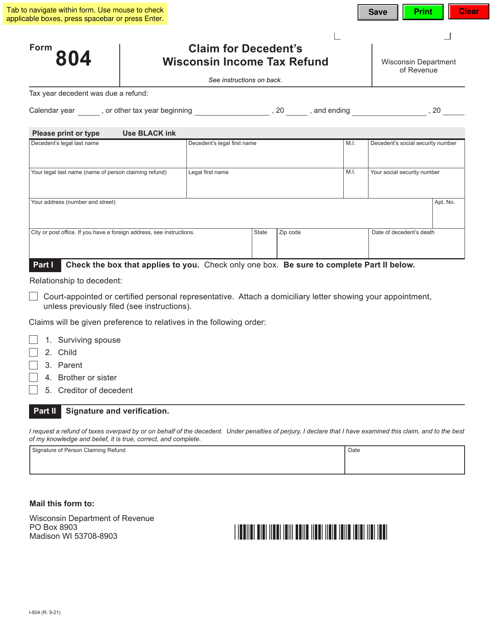

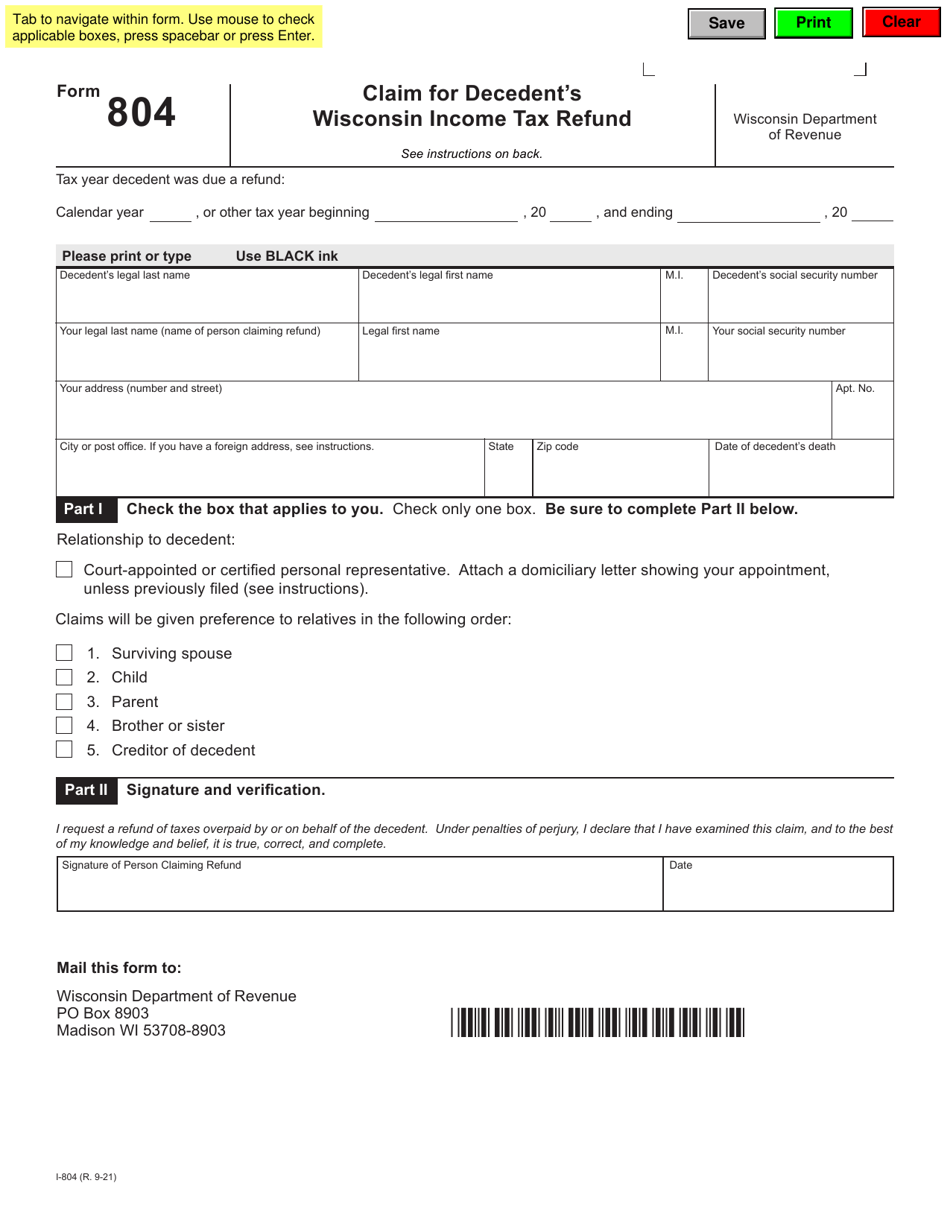

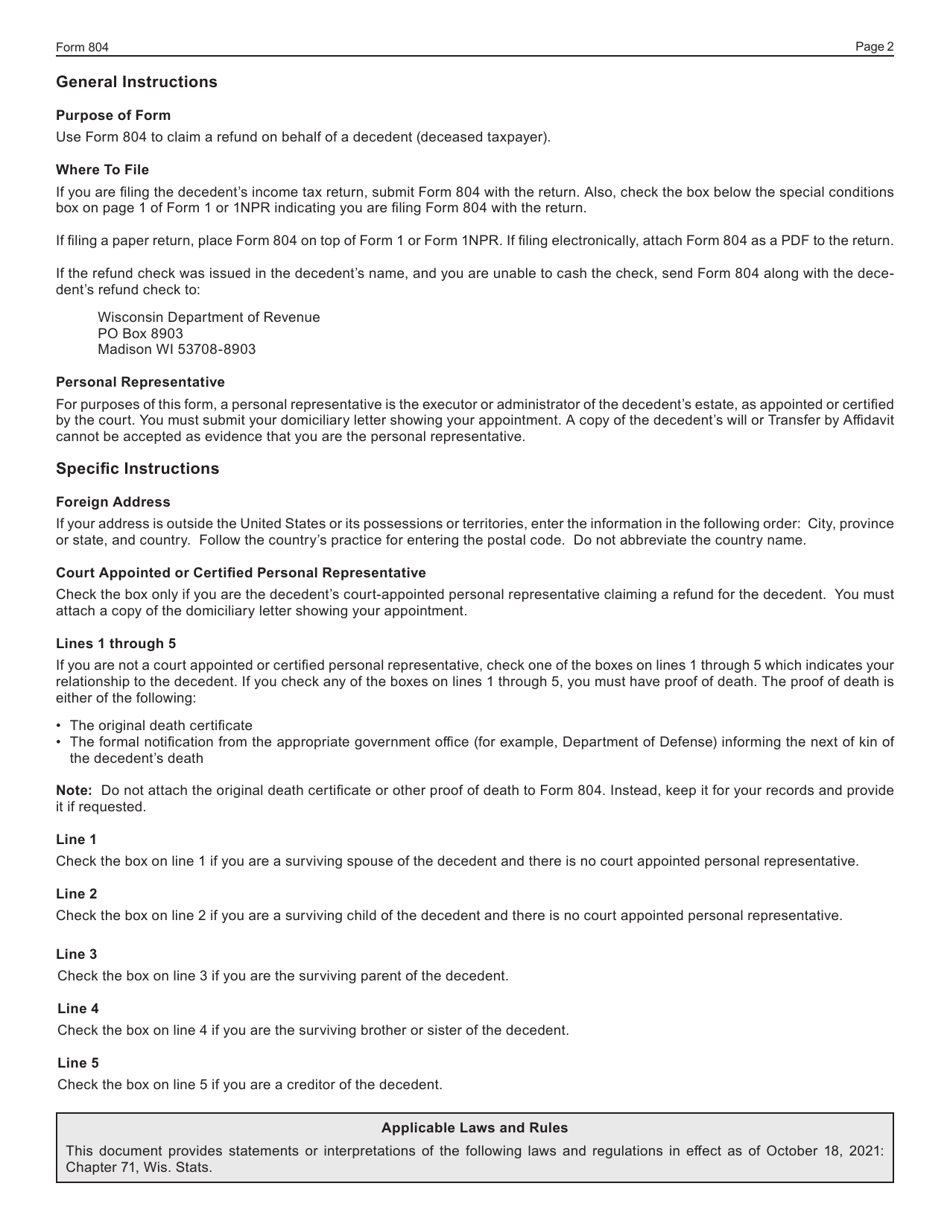

Form 804 (I-804) Claim for Decedent's Wisconsin Income Tax Refund - Wisconsin

What Is Form 804 (I-804)?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who can file Form 804 (I-804)?

A: Form 804 (I-804) can be filed by the personal representative of a deceased taxpayer's estate.

Q: What is the purpose of Form 804 (I-804)?

A: Form 804 (I-804) is used to claim a refund of Wisconsin income tax for a deceased taxpayer.

Q: Is there a time limit for filing Form 804 (I-804)?

A: Yes, Form 804 (I-804) must be filed within the statute of limitations for filing a claim for refund, which is generally 4 years from the date the tax was paid.

Q: What supporting documents are required to be submitted with Form 804 (I-804)?

A: Supporting documents may include a certified copy of the death certificate, a copy of the federal estate tax return (Form 706), and any other documentation necessary to support the claim for refund.

Q: Can Form 804 (I-804) be filed electronically?

A: No, Form 804 (I-804) cannot be filed electronically and must be filed by mail.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 804 (I-804) by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.