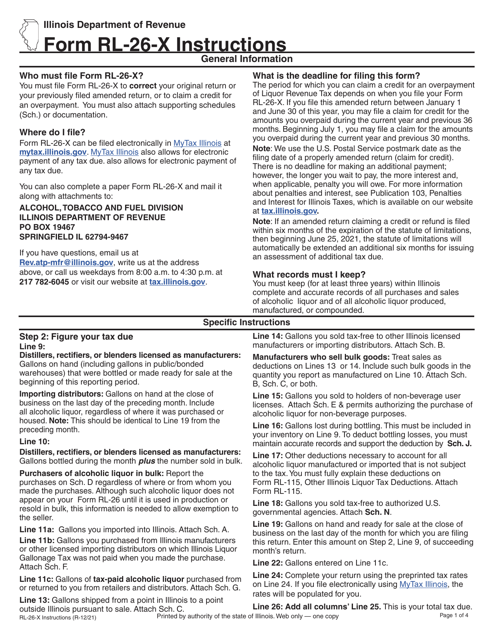

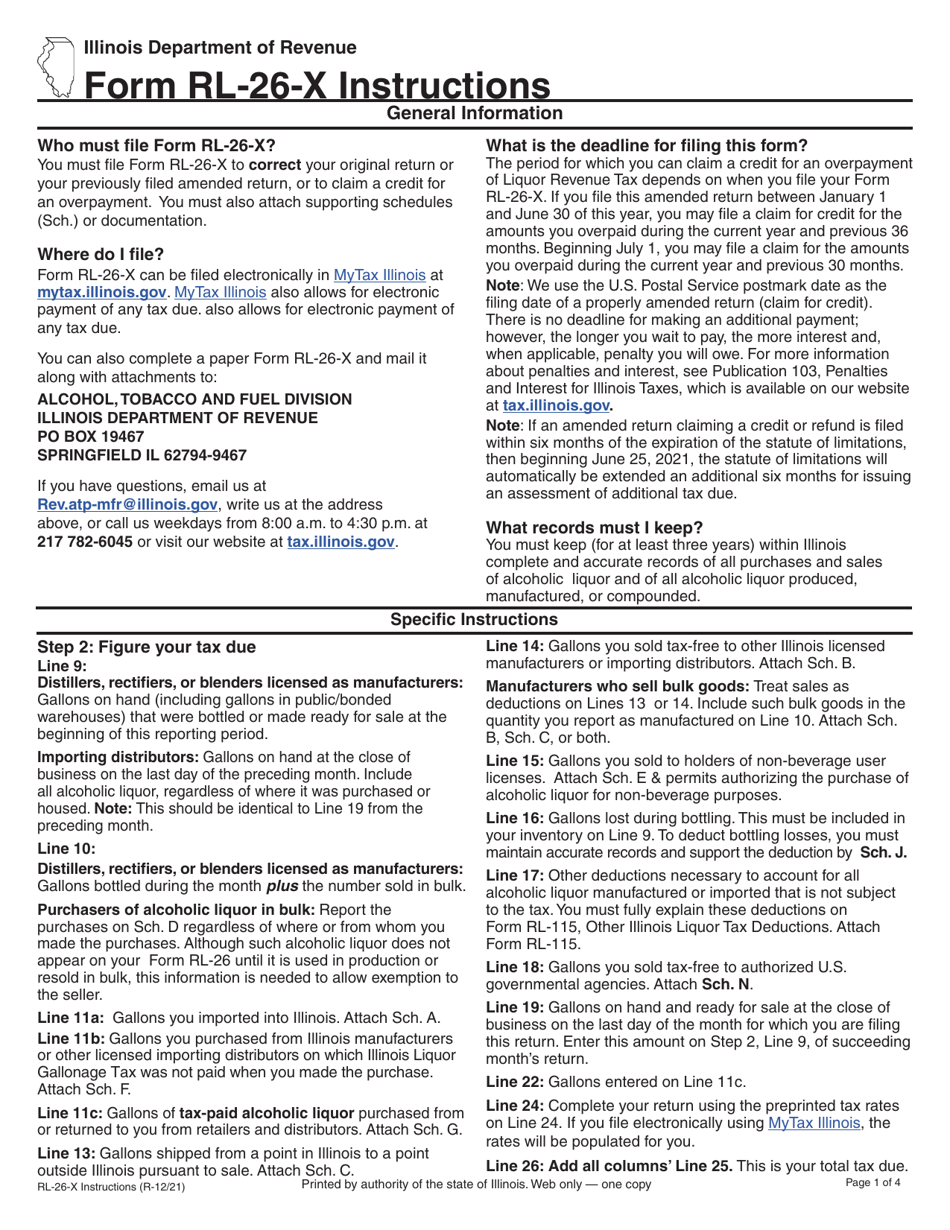

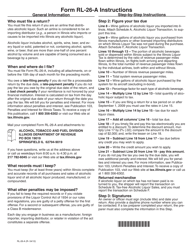

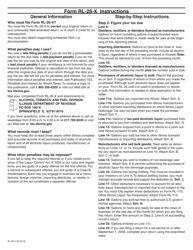

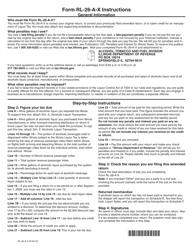

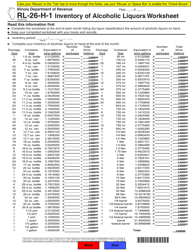

Instructions for Form RL-26-X, REV-1 Amended Liquor Revenue Return - Illinois

This document contains official instructions for Form RL-26-X , and Form REV-1 . Both forms are released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RL-26-X?

A: Form RL-26-X is the Amended Liquor Revenue Return for the state of Illinois.

Q: What does REV-1 mean?

A: REV-1 represents the revision number of the form.

Q: What is the purpose of Form RL-26-X?

A: The purpose of Form RL-26-X is to report any amended liquor revenue information for Illinois.

Q: What do I need to complete Form RL-26-X?

A: To complete Form RL-26-X, you will need your original liquor revenue return information, as well as any corrected or updated information.

Q: When should I file Form RL-26-X?

A: Form RL-26-X should be filed as soon as you discover an error or need to make a correction to your original liquor revenue return.

Q: Are there any penalties for filing an amended liquor revenue return?

A: Penalties may apply for filing an amended liquor revenue return, depending on the circumstances. It is best to consult the Illinois Department of Revenue or a tax professional for guidance.

Q: Is there a deadline to file Form RL-26-X?

A: The deadline to file Form RL-26-X is generally the same as the deadline for the original liquor revenue return. It is important to file the amended return as soon as possible to avoid potential penalties.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.