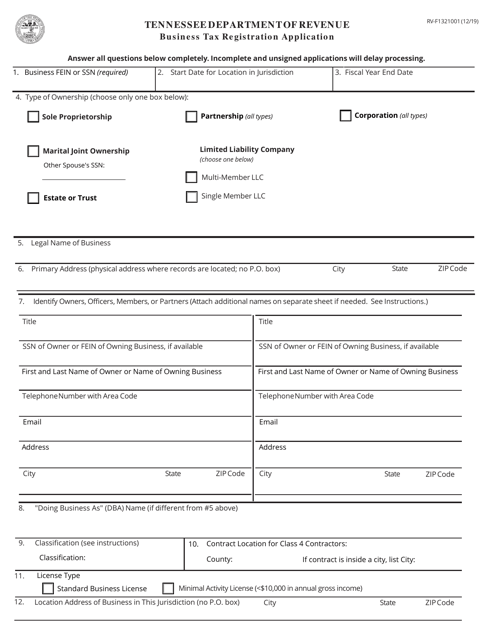

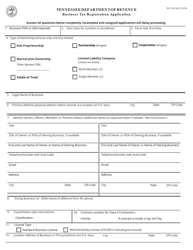

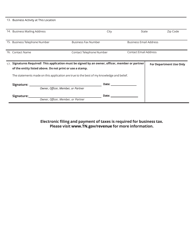

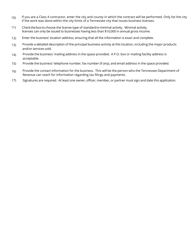

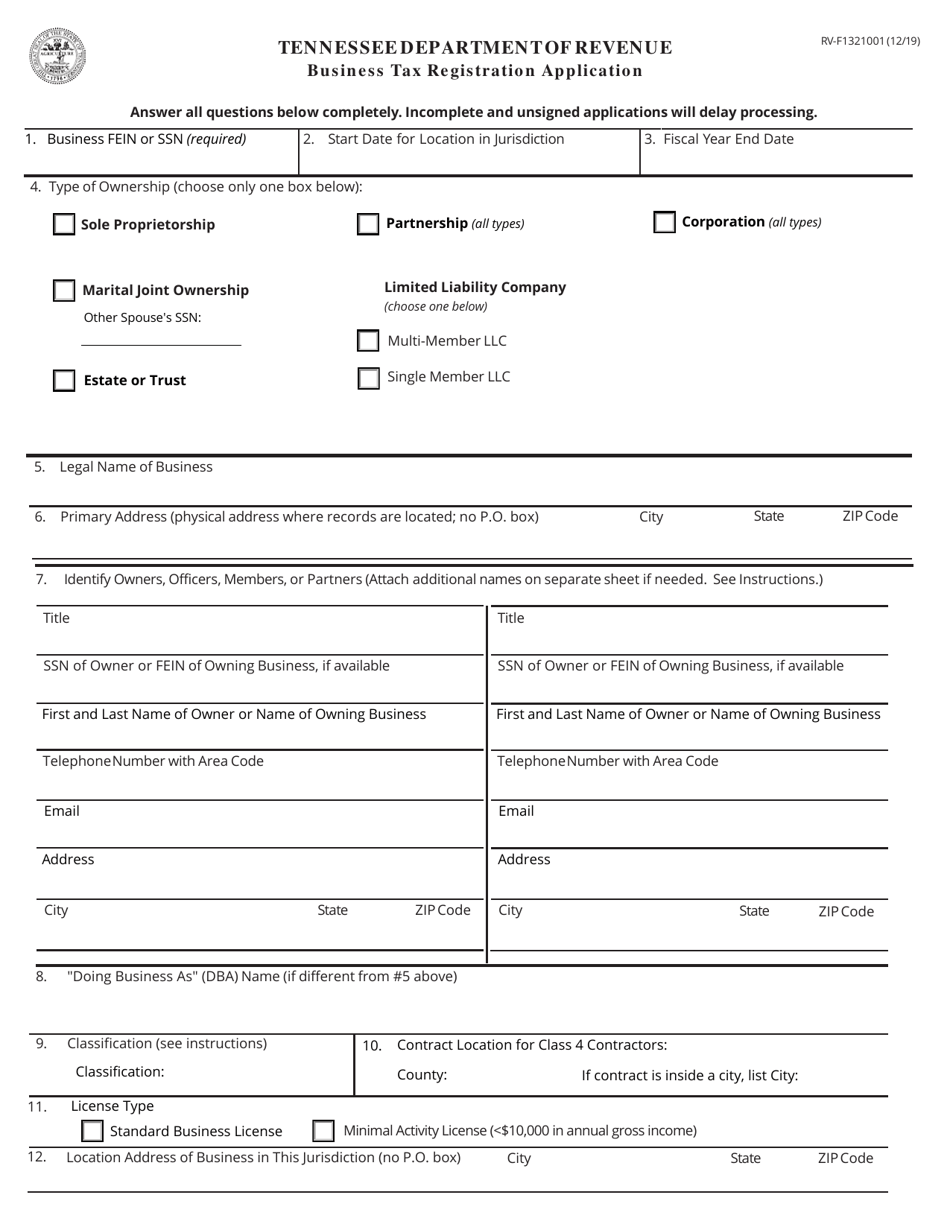

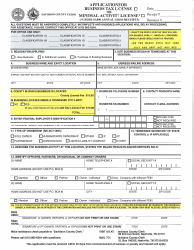

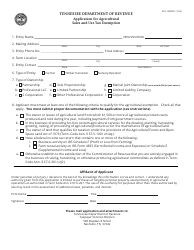

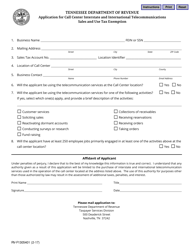

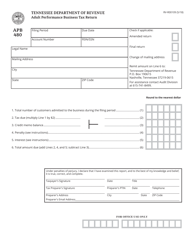

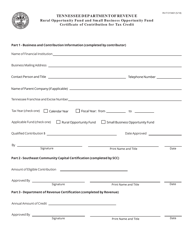

Form RV-F1321001 Business Tax Registration Application - Tennessee

What Is Form RV-F1321001?

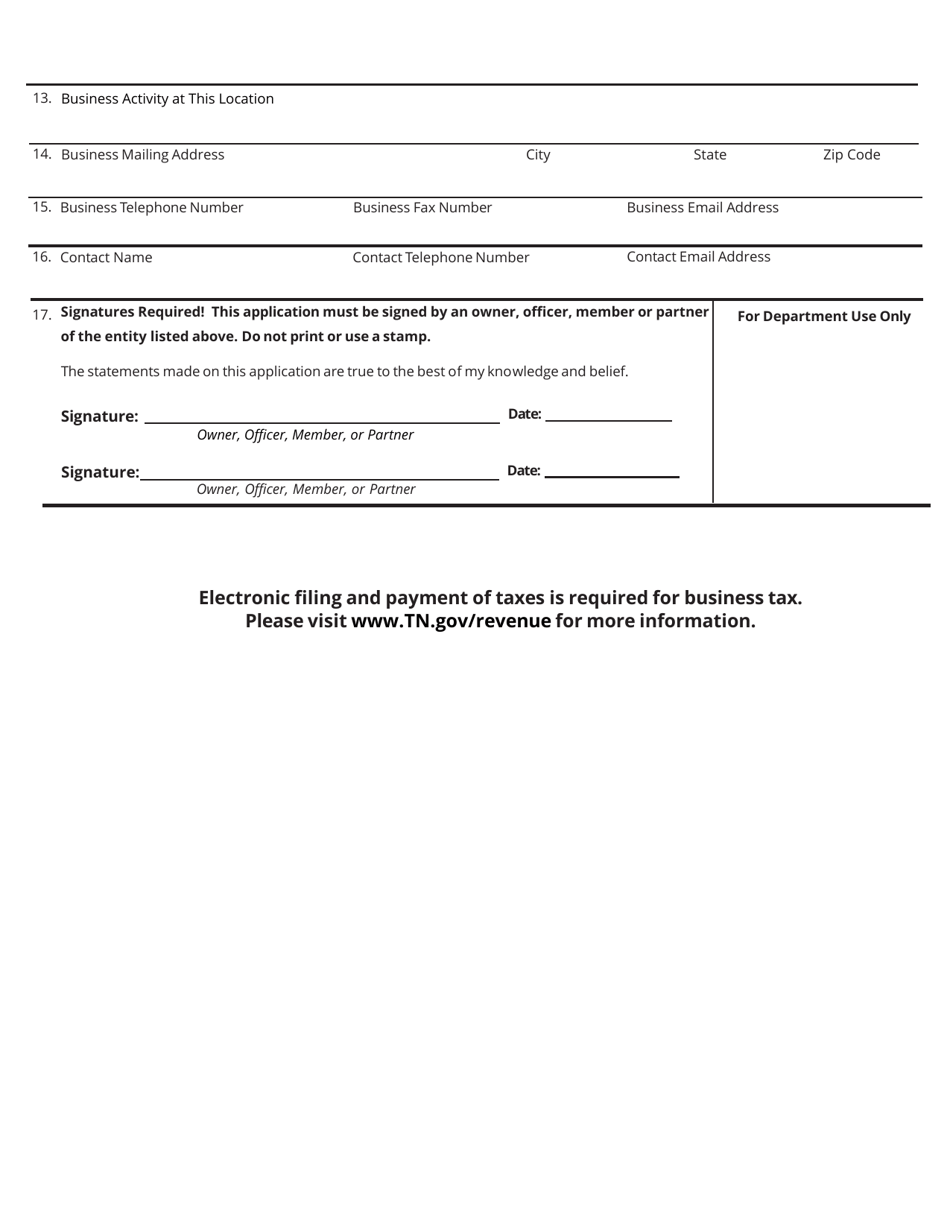

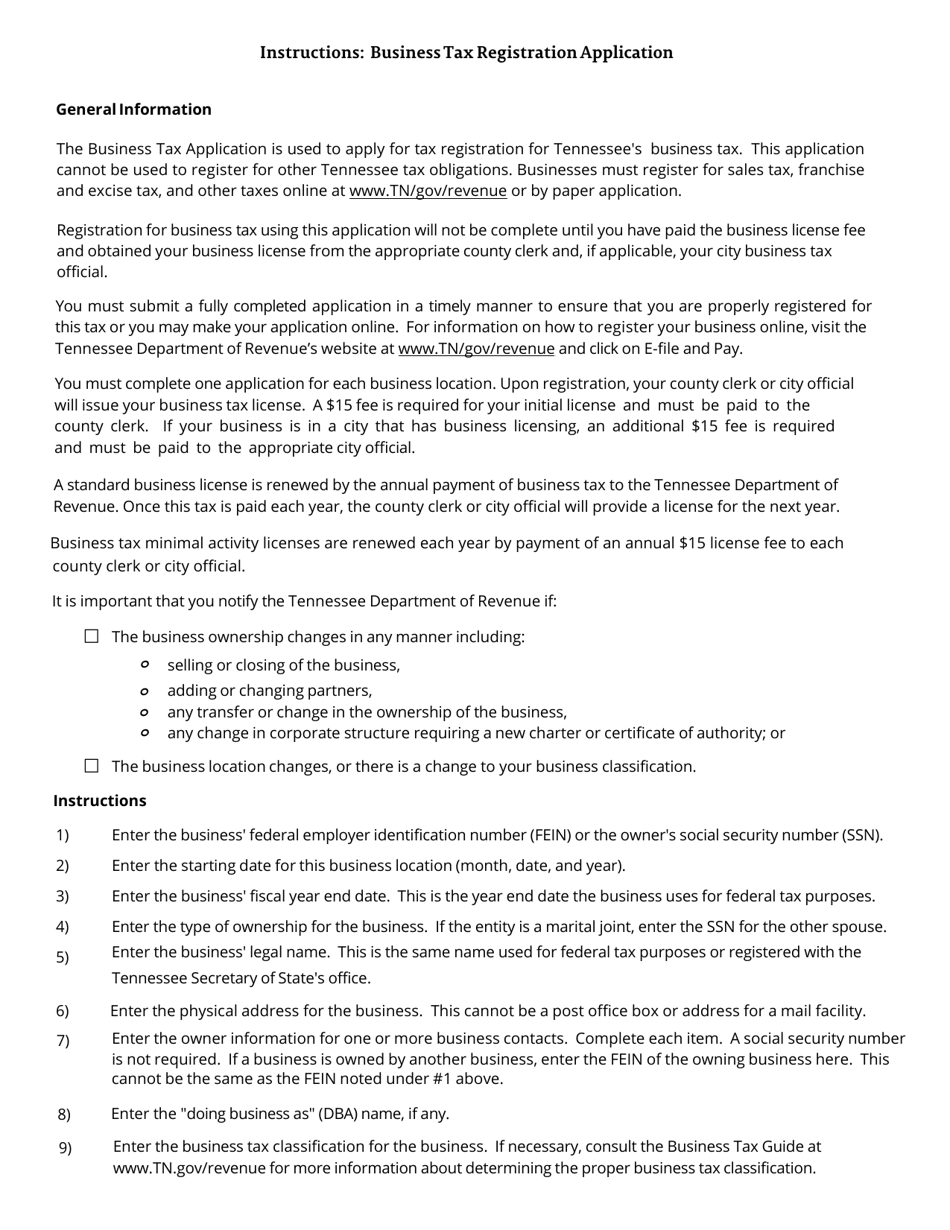

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

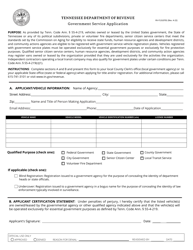

Q: What is the RV-F1321001 Business Tax Registration Application?

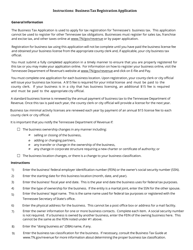

A: The RV-F1321001 Business Tax Registration Application is a form used to register a business for tax purposes in the state of Tennessee.

Q: Who needs to fill out the RV-F1321001 Business Tax Registration Application?

A: Any individual or entity conducting business activities in Tennessee needs to fill out this application.

Q: What information do I need to provide on the RV-F1321001 Business Tax Registration Application?

A: You will need to provide information about your business, such as its name, address, federal employer identification number (EIN), and type of business.

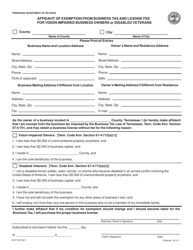

Q: Are there any fees associated with filing the RV-F1321001 Business Tax Registration Application?

A: No, there are no fees for filing this application.

Q: How long does it take to process the RV-F1321001 Business Tax Registration Application?

A: The processing time can vary, but you should receive your business tax registration certificate within a few weeks.

Q: What are the consequences of not filing the RV-F1321001 Business Tax Registration Application?

A: Failure to register your business for tax purposes in Tennessee can result in penalties and legal consequences.

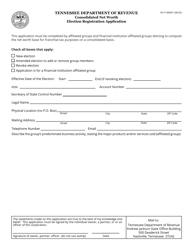

Q: Do I need to renew my business tax registration in Tennessee?

A: Yes, business tax registrations in Tennessee expire annually and need to be renewed.

Q: Can I make changes to my business information after filing the RV-F1321001 Business Tax Registration Application?

A: Yes, you can make changes by submitting an amended application to the Tennessee Department of Revenue.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RV-F1321001 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.