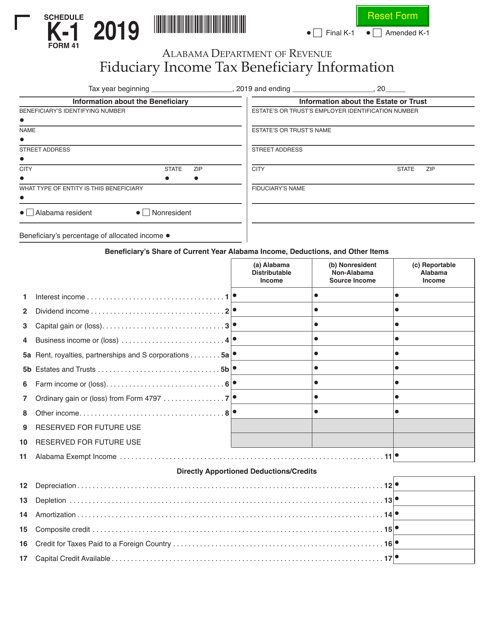

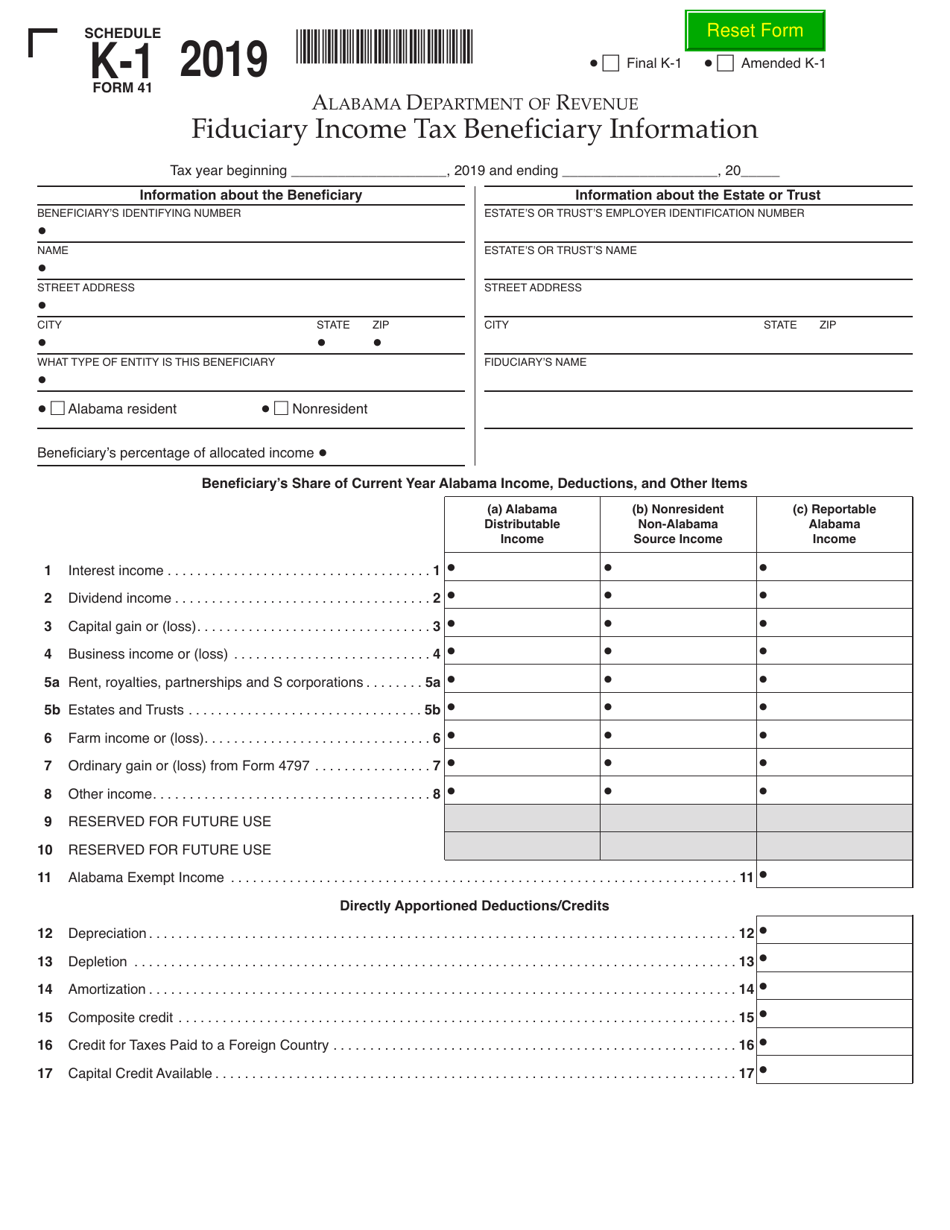

Form 41 Schedule K-1 Fiduciary Income Tax Beneficiary Information - Alabama

What Is Form 41 Schedule K-1?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama.The document is a supplement to Form 41, Fiduciary Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 41 Schedule K-1?

A: Form 41 Schedule K-1 is a tax form used to report fiduciary income tax information.

Q: Who needs to file Form 41 Schedule K-1?

A: Individuals who are beneficiaries of a fiduciary estate or trust in Alabama may need to file Form 41 Schedule K-1.

Q: What information is reported on Form 41 Schedule K-1?

A: Form 41 Schedule K-1 reports the beneficiary's share of income, deductions, and credits from the fiduciary estate or trust.

Q: When is the deadline to file Form 41 Schedule K-1?

A: The deadline to file Form 41 Schedule K-1 is the same as the filing deadline for the fiduciary income tax return, which is typically April 15th.

Q: Are there any specific instructions for completing Form 41 Schedule K-1?

A: Yes, the Alabama Department of Revenue provides instructions for completing Form 41 Schedule K-1. It is important to carefully follow these instructions to ensure accurate reporting.

Q: Is Form 41 Schedule K-1 only for Alabama residents?

A: No, Form 41 Schedule K-1 is used specifically for reporting fiduciary income tax information in Alabama, regardless of the beneficiary's residency status.

Q: What should I do if I have questions or need assistance with Form 41 Schedule K-1?

A: If you have questions or need assistance with Form 41 Schedule K-1, you can contact the Alabama Department of Revenue or seek help from a tax professional.

Q: What are the penalties for not filing Form 41 Schedule K-1?

A: Failure to file Form 41 Schedule K-1 or filing it late may result in penalties imposed by the Alabama Department of Revenue. It is important to submit the form on time to avoid any penalties.

Form Details:

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.