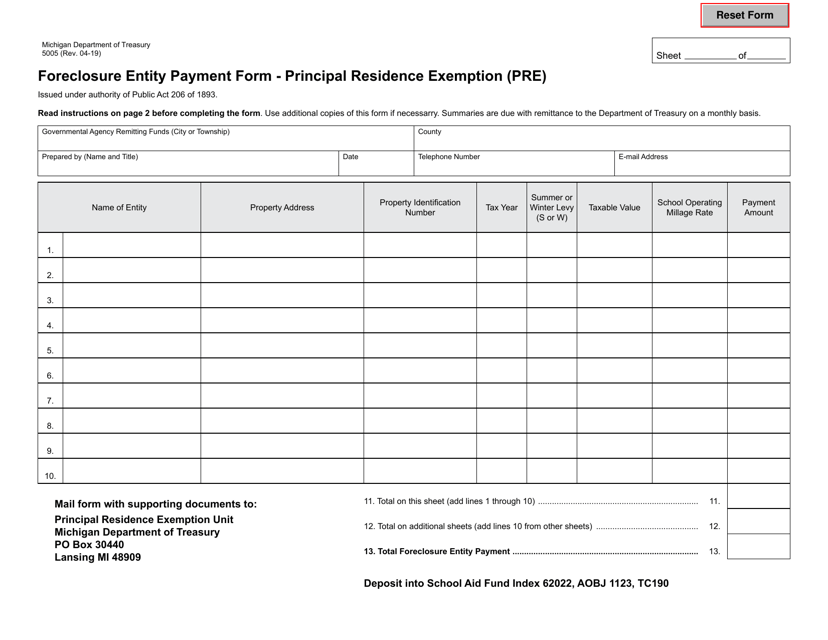

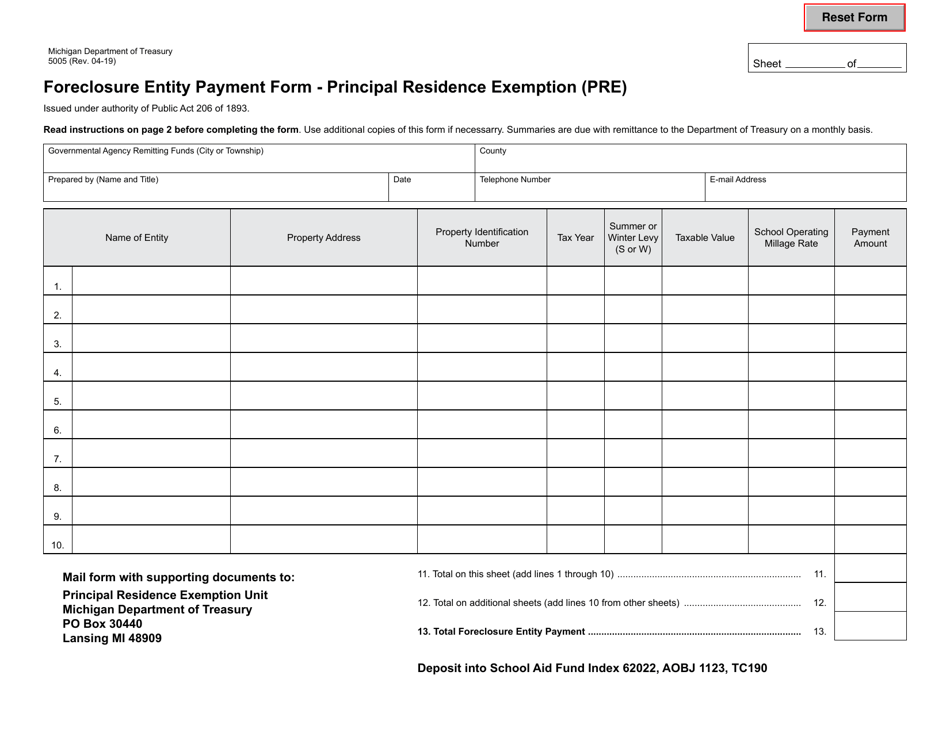

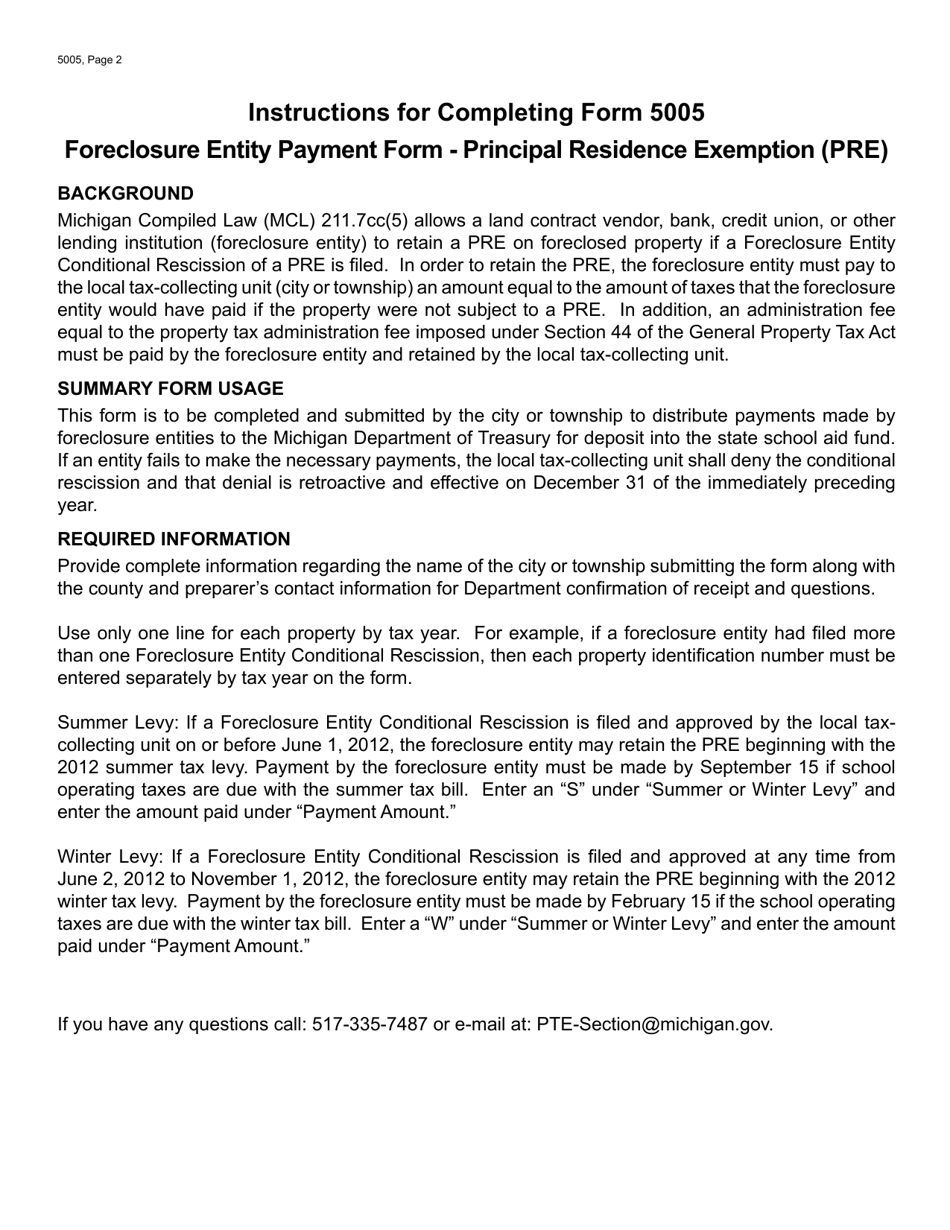

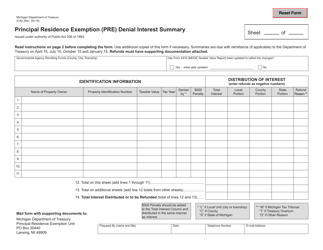

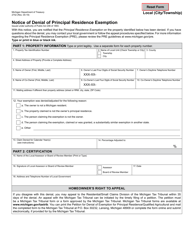

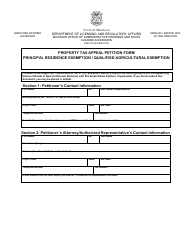

Form 5005 Foreclosure Entity Payment Form - Principal Residence Exemption (Pre) - Michigan

What Is Form 5005?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

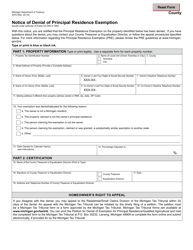

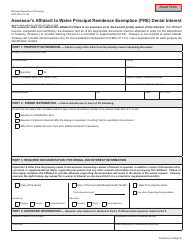

Q: What is Form 5005?

A: Form 5005 is a Foreclosure Entity Payment Form for the Principal Residence Exemption (PRE) in Michigan.

Q: What is the purpose of Form 5005?

A: The purpose of Form 5005 is to request a foreclosure entity to reimburse the PRE taxes paid on a foreclosed principal residence.

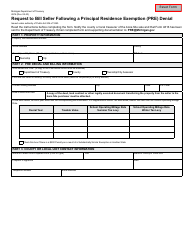

Q: Who should use Form 5005?

A: Foreclosure entities should use Form 5005 to reimburse the PRE taxes paid on a foreclosed principal residence.

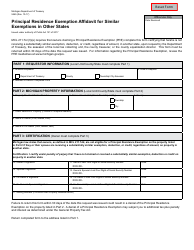

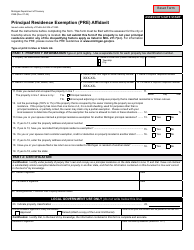

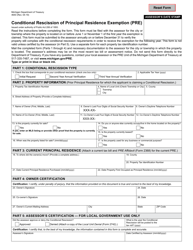

Q: What is a Principal Residence Exemption (PRE)?

A: Principal Residence Exemption (PRE) is a property tax exemption available to Michigan homeowners who use their property as their principal residence.

Q: Why would I need to use Form 5005?

A: If you are a foreclosure entity that has foreclosed on a principal residence and wants to reimburse the PRE taxes, you would need to use Form 5005.

Q: Is there a deadline for submitting Form 5005?

A: Yes, Form 5005 must be submitted to the Michigan Department of Treasury by the due date specified on the form.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5005 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.