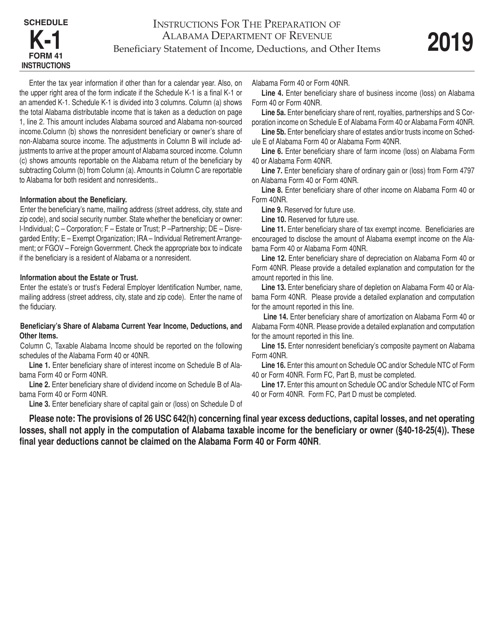

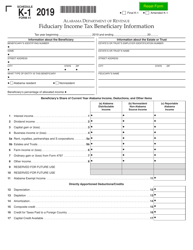

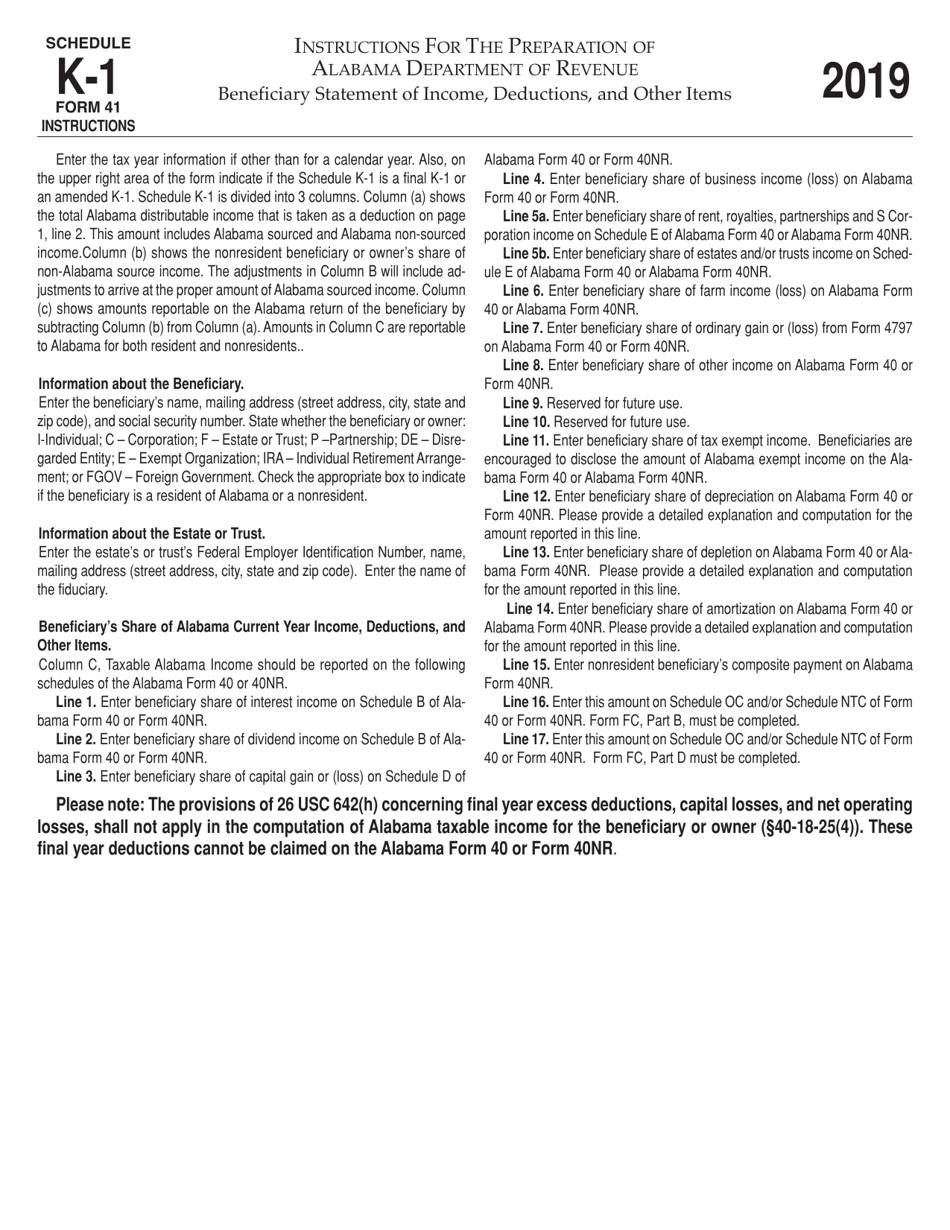

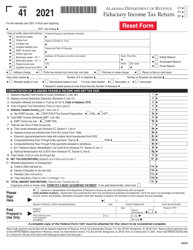

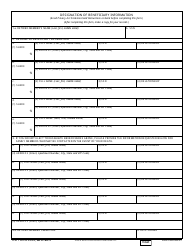

Instructions for Form 41 Schedule K-1 Fiduciary Income Tax Beneficiary Information - Alabama

This document contains official instructions for Form 41 Schedule K-1, Fiduciary Income Tax Beneficiary Information - a form released and collected by the Alabama Department of Revenue. An up-to-date fillable Form 41 Schedule K-1 is available for download through this link.

FAQ

Q: What is Form 41 Schedule K-1?

A: Form 41 Schedule K-1 is a tax form used to report beneficiary information for fiduciary income tax in Alabama.

Q: Who should complete Form 41 Schedule K-1?

A: Form 41 Schedule K-1 should be completed by fiduciaries who have income tax liabilities in Alabama and are distributing income to beneficiaries.

Q: What is a fiduciary?

A: A fiduciary is a person or entity appointed to manage the assets or affairs of another, such as an executor, administrator, or trustee.

Q: What information is required on Form 41 Schedule K-1?

A: Form 41 Schedule K-1 requires information such as the name, address, and taxpayer identification number (TIN) of the fiduciary and the beneficiaries, as well as details of distribution and income.

Q: Are there any filing deadlines for Form 41 Schedule K-1?

A: Yes, Form 41 Schedule K-1 must be filed by the fiduciary along with Form 41, Fiduciary Income Tax Return, on or before the 15th day of the fourth month following the close of the taxable year.

Q: Can Form 41 Schedule K-1 be e-filed?

A: Yes, Form 41 Schedule K-1 can be e-filed using the Alabama e-services system.

Q: Do I need to submit copies of Form 41 Schedule K-1 to the beneficiaries?

A: Yes, the fiduciary is required to provide each beneficiary with a copy of their respective Schedule K-1.

Q: What happens if I don't file Form 41 Schedule K-1?

A: Failure to file Form 41 Schedule K-1 may result in penalties and interest being assessed by the Alabama Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.