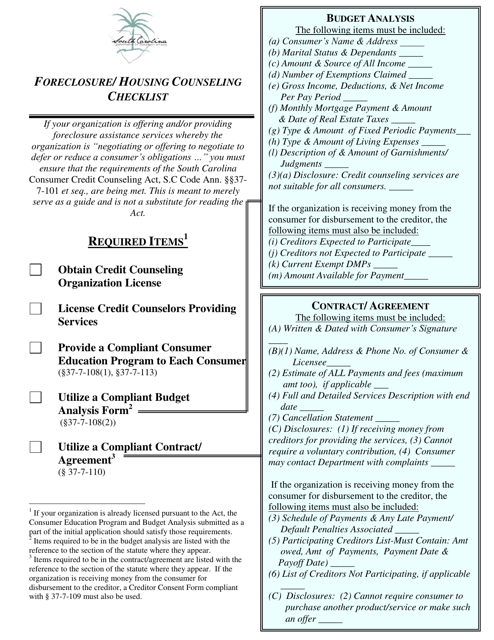

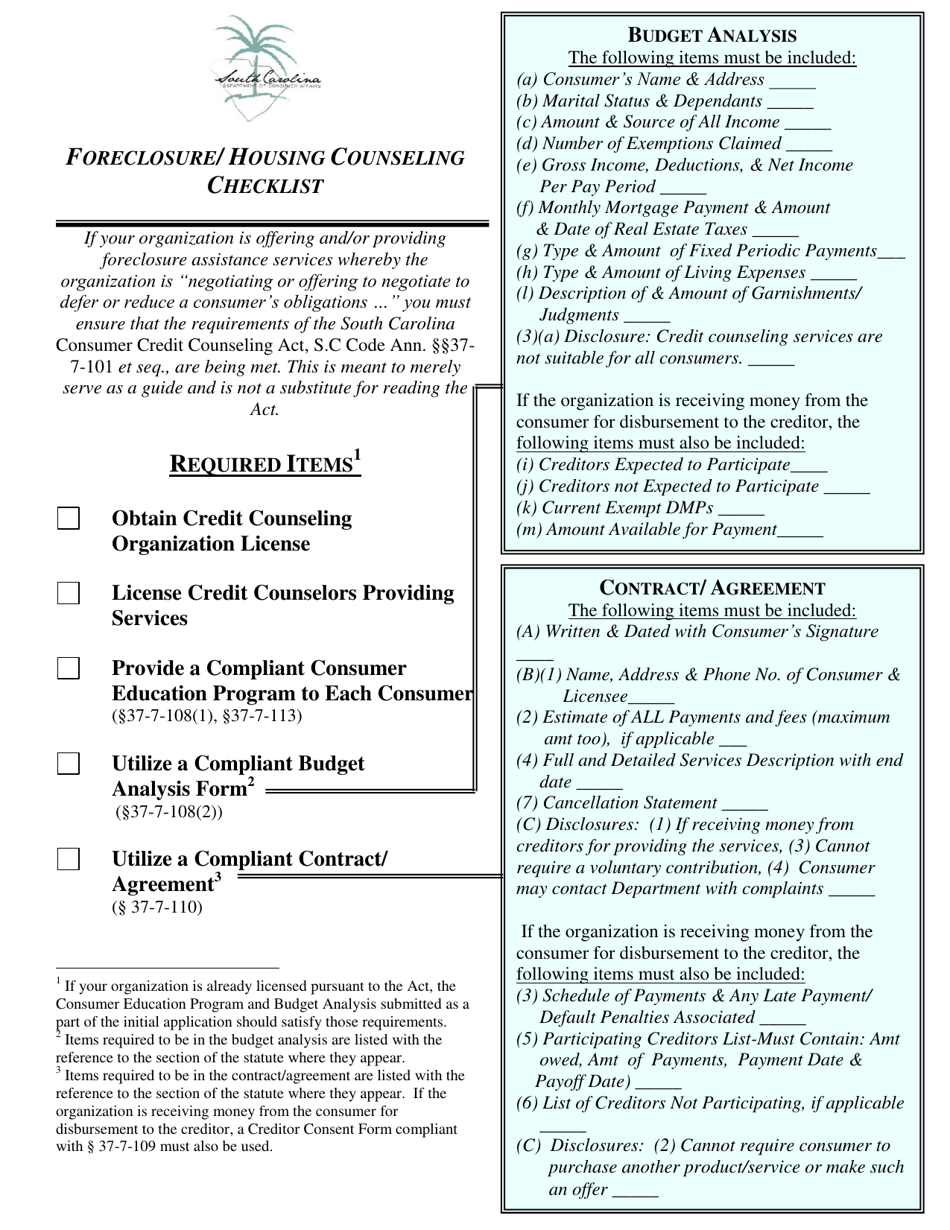

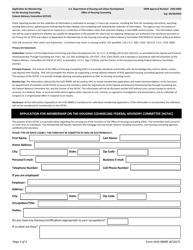

Foreclosure / Housing Counseling Checklist - South Carolina

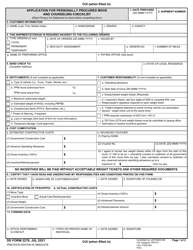

Foreclosure/ Housing Counseling Checklist is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is foreclosure?

A: Foreclosure is a legal process in which a lender takes possession of a property due to the borrower's failure to make mortgage payments.

Q: Why would I need housing counseling?

A: Housing counseling can help you understand your options and navigate the foreclosure process.

Q: What should I bring to a housing counseling session?

A: You should bring important documents such as your mortgage statements, bank statements, and proof of income.

Q: Can housing counseling stop foreclosure?

A: Housing counseling can provide guidance and assistance, but it cannot guarantee that foreclosure will be stopped.

Q: What are some alternatives to foreclosure?

A: Some alternatives to foreclosure include loan modification, forbearance, and short sale.

Q: Will I lose my home during the foreclosure process?

A: If you are unable to find a solution to avoid foreclosure, you may eventually lose your home.

Q: How long does the foreclosure process take in South Carolina?

A: The foreclosure process in South Carolina typically takes around 150-210 days.

Q: Are there any foreclosure prevention programs in South Carolina?

A: Yes, there are foreclosure prevention programs available in South Carolina, such as the South Carolina Homeownership and Employment Lending Program (SC HELP).

Q: Can I negotiate with my lender to avoid foreclosure?

A: Yes, you can negotiate with your lender to explore options to avoid foreclosure, such as loan modification or forbearance.

Form Details:

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.