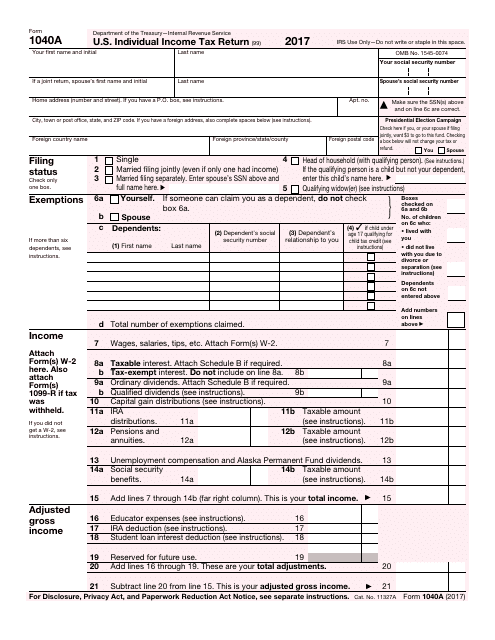

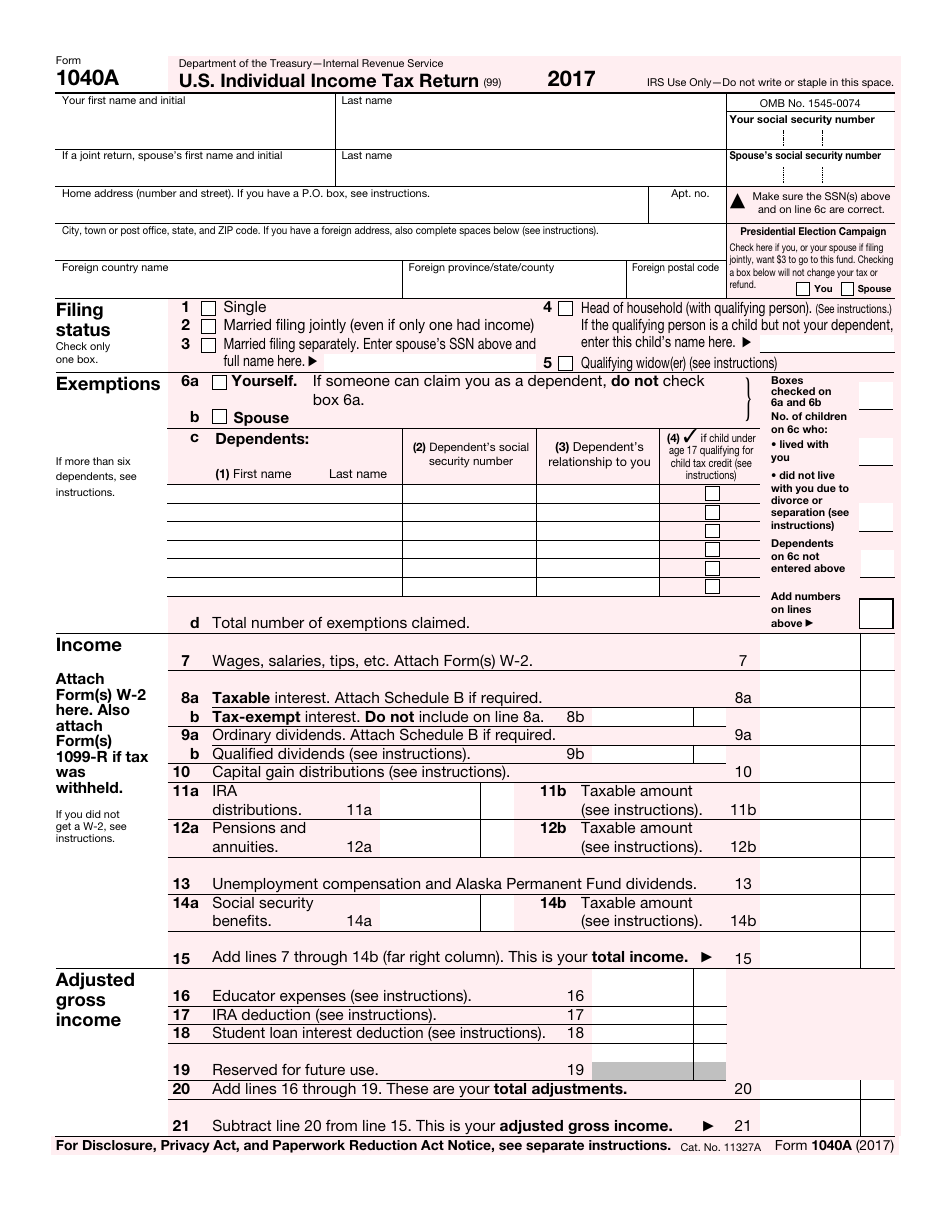

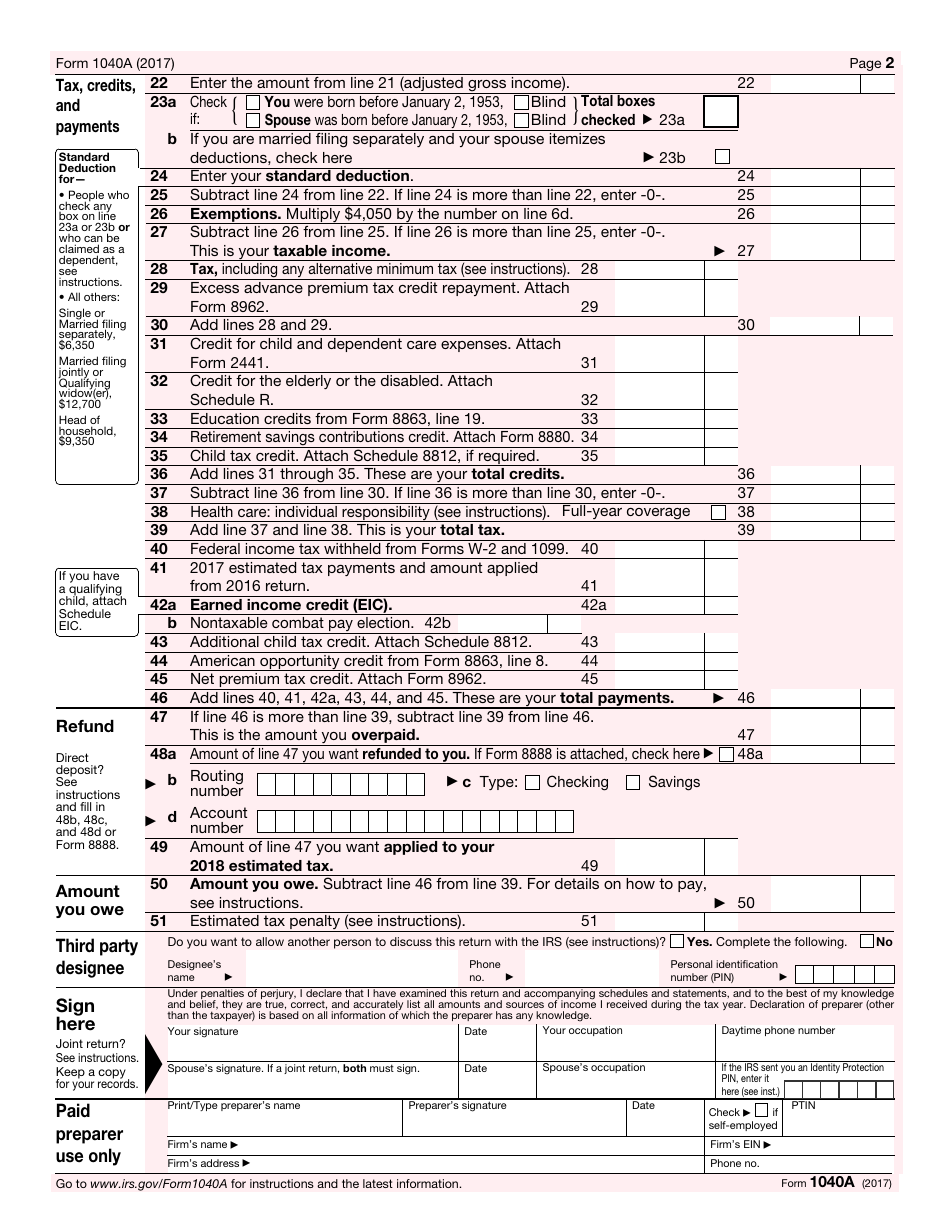

IRS Form 1040A U.S. Individual Income Tax Return

What Is IRS Form 1040A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040A?

A: IRS Form 1040A is the U.S. Individual Income Tax Return form that taxpayers can use to file their income tax return.

Q: Who can use IRS Form 1040A?

A: IRS Form 1040A can be used by individuals with taxable income less than $100,000, who do not itemize deductions, and who have specific types of income.

Q: What information is required to complete IRS Form 1040A?

A: To complete IRS Form 1040A, you will need information about your income, deductions, credits, and personal information such as your Social Security number and filing status.

Q: When is the deadline to file IRS Form 1040A?

A: The deadline to file IRS Form 1040A is typically April 15th, but it may vary depending on the tax year and any extensions.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040A through the link below or browse more documents in our library of IRS Forms.