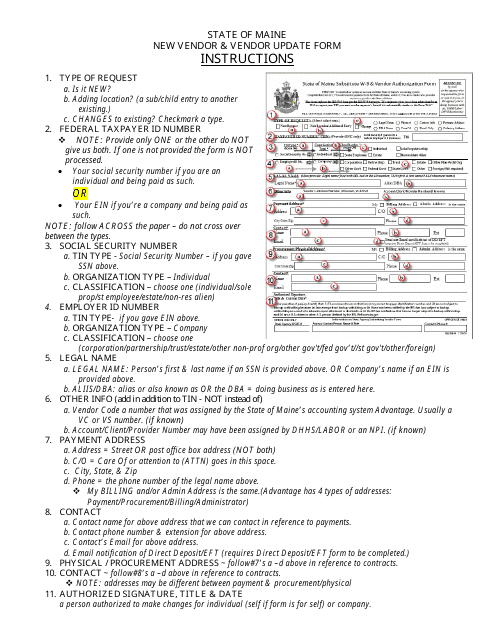

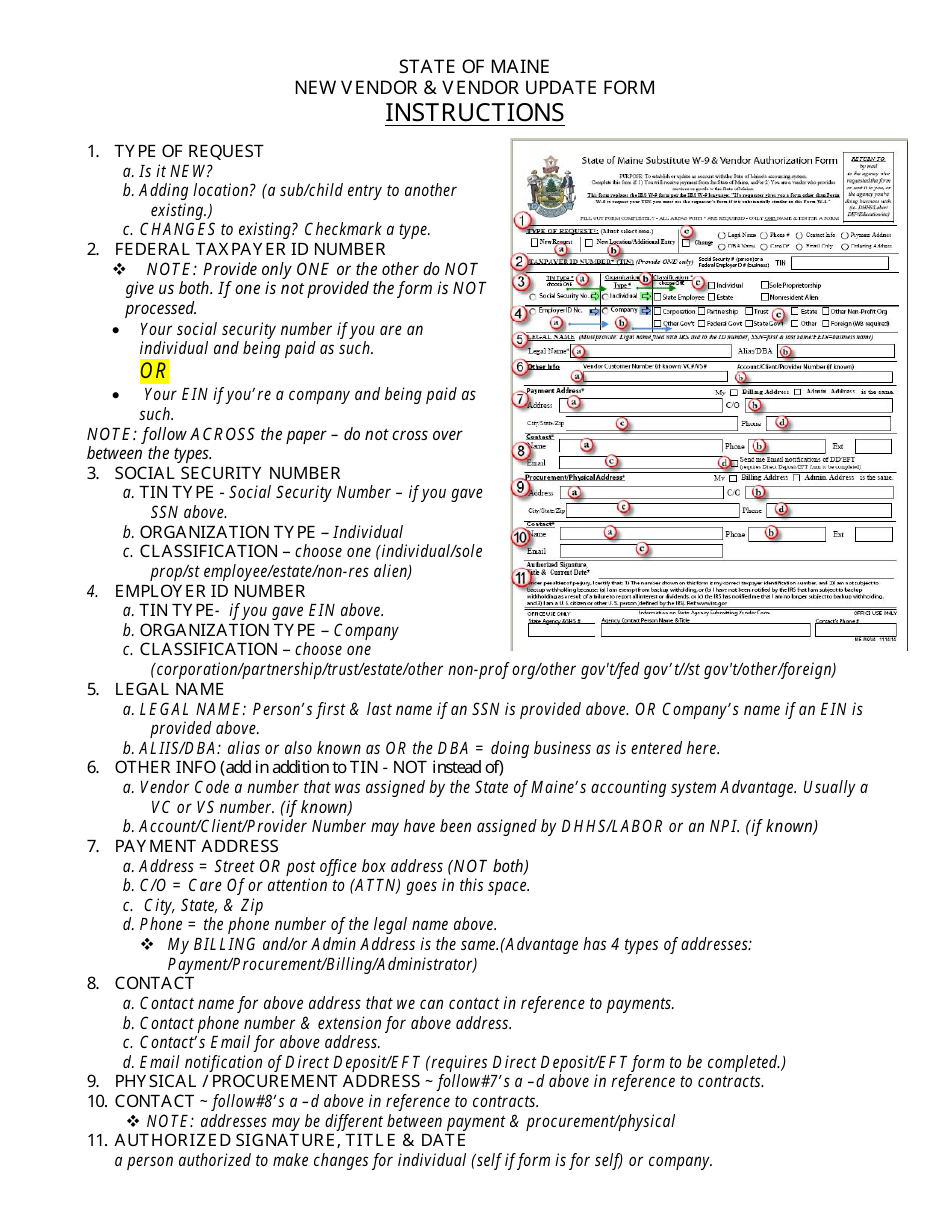

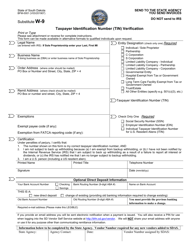

Instructions for Substitute W-9 & Vendor Authorization Form - Maine

This document was released by Maine Department of Administrative and Financial Services and contains the most recent official instructions for Substitute W-9 & Vendor Authorization Form .

FAQ

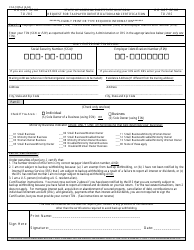

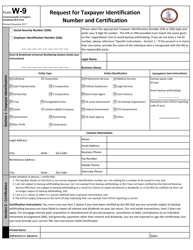

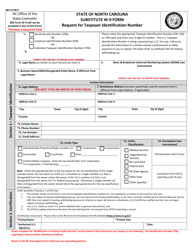

Q: What is a Substitute W-9?

A: A Substitute W-9 is a form used by businesses to collect information from vendors or independent contractors to report their income to the IRS.

Q: Why is a Substitute W-9 needed?

A: A Substitute W-9 is needed so that the business can accurately report the vendor's income to the IRS and comply with tax regulations.

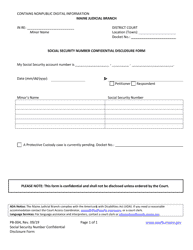

Q: What information is required on a Substitute W-9?

A: A Substitute W-9 typically requires the vendor's name, address, Social Security or taxpayer identification number, and certification regarding backup withholding.

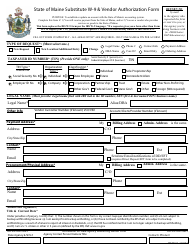

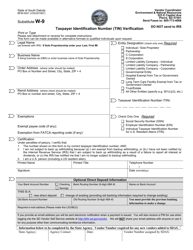

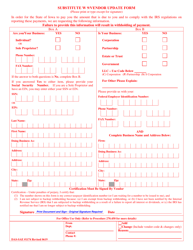

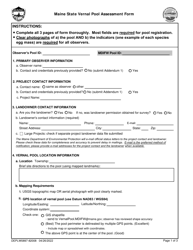

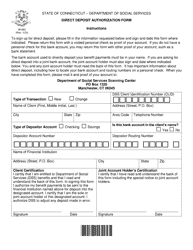

Q: What is a Vendor Authorization Form?

A: A Vendor Authorization Form is a document that grants permission to businesses to use a vendor's information for specific purposes, such as payment processing.

Q: Why is a Vendor Authorization Form important?

A: A Vendor Authorization Form is important because it ensures that the business has legal permission to use the vendor's information for specific purposes.

Q: What information is included in a Vendor Authorization Form?

A: A Vendor Authorization Form typically includes the vendor's name, contact information, payment terms, and any specific authorizations or restrictions.

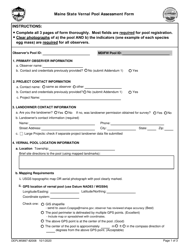

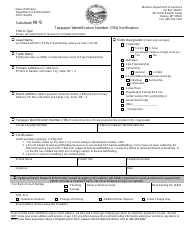

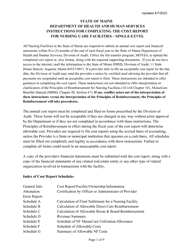

Q: Are there any specific requirements for filling out the Substitute W-9 and Vendor Authorization Form in Maine?

A: Yes, it is important to carefully follow the instructions provided by the Maine Department of Administrative and Financial Services when filling out the Substitute W-9 and Vendor Authorization Form.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library legal documents released by the Maine Department of Administrative and Financial Services.