This version of the form is not currently in use and is provided for reference only. Download this version of

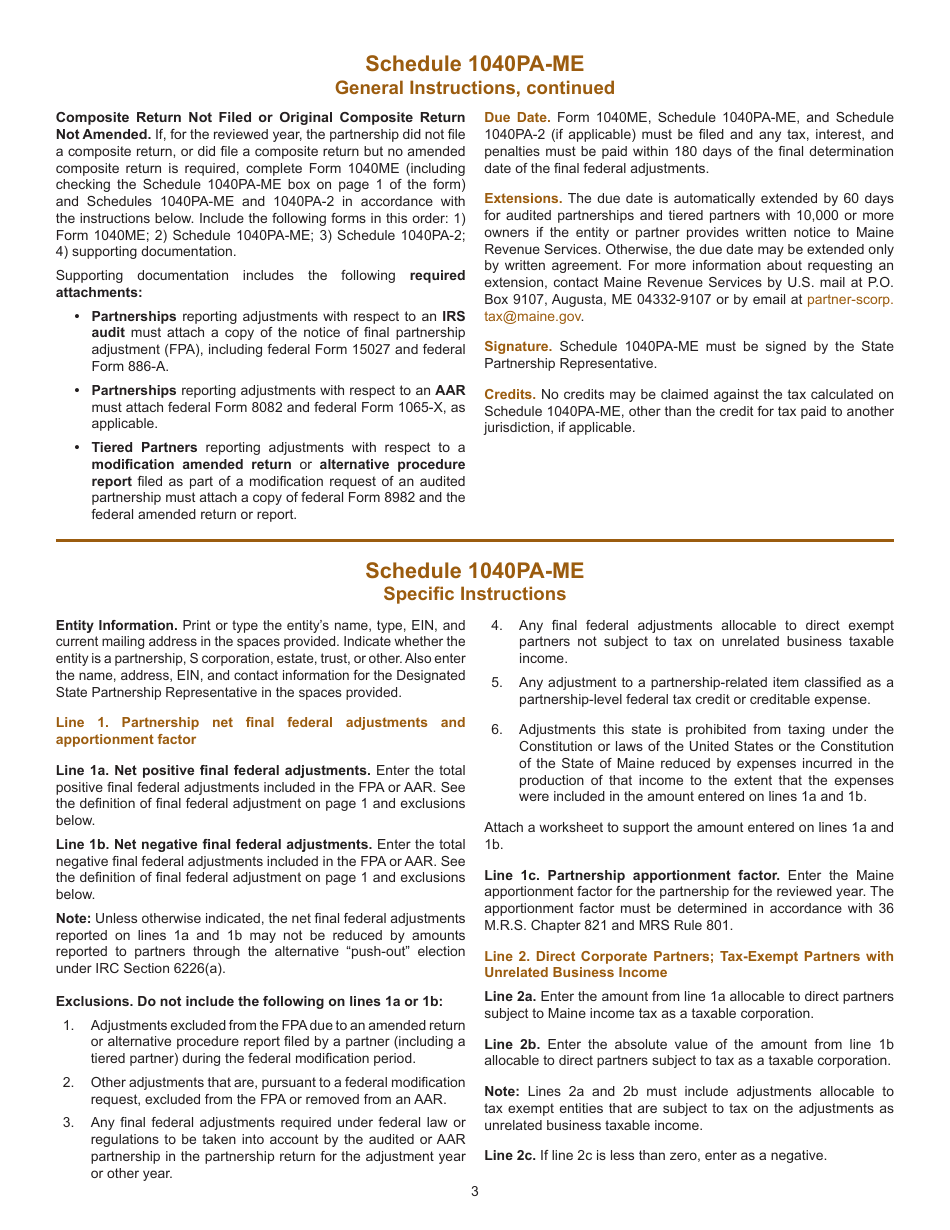

Instructions for Schedule 1040PA-2, 1040PA-ME

for the current year.

Instructions for Schedule 1040PA-2, 1040PA-ME - Maine

This document contains official instructions for Schedule 1040PA-2 , and Schedule 1040PA-ME . Both forms are released and collected by the Maine Revenue Services.

FAQ

Q: What is Schedule 1040PA-2?

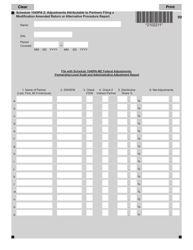

A: Schedule 1040PA-2 is a form used by Maine residents to report additional income adjustments.

Q: What is Schedule 1040PA-ME?

A: Schedule 1040PA-ME is a form used by Maine residents to calculate the portion of their income that is subject to Maine tax.

Q: Do I need to fill out Schedule 1040PA-2?

A: You should fill out Schedule 1040PA-2 if you have certain types of income adjustments, such as certain business expenses or self-employment tax.

Q: Do I need to fill out Schedule 1040PA-ME?

A: Yes, all Maine residents must fill out Schedule 1040PA-ME to calculate the amount of their income subject to Maine tax.

Q: What information do I need to fill out Schedule 1040PA-2 and Schedule 1040PA-ME?

A: You will need your federal tax return information, as well as any additional income adjustment information, such as business expenses or self-employment tax.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Revenue Services.