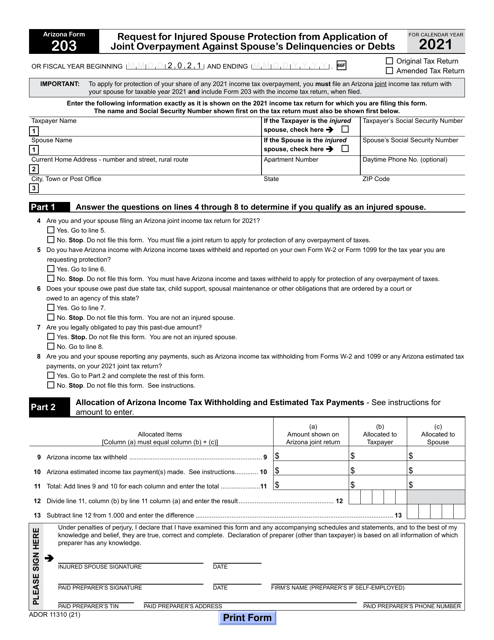

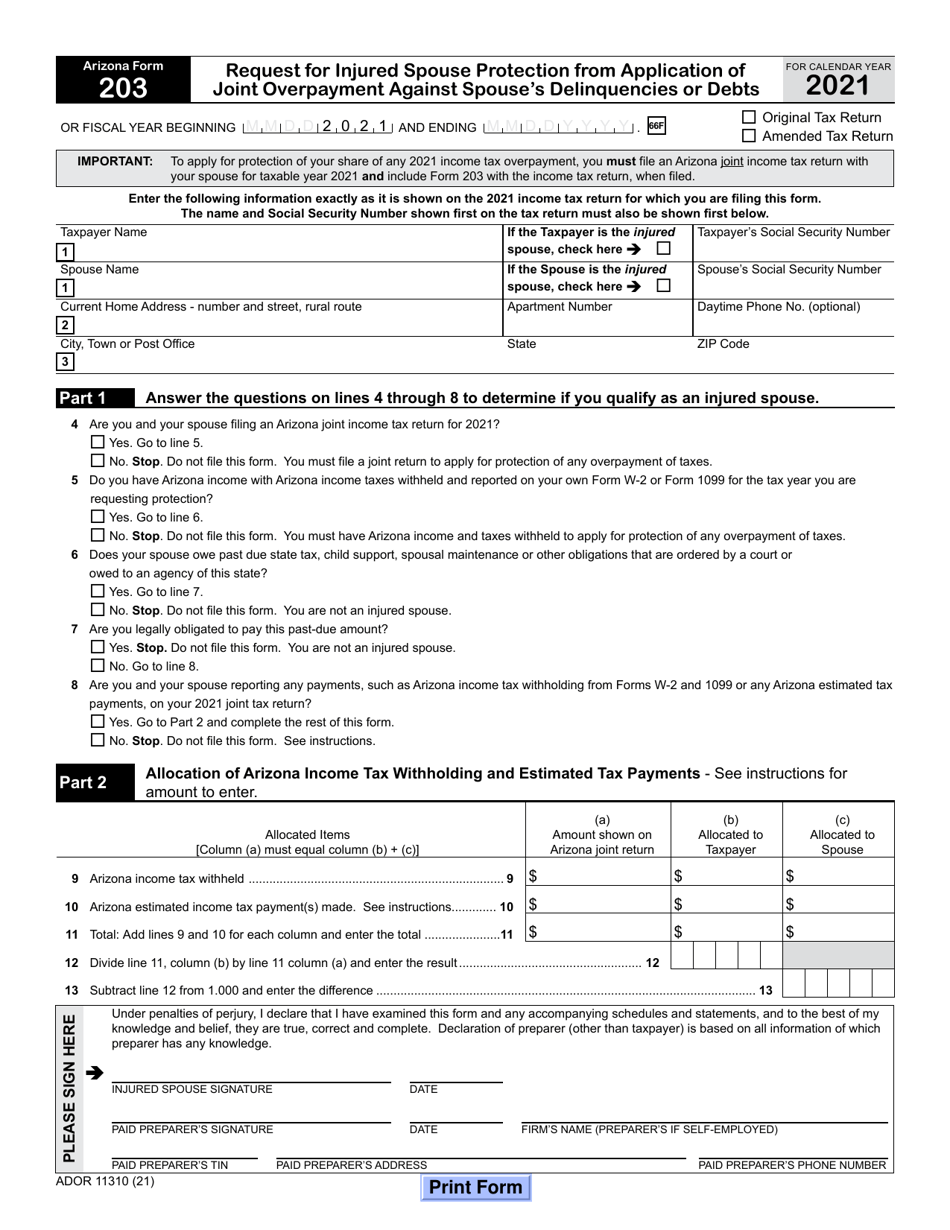

Arizona Form 203 (ADOR11310) Request for Injured Spouse Protection From Application of Joint Overpayment Against Spouse's Delinquencies or Debts - Arizona

What Is Arizona Form 203 (ADOR11310)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 203?

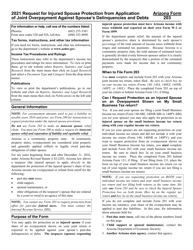

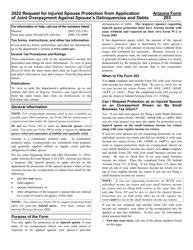

A: Arizona Form 203 is a form used to request injured spouse protection from applying a joint overpayment against a spouse's delinquencies or debts in Arizona.

Q: What is the purpose of Arizona Form 203?

A: The purpose of Arizona Form 203 is to protect an injured spouse in Arizona from having their share of a joint overpayment applied to their spouse's delinquencies or debts.

Q: Who should use Arizona Form 203?

A: Arizona Form 203 should be used by a taxpayer who files a joint tax return in Arizona and wants to protect their share of a joint overpayment from being applied against their spouse's delinquencies or debts.

Q: How do I fill out Arizona Form 203?

A: To fill out Arizona Form 203, you will need to provide your personal information, details about your spouse's delinquencies or debts, and calculate your share of the joint overpayment.

Q: Are there any fees associated with filing Arizona Form 203?

A: No, there are no fees associated with filing Arizona Form 203.

Q: When should I file Arizona Form 203?

A: You should file Arizona Form 203 as soon as possible after you become aware that your share of a joint overpayment may be applied against your spouse's delinquencies or debts, or when you file your joint tax return.

Q: What happens after I file Arizona Form 203?

A: After you file Arizona Form 203, the Arizona Department of Revenue will review your request and determine if you qualify for injured spouse protection.

Q: Is Arizona Form 203 only for married couples?

A: No, Arizona Form 203 can also be used by registered domestic partners or individuals in a civil union, as long as they file a joint tax return in Arizona.

Q: Can I use Arizona Form 203 to protect against federal tax debts?

A: No, Arizona Form 203 only applies to Protection From Application of Joint Overpayment Against Spouse's Delinquencies or Debts in Arizona; it does not protect against federal tax debts.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 203 (ADOR11310) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.