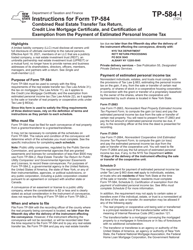

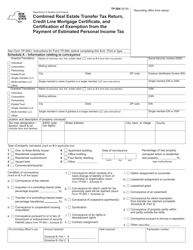

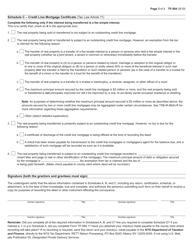

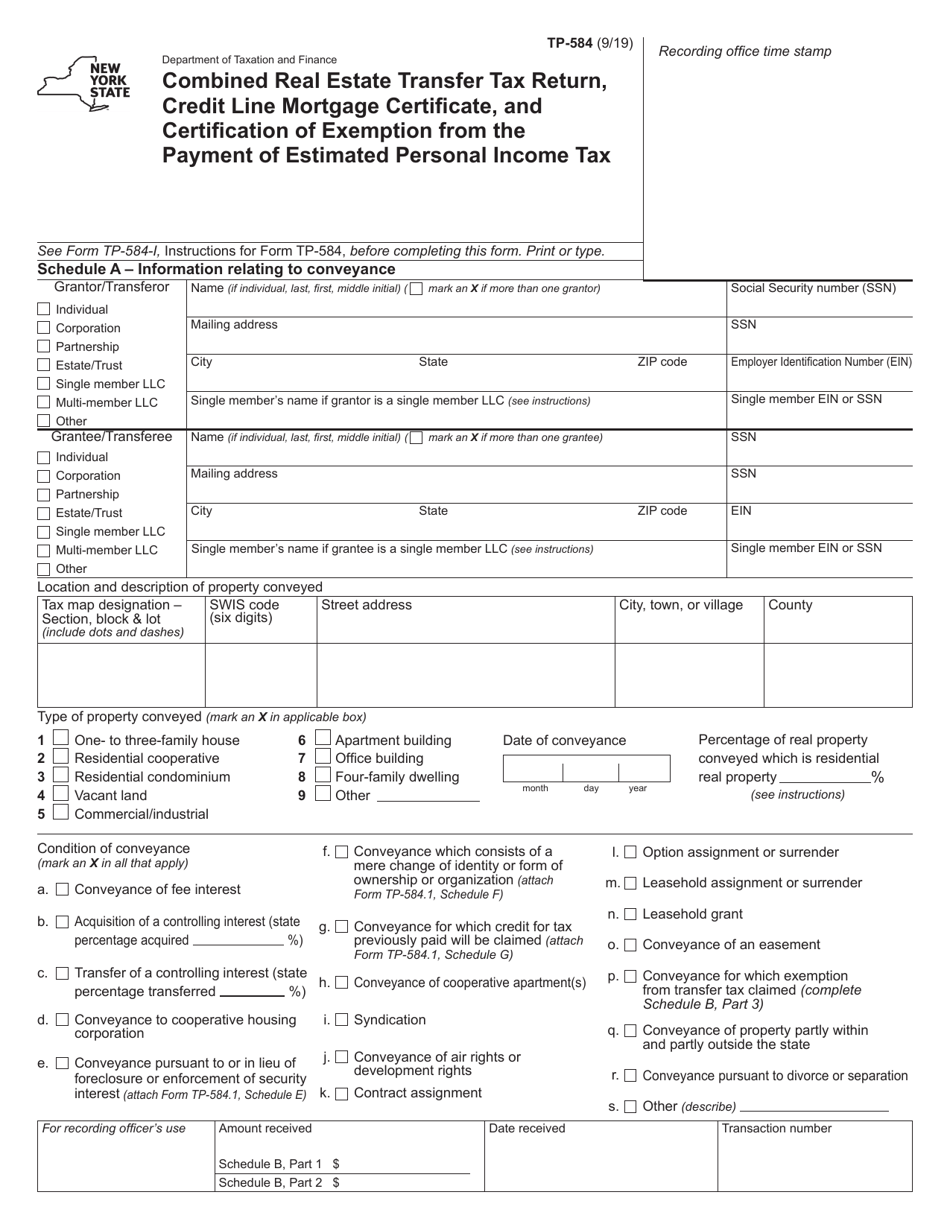

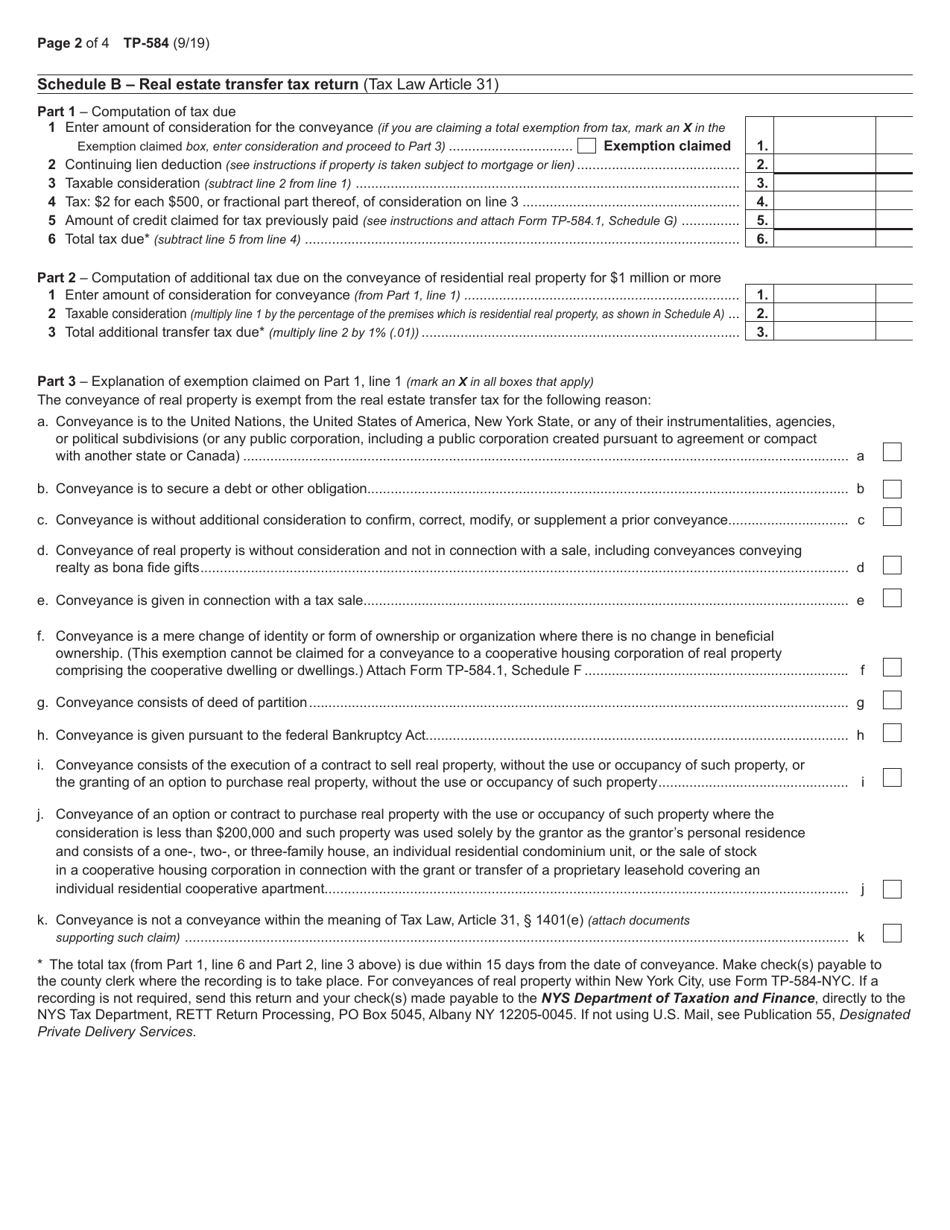

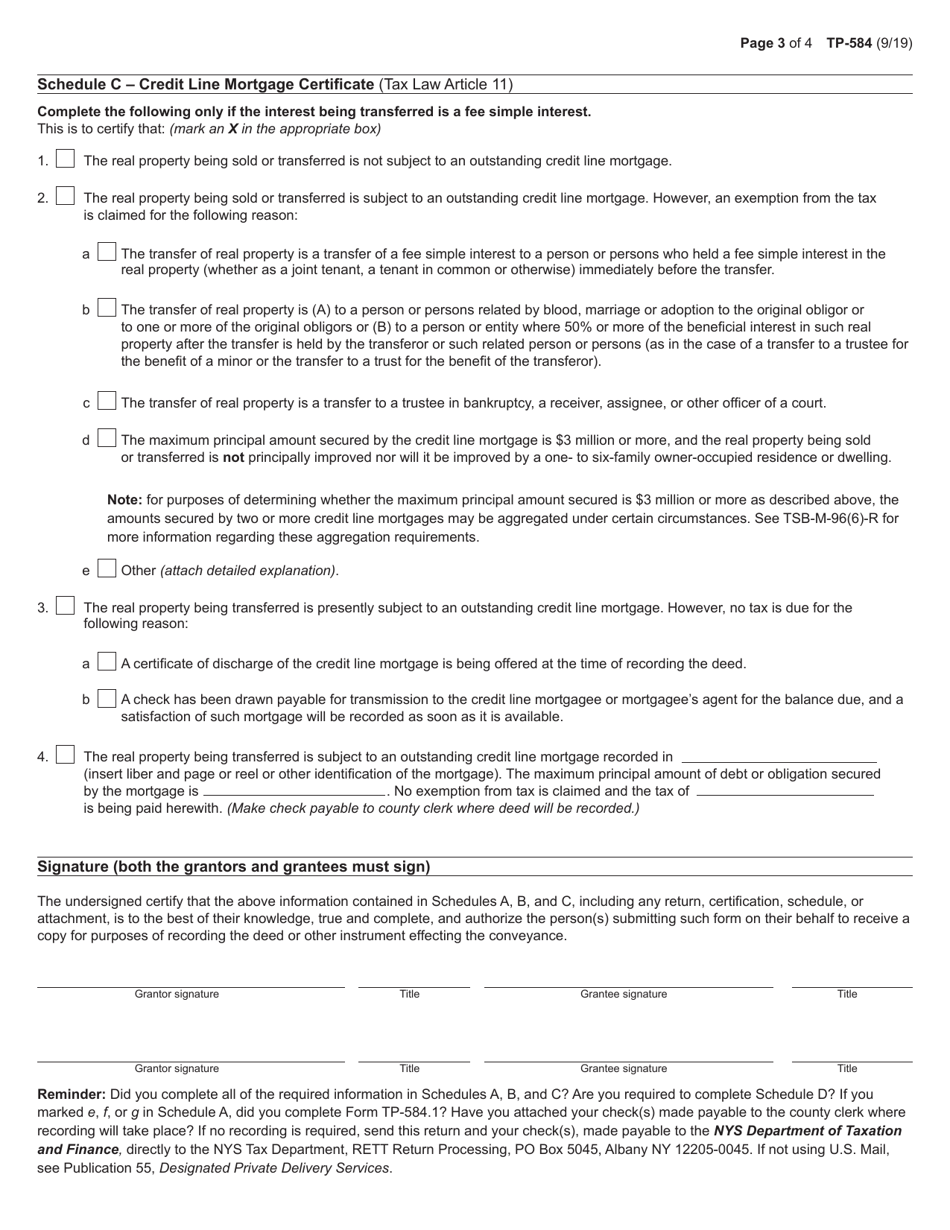

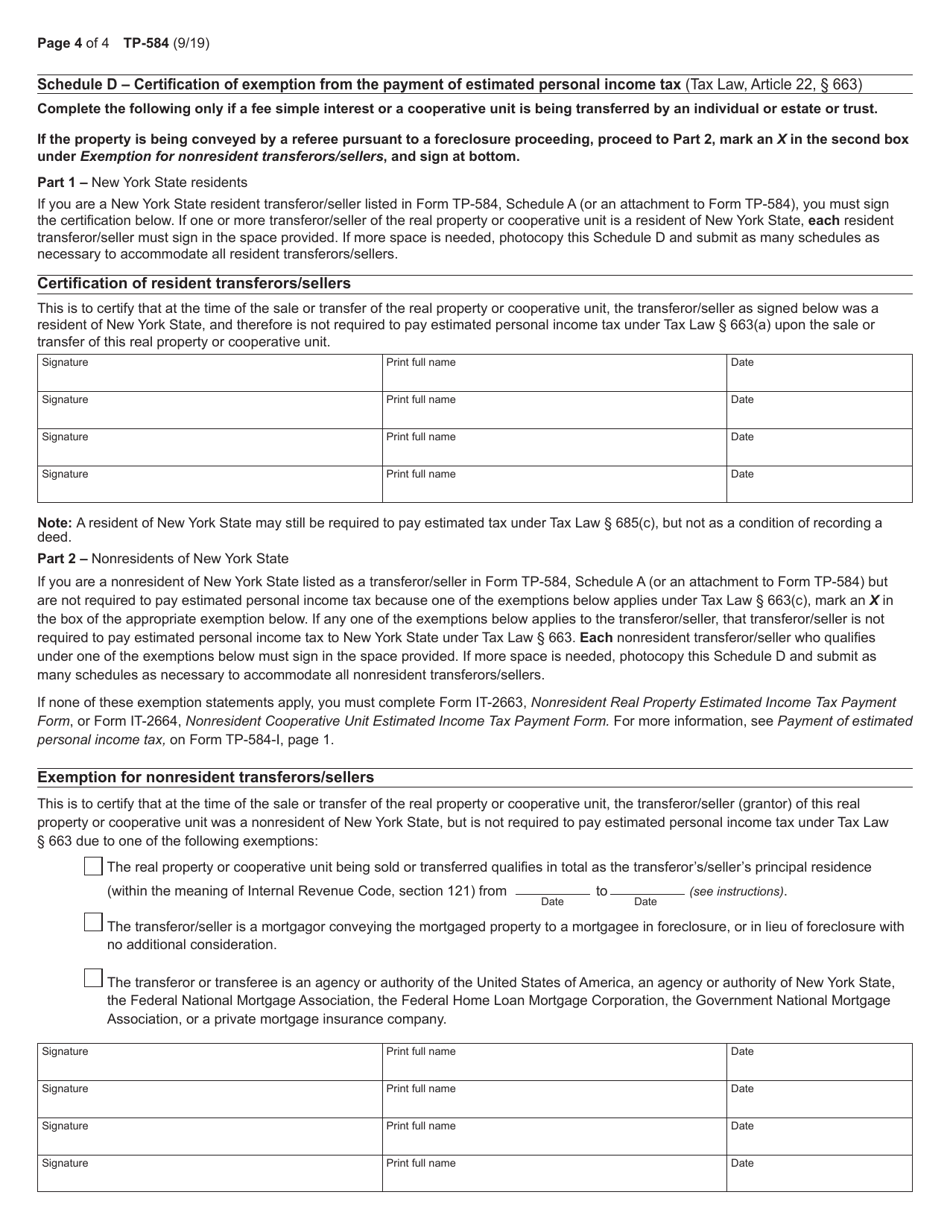

Form TP-584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption From the Payment of Estimated Personal Income Tax - New York

What Is Form TP-584?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the TP-584 form?

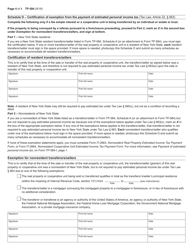

A: The TP-584 form is a Combined Real Estate Transfer Tax Return, Credit Line Mortgage Certificate, and Certification of Exemption From the Payment of Estimated Personal Income Tax.

Q: What is the purpose of the TP-584 form?

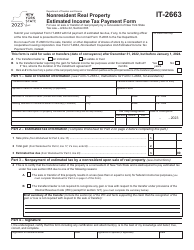

A: The purpose of the TP-584 form is to report and pay real estate transfer tax in New York, as well as to provide information about mortgages and exemptions from estimated personal income tax.

Q: Who needs to file the TP-584 form?

A: The TP-584 form needs to be filed by parties involved in a real estate transfer in New York, such as buyers, sellers, and lenders.

Q: What information is required on the TP-584 form?

A: The TP-584 form requires information about the property transfer, the parties involved, mortgage details, and any exemptions from estimated personal income tax.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-584 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.