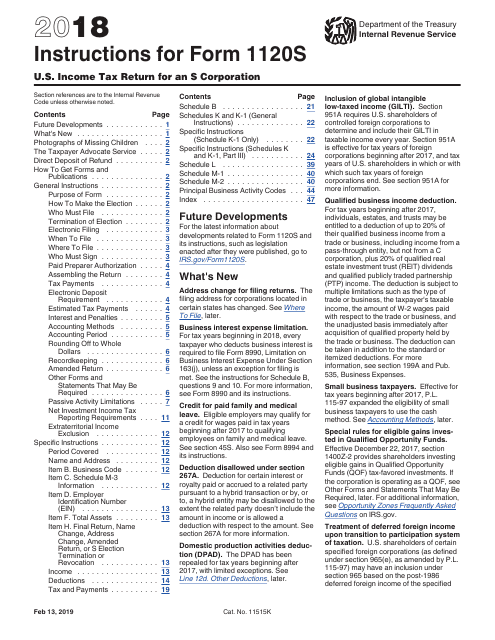

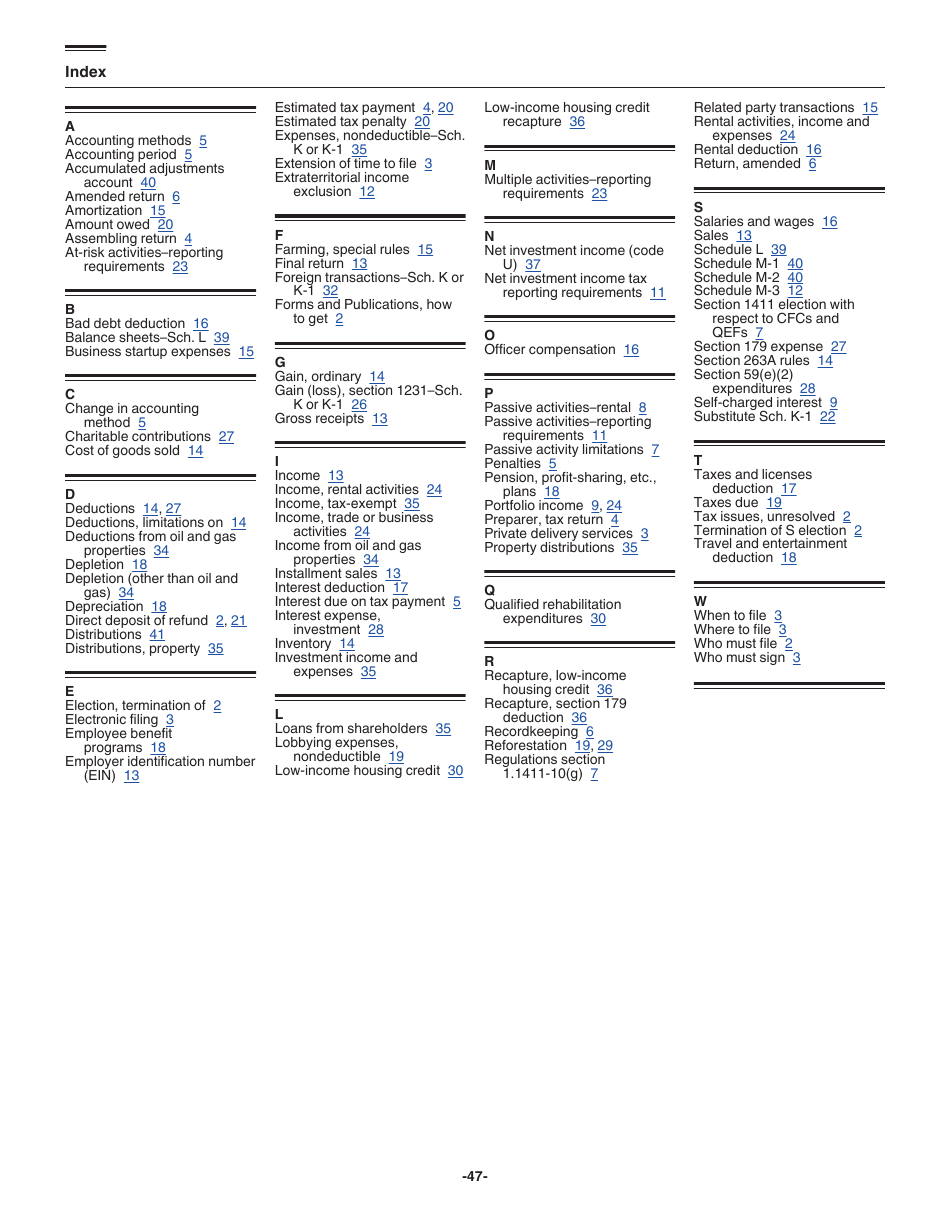

Instructions for IRS Form 1120S U.S. Income Tax Return for an S Corporation

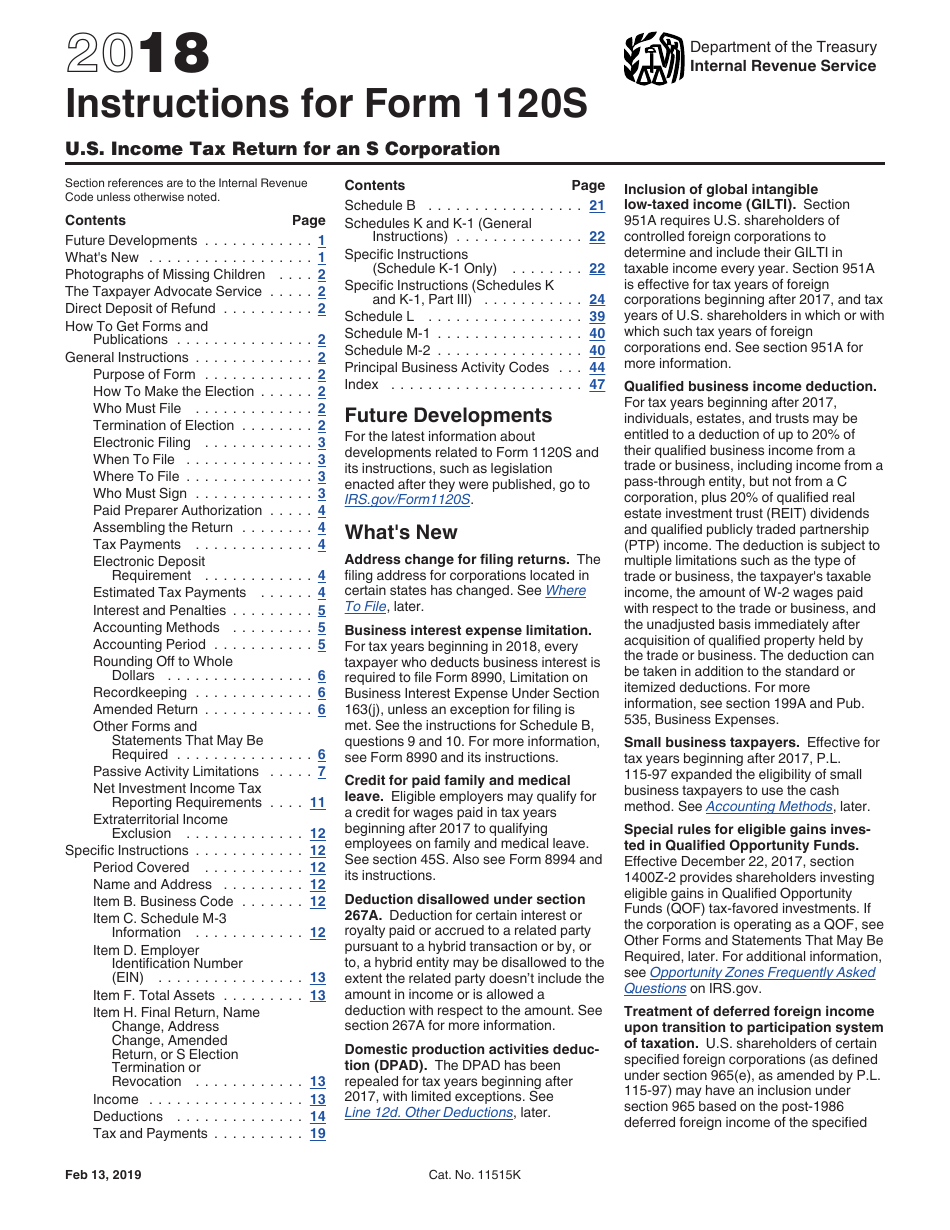

This document contains official instructions for IRS Form 1120S , U.S. Income Tax Return for an S Corporation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120S Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120S?

A: IRS Form 1120S is the U.S. Income Tax Return for an S Corporation.

Q: Who should file IRS Form 1120S?

A: S Corporations, also known as small business corporations, must file IRS Form 1120S.

Q: What is the purpose of filing IRS Form 1120S?

A: The purpose of filing IRS Form 1120S is to report the income, deductions, and credits of an S Corporation.

Q: What information is required to complete IRS Form 1120S?

A: To complete IRS Form 1120S, you will need information related to the S Corporation's income, deductions, credits, and shareholders.

Q: When is the deadline for filing IRS Form 1120S?

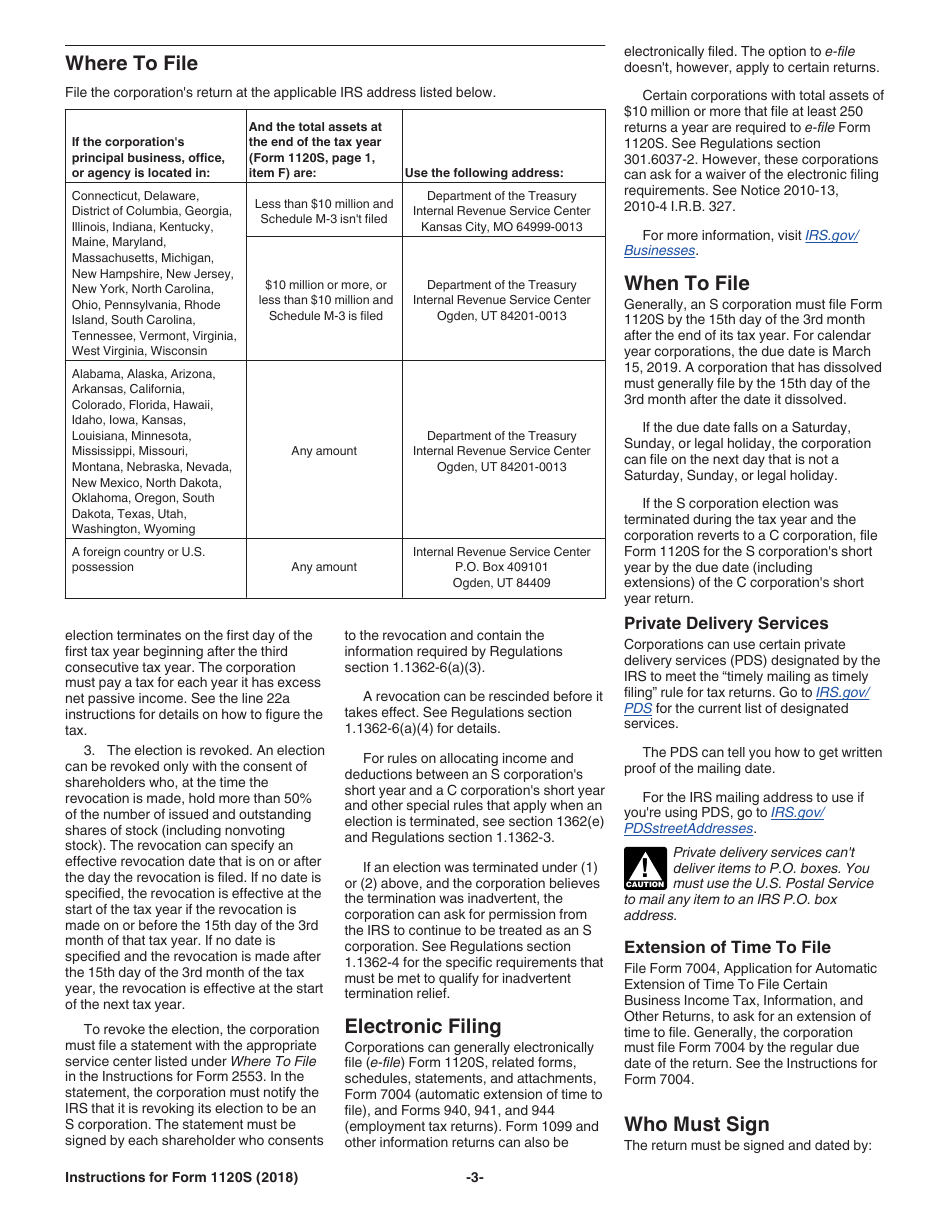

A: The deadline for filing IRS Form 1120S is the 15th day of the 3rd month after the end of the S Corporation's tax year.

Q: Are there any penalties for not filing IRS Form 1120S?

A: Yes, there are penalties for not filing IRS Form 1120S. It is important to file the form timely to avoid these penalties.

Q: Are there any additional schedules or forms that need to be filed with IRS Form 1120S?

A: Yes, there may be additional schedules or forms that need to be filed with IRS Form 1120S, depending on the specific circumstances of the S Corporation.

Q: Can I e-file IRS Form 1120S?

A: Yes, you can e-file IRS Form 1120S. The IRS has an Electronic Filing System that allows you to electronically submit your tax return.

Q: Do I need to include my S Corporation's financial statements with IRS Form 1120S?

A: No, you do not need to include your S Corporation's financial statements with IRS Form 1120S. However, you should keep them for your records.

Instruction Details:

- This 47-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.