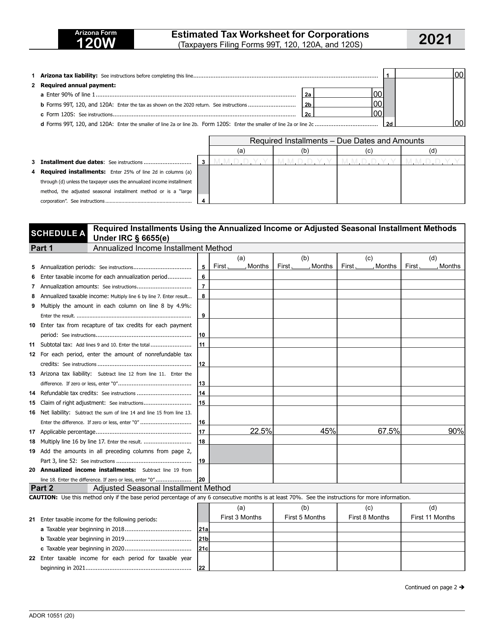

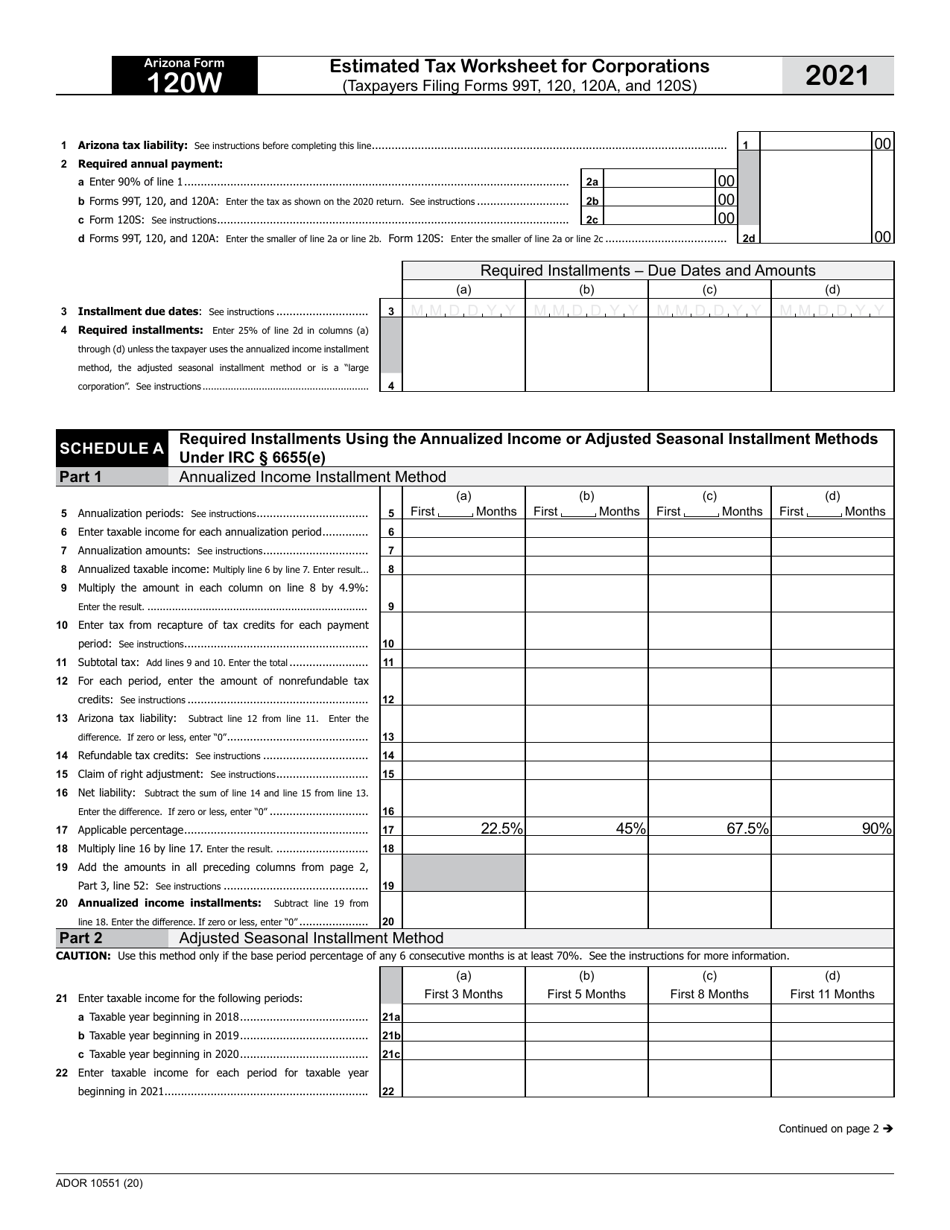

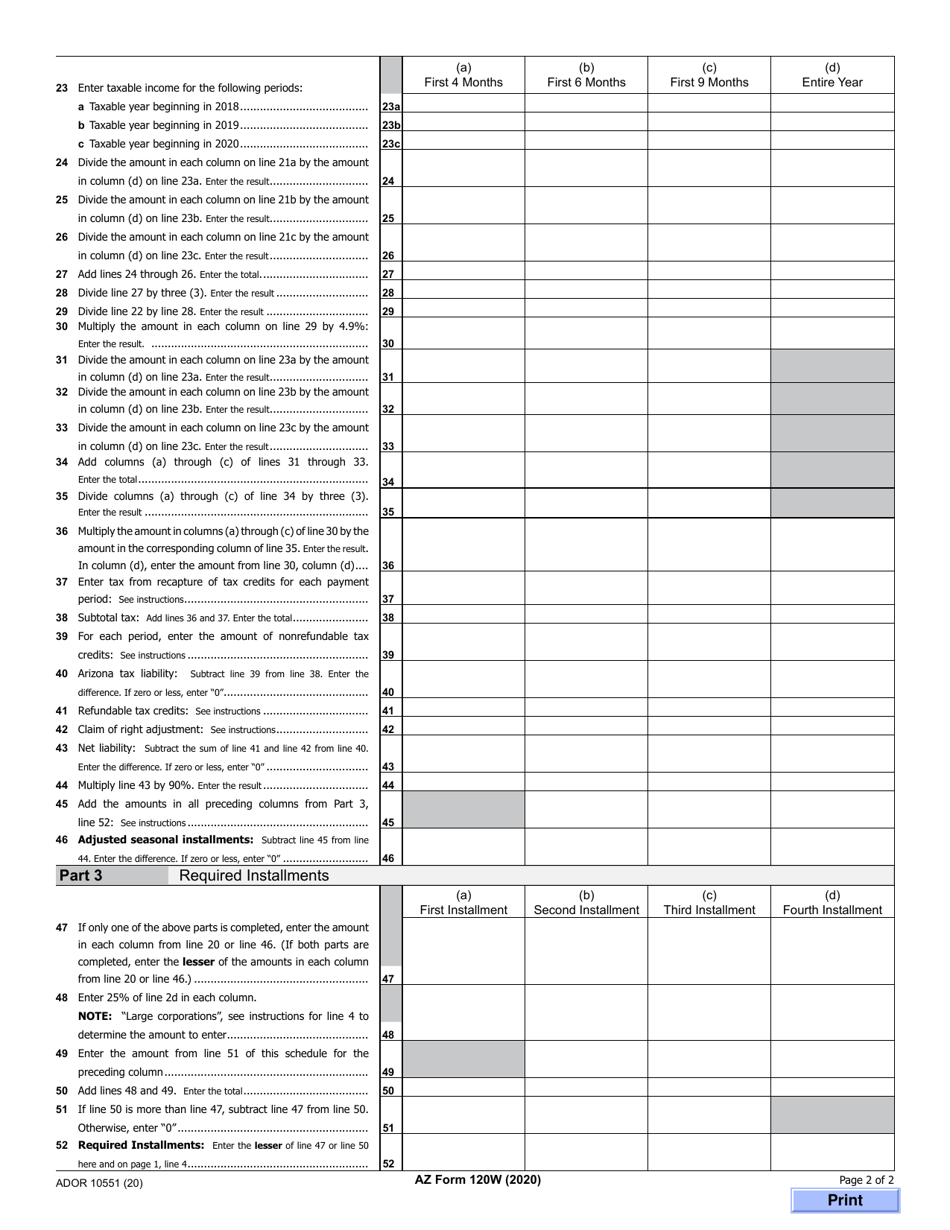

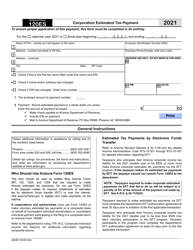

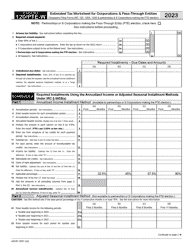

Arizona Form 120W (ADOR10551) Estimated Tax Worksheet for Corporations - Arizona

What Is Arizona Form 120W (ADOR10551)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 120W?

A: Arizona Form 120W is the Estimated Tax Worksheet for Corporations in Arizona.

Q: Who needs to fill out Arizona Form 120W?

A: Corporations in Arizona that need to make estimated tax payments.

Q: What is the purpose of Arizona Form 120W?

A: The purpose of Arizona Form 120W is to calculate and report estimated tax payments for corporations in Arizona.

Q: Is Arizona Form 120W the only form I need to file for corporate taxes in Arizona?

A: No, Arizona Form 120W is an estimated tax worksheet. You may need to file other forms depending on your corporation's tax situation.

Q: When is the deadline to file Arizona Form 120W?

A: The deadline to file Arizona Form 120W is typically the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

Q: Can I make changes to Arizona Form 120W after filing?

A: Yes, if you need to make changes, you can file an amended Arizona Form 120W.

Q: What happens if I don't file Arizona Form 120W?

A: If you are required to file Arizona Form 120W and fail to do so, you may be subject to penalties and interest on underpaid estimated tax.

Q: Can I e-file Arizona Form 120W?

A: No, currently Arizona Form 120W cannot be e-filed. It must be filed by mail or delivered in person.

Form Details:

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120W (ADOR10551) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.