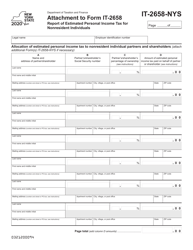

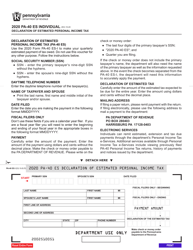

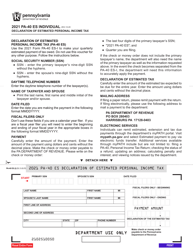

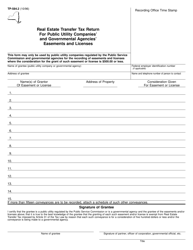

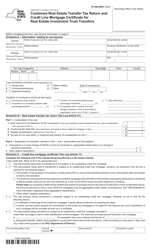

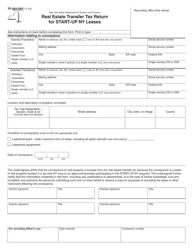

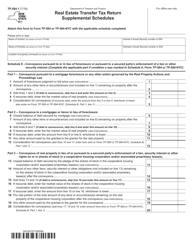

Instructions for Form TP-584-NYC Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption From the Payment of Estimated Personal Income Tax for the Conveyance of Real Property Located in New York City - New York

This document contains official instructions for Form TP-584-NYC , Combined Real Real Property Located in New York City - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form TP-584-NYC?

A: Form TP-584-NYC is a combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of estimated personal income tax for the conveyance of real property located in New York City, New York.

Q: Who needs to file Form TP-584-NYC?

A: Anyone who is involved in the conveyance of real property located in New York City needs to file Form TP-584-NYC.

Q: What information is required on Form TP-584-NYC?

A: Form TP-584-NYC requires information about the property being conveyed, the parties involved in the transaction, and the financial details of the transaction.

Q: Is there a fee for filing Form TP-584-NYC?

A: Yes, there is a fee for filing Form TP-584-NYC. The amount of the fee depends on the value of the property being conveyed.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.