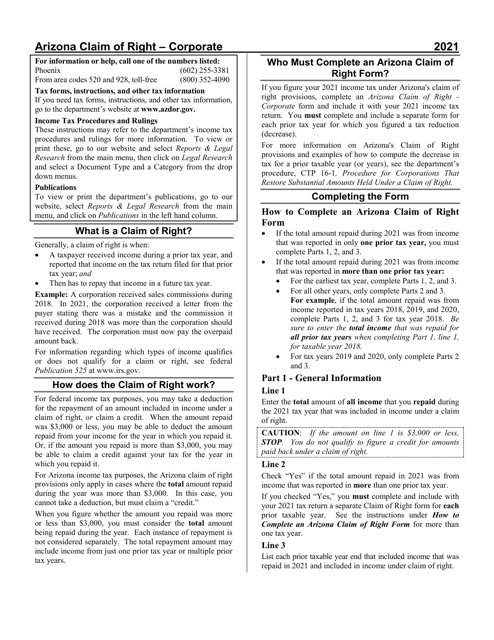

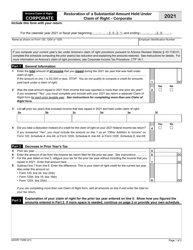

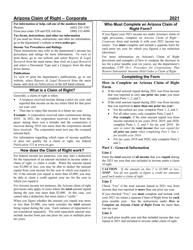

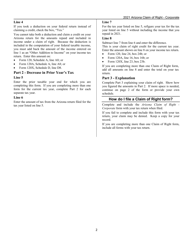

Instructions for Form ADOR11289 Restoration of a Substantial Amount Held Under Claim of Right - Corporate - Arizona

This document contains official instructions for Form ADOR11289 , Restoration of a Substantial Amount Held Under Claim of Right - Corporate - a form released and collected by the Arizona Department of Revenue. An up-to-date fillable Form ADOR11289 is available for download through this link.

FAQ

Q: What is Form ADOR11289?

A: Form ADOR11289 is a form used for restoration of a substantial amount held under claim of right by a corporate entity in Arizona.

Q: What is considered a substantial amount?

A: The exact definition of a substantial amount may vary, but it generally refers to a significant sum of money or property.

Q: Who needs to file Form ADOR11289?

A: Corporate entities in Arizona who need to restore a substantial amount held under claim of right are required to file this form.

Q: What is meant by 'held under claim of right'?

A: Held under claim of right means that the entity possessed the money or property believing it had a legal right to do so.

Q: What is the purpose of filing this form?

A: The purpose of filing Form ADOR11289 is to provide the Arizona Department of Revenue with information about the restoration of a substantial amount held under claim of right by a corporate entity.

Q: Are there any filing fees for Form ADOR11289?

A: There may be certain filing fees associated with submitting Form ADOR11289. The specific fees can be found in the instructions provided with the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.