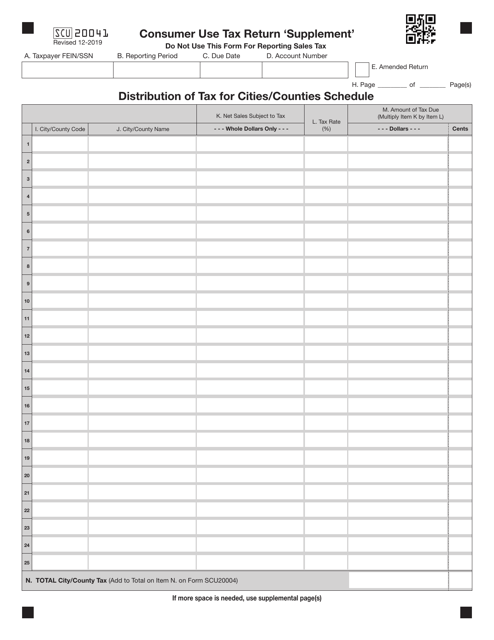

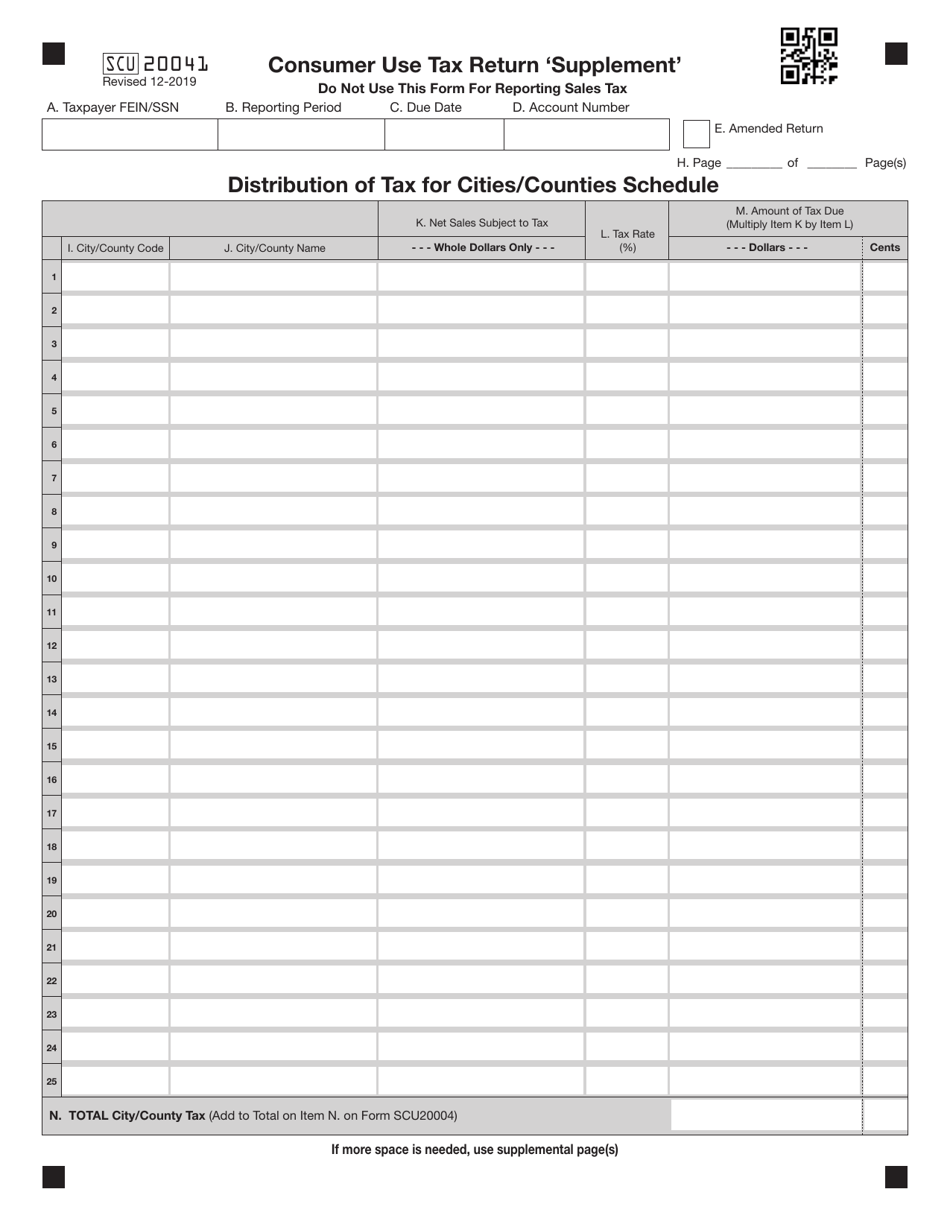

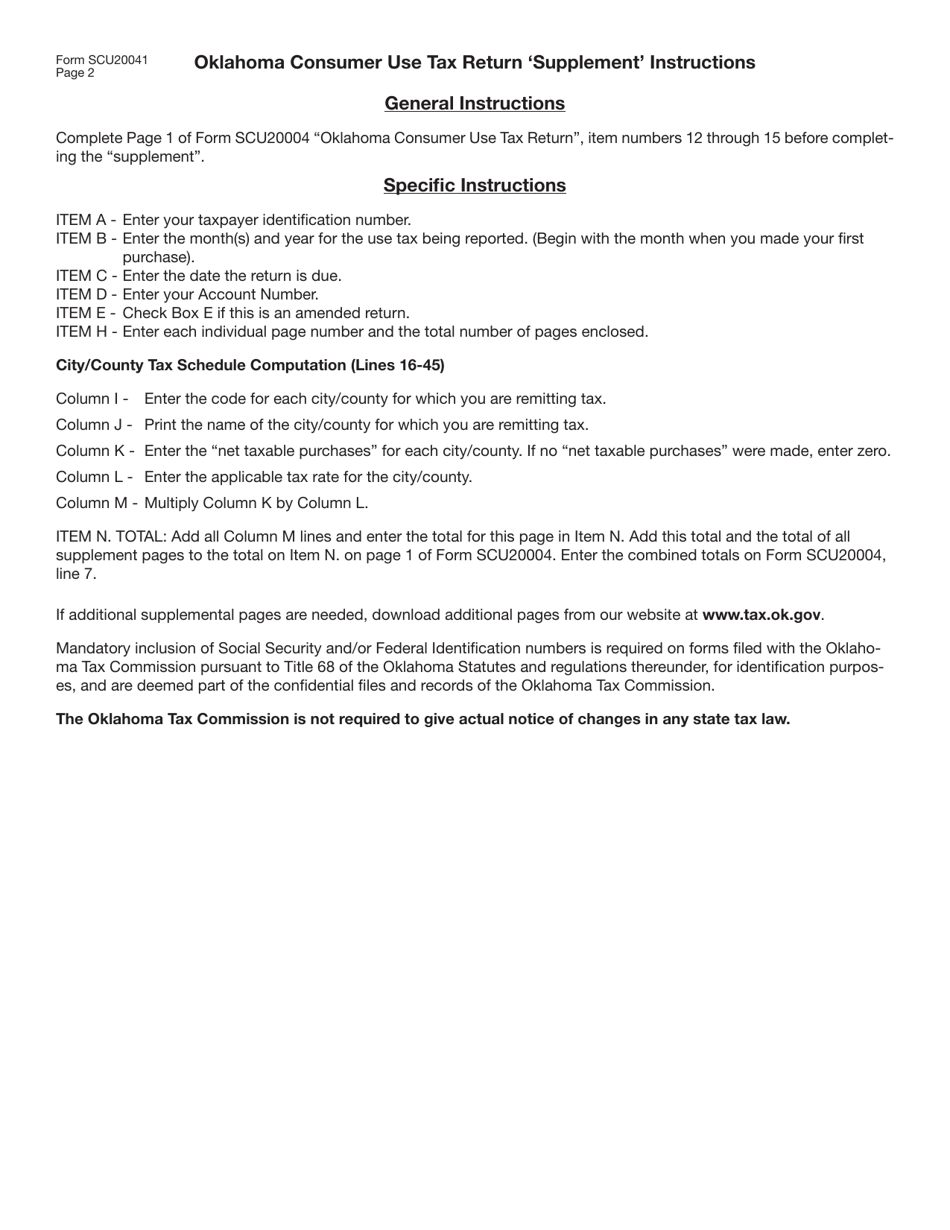

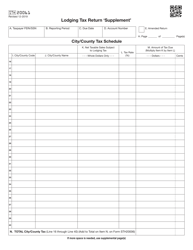

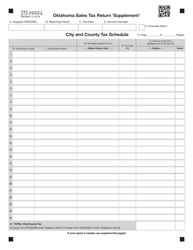

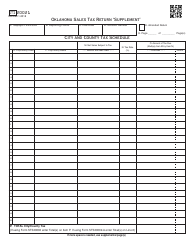

Form SCU20041 Consumer Use Tax Return 'supplement' - Oklahoma

What Is Form SCU20041?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SCU20041?

A: Form SCU20041 is the Consumer Use Tax Return 'supplement' for the state of Oklahoma.

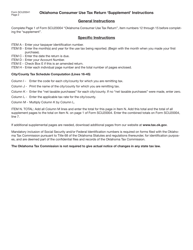

Q: Who needs to file Form SCU20041?

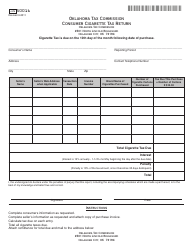

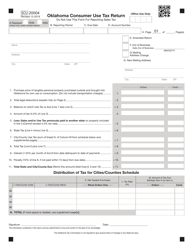

A: Individuals or businesses in Oklahoma who have made purchases from out-of-state sellers and owe use tax.

Q: What is use tax?

A: Use tax is a tax on goods purchased for use, storage, or consumption in Oklahoma that were not subject to sales tax.

Q: What is the purpose of Form SCU20041?

A: Form SCU20041 is used to report and remit use tax owed on purchases made from out-of-state sellers.

Q: When is Form SCU20041 due?

A: Form SCU20041 is due on or before the 20th day of the month following the end of the reporting period.

Q: Is Form SCU20041 required if I have no use tax liability?

A: Yes, even if you have no use tax liability, you are still required to file a zero-activity return.

Q: Are there any penalties for late filing of Form SCU20041?

A: Yes, there are penalties for late filing, including interest on any unpaid tax amounts.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SCU20041 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.