This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 3150

for the current year.

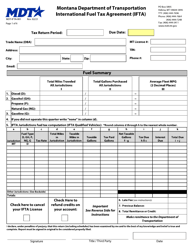

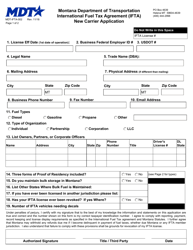

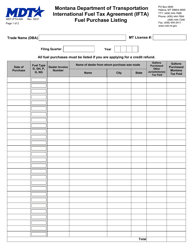

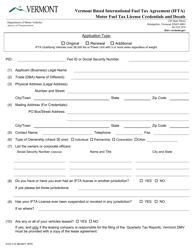

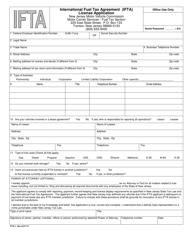

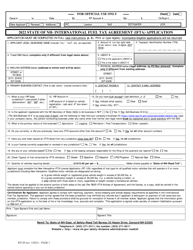

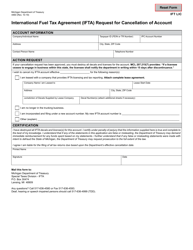

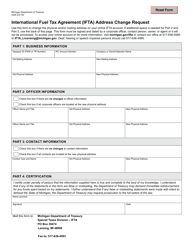

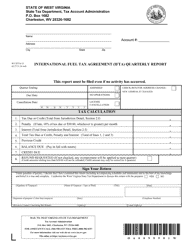

Instructions for Form 3150 International Fuel Tax Agreement (Ifta) Report - Idaho

This document contains official instructions for Form 3150 , International Fuel Tax Agreement (Ifta) Report - a form released and collected by the Idaho State Tax Commission.

FAQ

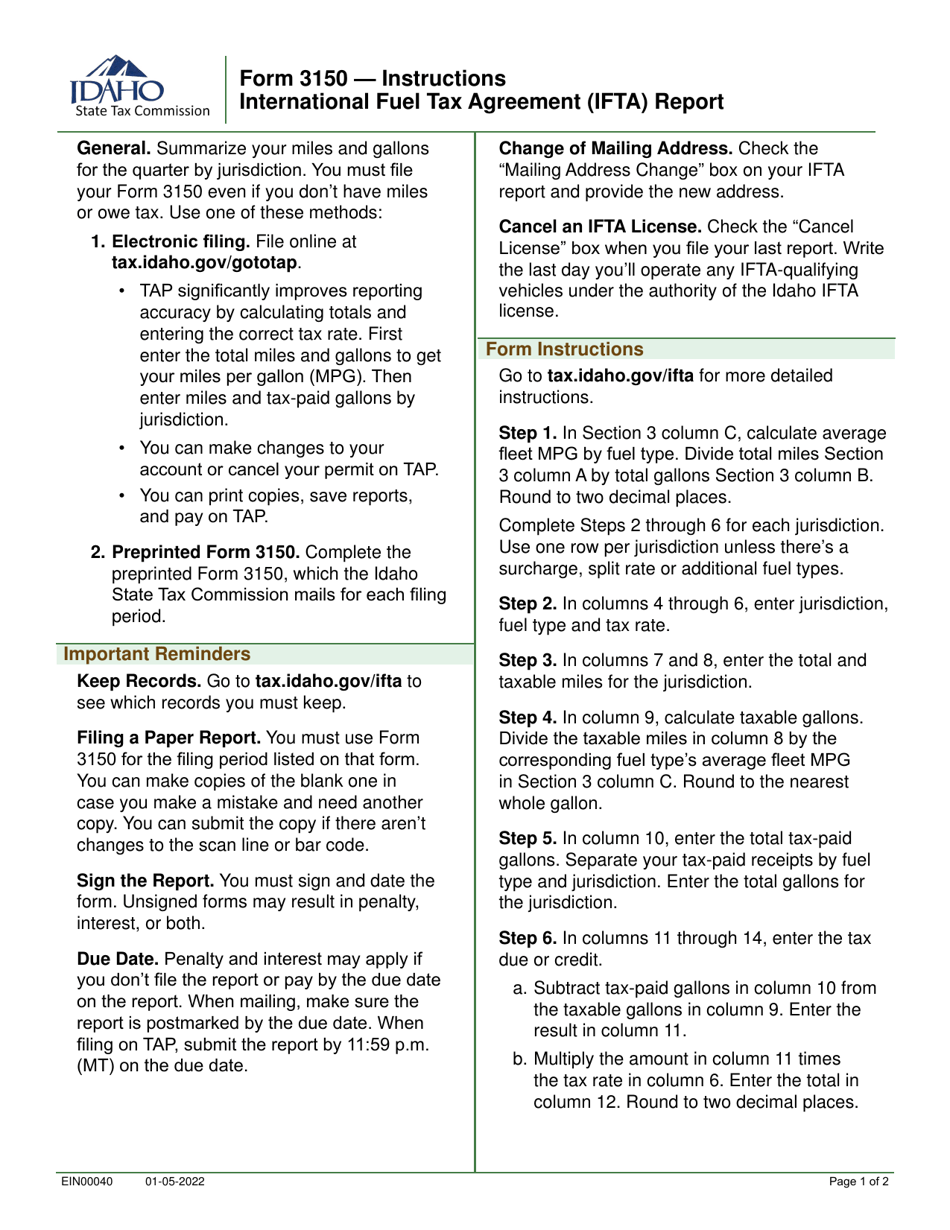

Q: What is Form 3150?

A: Form 3150 is the International Fuel Tax Agreement (IFTA) Report for Idaho.

Q: What is the purpose of Form 3150?

A: The purpose of Form 3150 is to report fuel tax information for vehicles operating in multiple jurisdictions.

Q: Who needs to file Form 3150?

A: All motor carriers based in Idaho who operate qualified motor vehicles in multiple jurisdictions need to file Form 3150.

Q: What information is required on Form 3150?

A: Form 3150 requires information about the miles traveled and gallons of fuel consumed in each jurisdiction.

Q: When is Form 3150 due?

A: Form 3150 is due by the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for not filing Form 3150 on time?

A: Yes, failure to file Form 3150 on time may result in penalties and interest.

Q: What if I have questions or need assistance with Form 3150?

A: If you have questions or need assistance with Form 3150, you can contact the Idaho State Tax Commission.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Idaho State Tax Commission.