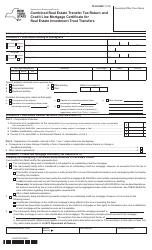

Instructions for Form TP-584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption From the Payment of Estimated Personal Income Tax - New York

This document contains official instructions for Form TP-584 , Combined Real Personal Income Tax - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form TP-584 is available for download through this link.

FAQ

Q: What is Form TP-584?

A: Form TP-584 is a combined real estate transfer tax return, credit line mortgage certificate, and certification of exemption from the payment of estimated personal income tax.

Q: What is the purpose of Form TP-584?

A: The purpose of Form TP-584 is to report and pay the real estate transfer tax, provide information about any mortgage associated with the property, and certify exemption from estimated personal income tax.

Q: Who needs to file Form TP-584?

A: Both the buyer and the seller of real property in New York State need to file Form TP-584.

Q: What is the real estate transfer tax?

A: The real estate transfer tax is a tax imposed on the transfer of real property in New York State.

Q: What information is required on Form TP-584?

A: Form TP-584 requires information about the buyer, seller, property being transferred, mortgage involved, and any exemptions or credits being claimed.

Q: Are there any fees associated with filing Form TP-584?

A: Yes, there are fees associated with filing Form TP-584. The fees vary depending on the value of the property being transferred.

Q: When should Form TP-584 be filed?

A: Form TP-584 should be filed within 30 days of the transfer of the property or the commitment date of the mortgage, whichever is earlier.

Q: What happens if Form TP-584 is not filed on time?

A: If Form TP-584 is not filed on time, penalties and interest may be assessed.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.