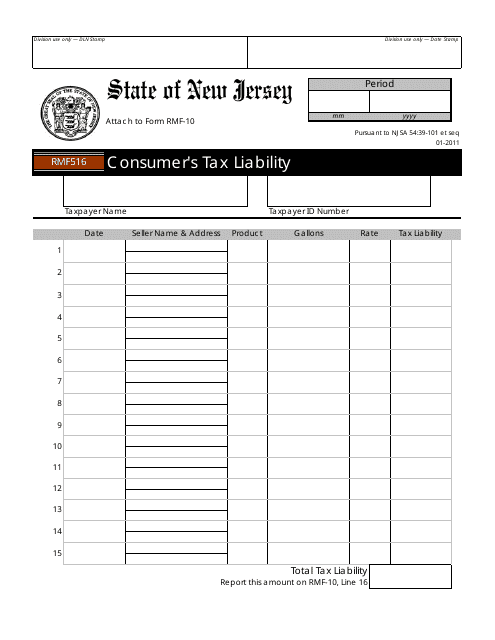

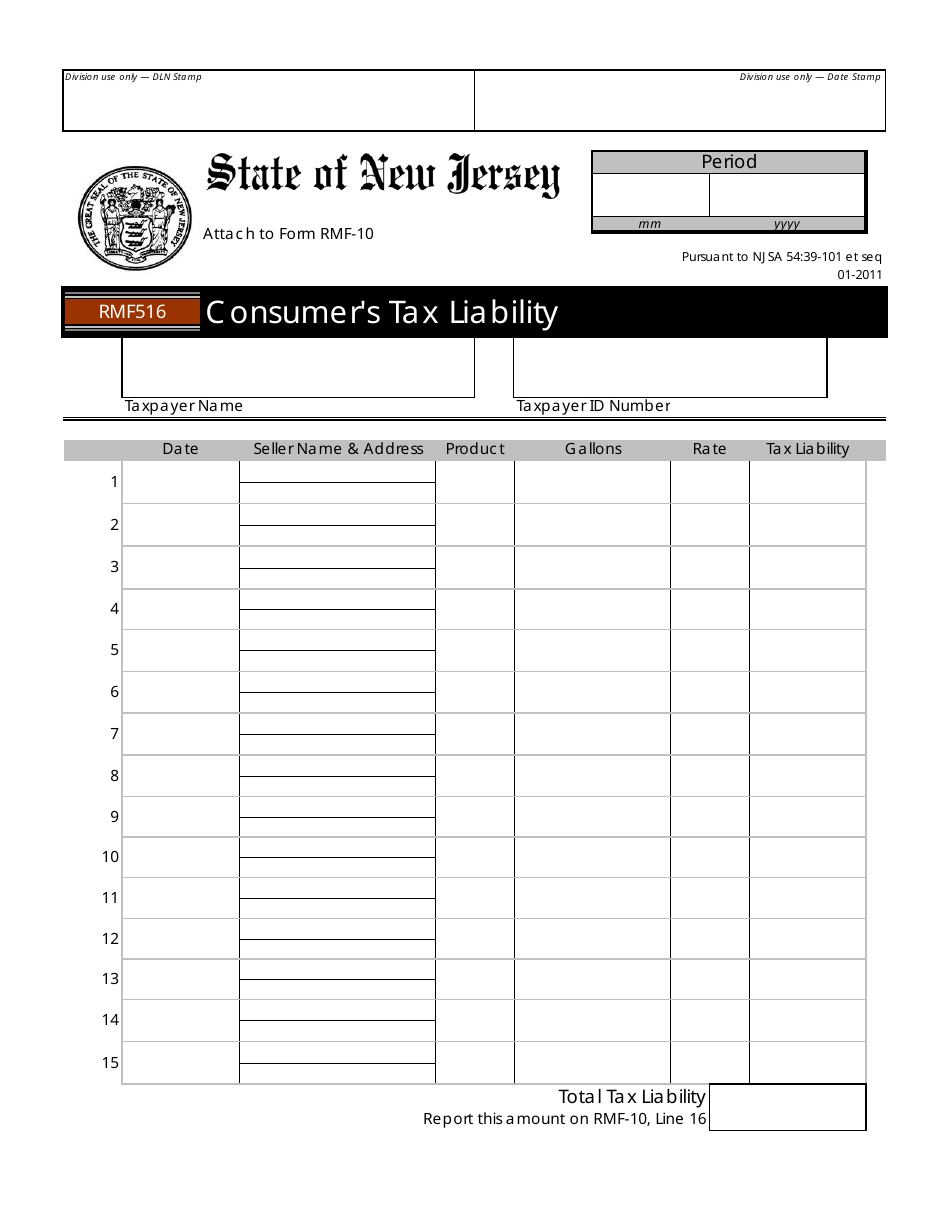

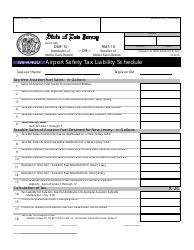

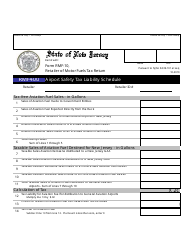

Form RMF516 Consumer's Tax Liability - New Jersey

What Is Form RMF516?

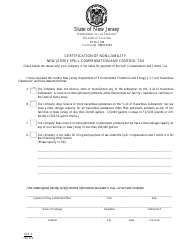

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMF516?

A: RMF516 is a form used by consumers in New Jersey to calculate their tax liability.

Q: Who needs to fill out RMF516?

A: Consumers in New Jersey who have tax liability need to fill out RMF516.

Q: What is the purpose of RMF516?

A: The purpose of RMF516 is to determine the amount of tax that a consumer in New Jersey needs to pay.

Q: What information is required on RMF516?

A: RMF516 requires information such as income, deductions, credits, and any additional taxes owed.

Q: When is the deadline to submit RMF516?

A: The deadline to submit RMF516 is April 15th, or the same as the federal tax deadline.

Q: Are there any penalties for not submitting RMF516?

A: Yes, if you do not submit RMF516 or pay your tax liability on time, you may be subject to penalties and interest.

Q: Can I make changes to RMF516 after submitting it?

A: No, once you submit RMF516, you cannot make any changes. However, you can file an amended return if needed.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RMF516 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.