This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 1120B-ME

for the current year.

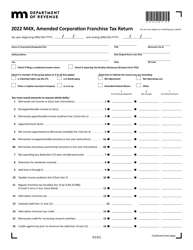

Instructions for Form 1120B-ME Maine Franchise Tax Return for Financial Institutions - Maine

This document contains official instructions for Form 1120B-ME , Maine Franchise Tax Return for Financial Institutions - a form released and collected by the Maine Revenue Services.

FAQ

Q: What is Form 1120B-ME?

A: Form 1120B-ME is the Maine Franchise Tax Return for Financial Institutions.

Q: Who needs to file Form 1120B-ME?

A: Financial institutions operating in Maine need to file Form 1120B-ME.

Q: What is the purpose of Form 1120B-ME?

A: The purpose of Form 1120B-ME is to calculate and report the franchise tax owed by financial institutions in Maine.

Q: What information is required on Form 1120B-ME?

A: Form 1120B-ME requires financial institutions to provide information about their income, deductions, and credits, among other details.

Q: When is Form 1120B-ME due?

A: Form 1120B-ME is due on the 15th day of the 3rd month following the end of the tax year.

Q: Are there any penalties for late filing of Form 1120B-ME?

A: Yes, there may be penalties for late filing or failure to file Form 1120B-ME.

Q: Are there any additional requirements for financial institutions filing Form 1120B-ME?

A: Yes, financial institutions may have additional reporting requirements based on their specific activities and operations in Maine.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maine Revenue Services.