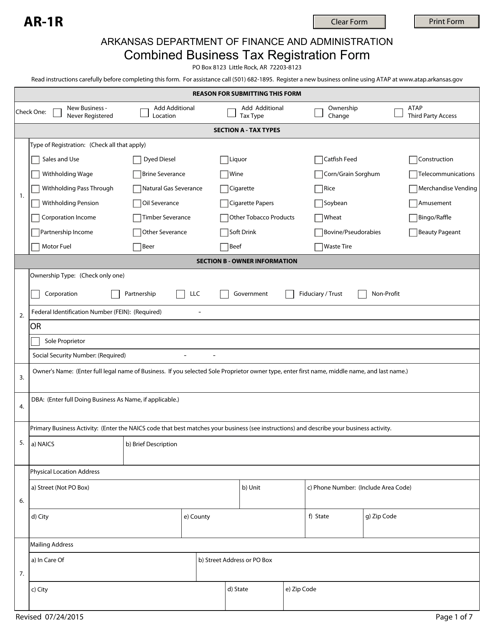

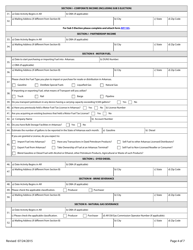

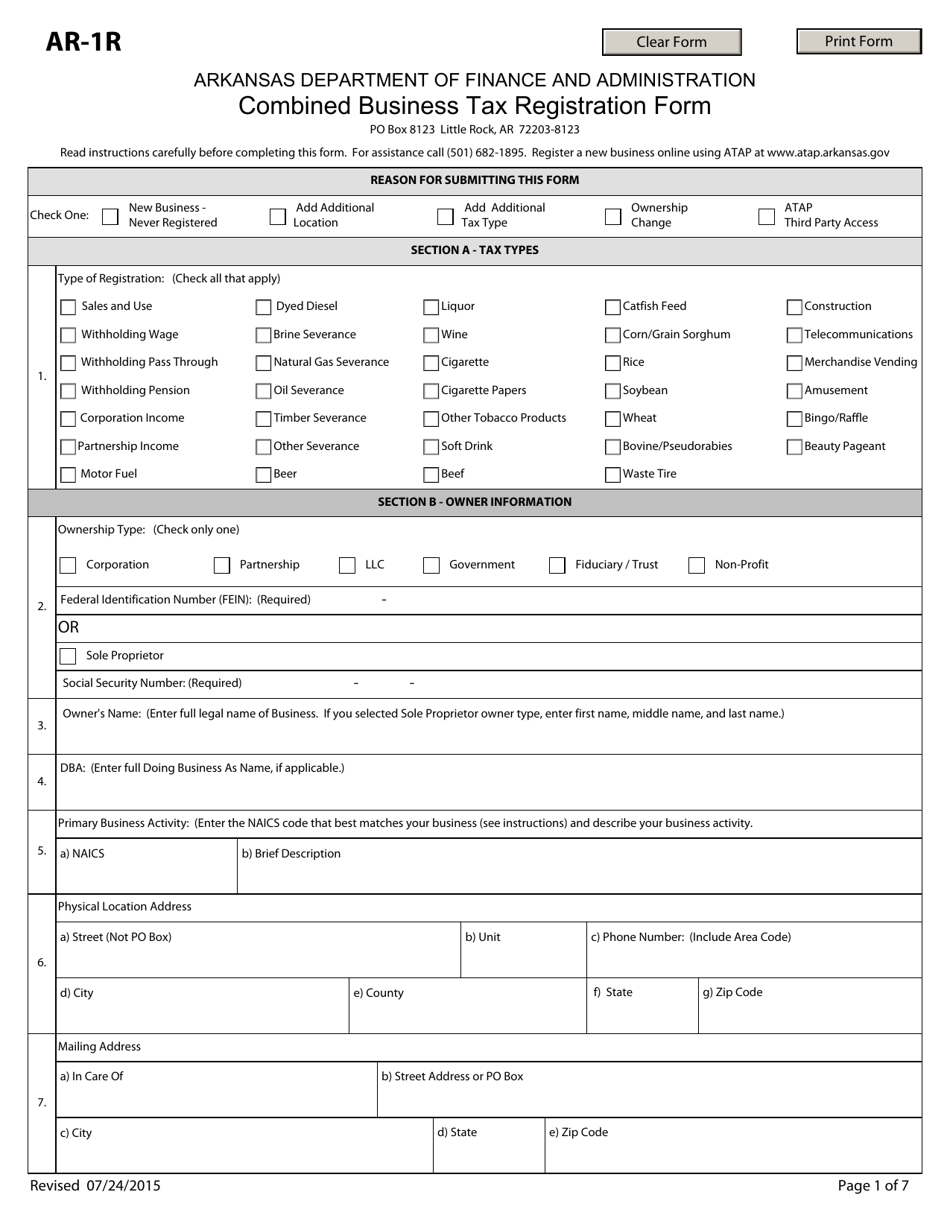

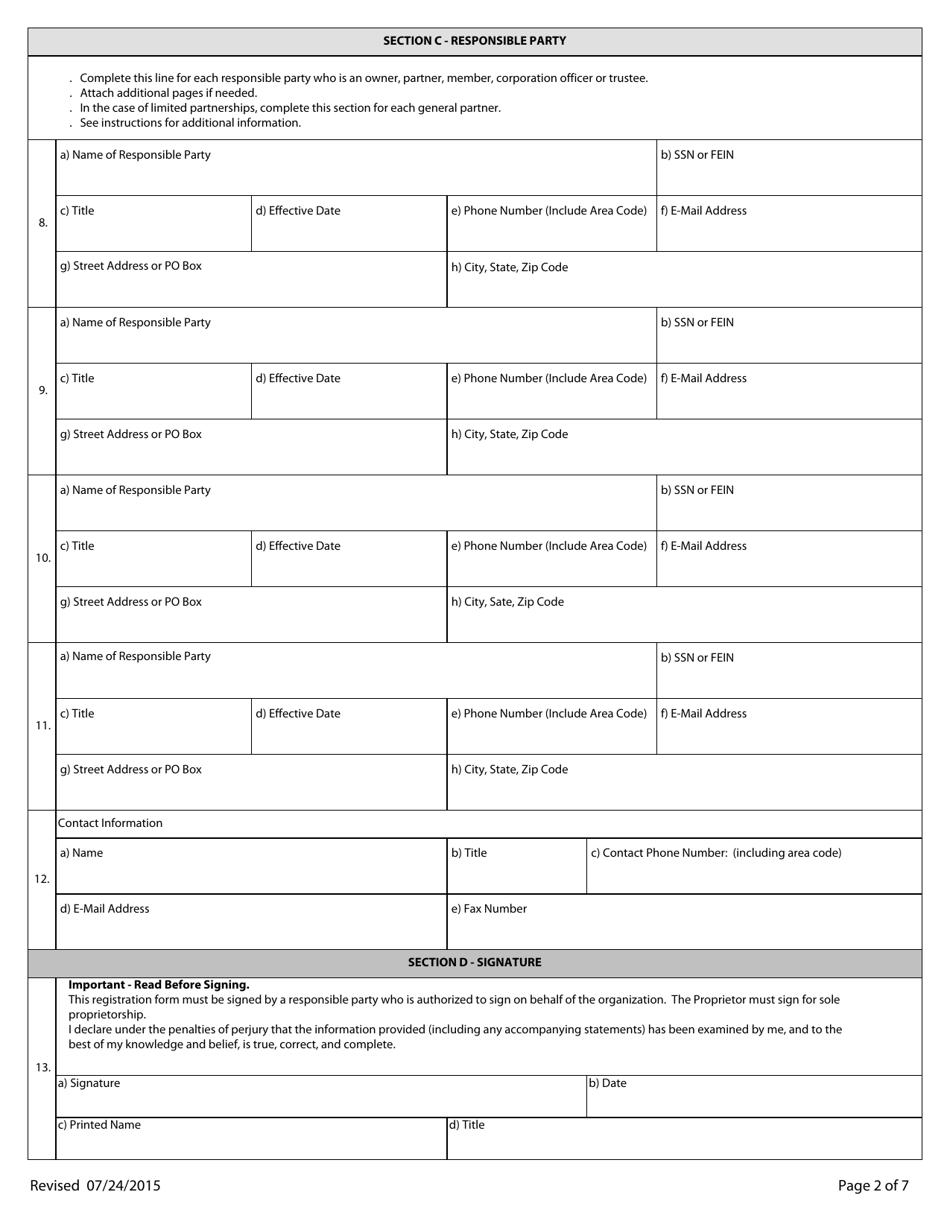

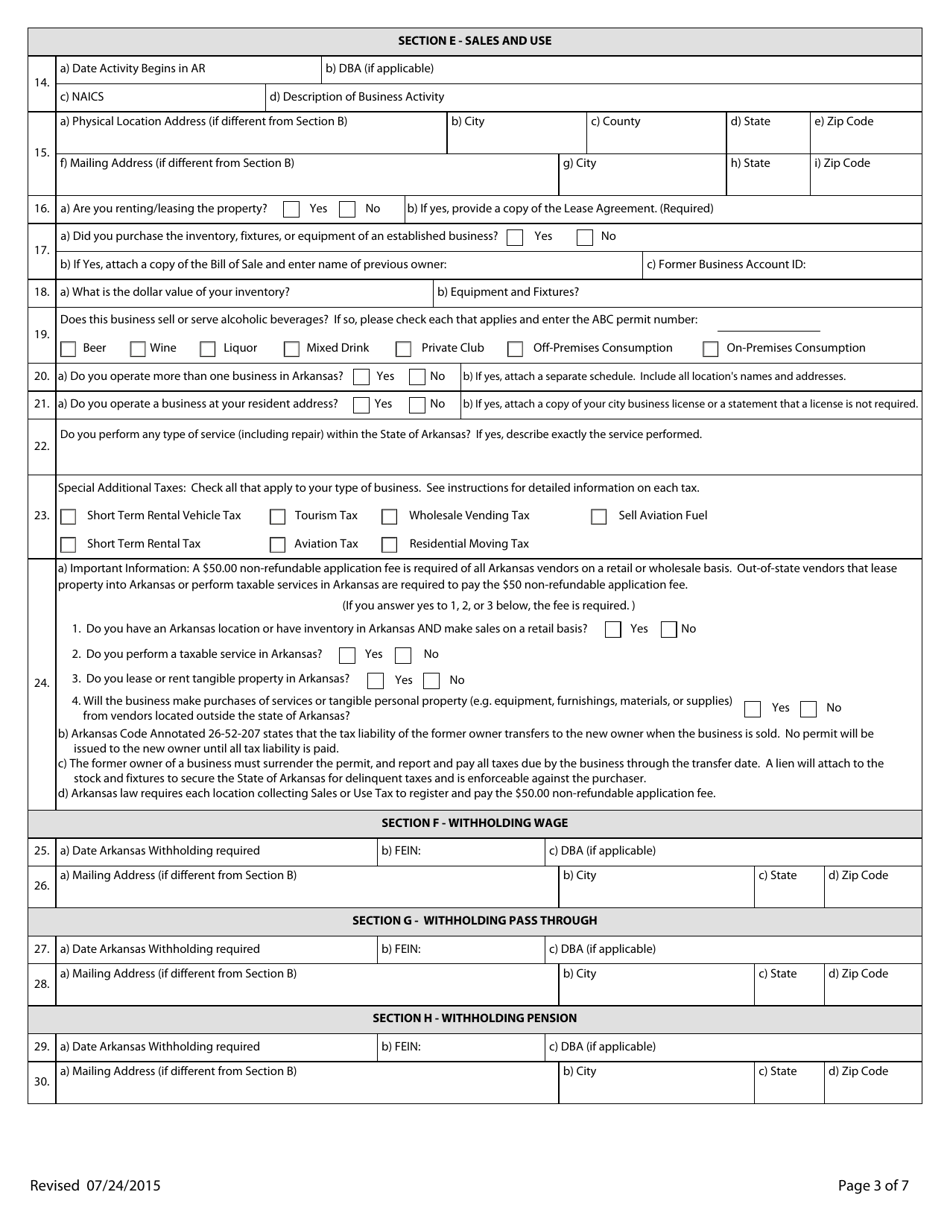

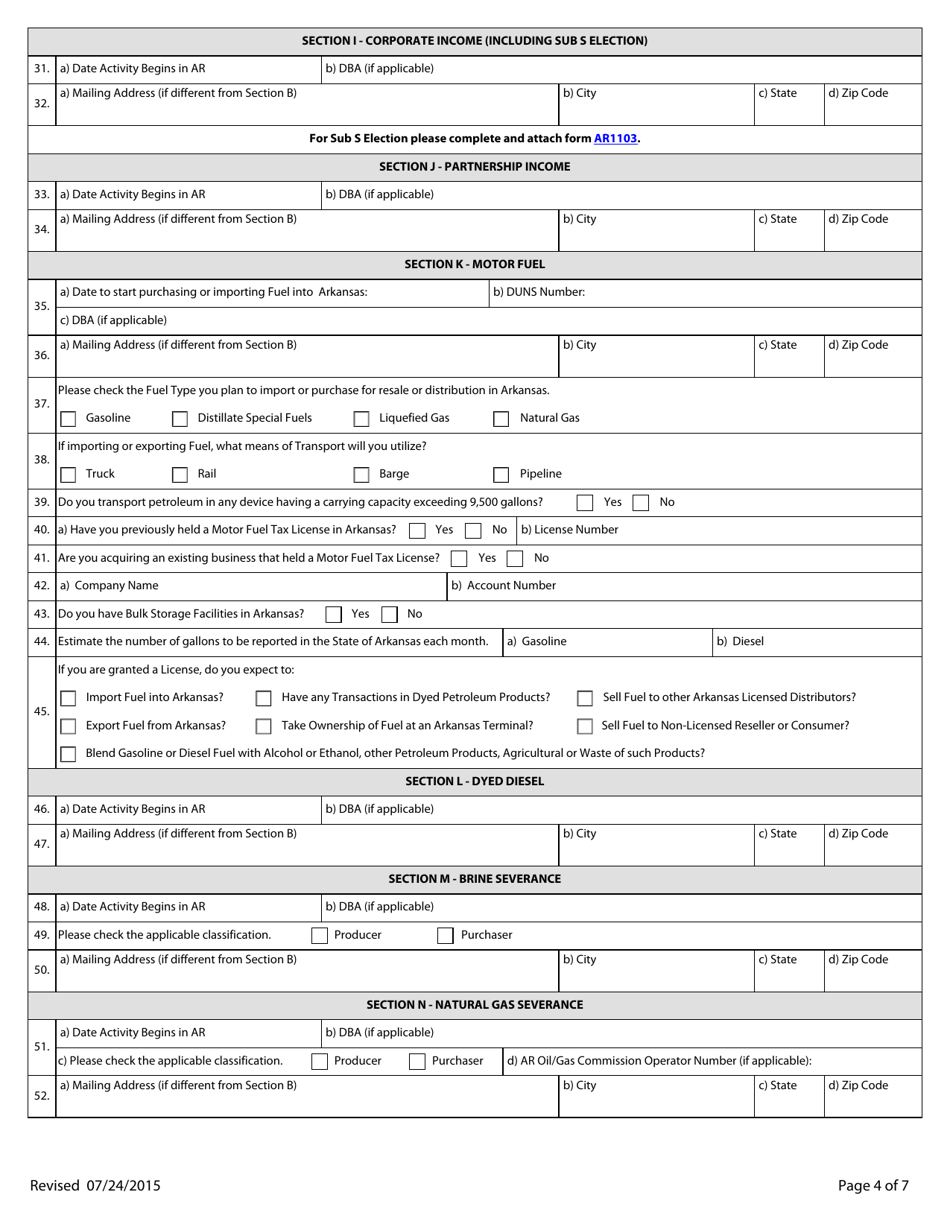

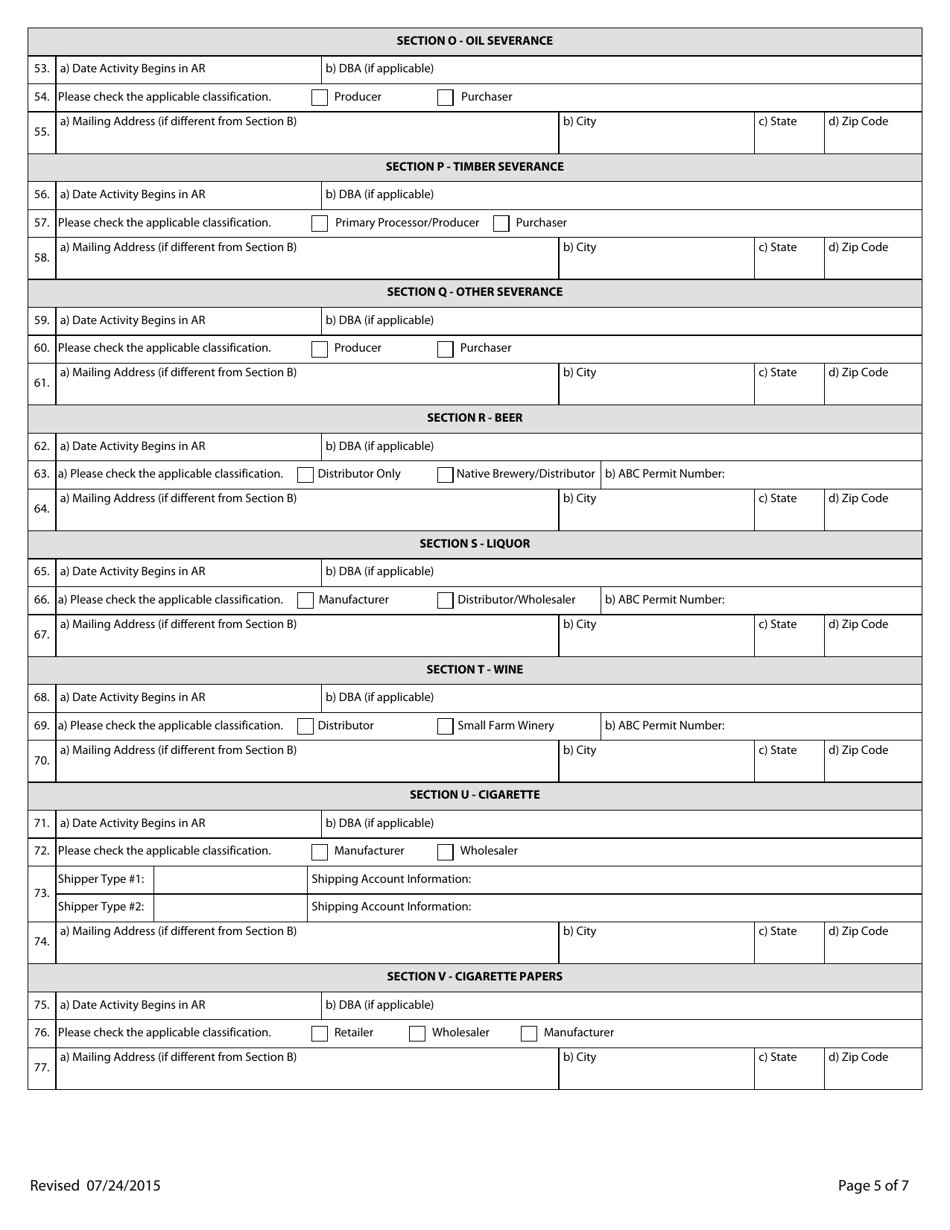

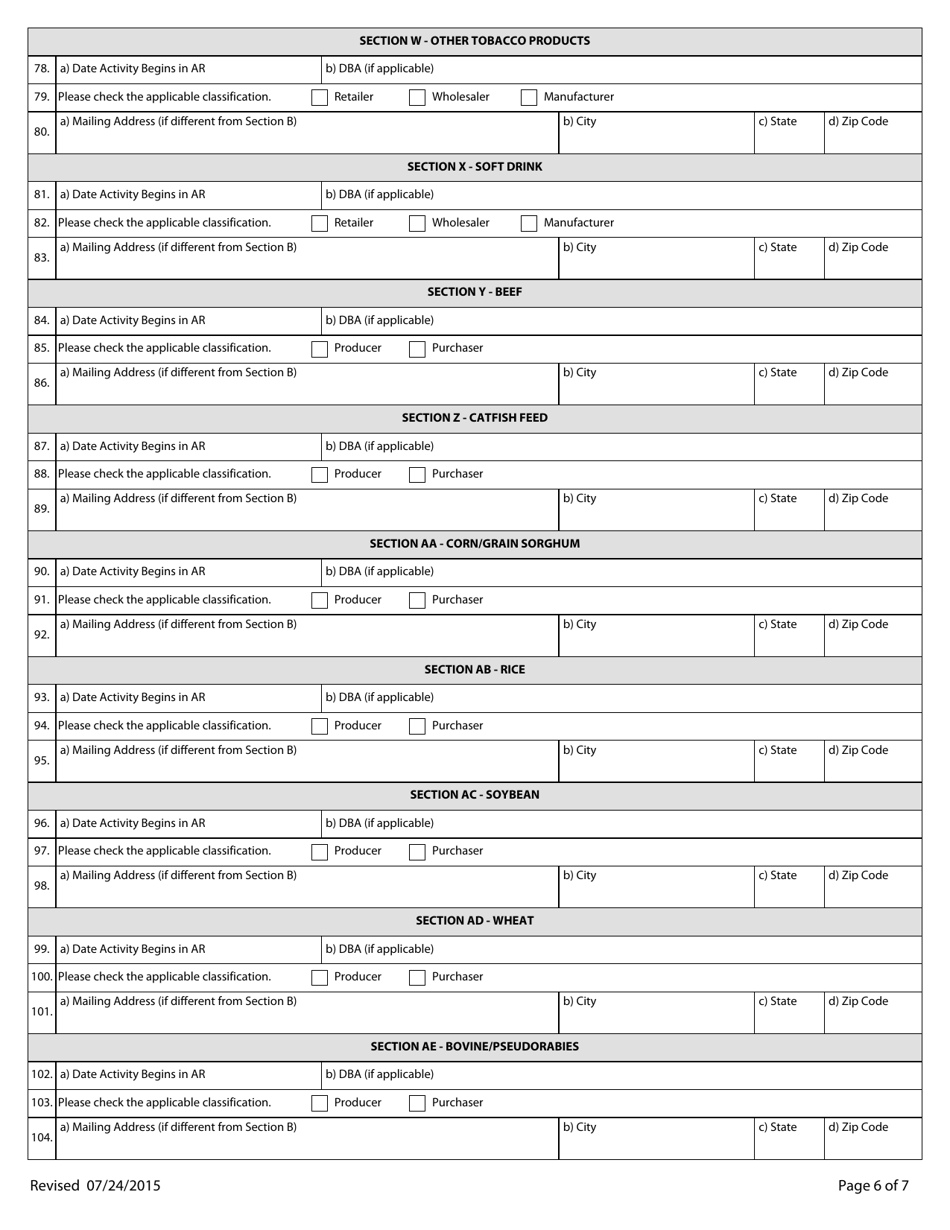

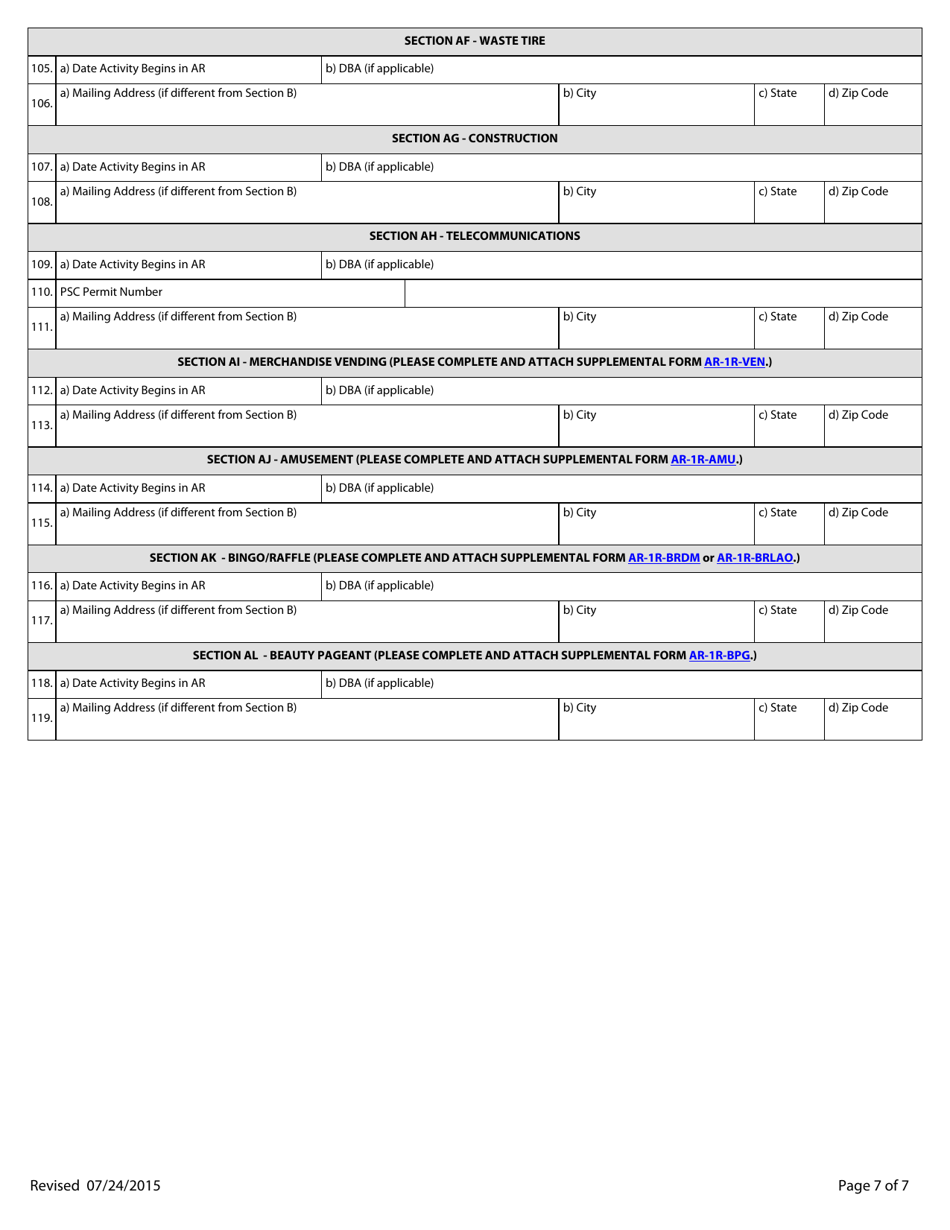

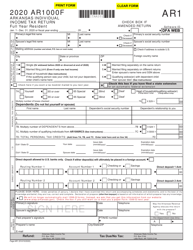

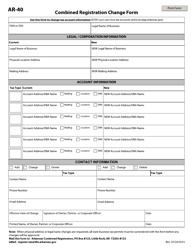

Form AR-1R Combined Business Tax Registration Form - Arkansas

What Is Form AR-1R?

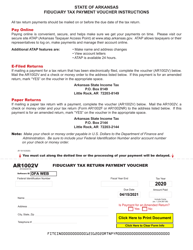

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AR-1R?

A: Form AR-1R is the Combined Business Tax Registration Form for the state of Arkansas.

Q: Who needs to file Form AR-1R?

A: Businesses operating in Arkansas need to file Form AR-1R to register for various tax programs.

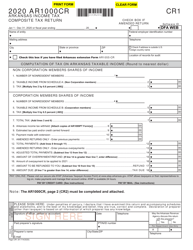

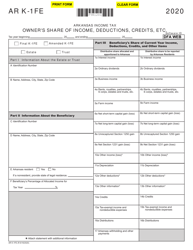

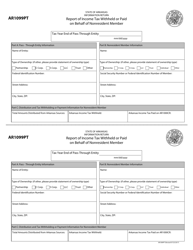

Q: What tax programs are covered by Form AR-1R?

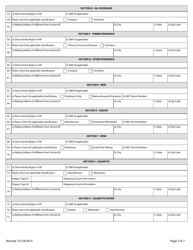

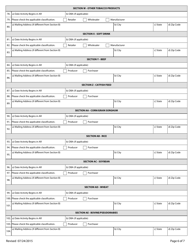

A: Form AR-1R covers the following tax programs: sales tax, use tax, withholding tax, corporate income tax, partnership tax, and financial institutions tax.

Q: Is there a fee to file Form AR-1R?

A: No, there is no fee to file Form AR-1R.

Q: When do I need to file Form AR-1R?

A: Form AR-1R should be filed before conducting any business activities in Arkansas.

Q: Are there any penalties for not filing Form AR-1R?

A: Yes, failure to file Form AR-1R can result in penalties and interest charges.

Q: Can I use Form AR-1R for registering a new business?

A: Yes, Form AR-1R can be used to register a new business in Arkansas.

Form Details:

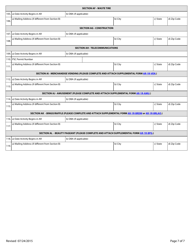

- Released on July 24, 2015;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR-1R by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.