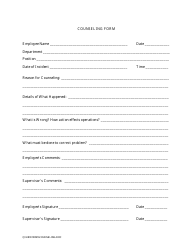

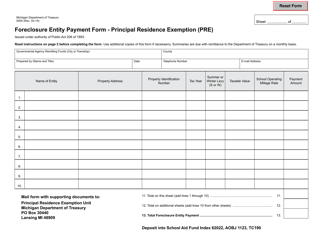

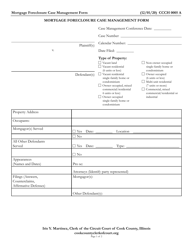

Sample Foreclosure Prevention Counseling Forms - National Consumer Law Center

Sample Foreclosure Prevention Counseling Forms - National Consumer Law Center is for providing guidance and templates to counselors who assist individuals facing foreclosure. It helps ensure that the counseling process is properly documented and follows best practices.

FAQ

Q: What is foreclosure prevention counseling?

A: Foreclosure prevention counseling is a service provided by housing counseling agencies to help homeowners prevent foreclosure on their homes.

Q: How can foreclosure prevention counseling help homeowners?

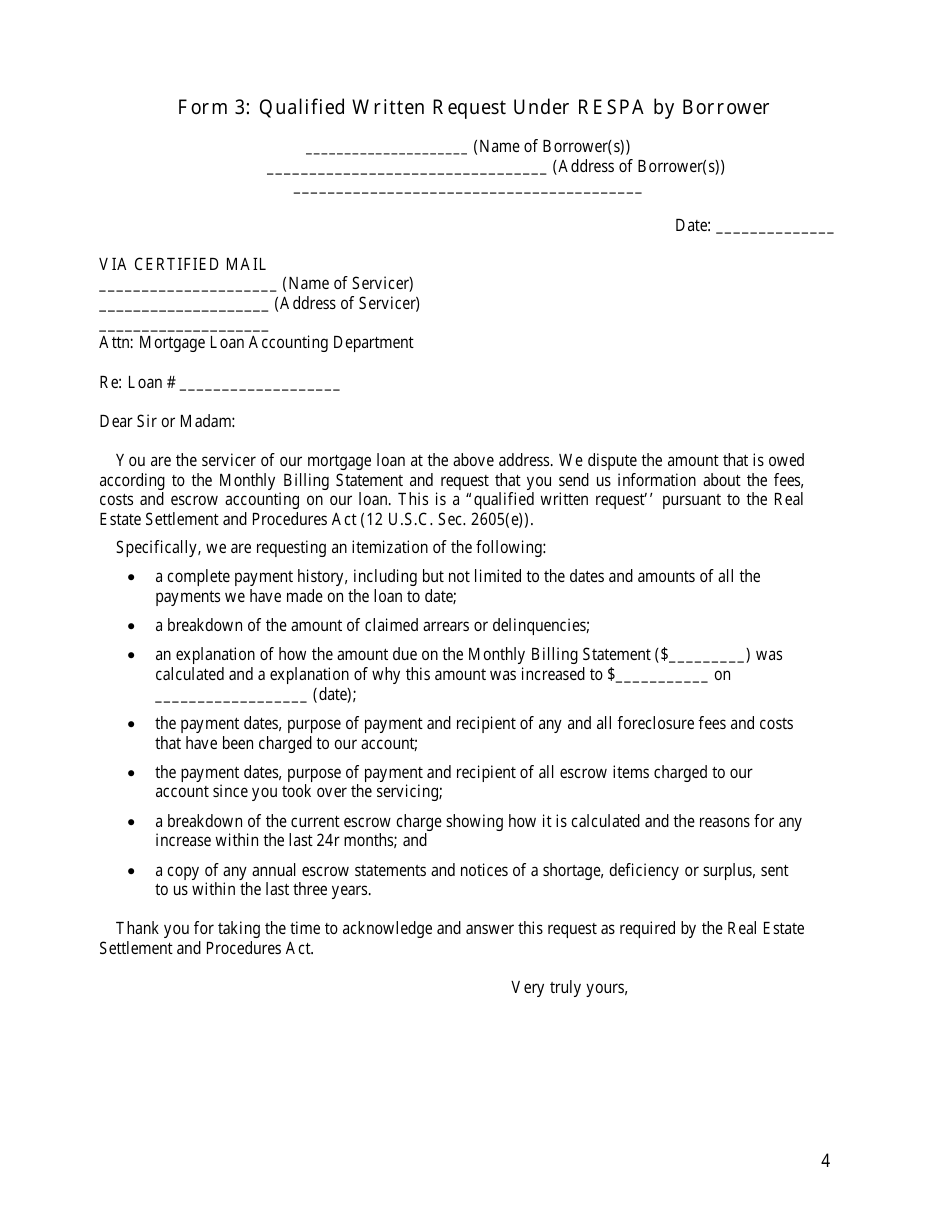

A: Foreclosure prevention counseling can help homeowners understand their options, negotiate with their lenders, and develop a plan to avoid foreclosure.

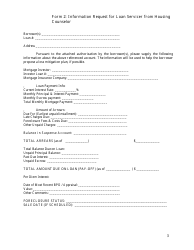

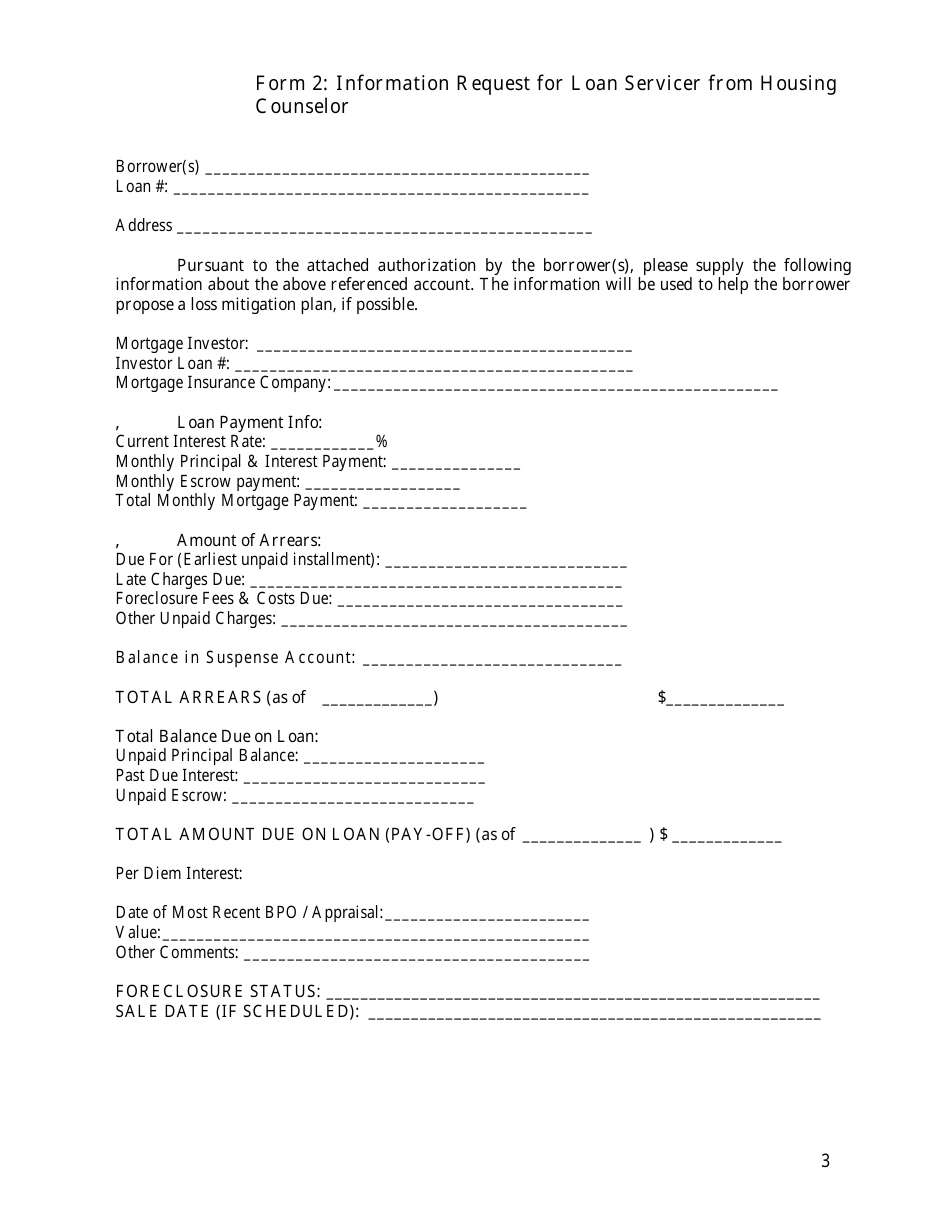

Q: What documents are needed for foreclosure prevention counseling?

A: Documents needed for foreclosure prevention counseling typically include proof of income, mortgage statement, bank statements, tax returns, and hardship letter.

Q: Is foreclosure prevention counseling free?

A: Many foreclosure prevention counseling services are free or offered at a low cost, especially for low-income homeowners.

Q: Will foreclosure prevention counseling guarantee that my home will be saved?

A: Foreclosure prevention counseling can provide guidance and support, but it cannot guarantee that a home will be saved from foreclosure. The outcome depends on various factors, including the homeowner's financial situation and the lender's willingness to work with the homeowner.

Q: Can homeowners receive foreclosure prevention counseling if they have already received a foreclosure notice?

A: Yes, homeowners can still receive foreclosure prevention counseling even after receiving a foreclosure notice. It is recommended to seek assistance as early as possible.

Q: Are there any government programs that provide foreclosure prevention assistance?

A: Yes, there are several government programs available to provide foreclosure prevention assistance, such as the Home Affordable Modification Program (HAMP) and the Hardest Hit Fund.

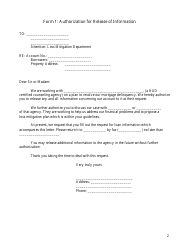

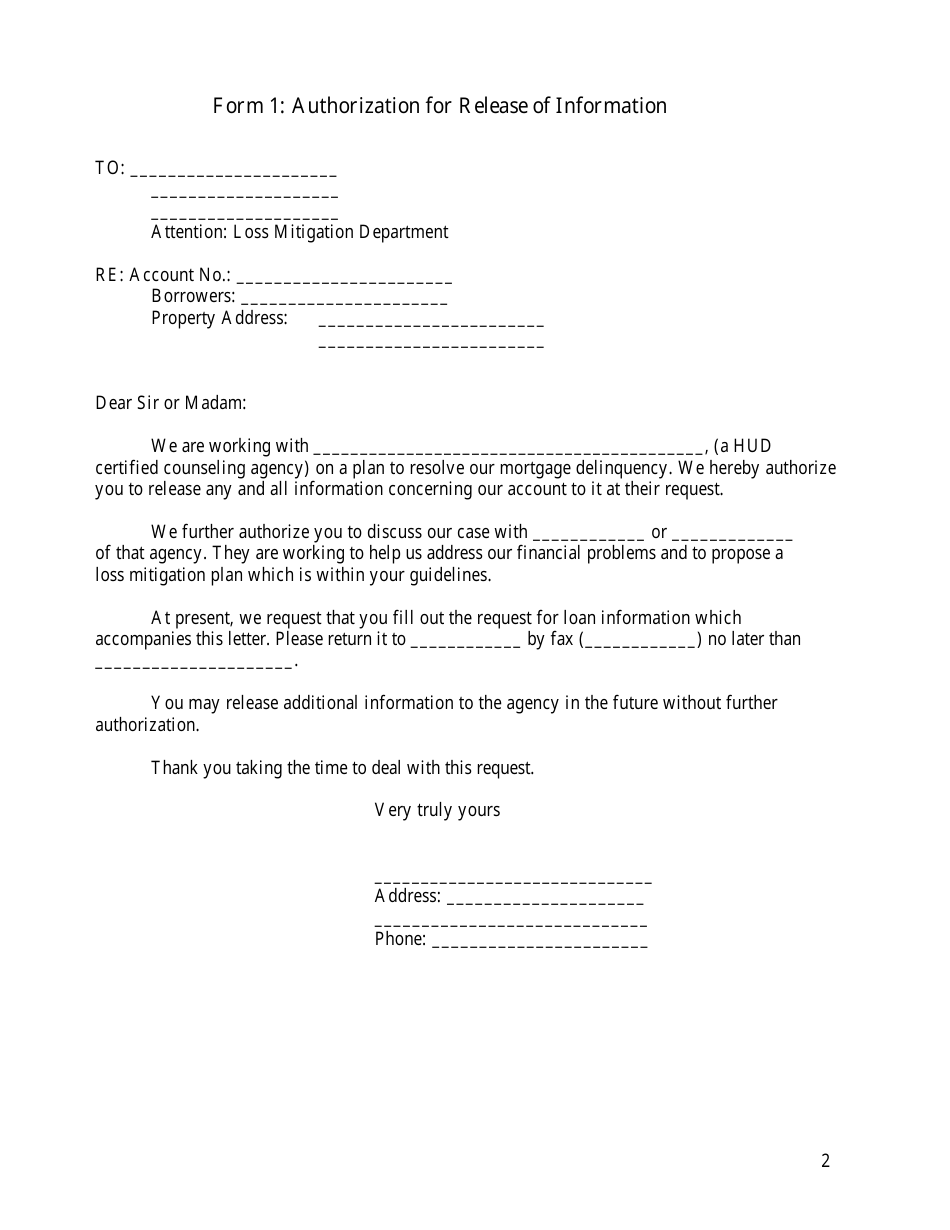

Q: Are foreclosure prevention counselors required to keep homeowner's information confidential?

A: Yes, foreclosure prevention counselors are required to keep homeowner's information confidential. They should not share any personal or financial information without the homeowner's consent.

Q: How long does foreclosure prevention counseling typically take?

A: The duration of foreclosure prevention counseling can vary depending on the homeowner's situation. It may involve multiple sessions and follow-up discussions to develop a suitable plan.