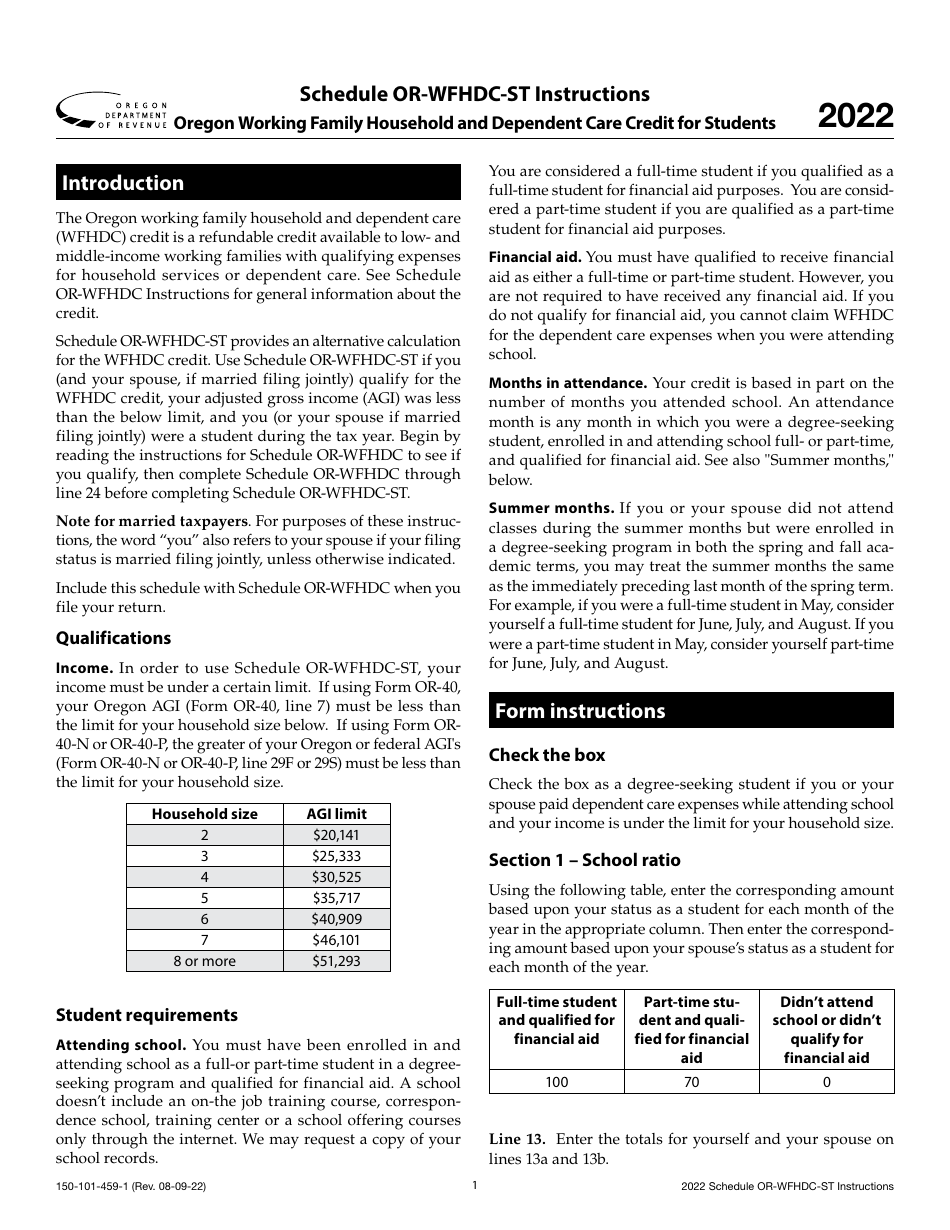

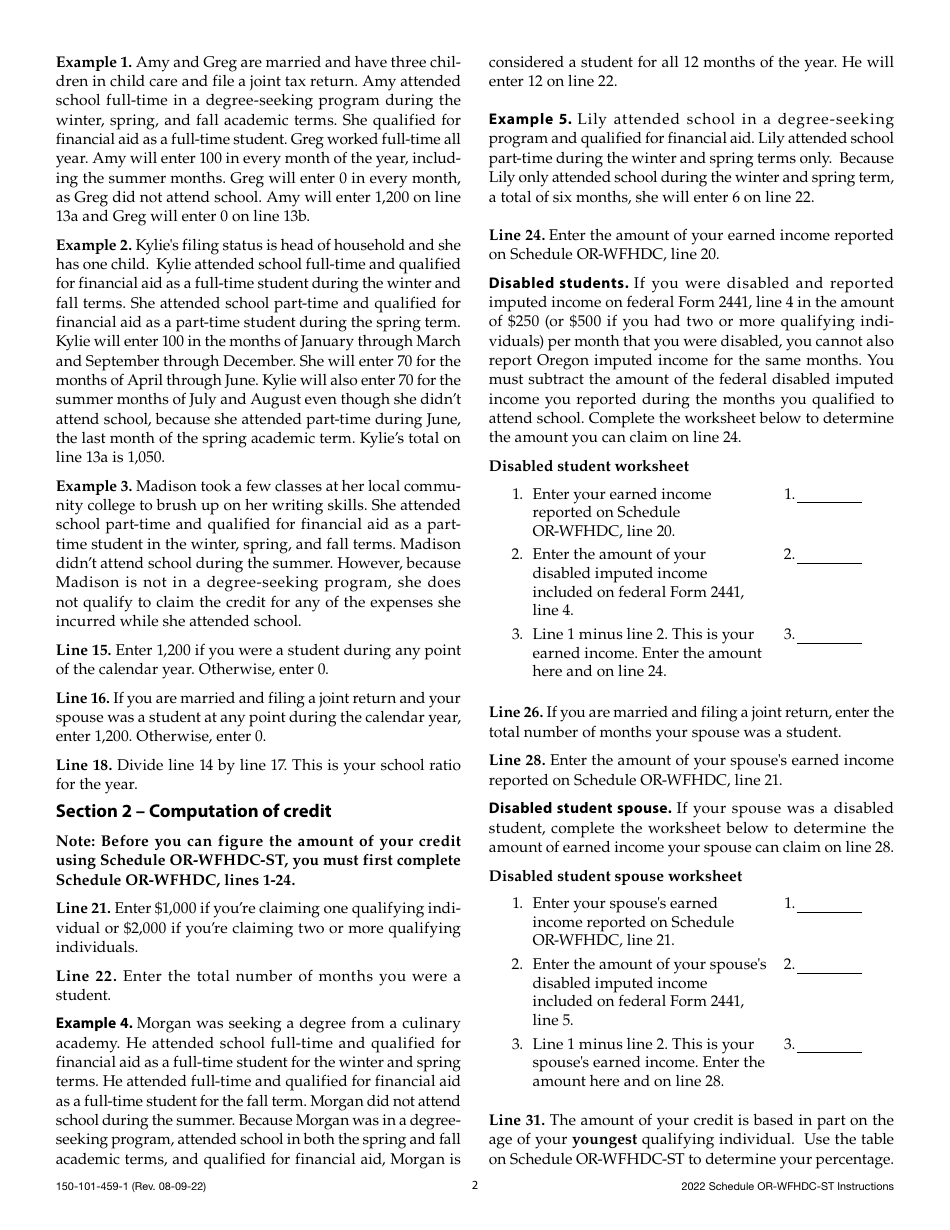

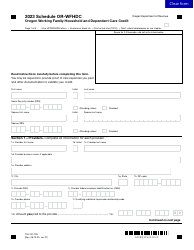

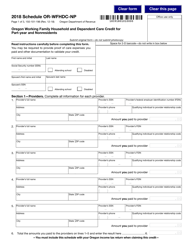

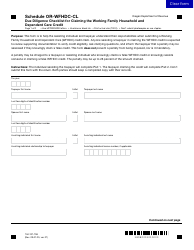

Instructions for Form 150-101-459 Schedule OR-WFHDC-ST Oregon Working Family Household and Dependent Care Credit for Students - Oregon

This document contains official instructions for Form 150-101-459 Schedule OR-WFHDC-ST, Oregon Dependent Care Credit for Students - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-459 Schedule OR-WFHDC-ST is available for download through this link.

FAQ

Q: What is Form 150-101-459?

A: Form 150-101-459 is a schedule used in Oregon to claim the Working Family Household and Dependent Care Credit for Students.

Q: What is the purpose of this form?

A: The purpose of this form is to allow taxpayers in Oregon to claim a credit for expenses related to dependent care services provided to students.

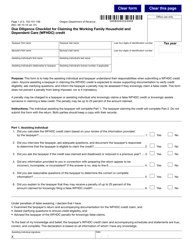

Q: Who is eligible to use this form?

A: Taxpayers in Oregon who have paid for dependent care services for students and meet certain requirements are eligible to use this form.

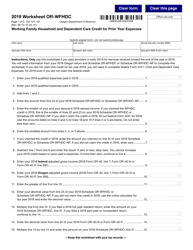

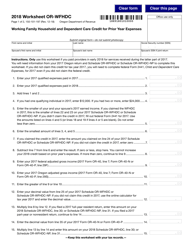

Q: What expenses qualify for the credit?

A: Expenses such as daycare, preschool, and before- and after-school care for dependent students may qualify for the credit.

Q: What are the requirements to claim the credit?

A: To claim the credit, the taxpayer must have a dependent student, have paid for qualifying dependent care services, and meet income and other eligibility criteria.

Q: How do I fill out this form?

A: To fill out the form, you will need to provide information about the taxpayer, dependent student(s), and the expenses paid for dependent care services.

Q: Is there a deadline to file this form?

A: The deadline to file this form is the same as the deadline for filing your Oregon income tax return, usually April 15th.

Q: Are there any other forms or documents I need to include with this form?

A: You may need to include supporting documents such as receipts or invoices for the expenses paid for dependent care services.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.