This version of the form is not currently in use and is provided for reference only. Download this version of

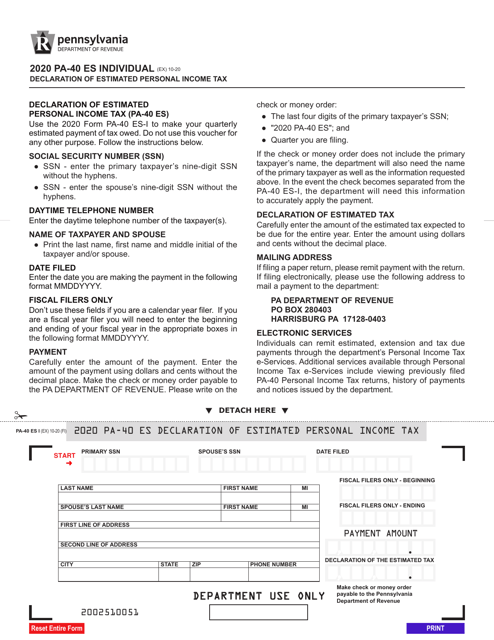

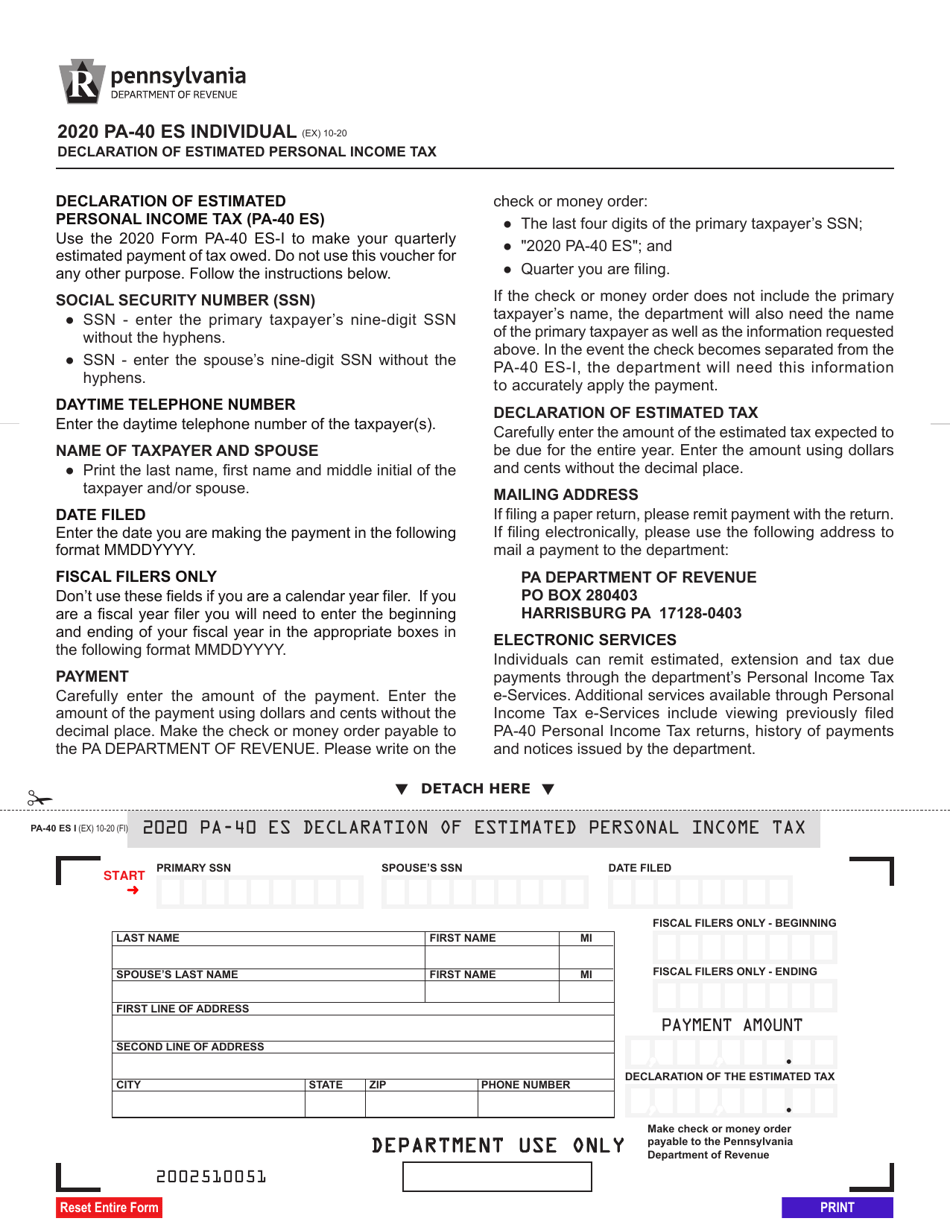

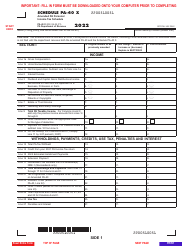

Form PA-40 ES

for the current year.

Form PA-40 ES Declaration of Estimated Personal Income Tax - Pennsylvania

What Is Form PA-40 ES?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 ES?

A: Form PA-40 ES is the Declaration of Estimated Personal Income Tax form for residents of Pennsylvania.

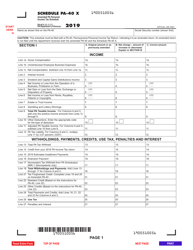

Q: Who needs to fill out Form PA-40 ES?

A: Pennsylvania residents who have income that is not subject to withholding tax, such as self-employment income, rental income, or interest and dividend income, need to fill out Form PA-40 ES.

Q: What is the purpose of Form PA-40 ES?

A: The purpose of Form PA-40 ES is to calculate and pay estimated personal income tax throughout the year, in order to avoid underpayment penalties.

Q: When is Form PA-40 ES due?

A: Form PA-40 ES is due quarterly, with the following due dates: April 15, June 15, September 15, and January 15 of the following year.

Q: What information is required on Form PA-40 ES?

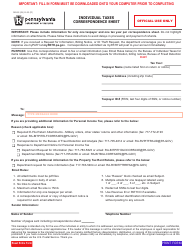

A: Form PA-40 ES requires taxpayers to provide their name, address, Social Security number, estimated taxable income, and estimated tax liability for the year.

Q: Are there any penalties for not filing Form PA-40 ES?

A: Yes, if you do not file Form PA-40 ES or underpay your estimated taxes, you may be subject to penalties and interest on the underpaid amount.

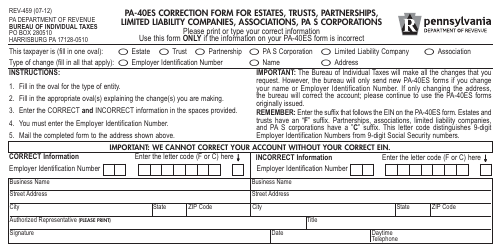

Q: Can I make changes to my estimated tax payments?

A: Yes, if you need to make changes to your estimated tax payments, you can file an amended Form PA-40 ES or make adjustments with your final annual return.

Q: Do I need to attach any documents with Form PA-40 ES?

A: No, you do not need to attach any documents with Form PA-40 ES, but you should keep a copy of the form and any related payment receipts for your records.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 ES by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.