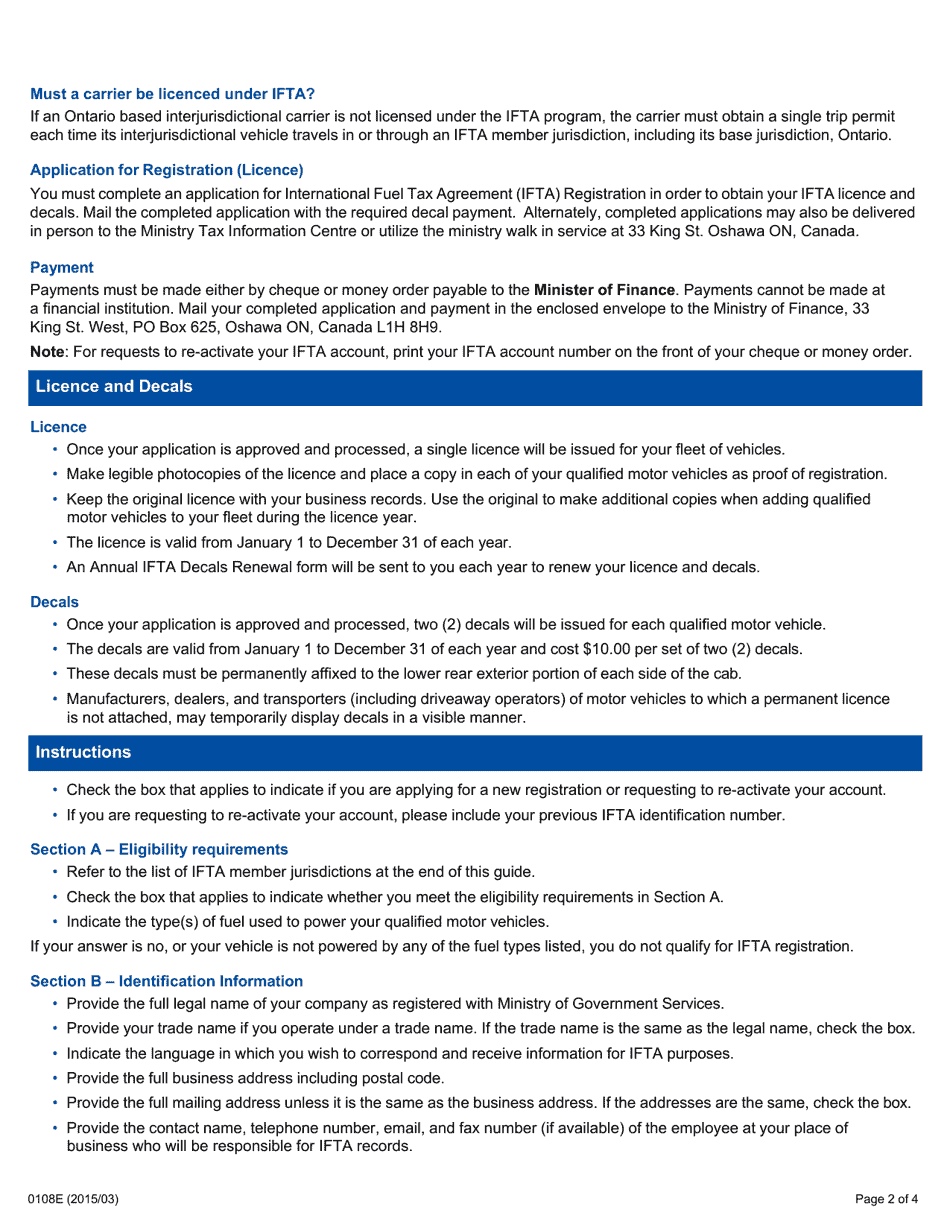

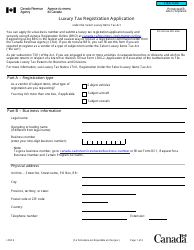

Instructions for Form 0166E Application for International Fuel Tax Agreement (Ifta) Registration - Ontario, Canada

The Instructions for Form 0166E Application for International Fuel Tax Agreement (IFTA) Registration - Ontario, Canada provides guidance on how to complete and submit the application for IFTA registration in the province of Ontario, Canada. It explains the requirements, necessary information, and the process for registering under the International Fuel Tax Agreement.

The instructions for Form 0166E Application for International Fuel Tax Agreement (IFTA) Registration - Ontario, Canada are filed by the Ontario Ministry of Finance.

FAQ

Q: What is Form 0166E?

A: Form 0166E is the Application for International Fuel Tax Agreement (IFTA) Registration in Ontario, Canada.

Q: What is IFTA?

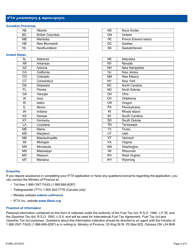

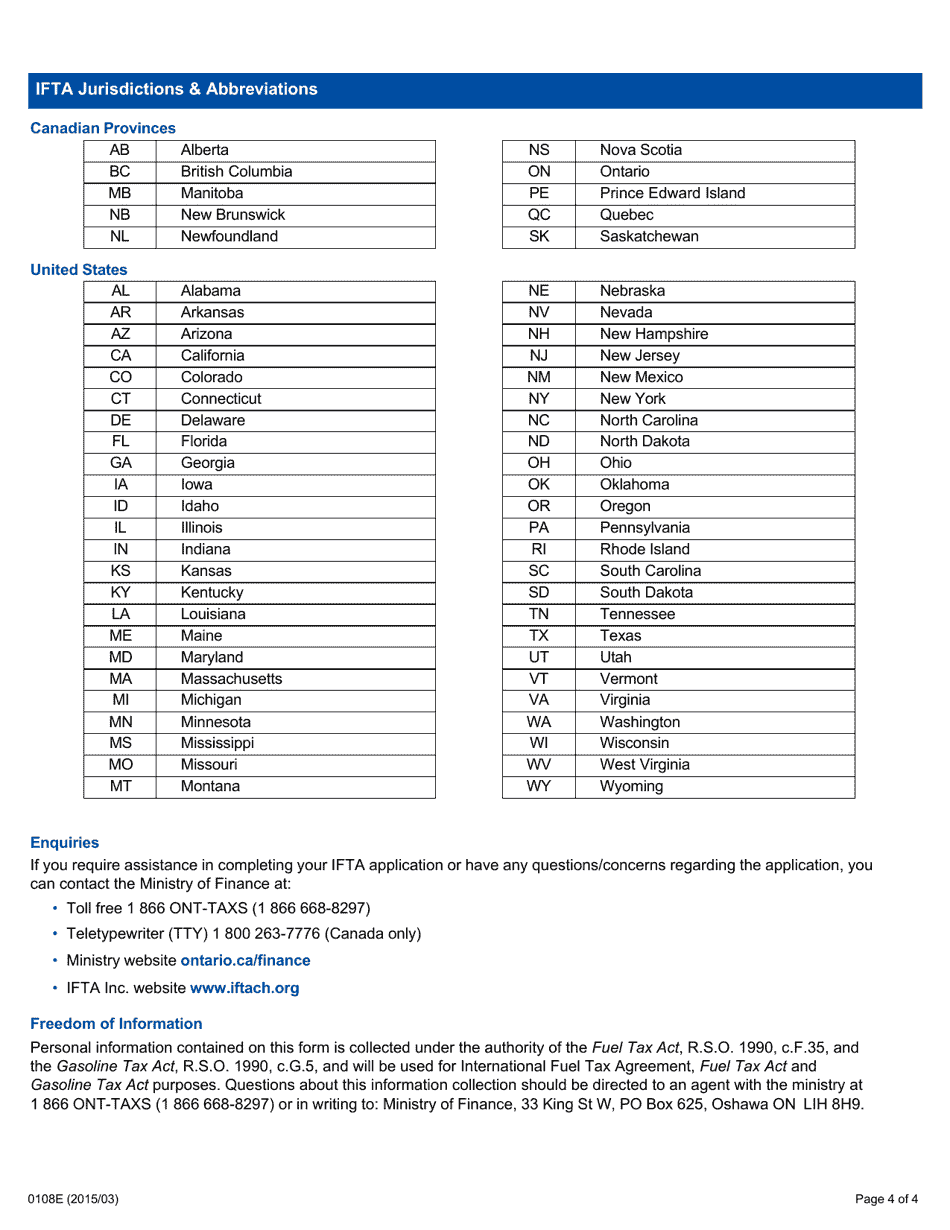

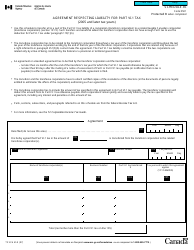

A: The International Fuel Tax Agreement (IFTA) is an agreement among the United States and Canadian provinces, including Ontario, that simplifies the reporting and payment of fuel taxes by motor carriers operating in multiple jurisdictions.

Q: Who needs to submit Form 0166E?

A: Motor carriers who operate qualified motor vehicles in Ontario and other jurisdictions under IFTA need to submit Form 0166E for IFTA registration.

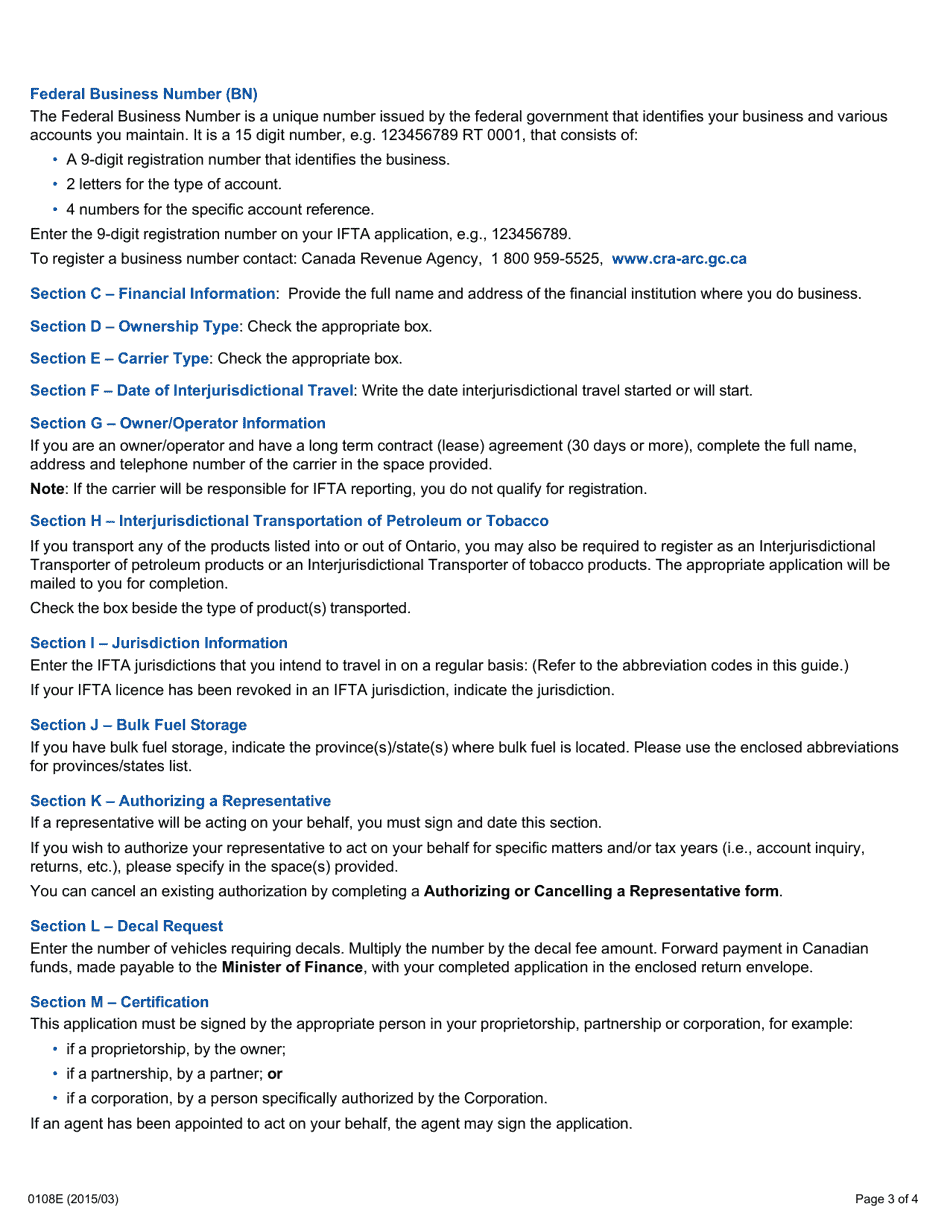

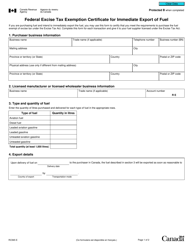

Q: What information is required in Form 0166E?

A: Form 0166E requires information about the motor carrier, such as contact details, vehicle information, and fuel usage records. It also requires an acknowledgment of the terms and conditions of the IFTA agreement.