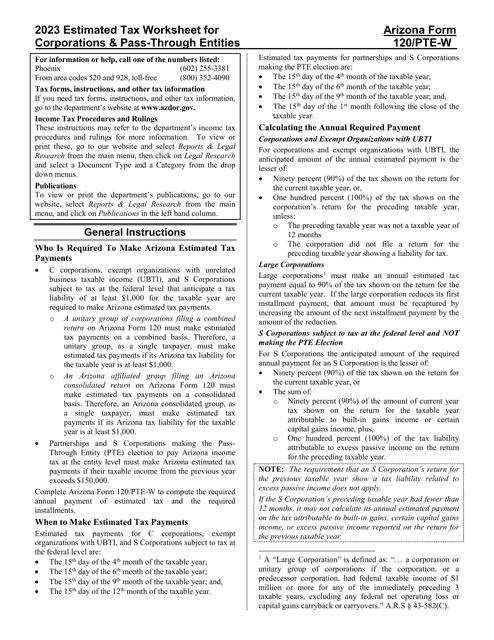

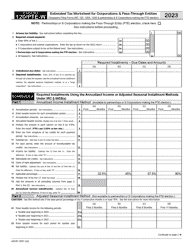

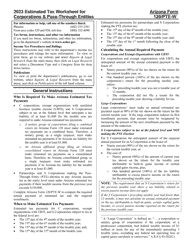

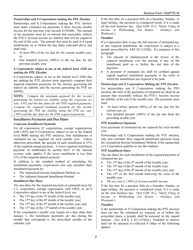

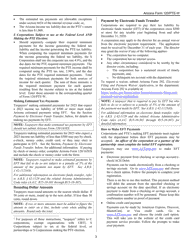

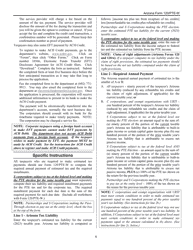

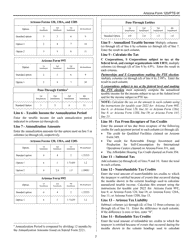

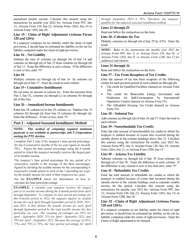

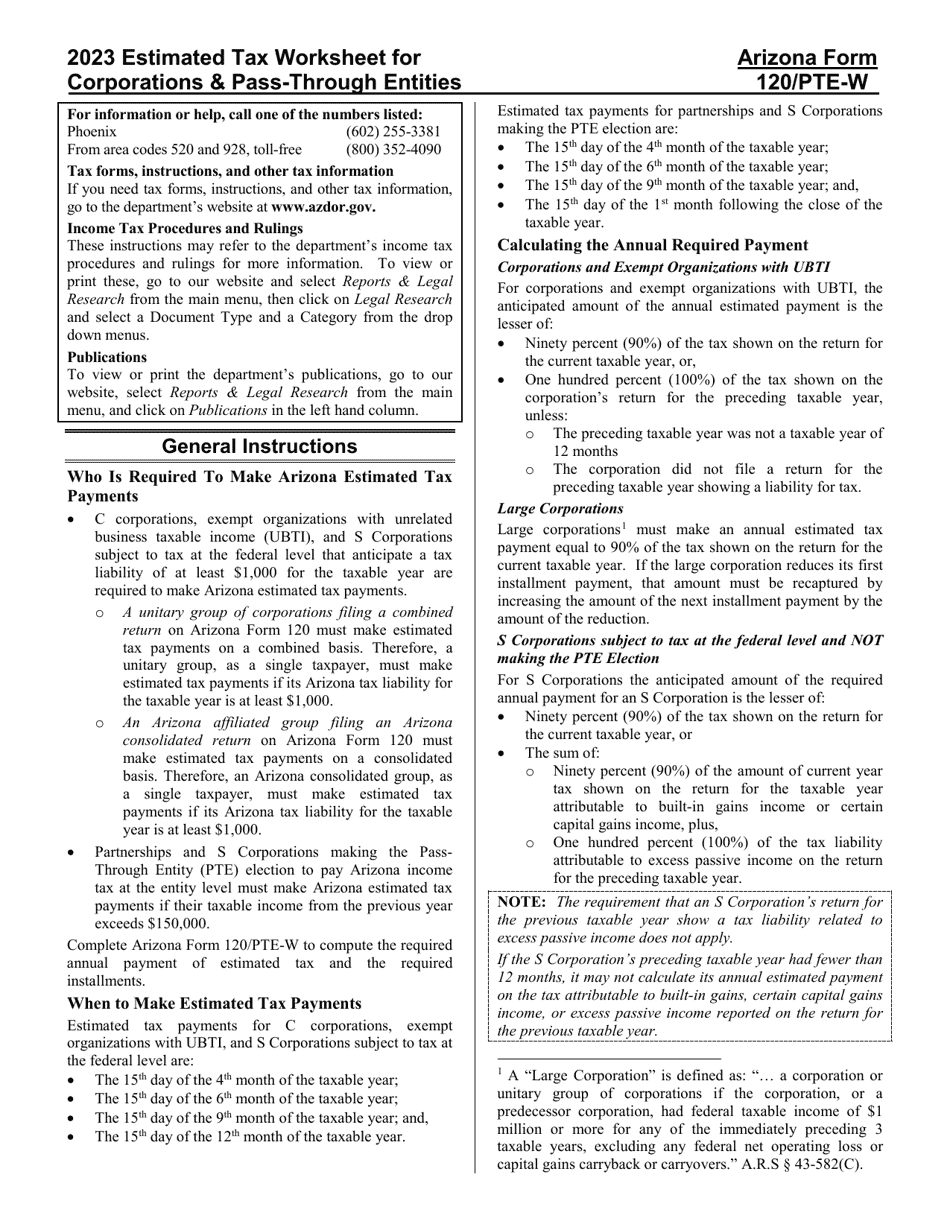

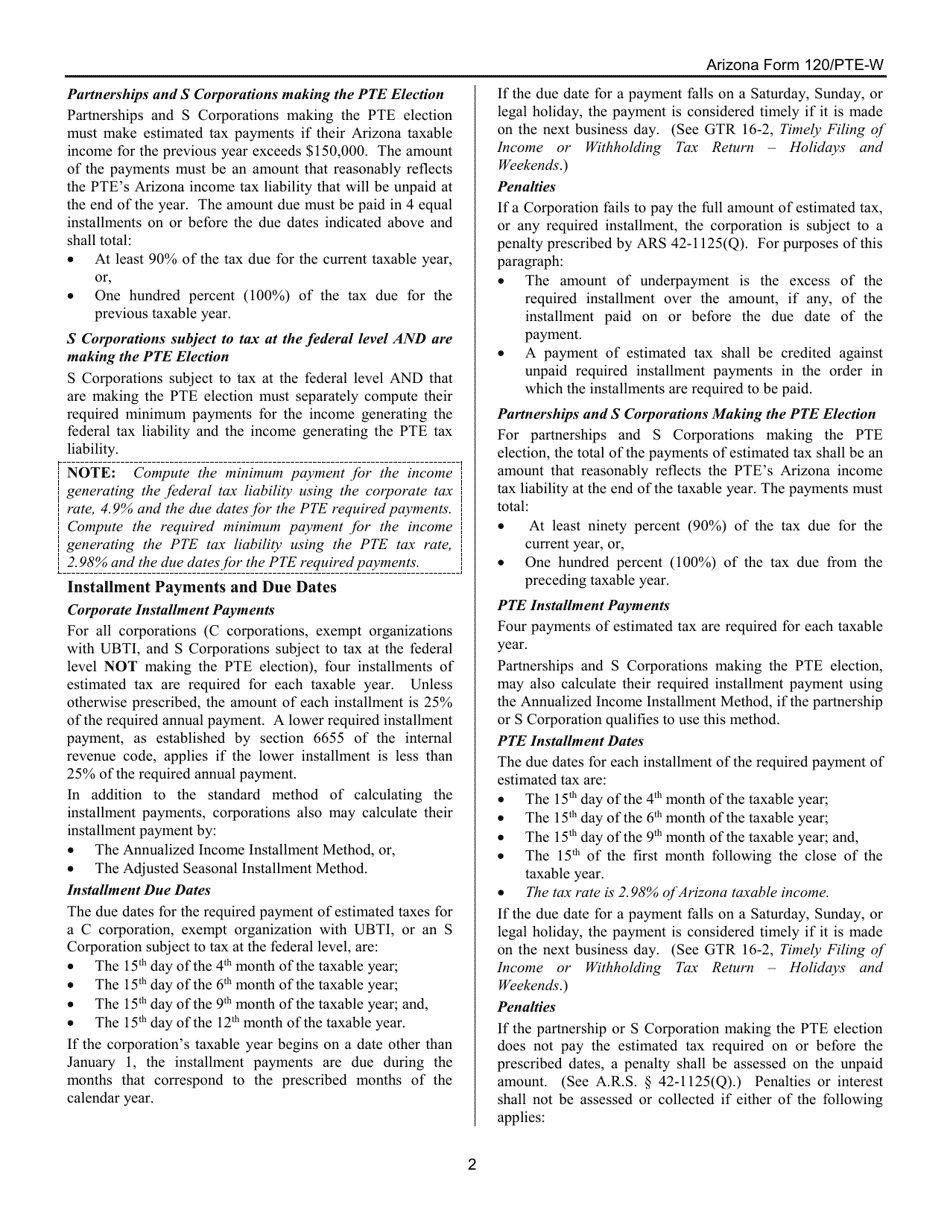

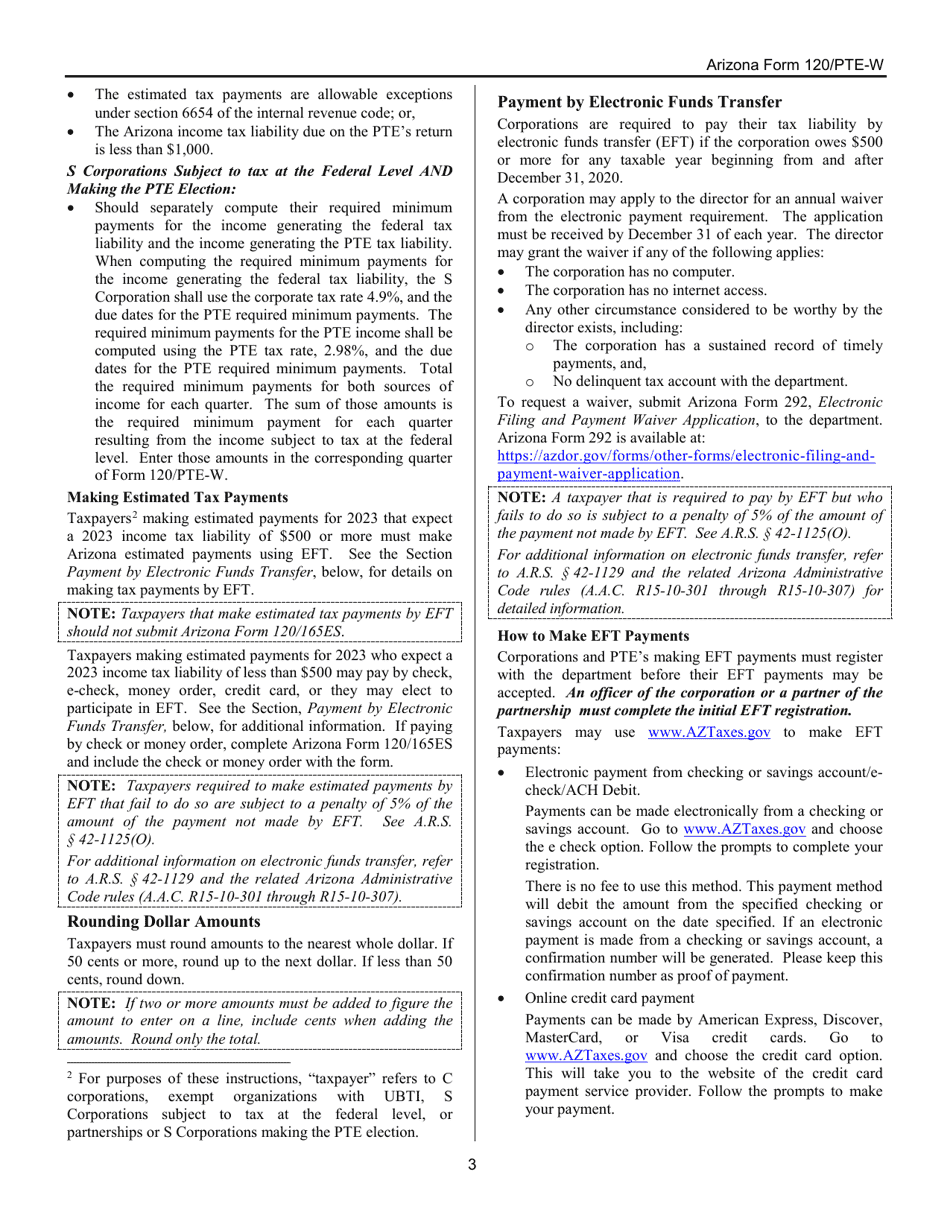

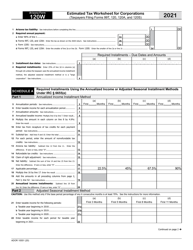

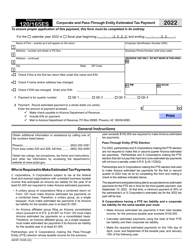

Instructions for Arizona Form 120 / PTE-W, ADOR10551 Estimated Tax Worksheet for Corporations & Pass-Through Entities - Arizona

This document contains official instructions for Arizona Form 120/PTE-W , and Form ADOR10551 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 120/PTE-W (ADOR10551) is available for download through this link.

FAQ

Q: What is Form 120/PTE-W?

A: Form 120/PTE-W is the Estimated Tax Worksheet for Corporations & Pass-Through Entities in Arizona.

Q: Who needs to use Form 120/PTE-W?

A: Corporations and pass-through entities in Arizona are required to use Form 120/PTE-W for estimating their tax liability.

Q: What is the purpose of Form 120/PTE-W?

A: Form 120/PTE-W is used to calculate and report estimated tax payments for corporations and pass-through entities in Arizona.

Q: Is Form 120/PTE-W required for individuals?

A: No, Form 120/PTE-W is specifically for corporations and pass-through entities, not for individuals.

Q: Are estimated tax payments required in Arizona?

A: Yes, corporations and pass-through entities in Arizona are required to make estimated tax payments.

Q: What happens if I don't file or pay estimated taxes?

A: Failure to file or pay estimated taxes may result in penalties and interest charges.

Instruction Details:

- This 9-page document is available for download in PDF;

- Might not be applicable for the current year. Choose an older version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.