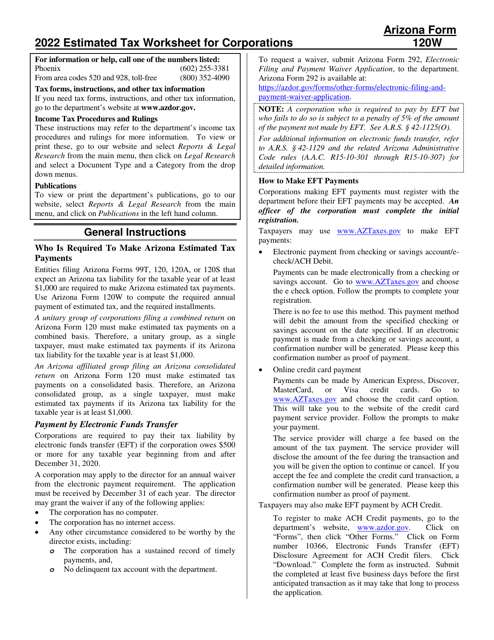

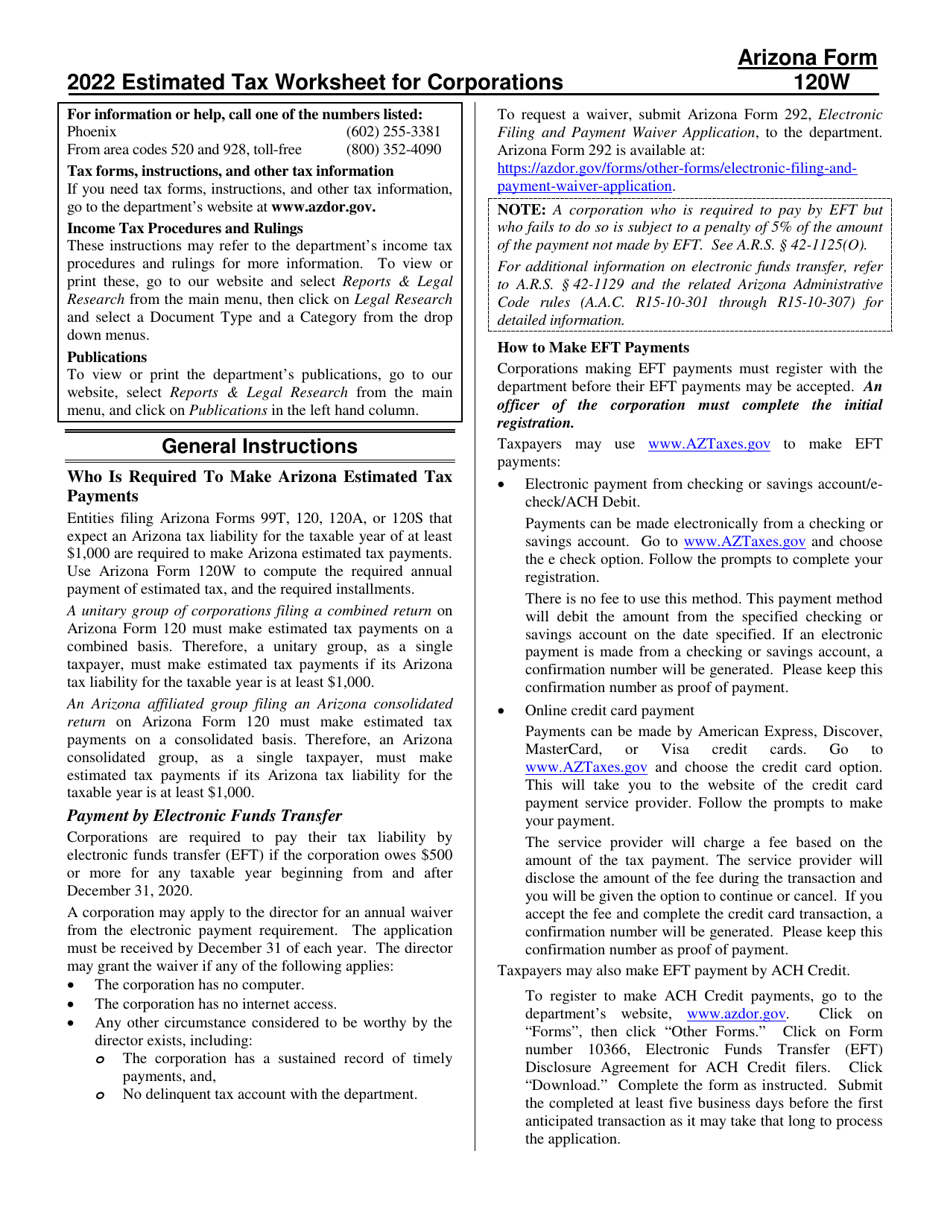

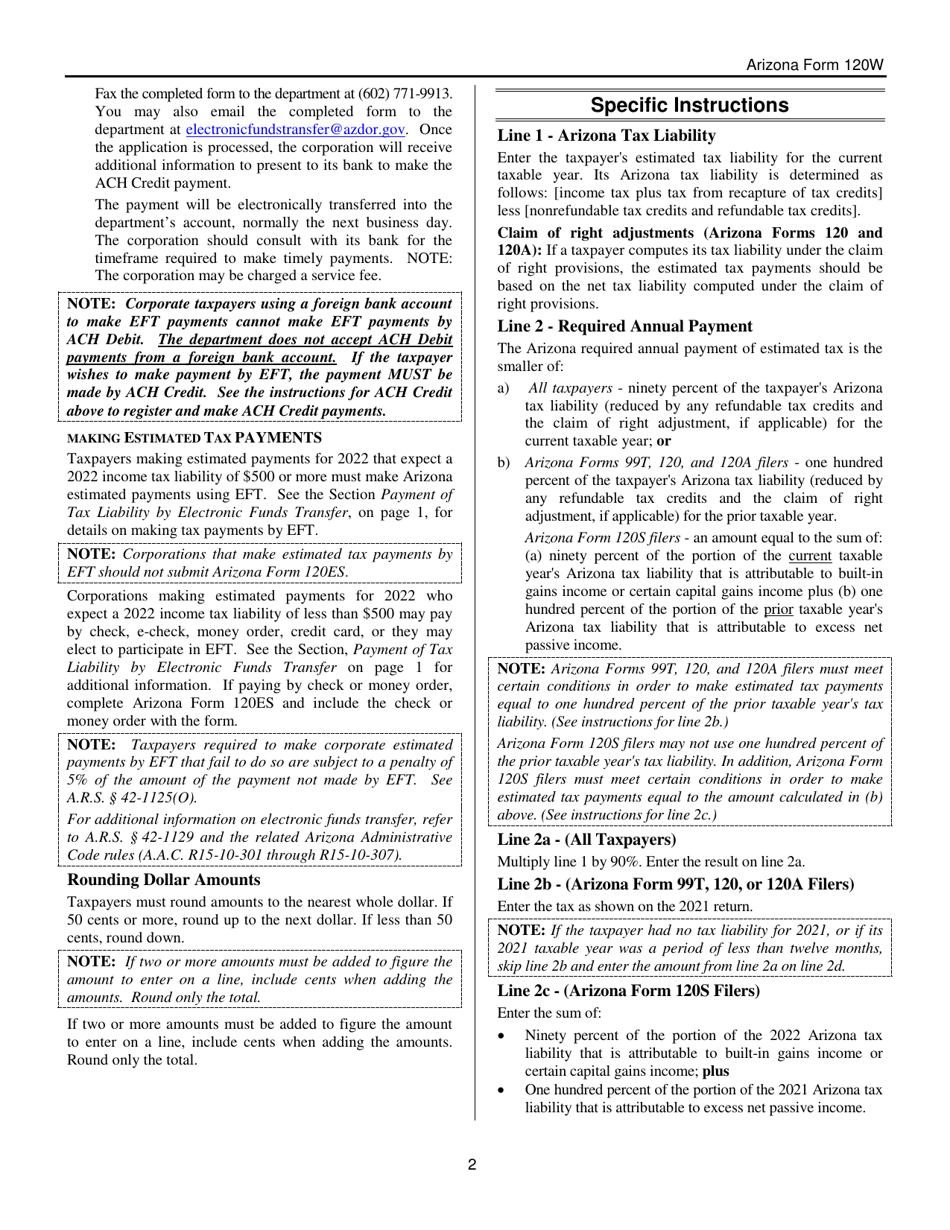

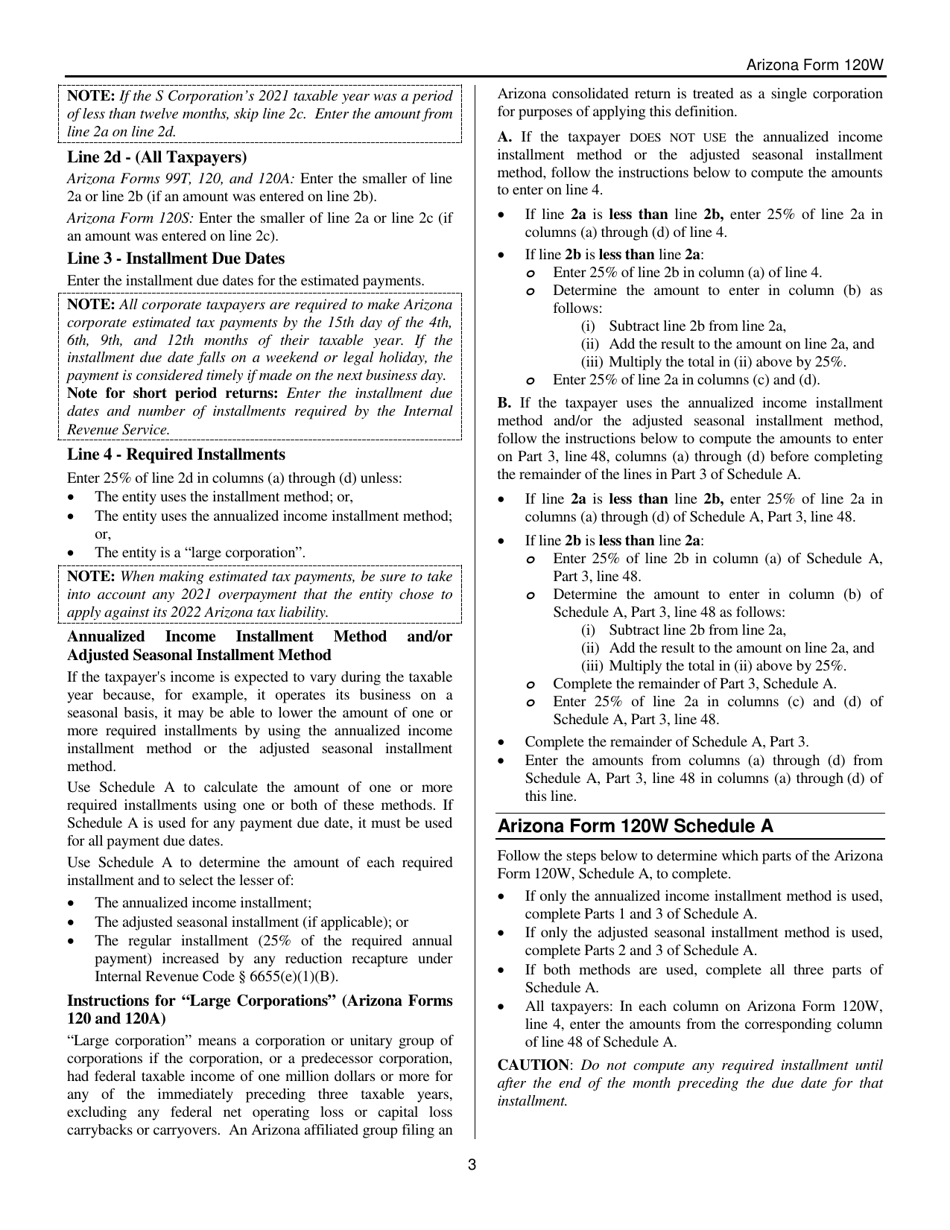

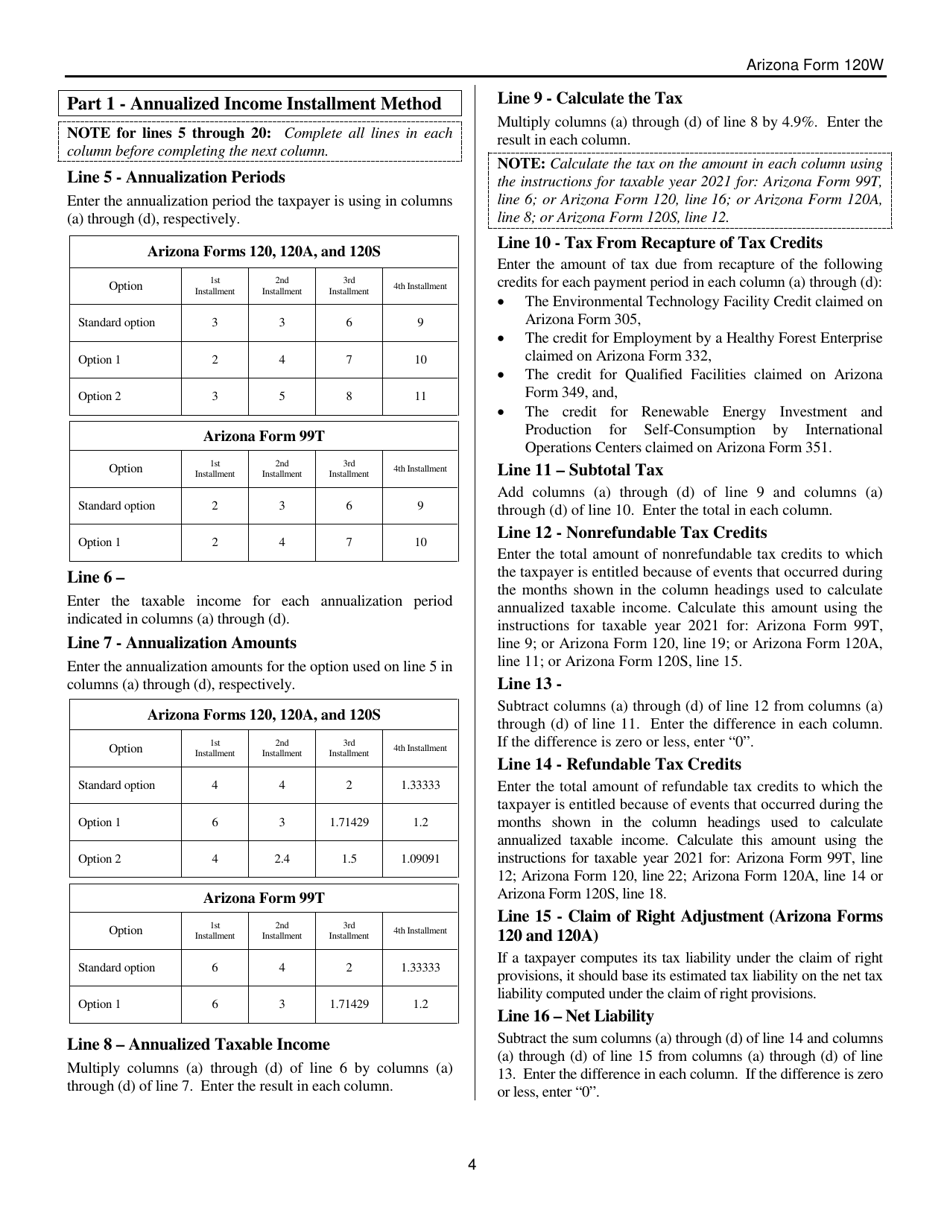

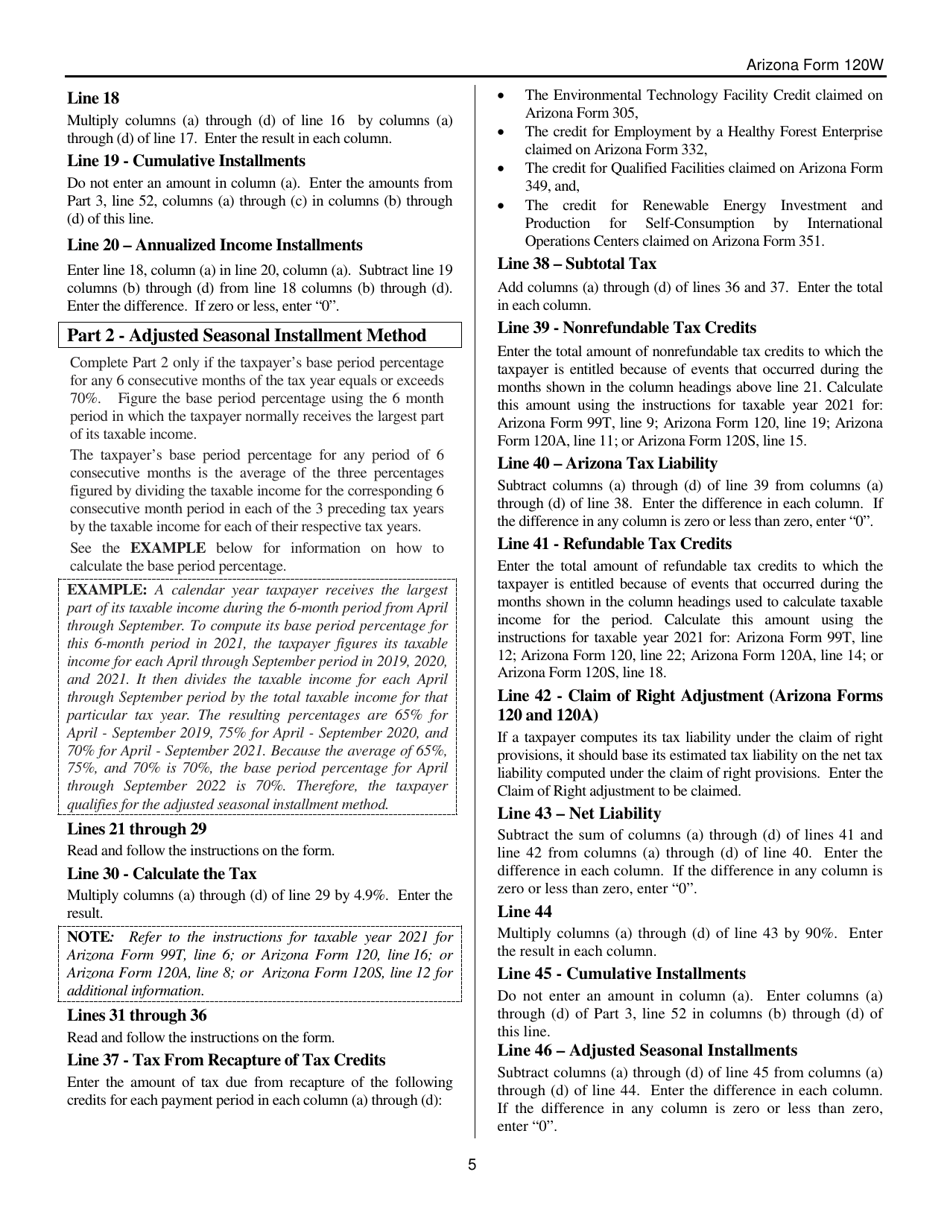

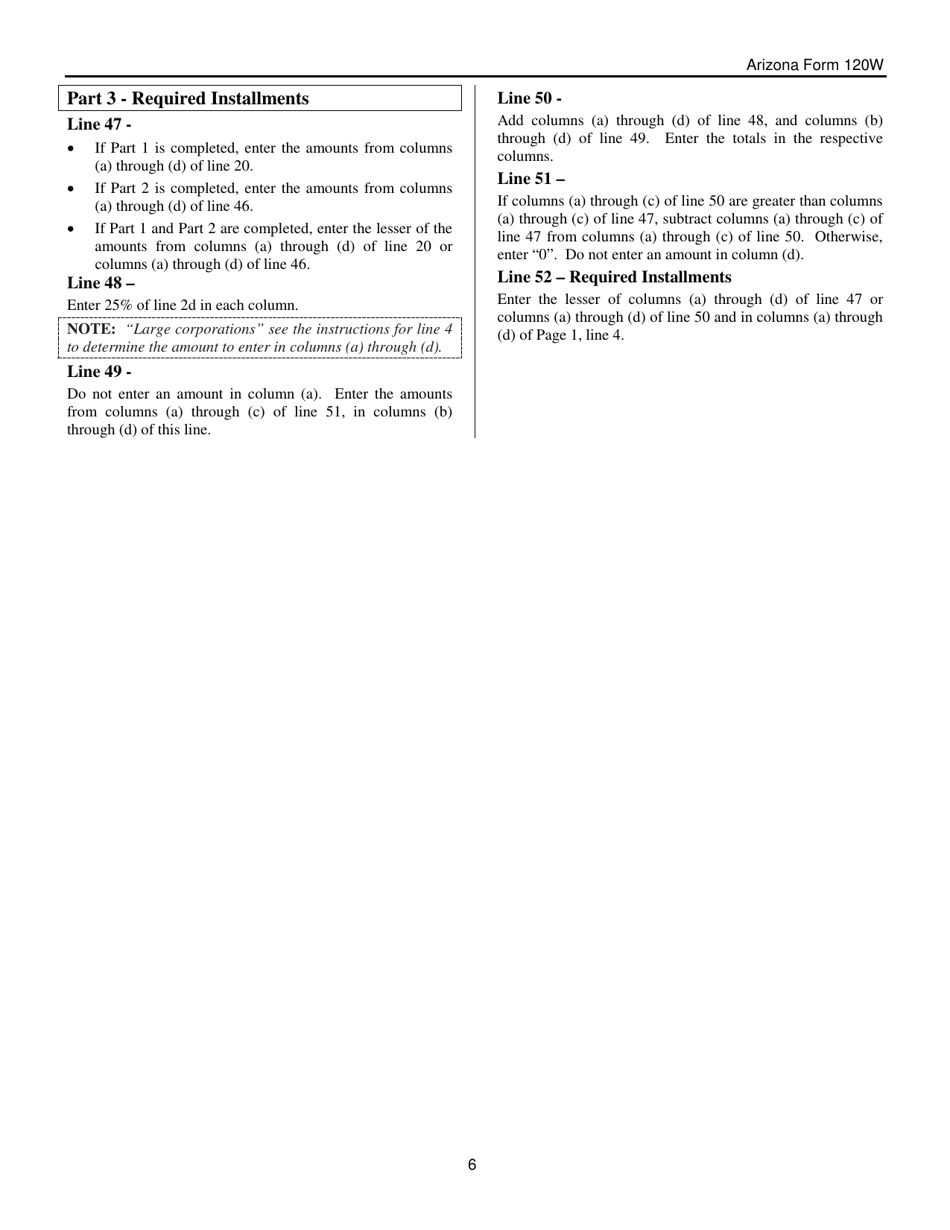

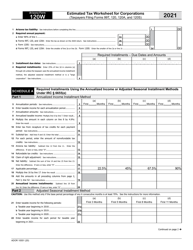

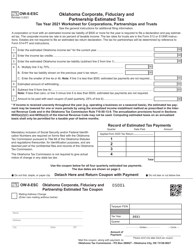

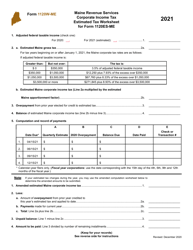

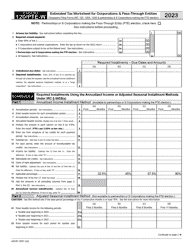

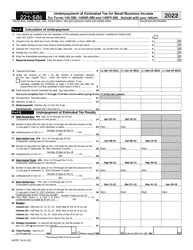

Instructions for Arizona Form 120W, ADOR10551 Estimated Tax Worksheet for Corporations - Arizona

This document contains official instructions for Arizona Form 120W , and Form ADOR10551 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

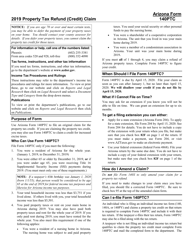

Q: What is form Arizona Form 120W?

A: Arizona Form 120W is the Estimated Tax Worksheet for Corporations in Arizona.

Q: What is the purpose of Arizona Form 120W?

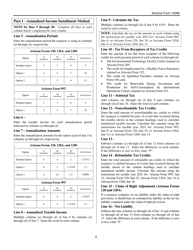

A: The purpose of Arizona Form 120W is to calculate estimated tax payments for corporations in Arizona.

Q: Who needs to fill out Arizona Form 120W?

A: Corporations in Arizona that need to make estimated tax payments are required to fill out Arizona Form 120W.

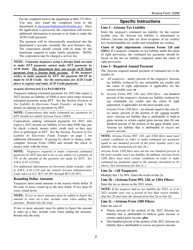

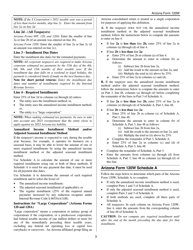

Q: What information is needed to fill out Arizona Form 120W?

A: To fill out Arizona Form 120W, you will need information about your corporation's income, deductions, credits, and previous year's tax liability.

Q: Does Arizona Form 120W need to be filed with the tax return?

A: No, Arizona Form 120W is separate from the tax return and should not be filed with it. It is used solely to calculate estimated tax payments.

Q: What happens if estimated tax payments are not made?

A: If estimated tax payments are not made or are underpaid, the corporation may be subject to penalties and interest.

Q: Are there any penalties for not filing Arizona Form 120W?

A: If a corporation is required to make estimated tax payments and fails to file Arizona Form 120W, it may be subject to penalties.

Q: Can Arizona Form 120W be filed electronically?

A: Yes, Arizona Form 120W can be filed electronically through the Arizona Department of Revenue's e-file system.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.