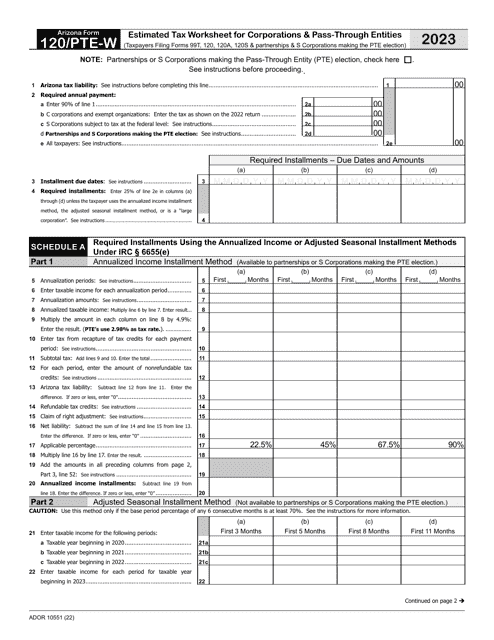

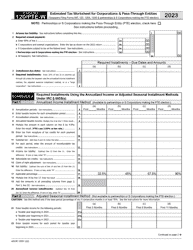

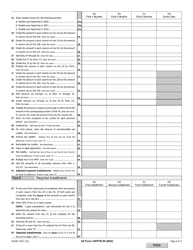

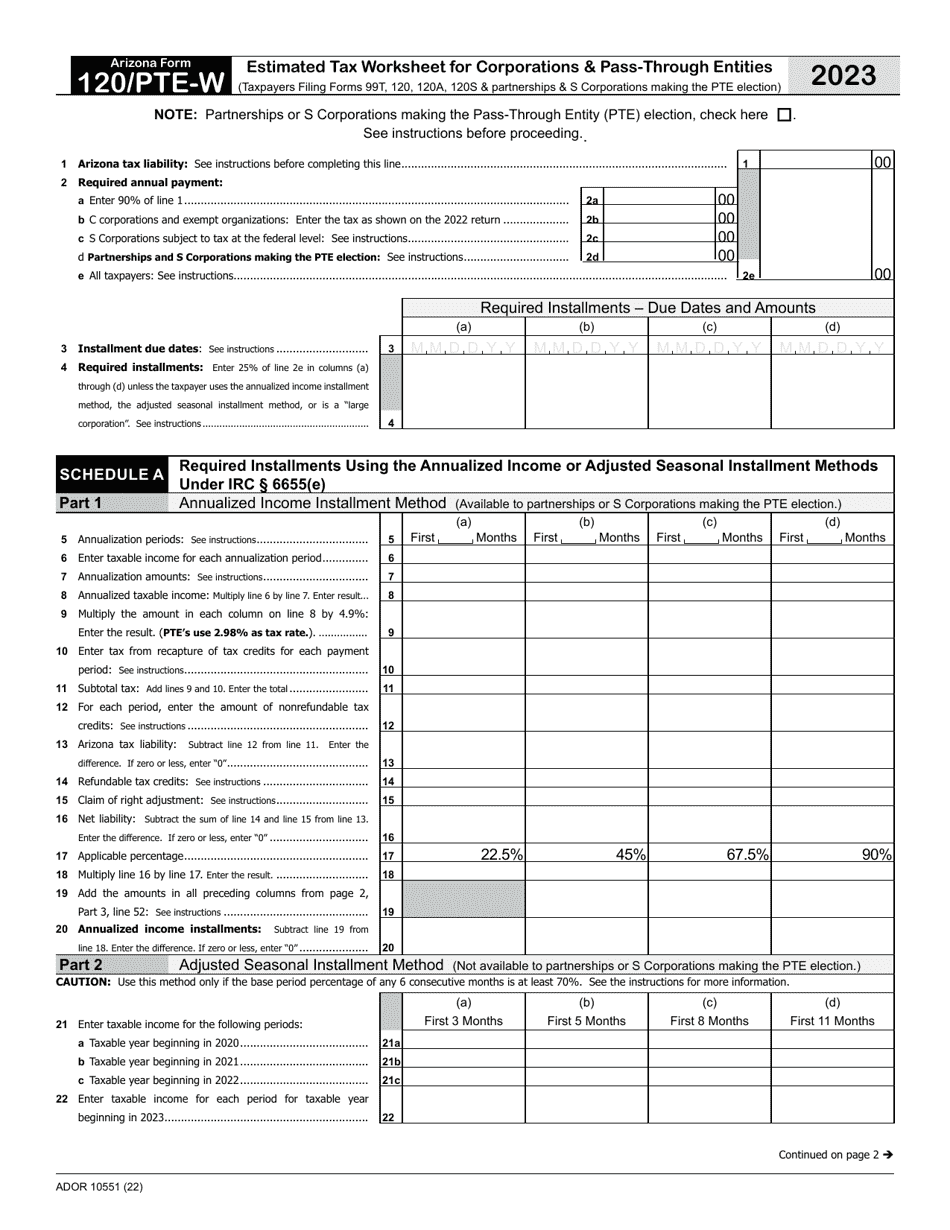

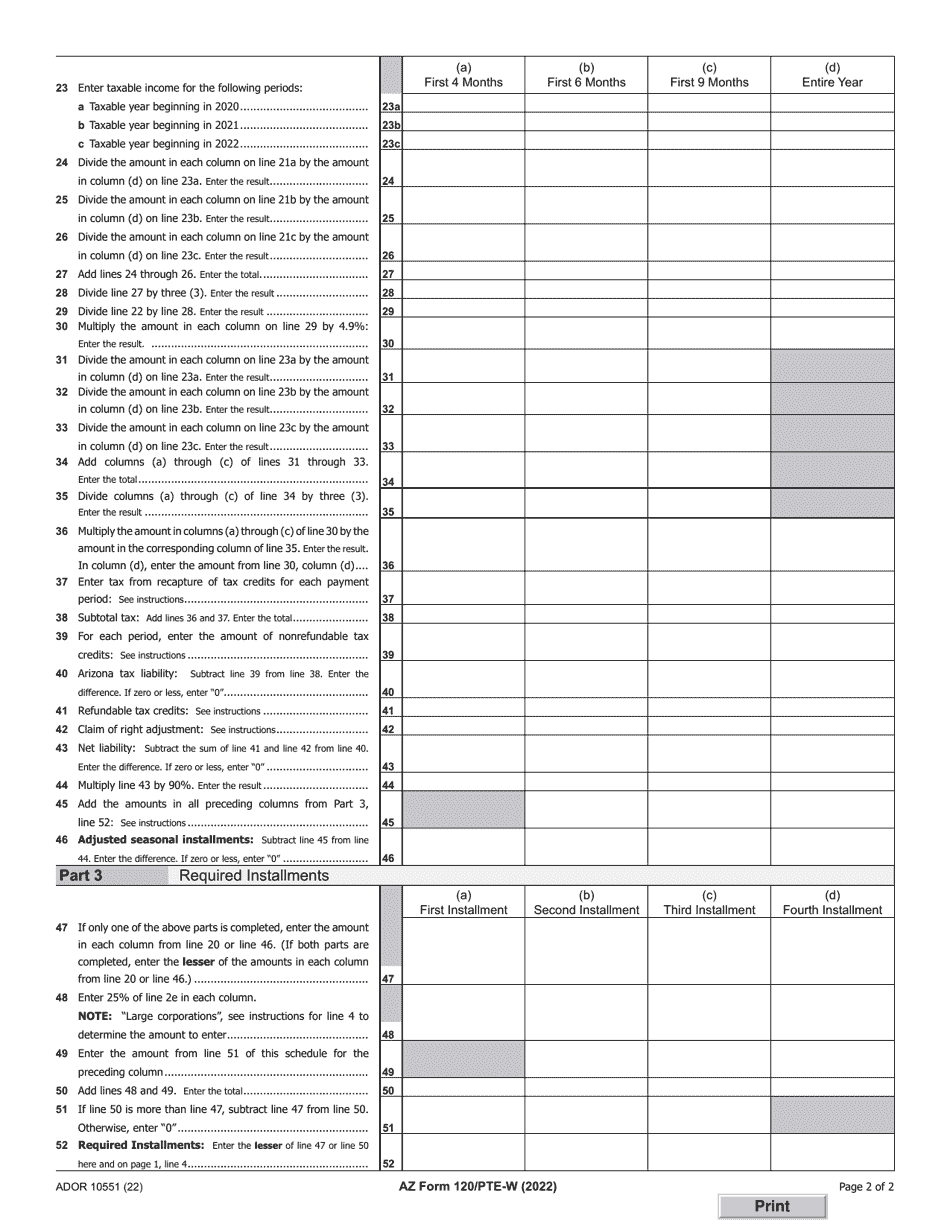

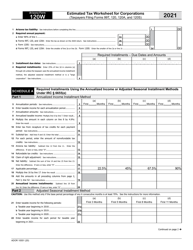

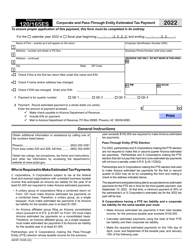

Arizona Form 120 / PTE-W (ADOR10551) Estimated Tax Worksheet for Corporations & Pass-Through Entities - Arizona

What Is Arizona Form 120/PTE-W (ADOR10551)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Arizona Form 120/PTE-W?

A: Arizona Form 120/PTE-W is the Estimated Tax Worksheet for Corporations & Pass-Through Entities in Arizona.

Q: Who needs to file Arizona Form 120/PTE-W?

A: Corporations and Pass-Through Entities in Arizona need to file Arizona Form 120/PTE-W.

Q: What is the purpose of Arizona Form 120/PTE-W?

A: The purpose of Arizona Form 120/PTE-W is to calculate and report estimated tax payments for Corporations & Pass-Through Entities in Arizona.

Q: When is the deadline to file Arizona Form 120/PTE-W?

A: The deadline to file Arizona Form 120/PTE-W is usually the 15th day of the 4th month following the close of the tax year.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 120/PTE-W (ADOR10551) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.