Instructions for IRS Form 1040X Amended U.S. Individual Income Tax Return

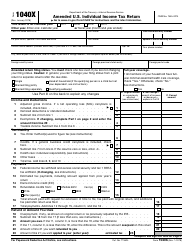

This document contains official instructions for IRS Form 1040X , Amended U.S. Individual Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040X is available for download through this link.

FAQ

Q: What is IRS Form 1040X?

A: IRS Form 1040X is the Amended U.S. Individual Income Tax Return.

Q: When should I use Form 1040X?

A: You should use Form 1040X when you need to correct errors or make changes to your previously filed tax return.

Q: What are the common reasons to file Form 1040X?

A: Common reasons include reporting additional income, correcting errors in deductions or credits, or changing your filing status.

Q: Can I file Form 1040X electronically?

A: No, you cannot file Form 1040X electronically. It must be filed by mail.

Q: Is there a deadline to file Form 1040X?

A: Yes, you generally have three years from the original due date of the tax return or two years from the date you paid the tax, whichever is later.

Q: What documents should I include with Form 1040X?

A: Include any necessary supporting documents, such as revised W-2 forms or additional schedules.

Q: Will filing Form 1040X result in a refund or additional tax payment?

A: It depends on the changes you make. You may receive a refund or owe additional tax.

Q: Can I amend my state tax return using Form 1040X?

A: No, Form 1040X is used only for federal tax returns. You will need to check your state's tax agency for instructions on amending state returns.

Q: What if I made a mistake on my amended return?

A: If you made a mistake on your amended return, you can file another Form 1040X to correct it.

Instruction Details:

- This 19-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.