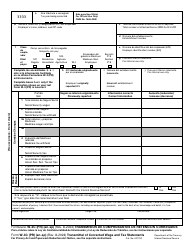

Instructions for IRS Form W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C

This document contains official instructions for IRS Form W-2 , IRS Form W-3 , IRS Form W-2AS , IRS Form W-2CM , IRS Form W-2GU , IRS Form W-2VI , IRS Form W-3SS , IRS Form W-2C , and IRS Form W-3C . All forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-2 is available for download through this link. The latest available IRS Form W-3 can be downloaded through this link. IRS Form W-2AS can be found here. IRS Form W-2GU can be downloaded here. An up-to-date fillable IRS Form W-2VI is available for download through this link. The latest available IRS Form W-3SS can be downloaded through this link.

FAQ

Q: What is IRS Form W-2?

A: IRS Form W-2 is a tax form that employers use to report wages, tips, and other compensation paid to employees.

Q: What is IRS Form W-3?

A: IRS Form W-3 is a transmittal form that employers use to submit copies of Form W-2 to the Social Security Administration.

Q: What are the other forms related to IRS Form W-2?

A: Other related forms include W-2AS (for American Samoa), W-2CM (for the Commonwealth of the Northern Mariana Islands), W-2GU (for Guam), W-2VI (for the U.S. Virgin Islands), W-3SS (for filing with the Social Security Administration), W-2C (corrected Wage and Tax Statement), and W-3C (transmittal of corrected Wage and Tax Statements)

Instruction Details:

- This 34-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.