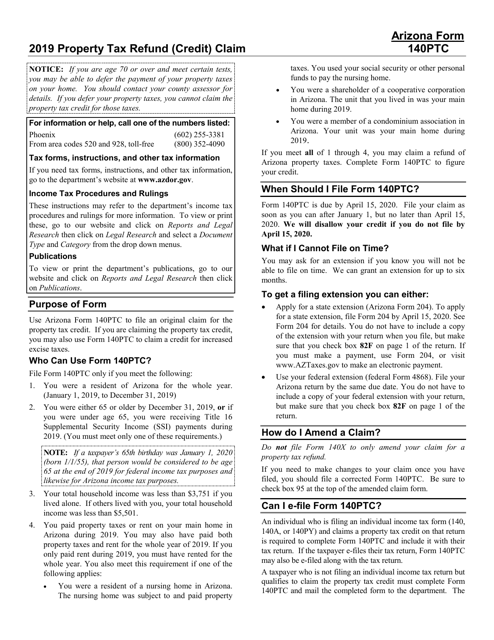

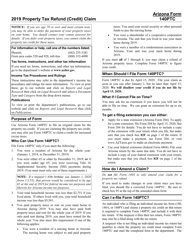

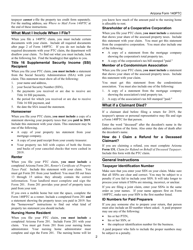

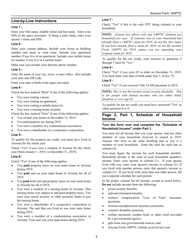

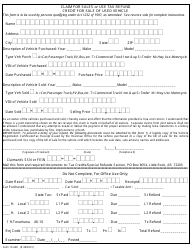

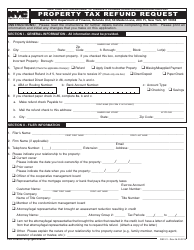

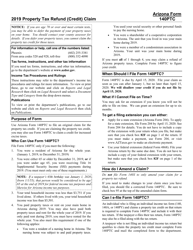

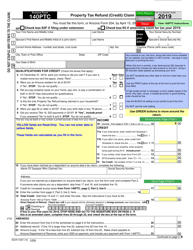

Instructions for Arizona Form 140PTC, ADOR10567 Property Tax Refund (Credit) Claim - Arizona

This document contains official instructions for Arizona Form 140PTC , and Form ADOR10567 . Both forms are released and collected by the Arizona Department of Revenue.

FAQ

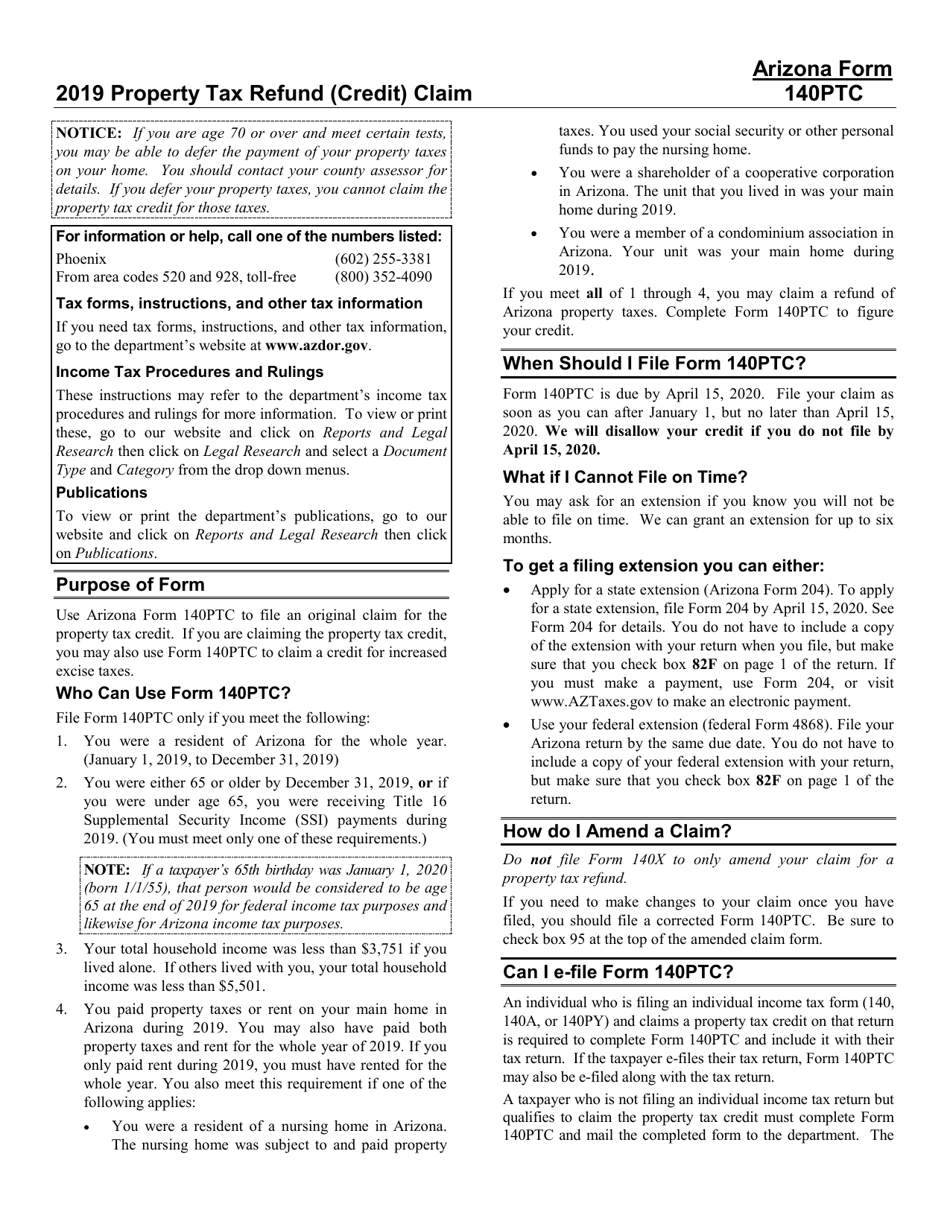

Q: What is Arizona Form 140PTC?

A: Arizona Form 140PTC is a form used to claim a property tax refund (credit) in Arizona.

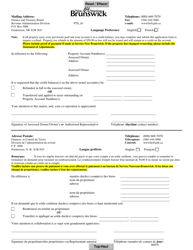

Q: Who can file Arizona Form 140PTC?

A: Arizona residents who own or rent a home and paid property taxes on that home may be eligible to file Arizona Form 140PTC.

Q: What is the purpose of filing Form 140PTC?

A: The purpose of filing Form 140PTC is to claim a refund or credit for property taxes paid on a primary residence in Arizona.

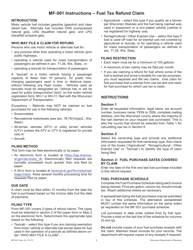

Q: Is there an income limit to qualify for the property tax refund?

A: Yes, there is an income limit to qualify for the property tax refund. The income limit varies depending on filing status and the year.

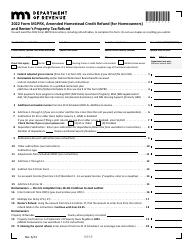

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.