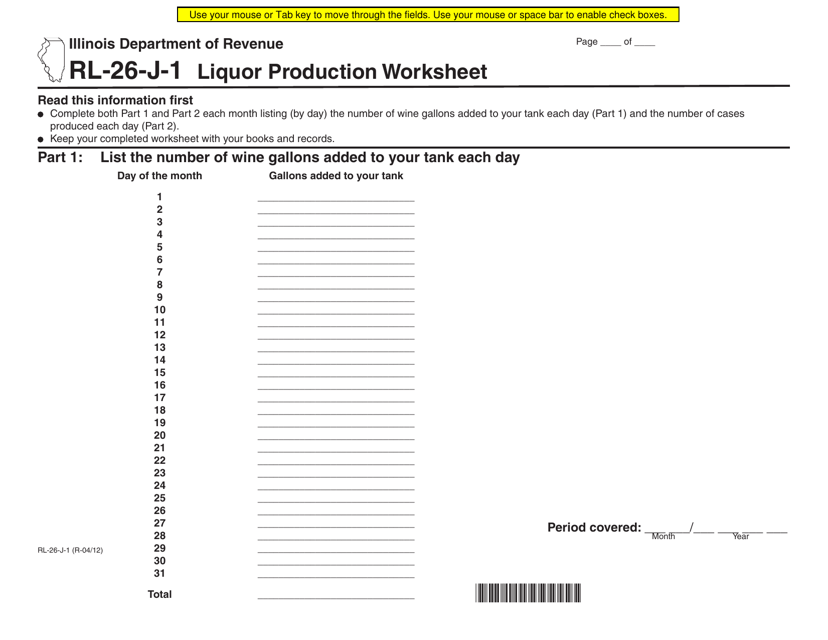

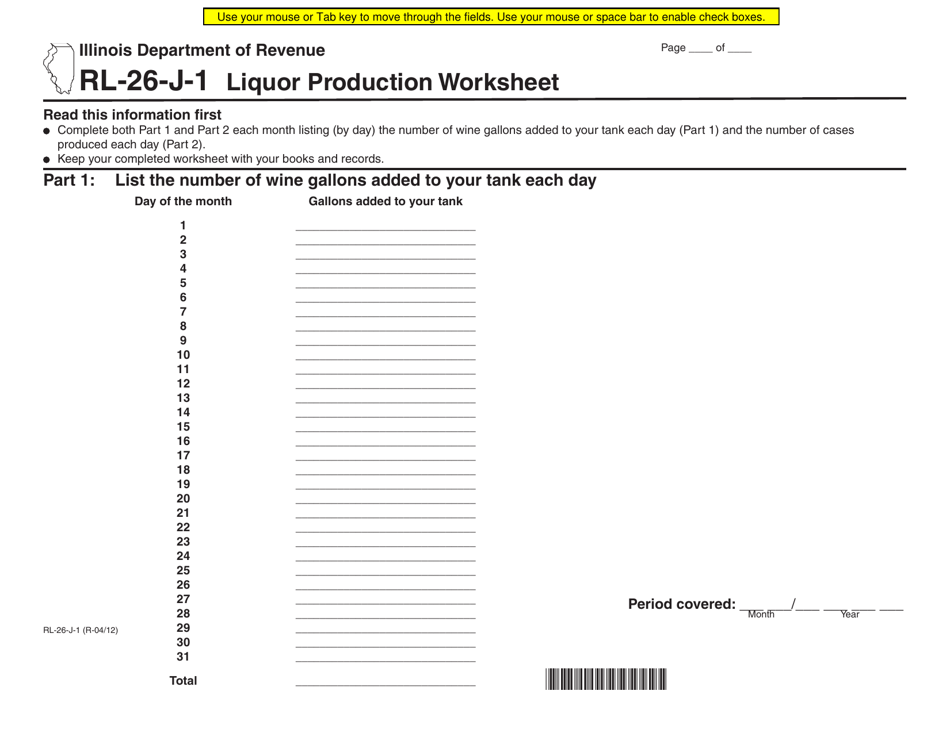

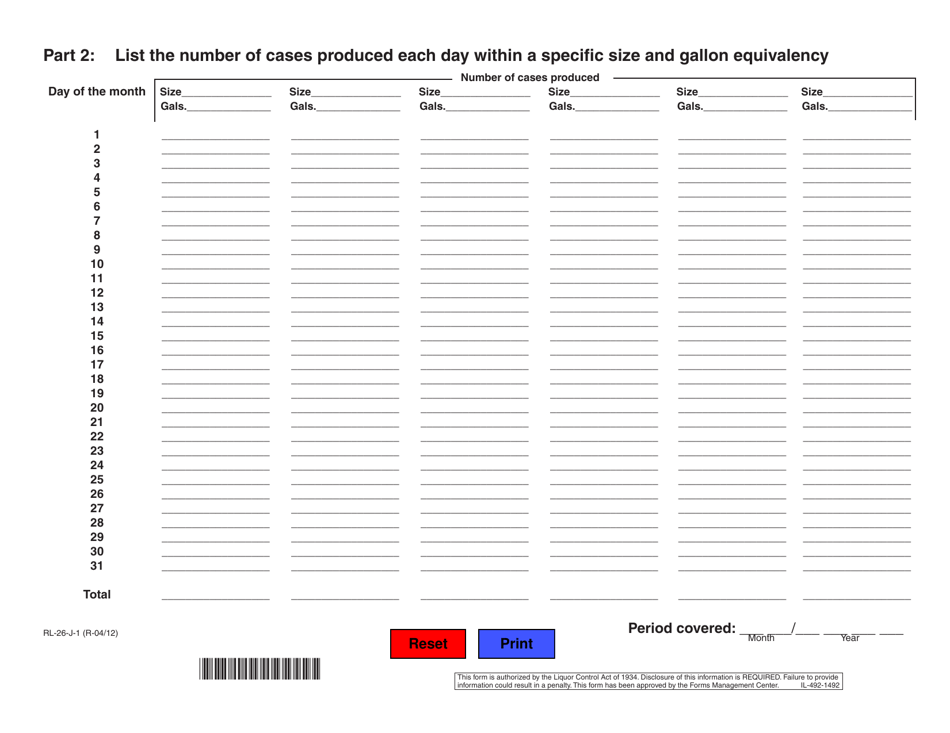

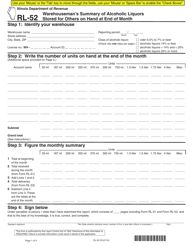

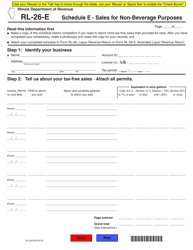

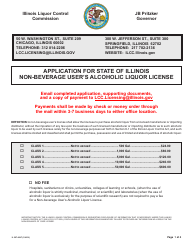

Form RL-26-J-1 Liquor Production Worksheet - Illinois

What Is Form RL-26-J-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RL-26-J-1?

A: Form RL-26-J-1 is a Liquor Production Worksheet in Illinois.

Q: What is the purpose of Form RL-26-J-1?

A: The purpose of Form RL-26-J-1 is to report information about liquor production in Illinois.

Q: Who needs to file Form RL-26-J-1?

A: Any business or individual engaged in liquor production in Illinois needs to file Form RL-26-J-1.

Q: How often do I need to file Form RL-26-J-1?

A: Form RL-26-J-1 is filed monthly.

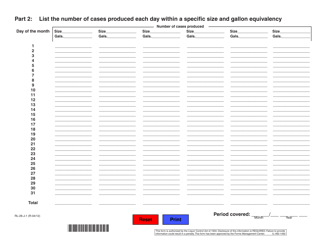

Q: What information do I need to provide on Form RL-26-J-1?

A: You will need to provide details about the quantity and value of liquor produced, as well as any tax due.

Q: Are there any penalties for not filing Form RL-26-J-1?

A: Yes, there are penalties for failure to file or filing late, including possible fines and interest charges.

Q: Is there a deadline for filing Form RL-26-J-1?

A: Yes, Form RL-26-J-1 must be filed by the 20th day of the month following the reporting period.

Q: Can I amend Form RL-26-J-1 if I made a mistake?

A: Yes, you can file an amended Form RL-26-J-1 to correct any errors or omissions.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RL-26-J-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.