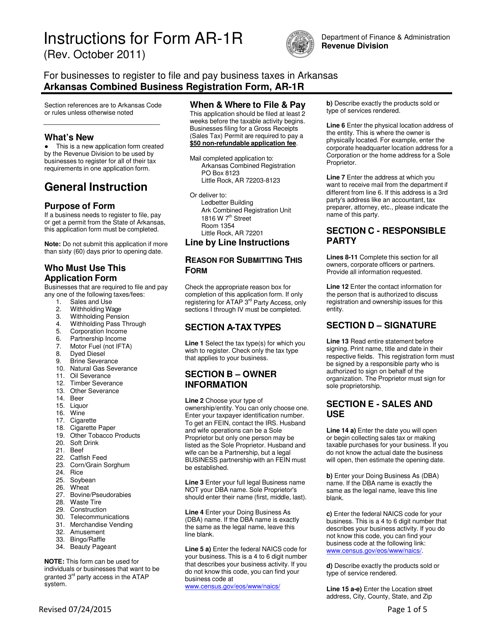

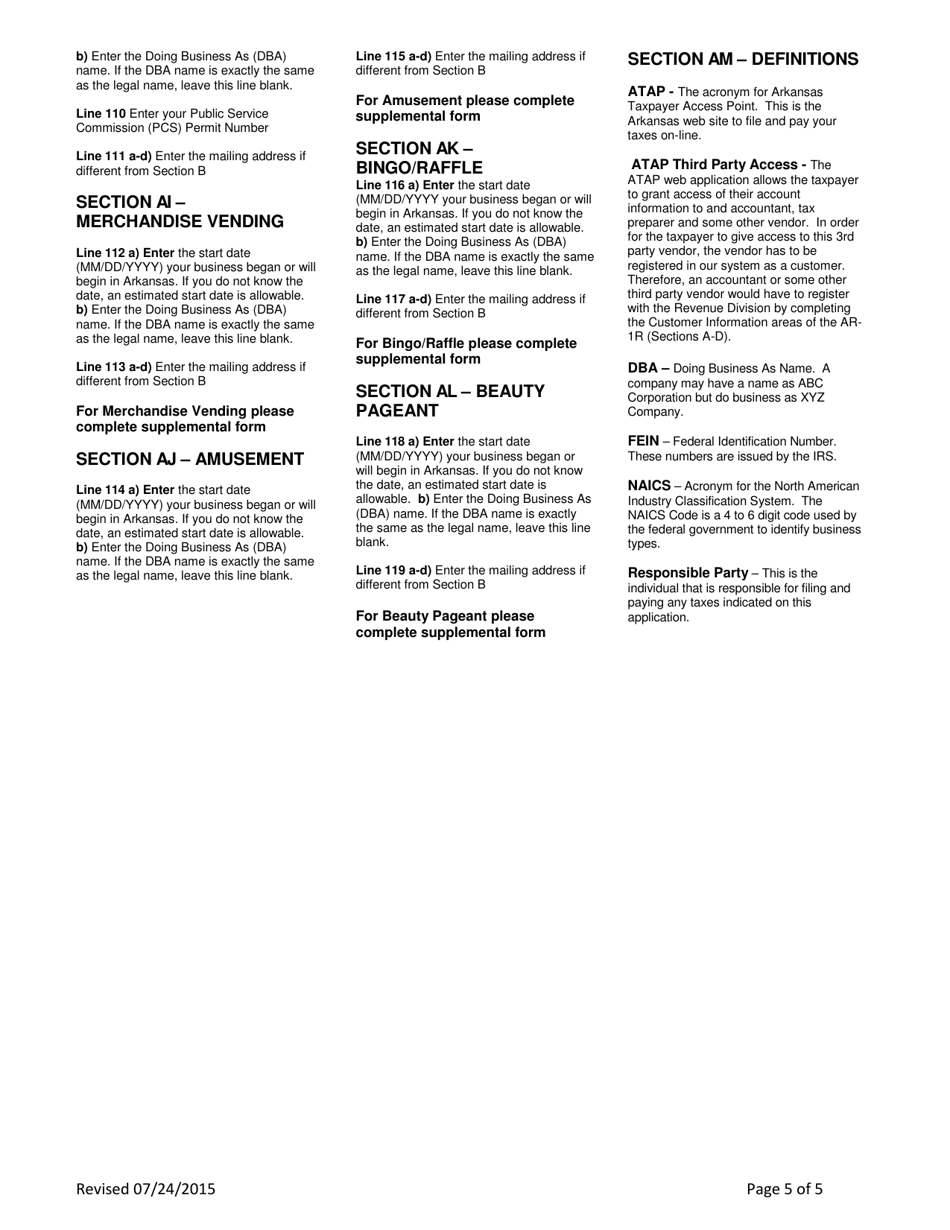

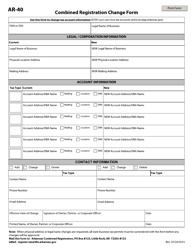

Instructions for Form AR-1R Combined Business Tax Registration Form - Arkansas

This document contains official instructions for Form AR-1R , Combined Business Tax Registration Form - a form released and collected by the Arkansas Department of Finance & Administration. An up-to-date fillable Form AR-1R is available for download through this link.

FAQ

Q: What is Form AR-1R?

A: Form AR-1R is the Combined Business Tax Registration Form for businesses in Arkansas.

Q: Who needs to file Form AR-1R?

A: Any business that is starting or expanding its operations in Arkansas needs to file Form AR-1R.

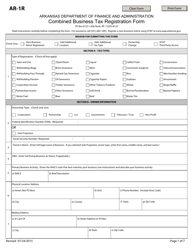

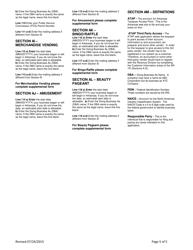

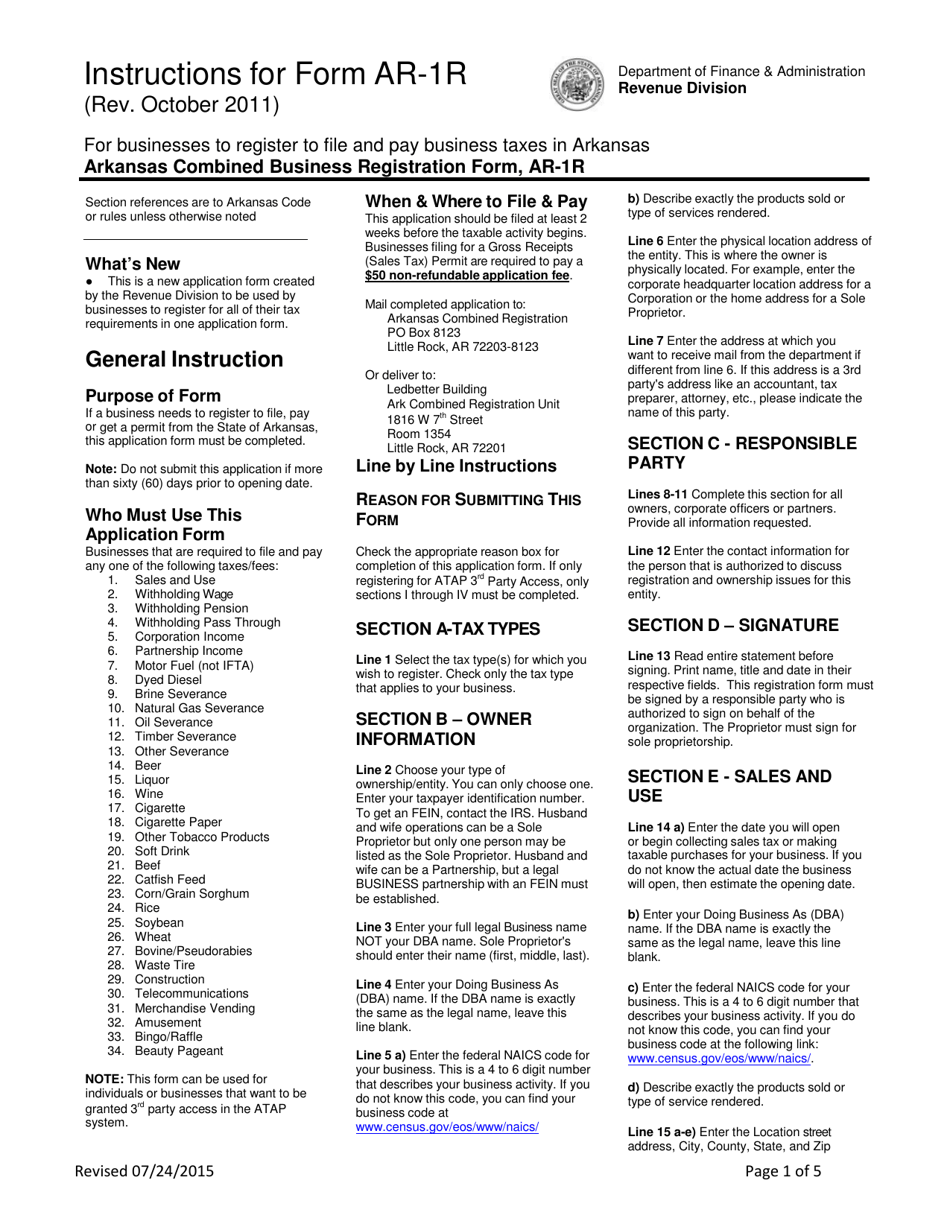

Q: What information is required on Form AR-1R?

A: Form AR-1R requires information about the business entity, owners, location, and other details related to the business operations.

Q: When is the deadline to file Form AR-1R?

A: Form AR-1R should be filed within 30 days of starting or expanding your business operations in Arkansas.

Q: Are there any fees associated with filing Form AR-1R?

A: No, there are no fees associated with filing Form AR-1R.

Q: What other tax registrations may be required in Arkansas?

A: Depending on your business activities, you may need to register for additional taxes such as sales tax, withholding tax, or unemployment tax.

Q: What happens after I file Form AR-1R?

A: After filing Form AR-1R, you will receive a Taxpayer Identification Number (TIN) and any other relevant tax registration information for your business in Arkansas.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arkansas Department of Finance & Administration.