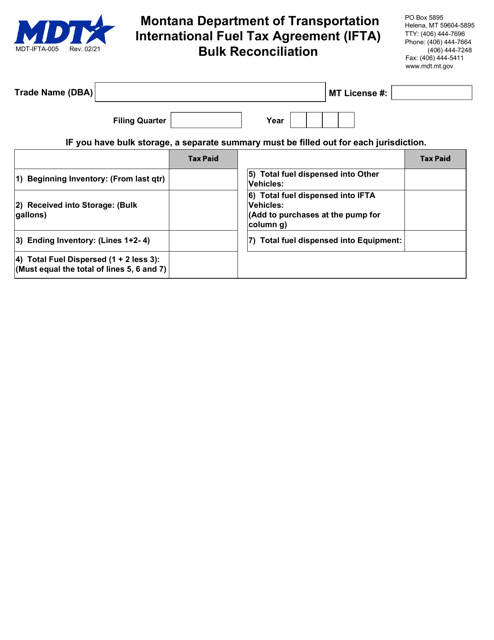

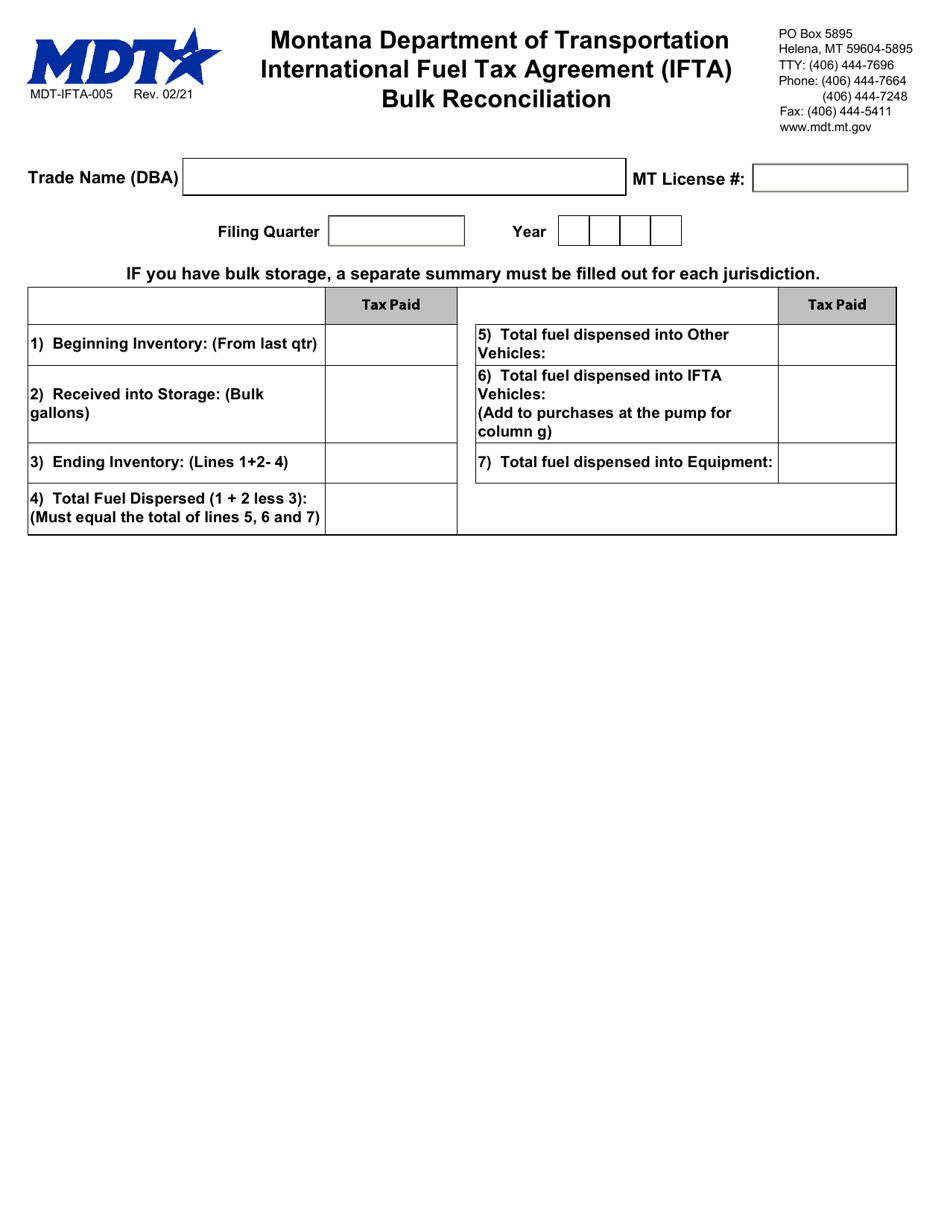

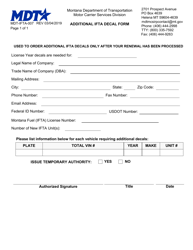

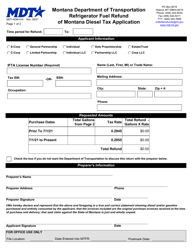

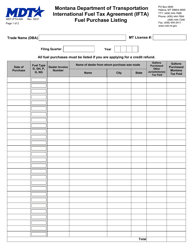

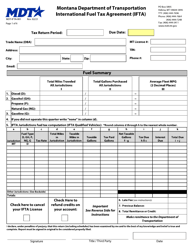

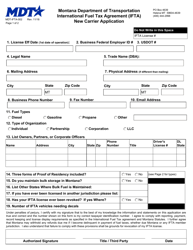

Form MDT-IFTA-005 International Fuel Tax Agreement (Ifta) Bulk Reconciliation - Montana

What Is Form MDT-IFTA-005?

This is a legal form that was released by the Montana Department of Transportation - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MDT-IFTA-005?

A: Form MDT-IFTA-005 is the International Fuel Tax Agreement (IFTA) Bulk Reconciliation form for the state of Montana.

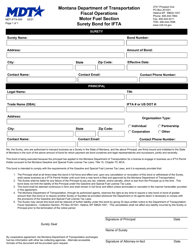

Q: What is the International Fuel Tax Agreement (IFTA)?

A: The International Fuel Tax Agreement (IFTA) is an agreement among the United States and Canadian provinces that simplifies the reporting and payment of fuel taxes by interstate motor carriers.

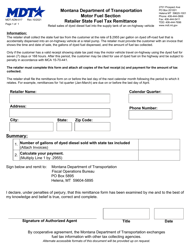

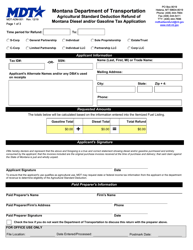

Q: What is a Bulk Reconciliation?

A: Bulk Reconciliation is the process of reconciling fuel purchases and usage for multiple vehicles or multiple reporting periods.

Q: Who needs to file Form MDT-IFTA-005?

A: Motor carriers who are registered under the International Fuel Tax Agreement (IFTA) and have multiple vehicles or reporting periods to reconcile need to file Form MDT-IFTA-005.

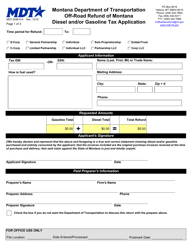

Q: What information is required on Form MDT-IFTA-005?

A: Form MDT-IFTA-005 requires information such as total miles traveled, total gallons of fuel purchased and used, and the calculation of fuel tax liability for each jurisdiction.

Q: When is the deadline to file Form MDT-IFTA-005?

A: The filing deadline for Form MDT-IFTA-005 is the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form MDT-IFTA-005?

A: Yes, there may be penalties for late filing or failure to file Form MDT-IFTA-005.

Q: Is there a fee for filing Form MDT-IFTA-005?

A: There is no fee for filing Form MDT-IFTA-005 with the Montana Department of Transportation.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Montana Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MDT-IFTA-005 by clicking the link below or browse more documents and templates provided by the Montana Department of Transportation.