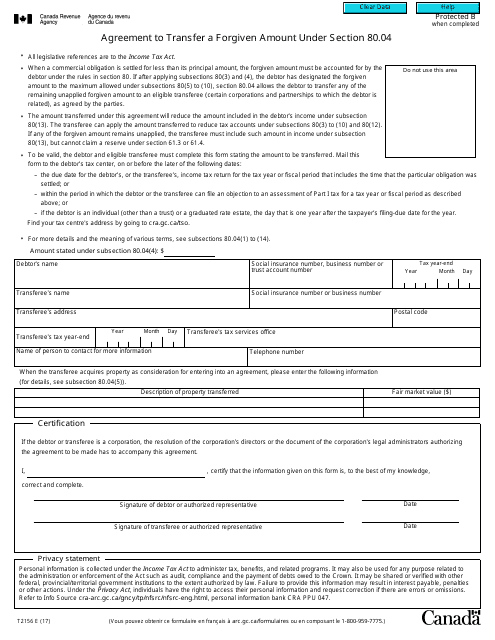

Form T2156 Agreement to Transfer a Forgiven Amount Under Section 80.04 - Canada

Form T2156, Agreement to Transfer a Forgiven Amount Under Section 80.04, is used in Canada for transferring a forgiven amount to an eligible transferee. This form is typically used when a taxpayer has received a forgiveness of debt and wishes to transfer that forgiven amount to another person or corporation. It is important to note that specific details regarding the forgiven amount, the original creditor, and the transferee must be provided in the form for the transfer to be valid.

The person who is eligible to claim a forgiven amount under Section 80.04 in Canada is responsible for filing the Form T2156 Agreement to Transfer a Forgiven Amount. This form is used to transfer an amount that has been forgiven or cancelled to another person, such as a spouse or common-law partner.

FAQ

Q: What is Form T2156?

A: Form T2156 is an agreement to transfer a forgiven amount under section 80.04 of the Income Tax Act in Canada.

Q: What is the purpose of Form T2156?

A: The purpose of Form T2156 is to transfer a forgiven amount to another person or organization, in accordance with the rules outlined in section 80.04 of the Income Tax Act.

Q: When should I use Form T2156?

A: You should use Form T2156 if you have received a forgiven amount and want to transfer it to another person or organization. This form is specifically designed for use under section 80.04 of the Income Tax Act in Canada.

Q: Do I need to include Form T2156 with my tax return?

A: No, you do not need to include Form T2156 with your tax return. However, you should keep a copy of the completed form for your records and be prepared to provide it to the Canada Revenue Agency upon request.

Q: Is there a deadline for submitting Form T2156?

A: There is no specific deadline for submitting Form T2156. However, it is recommended to submit the form as soon as possible after the forgiven amount is received and the decision to transfer it has been made.