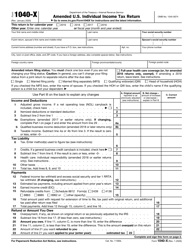

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-X

for the current year.

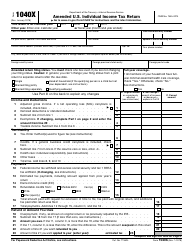

Instructions for IRS Form 1040-X Amended U.S. Individual Income Tax Return

This document contains official instructions for IRS Form 1040-X , Amended U.S. Individual Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1040-X?

A: IRS Form 1040-X is used to amend a previously filed U.S. Individual Income Tax Return.

Q: When should I use IRS Form 1040-X?

A: You should use IRS Form 1040-X to correct errors or make changes to your previously filed U.S. Individual Income Tax Return.

Q: How do I fill out IRS Form 1040-X?

A: You need to provide information about your original tax return, explain the changes you are making, and include any necessary supporting documents.

Q: How long does it take for the IRS to process Form 1040-X?

A: The processing time for IRS Form 1040-X can vary, but it typically takes about 16 weeks to process an amended return.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.