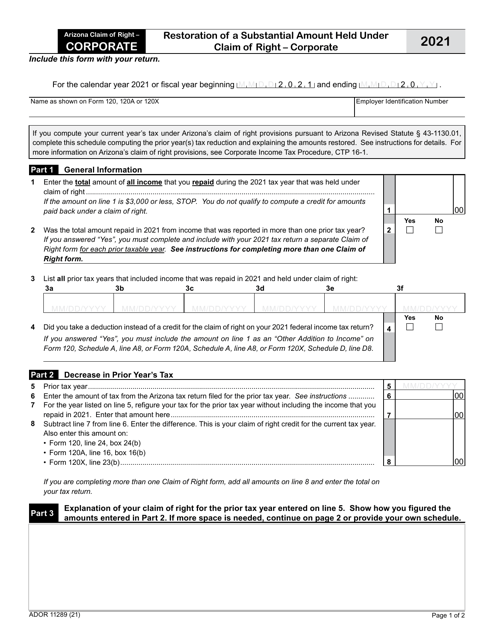

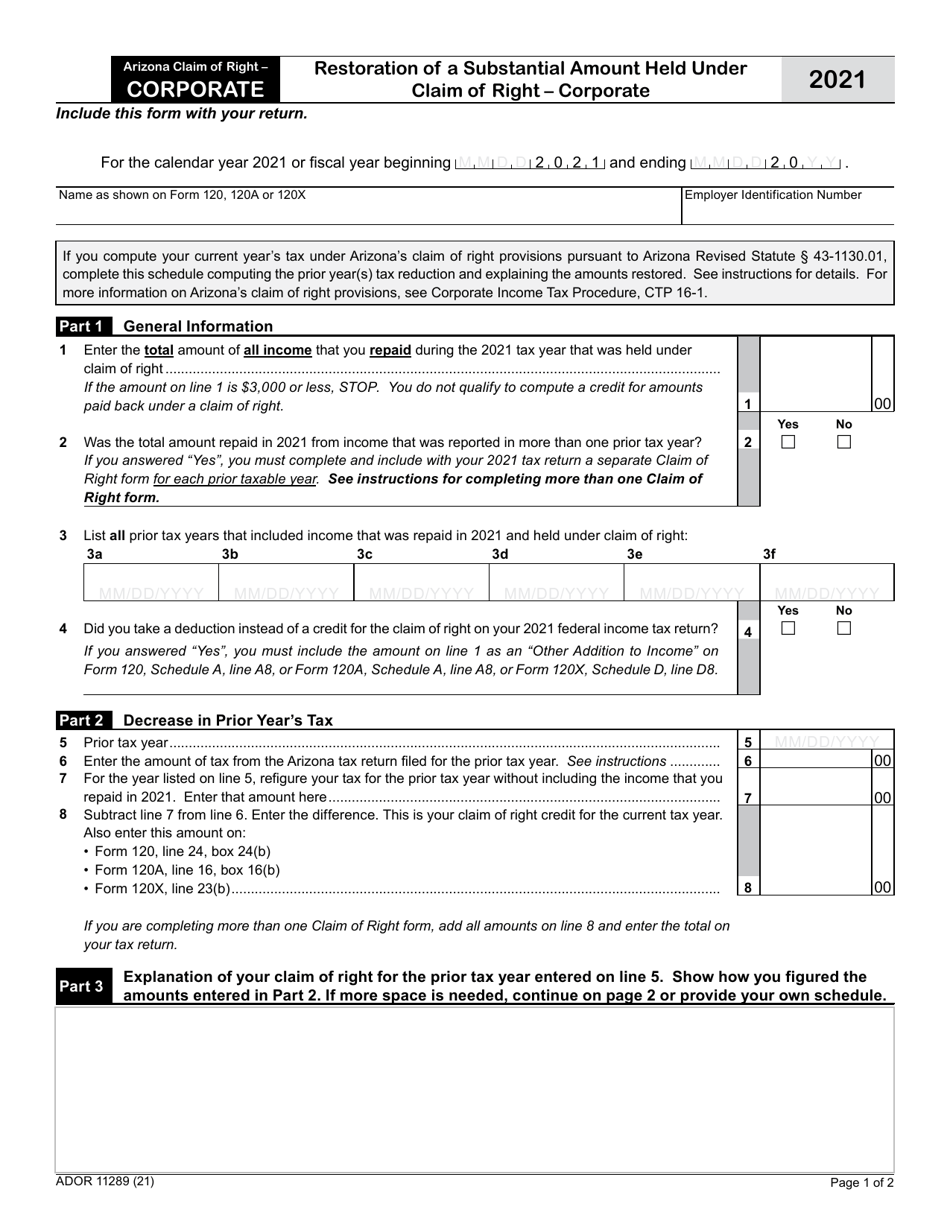

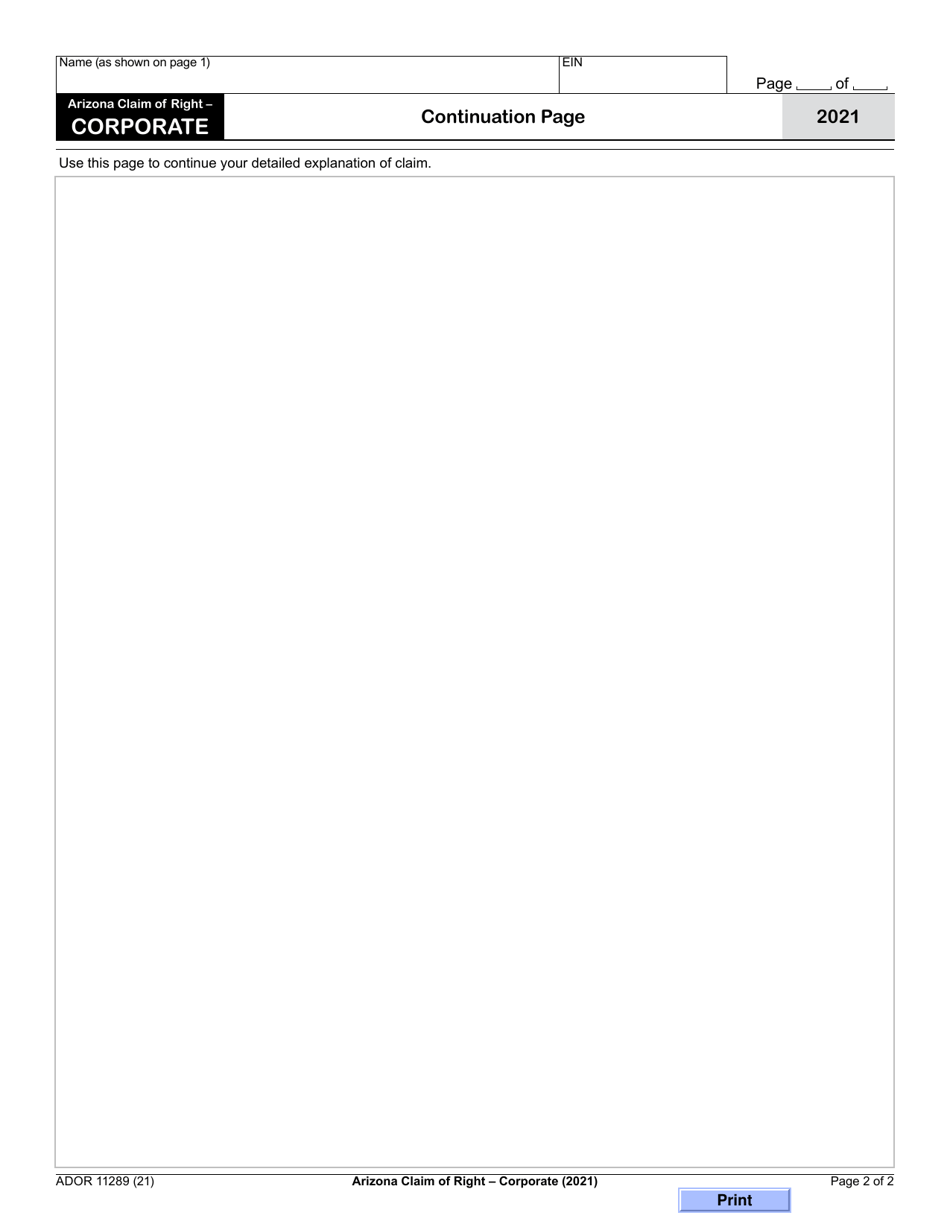

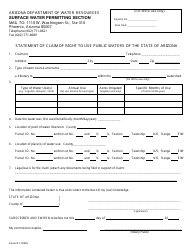

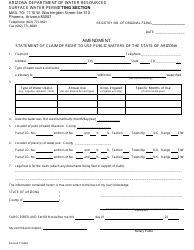

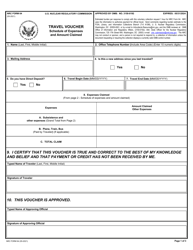

Form ADOR11289 Restoration of a Substantial Amount Held Under Claim of Right - Corporate - Arizona

What Is Form ADOR11289?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

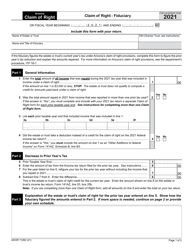

Q: What is Form ADOR11289?

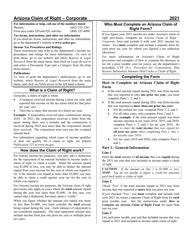

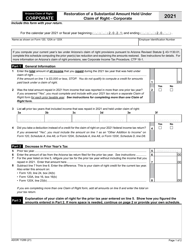

A: Form ADOR11289 is a form used for Restoration of a Substantial Amount Held Under Claim of Right for Corporate taxpayers in Arizona.

Q: What is the purpose of Form ADOR11289?

A: The purpose of Form ADOR11289 is to allow corporate taxpayers in Arizona to request a restoration of a substantial amount held under a claim of right.

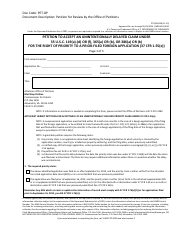

Q: Who can use Form ADOR11289?

A: Form ADOR11289 is specifically for corporate taxpayers in Arizona.

Q: What is meant by 'Restoration of a Substantial Amount Held Under Claim of Right'?

A: Restoration of a Substantial Amount Held Under Claim of Right refers to the process of returning or recovering money that was improperly claimed or acquired.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11289 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.