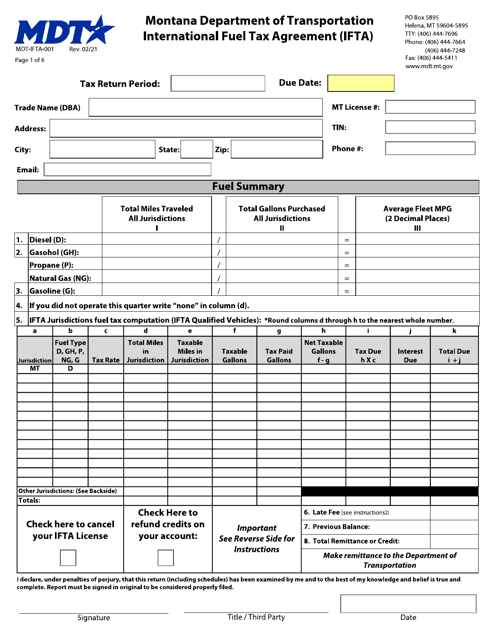

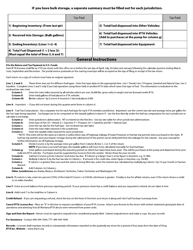

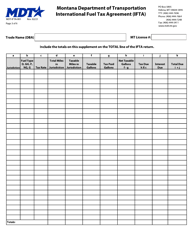

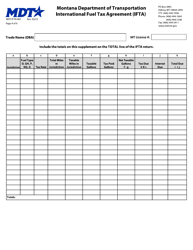

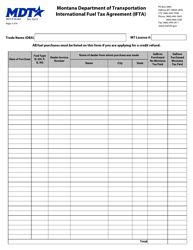

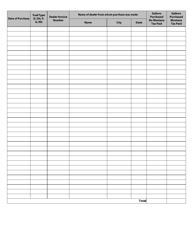

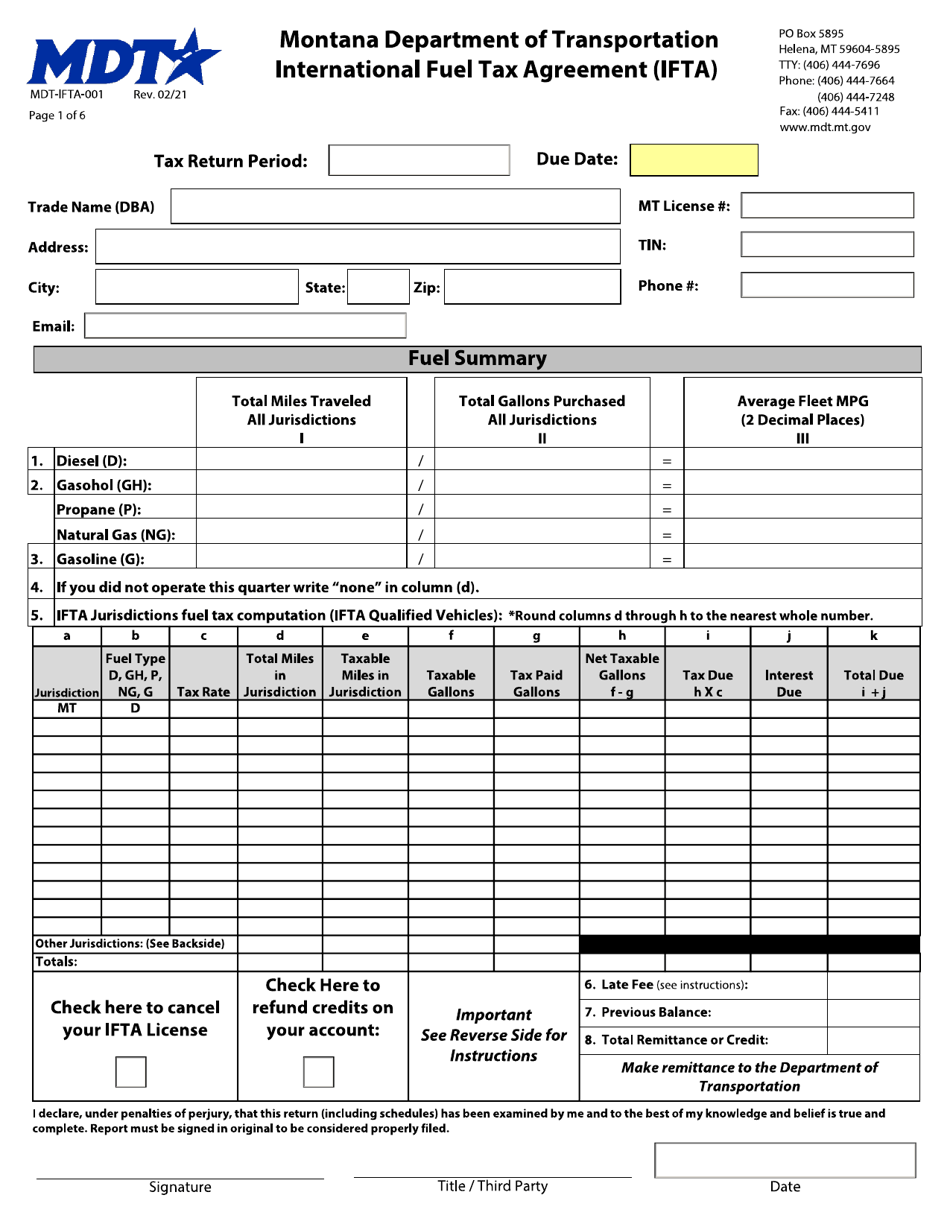

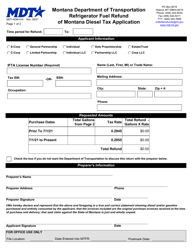

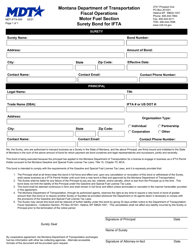

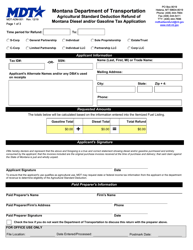

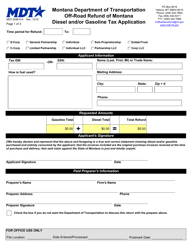

Form MDT-IFTA-001 International Fuel Tax Agreement (Ifta) Tax Return - Montana

What Is Form MDT-IFTA-001?

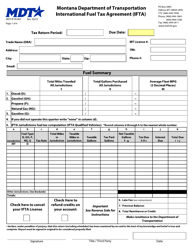

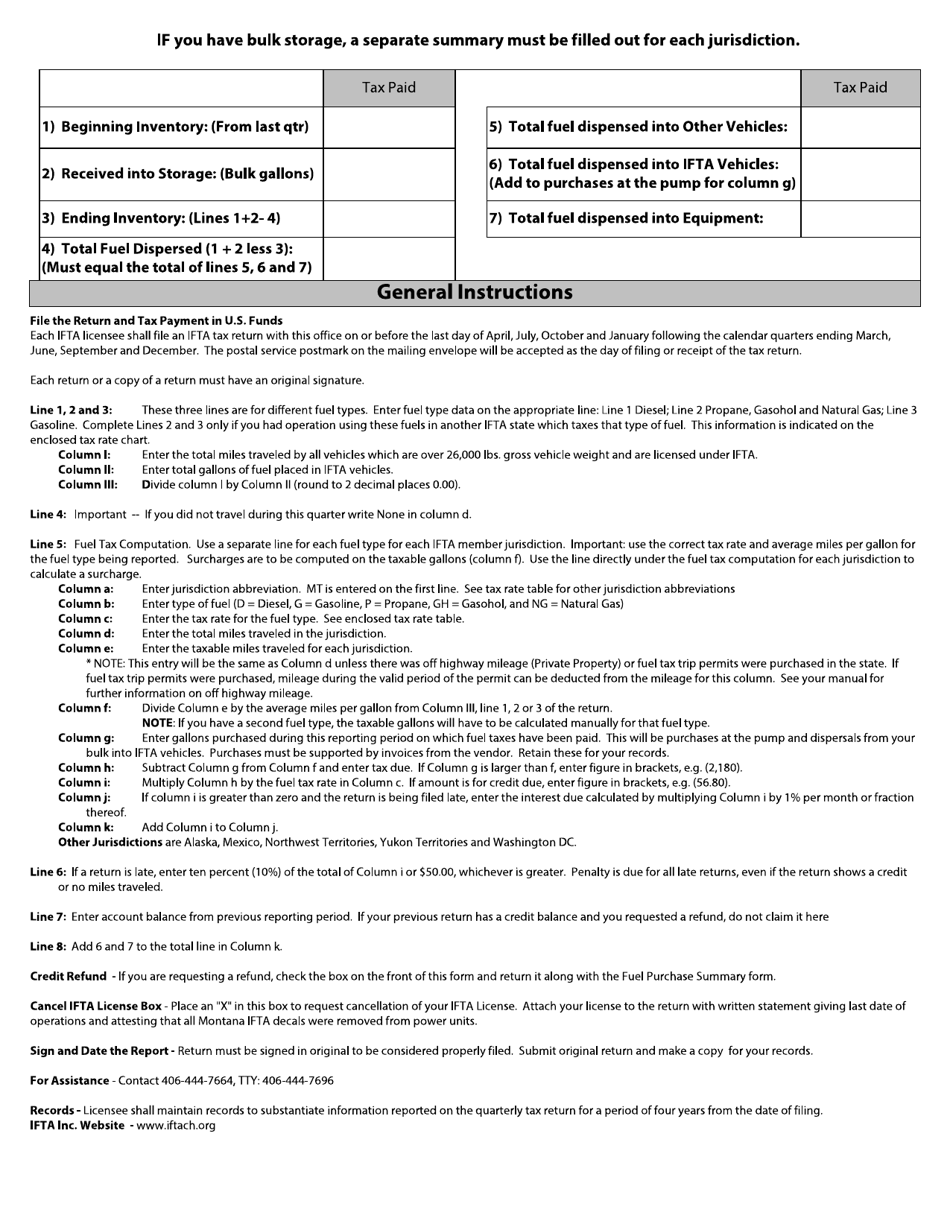

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MDT-IFTA-001?

A: Form MDT-IFTA-001 is the International Fuel Tax Agreement (IFTA) Tax Return for Montana.

Q: What is the International Fuel Tax Agreement (IFTA)?

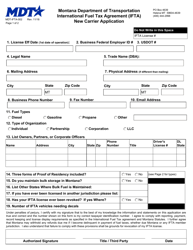

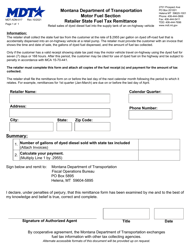

A: The International Fuel Tax Agreement (IFTA) is an agreement among the 48 contiguous states of the United States and the 10 Canadian provinces, which simplifies fuel tax reporting for motor carriers that operate in multiple jurisdictions.

Q: Who needs to file Form MDT-IFTA-001?

A: Motor carriers who operate qualified motor vehicles in Montana and other IFTA jurisdictions need to file Form MDT-IFTA-001.

Q: What is a qualified motor vehicle?

A: A qualified motor vehicle is a motor vehicle used or designed for use in the transportation of persons or property that has two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or has three or more axles regardless of weight.

Q: When is Form MDT-IFTA-001 due?

A: Form MDT-IFTA-001 is due on the last day of the month following the end of each calendar quarter. For example, the first quarter (January-March) return is due on April 30th.

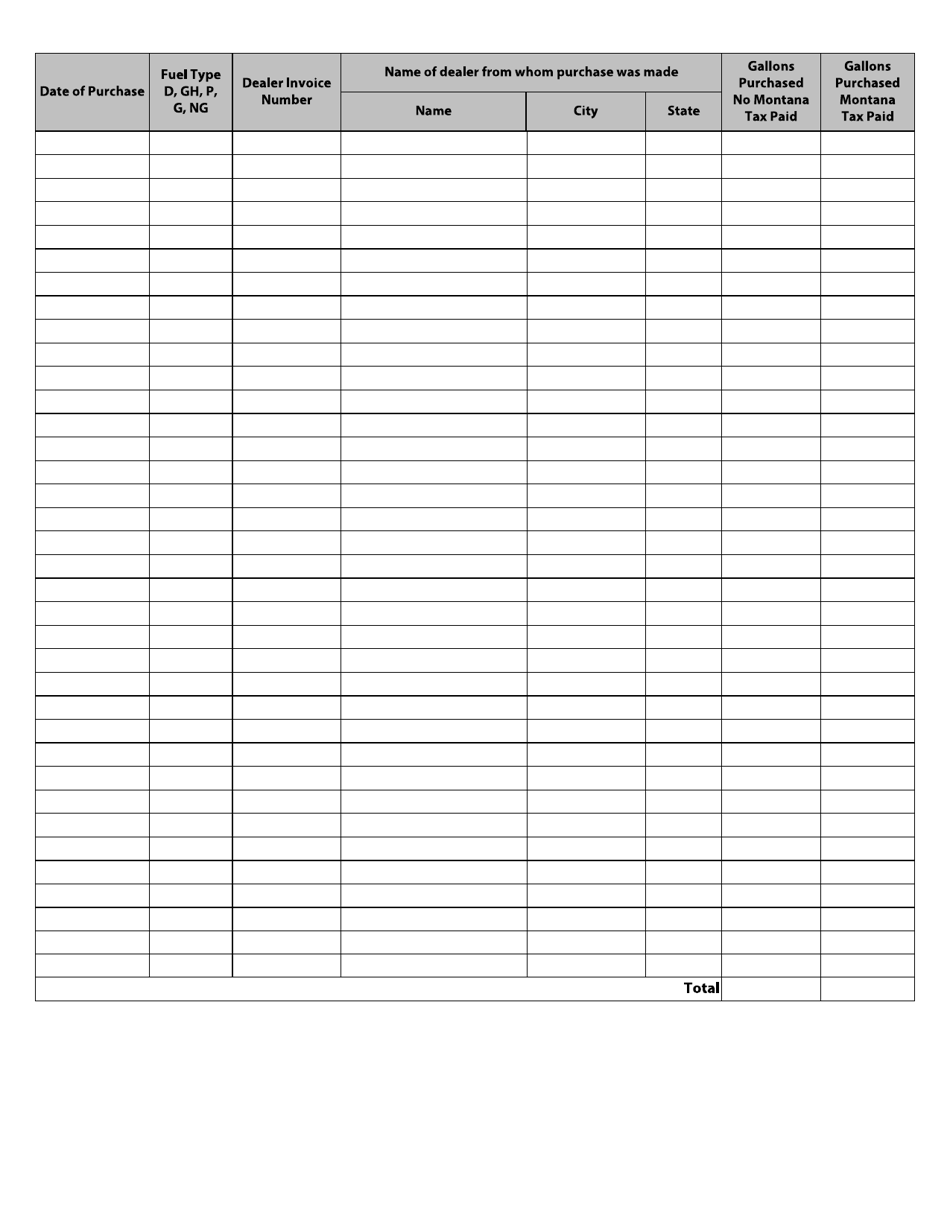

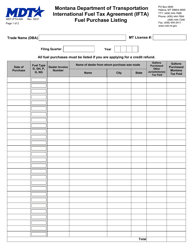

Q: What information do I need to complete Form MDT-IFTA-001?

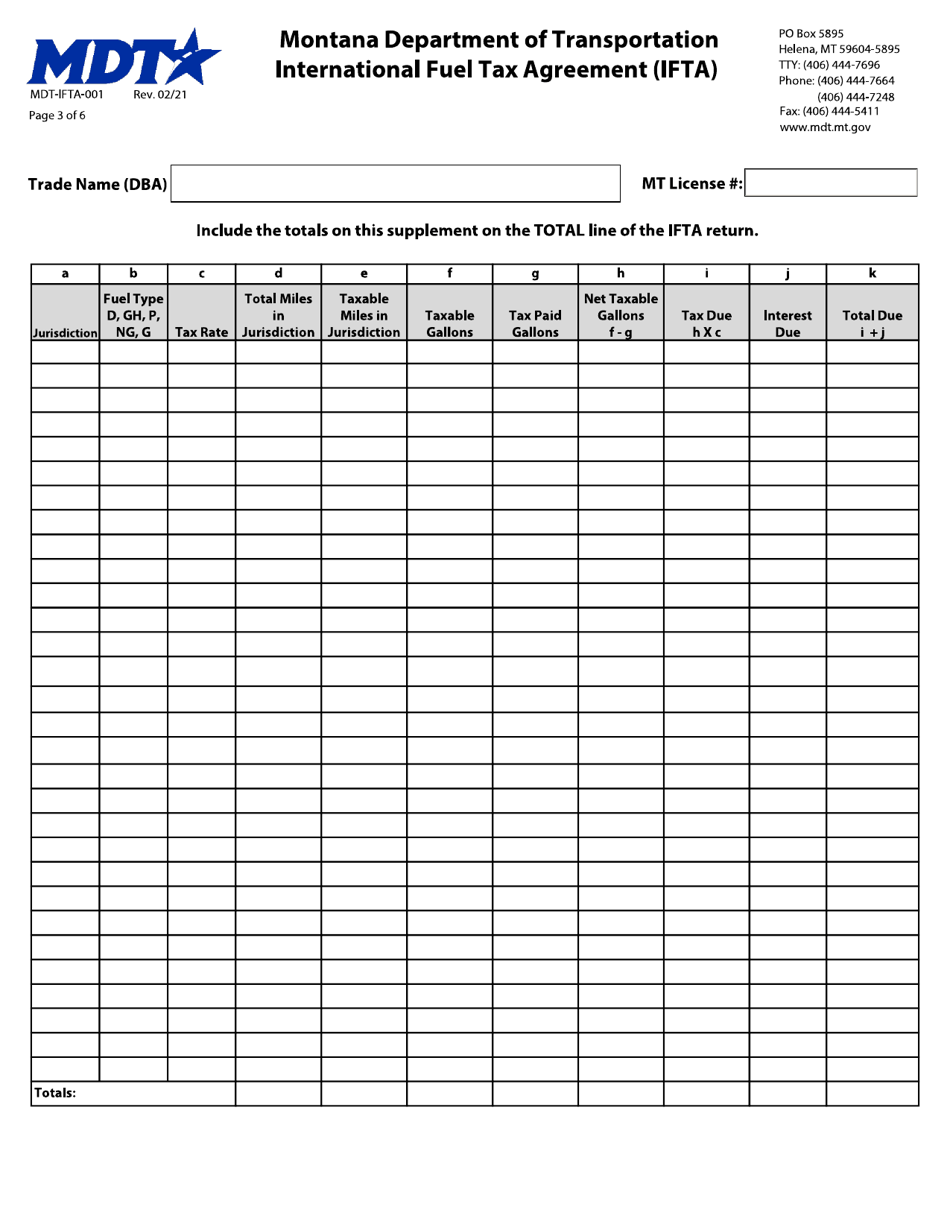

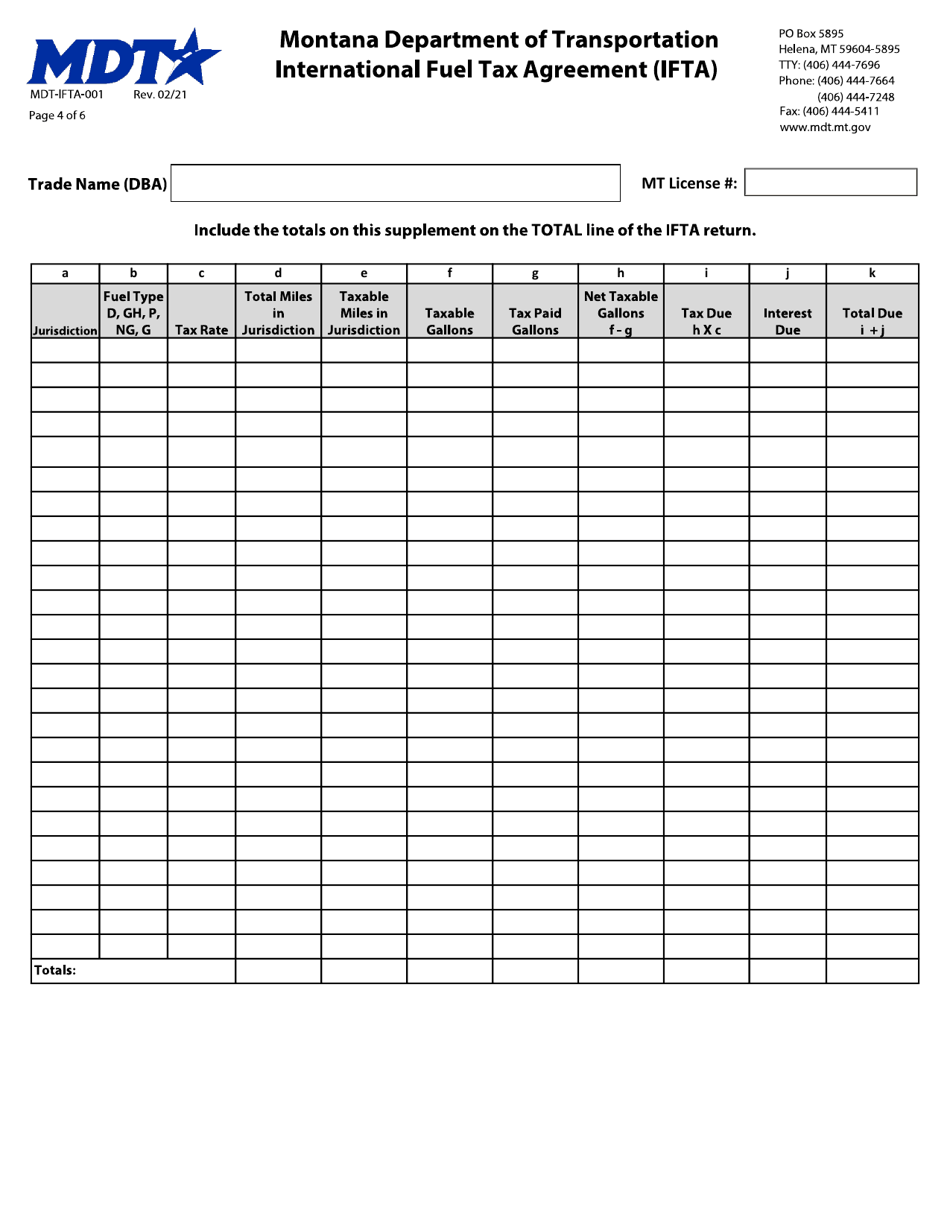

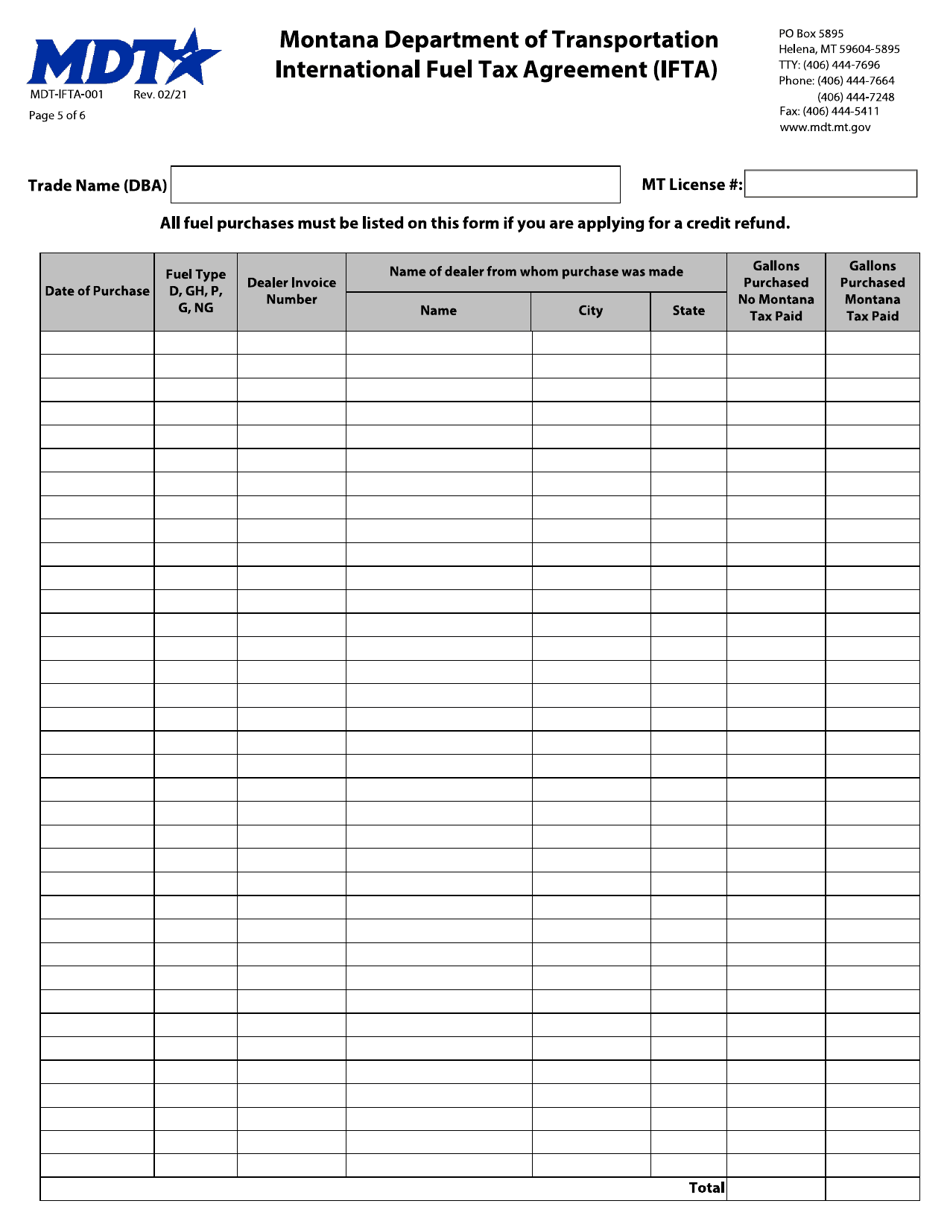

A: You will need your IFTA account number, total miles traveled in each IFTA jurisdiction, total gallons of fuel consumed in each IFTA jurisdiction, and other relevant financial information.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MDT-IFTA-001 by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.