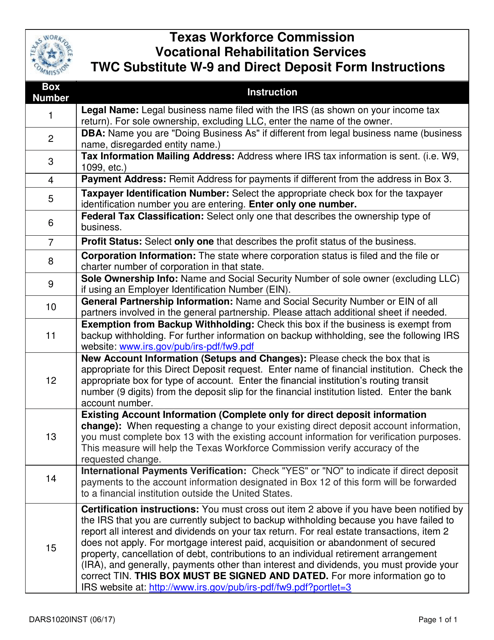

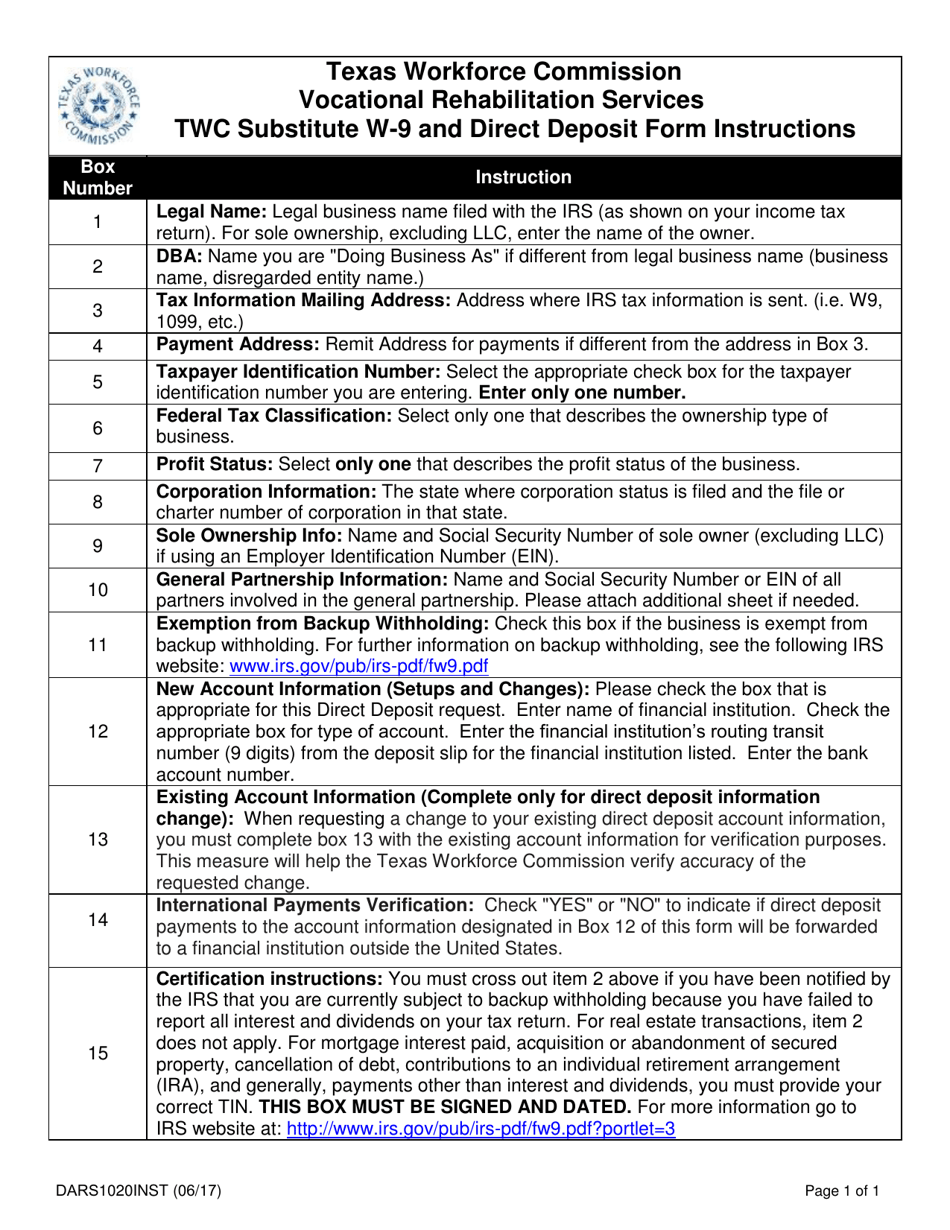

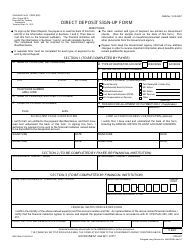

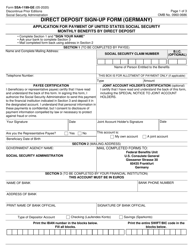

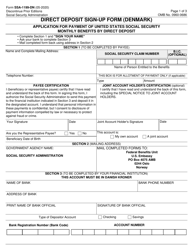

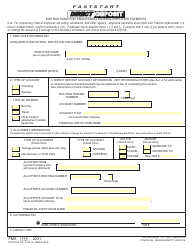

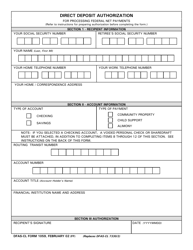

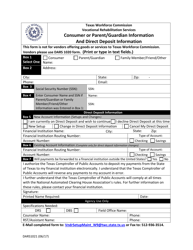

Instructions for Form TWC1020 Twc Substitute W-9 and Direct Deposit Form - Texas

This document contains official instructions for Form TWC1020 , Twc Substitute W-9 and Direct Deposit Form - a form released and collected by the Texas Workforce Commission. An up-to-date fillable Form TWC1020 is available for download through this link.

FAQ

Q: What is Form TWC1020?

A: Form TWC1020 is the Twc Substitute W-9 and Direct Deposit Form used in Texas.

Q: What is the purpose of Form TWC1020?

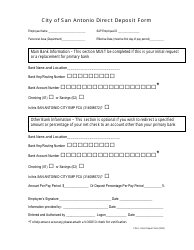

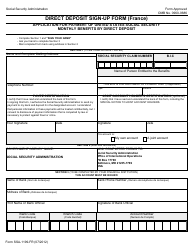

A: The purpose of Form TWC1020 is to provide necessary information for tax reporting and set up direct deposit for unemployment benefits.

Q: Who needs to fill out Form TWC1020?

A: Individuals who are applying for or receiving unemployment benefits in Texas and want to set up direct deposit need to fill out Form TWC1020.

Q: What information is required on Form TWC1020?

A: Form TWC1020 requires personal information such as name, address, social security number, and banking information for direct deposit.

Q: Is Form TWC1020 mandatory?

A: Form TWC1020 is mandatory for individuals who want to set up direct deposit for unemployment benefits in Texas.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Texas Workforce Commission.