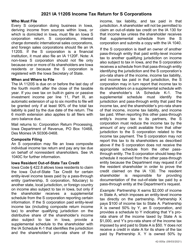

Instructions for Form IA1120S, 42-004, 42-008 Schedule K-1 Iowa Income Tax Return of S Corporation - Iowa

This document contains official instructions for Schedule K-1 for Form IA1120S , Form 42-004 , and Form 42-008 . . These documents are released and collected by the Iowa Department of Revenue.

FAQ

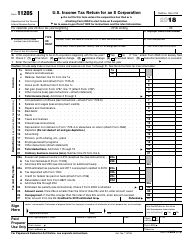

Q: What is Form IA1120S?

A: Form IA1120S is the Iowa Income Tax Return for S Corporation.

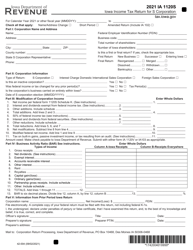

Q: What are the schedules included in Form IA1120S?

A: The schedules included in Form IA1120S are 42-004 and 42-008.

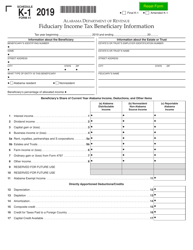

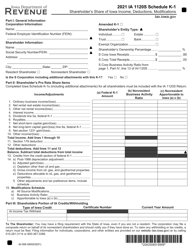

Q: What is Schedule K-1?

A: Schedule K-1 is a schedule that reports the income, deductions, and credits for each individual shareholder of the S Corporation.

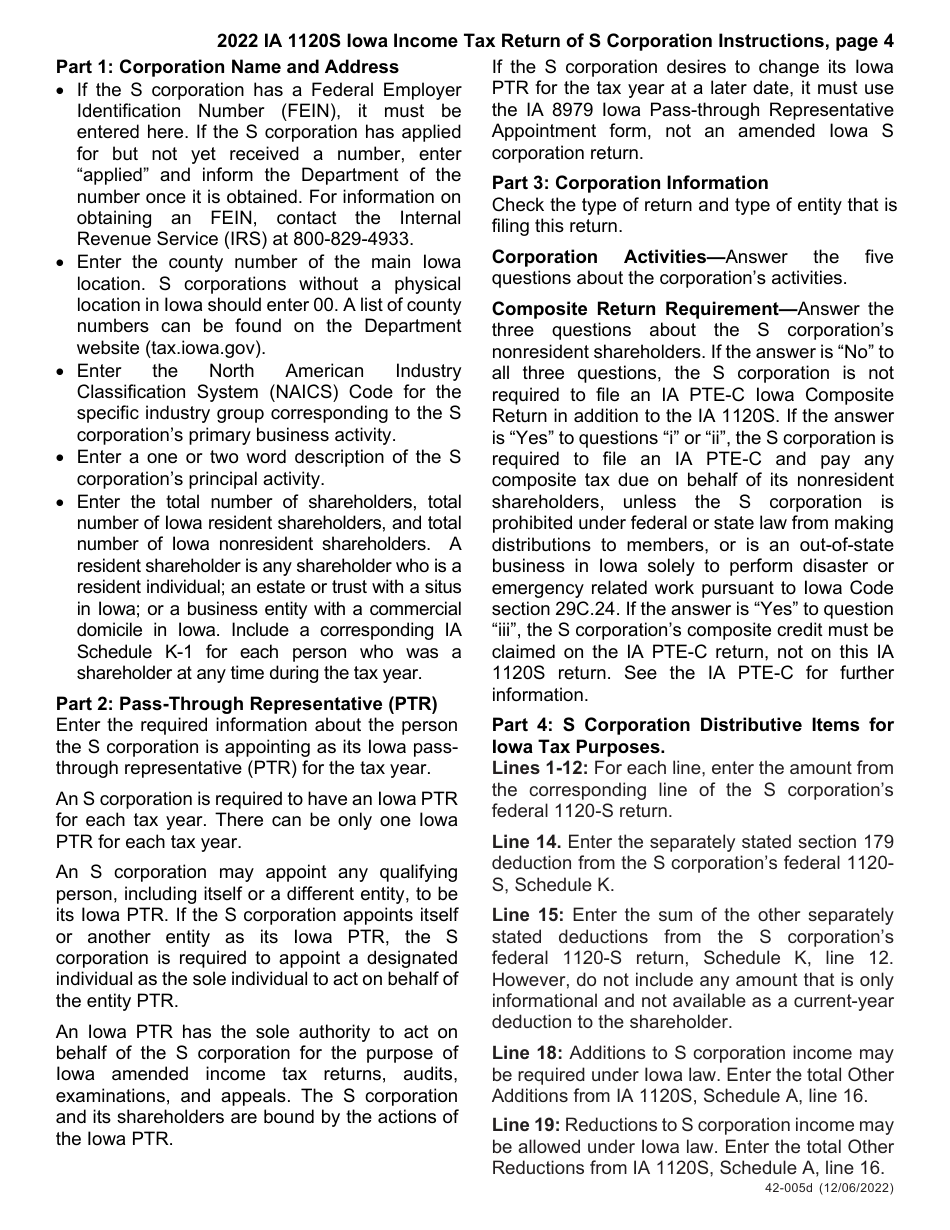

Q: Who needs to file Form IA1120S?

A: S Corporations operating in Iowa need to file Form IA1120S.

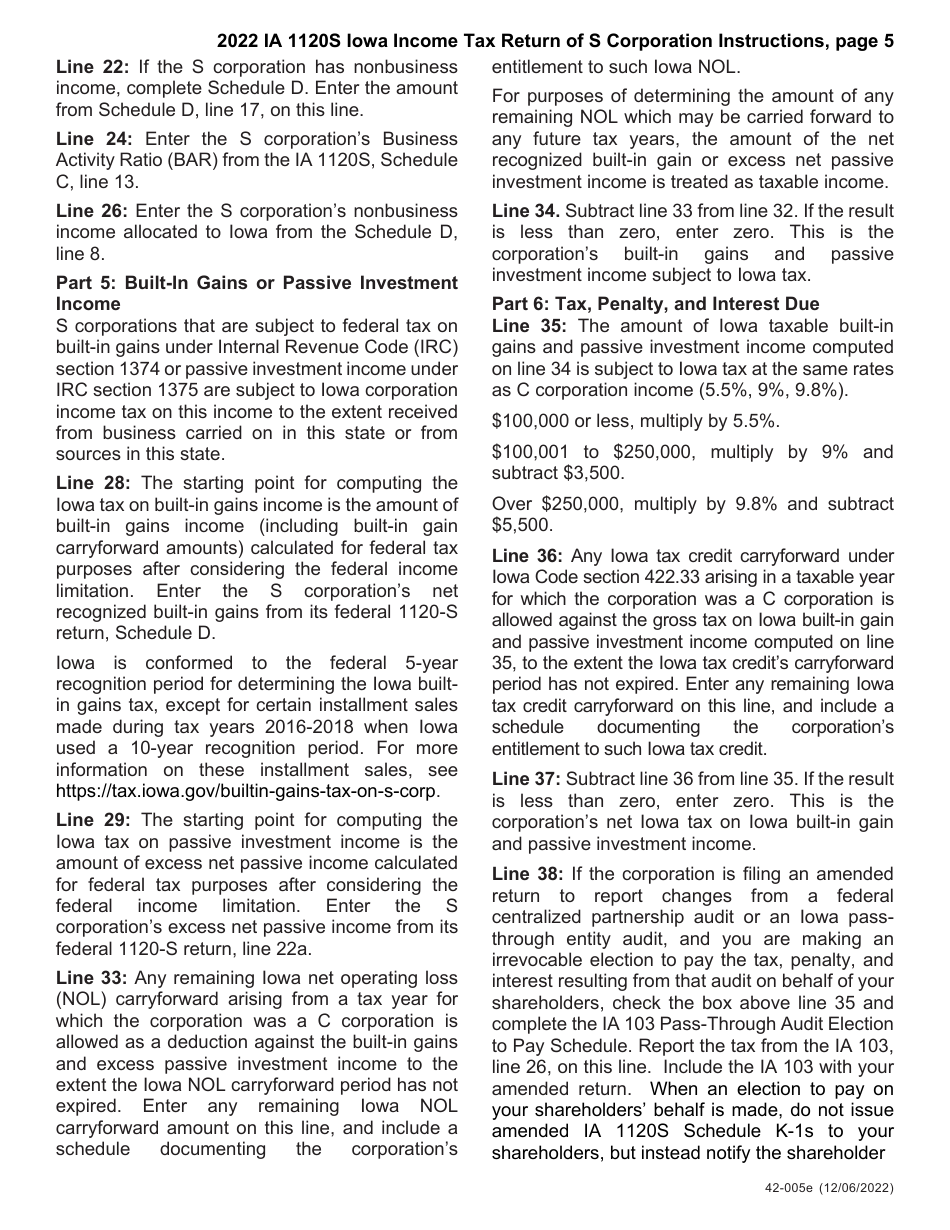

Q: What information is required for Form IA1120S?

A: Form IA1120S requires information about the S Corporation's income, deductions, credits, and shareholders.

Instruction Details:

- This 13-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Iowa Department of Revenue.