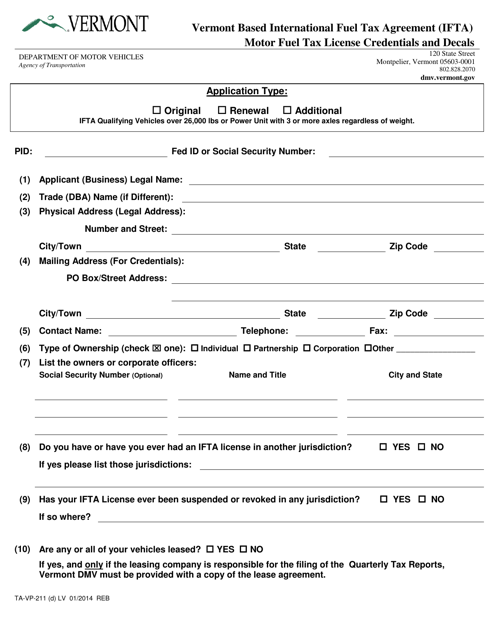

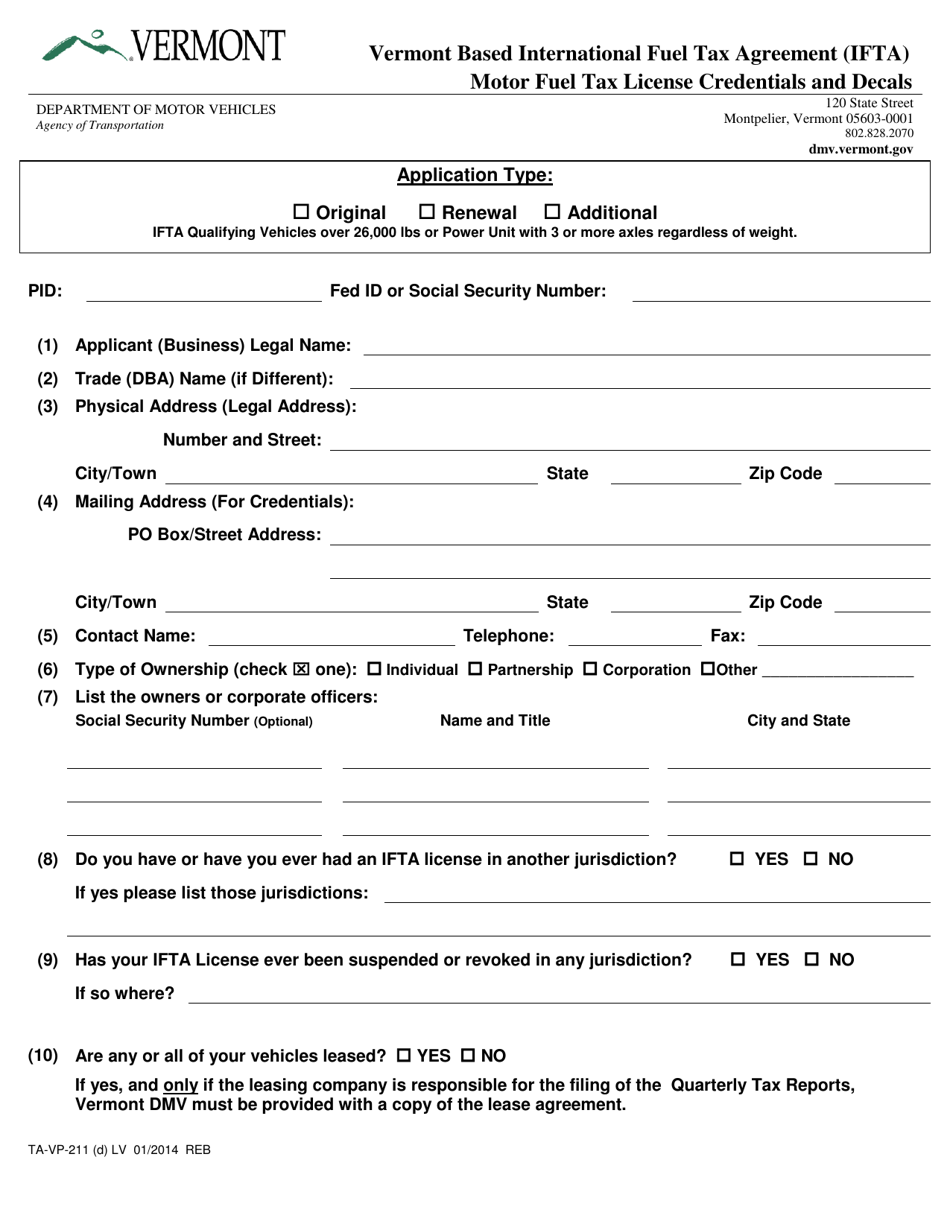

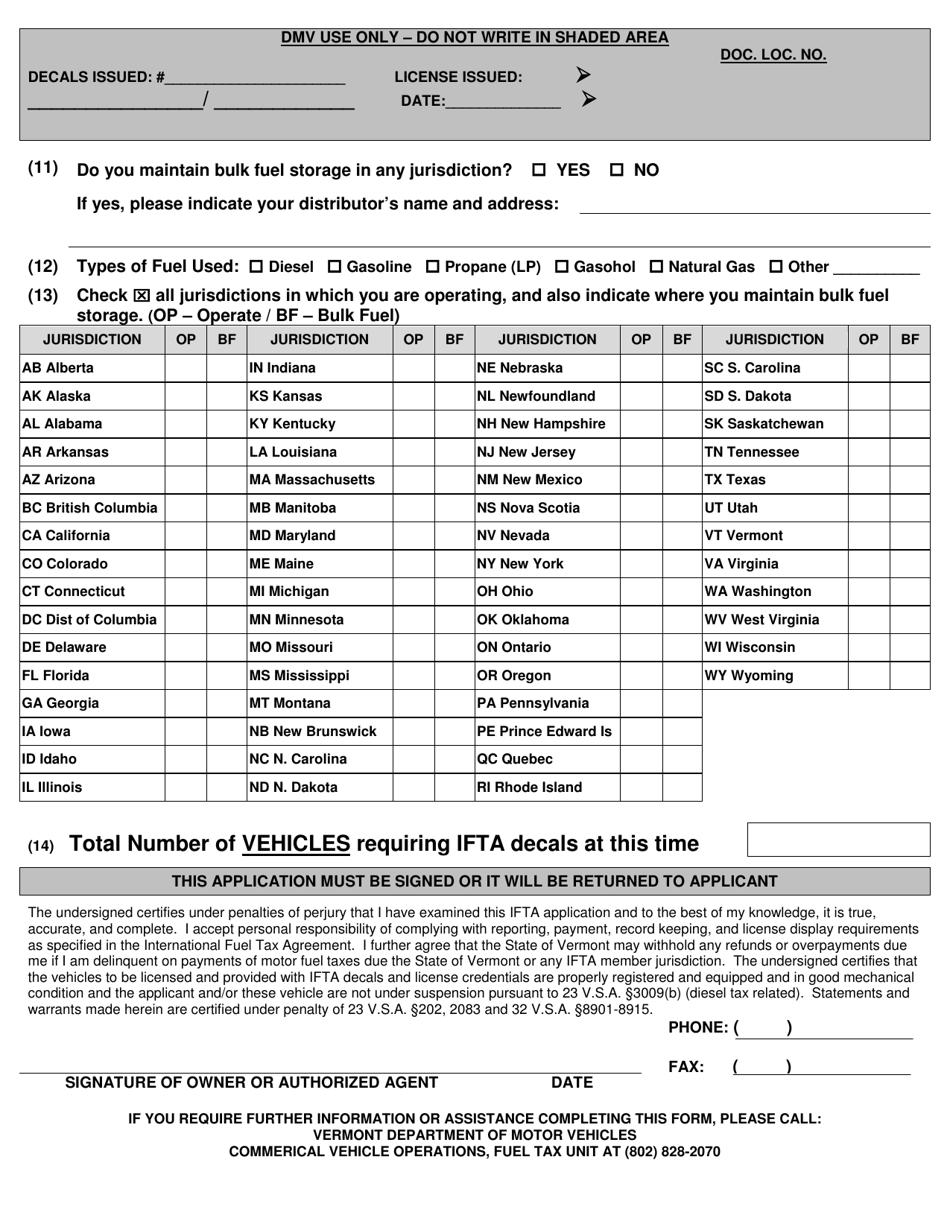

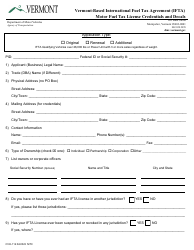

Form TA-VP-211 Vermont Based International Fuel Tax Agreement (Ifta) Motor Fuel Tax License Credentials and Decals - Vermont

What Is Form TA-VP-211?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TA-VP-211?

A: Form TA-VP-211 is a form used to apply for a Vermont Based International Fuel Tax Agreement (IFTA) Motor FuelTax License Credentials and Decals.

Q: What is the International Fuel Tax Agreement (IFTA)?

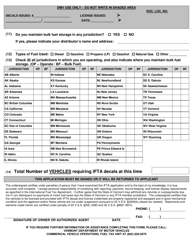

A: The International Fuel Tax Agreement (IFTA) is an agreement among the United States and Canadian provinces that simplifies the reporting and payment of fuel taxes for motor carriers that operate in multiple jurisdictions.

Q: Who needs to apply for a Vermont Based IFTA Motor Fuel Tax License?

A: Motor carriers that operate in Vermont and other IFTA jurisdictions need to apply for a Vermont Based IFTA Motor Fuel Tax License.

Q: What are the license credentials and decals?

A: License credentials and decals are the documentation and stickers that indicate a motor carrier's compliance with IFTA.

Q: How can I apply for a Vermont Based IFTA Motor Fuel Tax License?

A: You can apply for a Vermont Based IFTA Motor Fuel Tax License by completing and submitting Form TA-VP-211.

Q: What information do I need to provide on Form TA-VP-211?

A: You will need to provide information about your business, such as your business name, address, and federal tax identification number.

Q: Are there any fees associated with the Vermont Based IFTA Motor Fuel Tax License?

A: Yes, there are fees associated with the Vermont Based IFTA Motor Fuel Tax License. The exact fee amount can be found on the application form.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TA-VP-211 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.