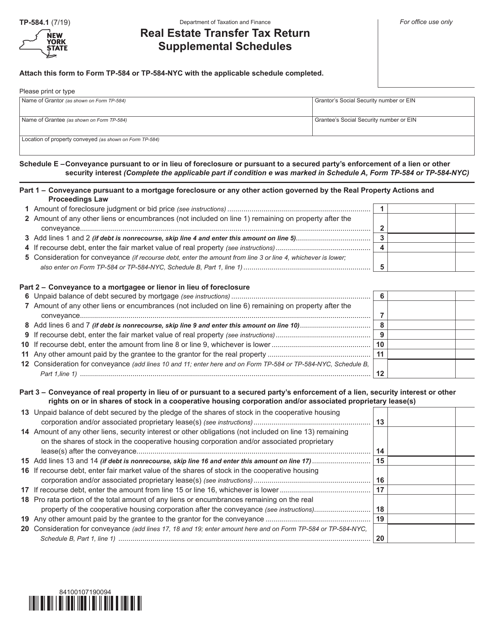

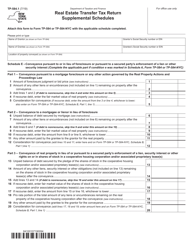

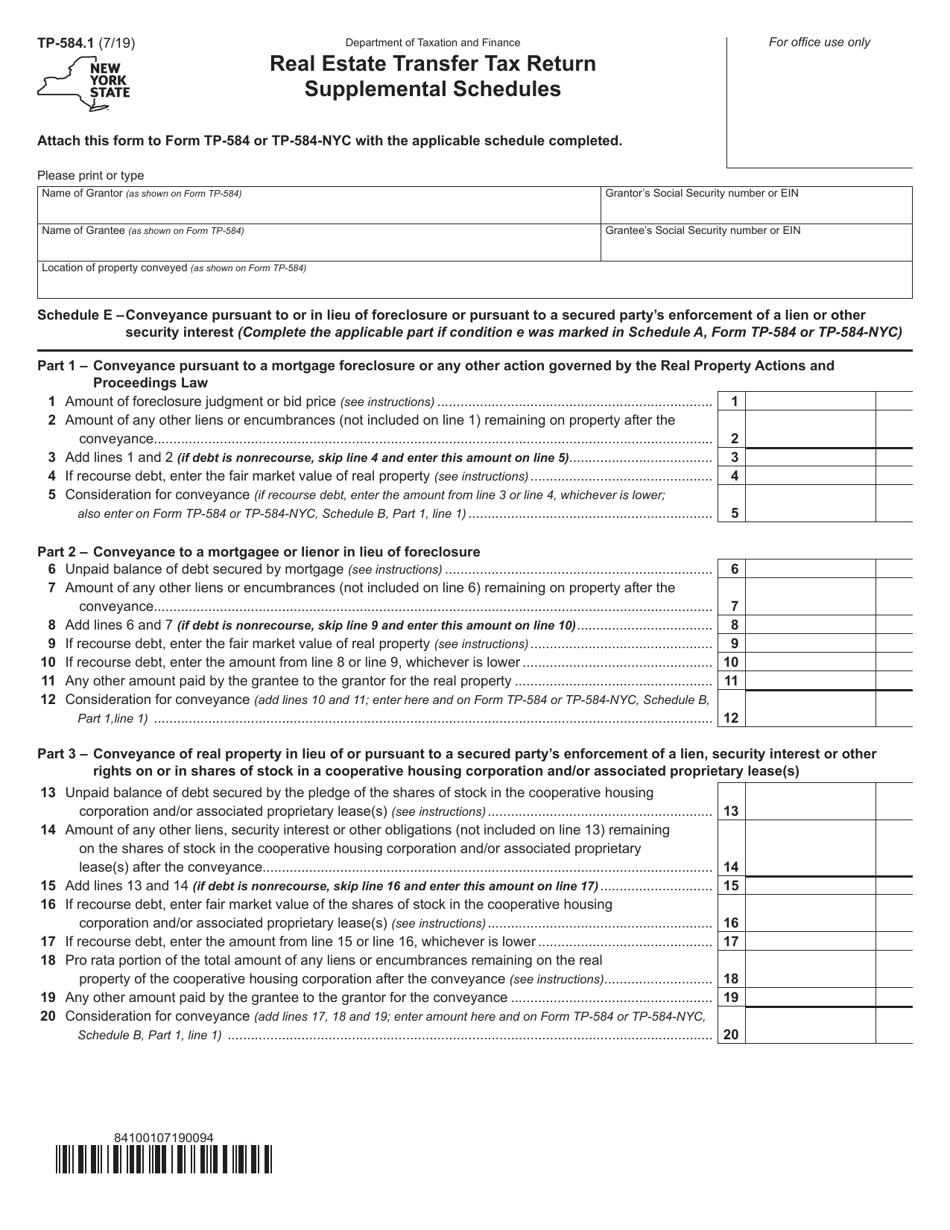

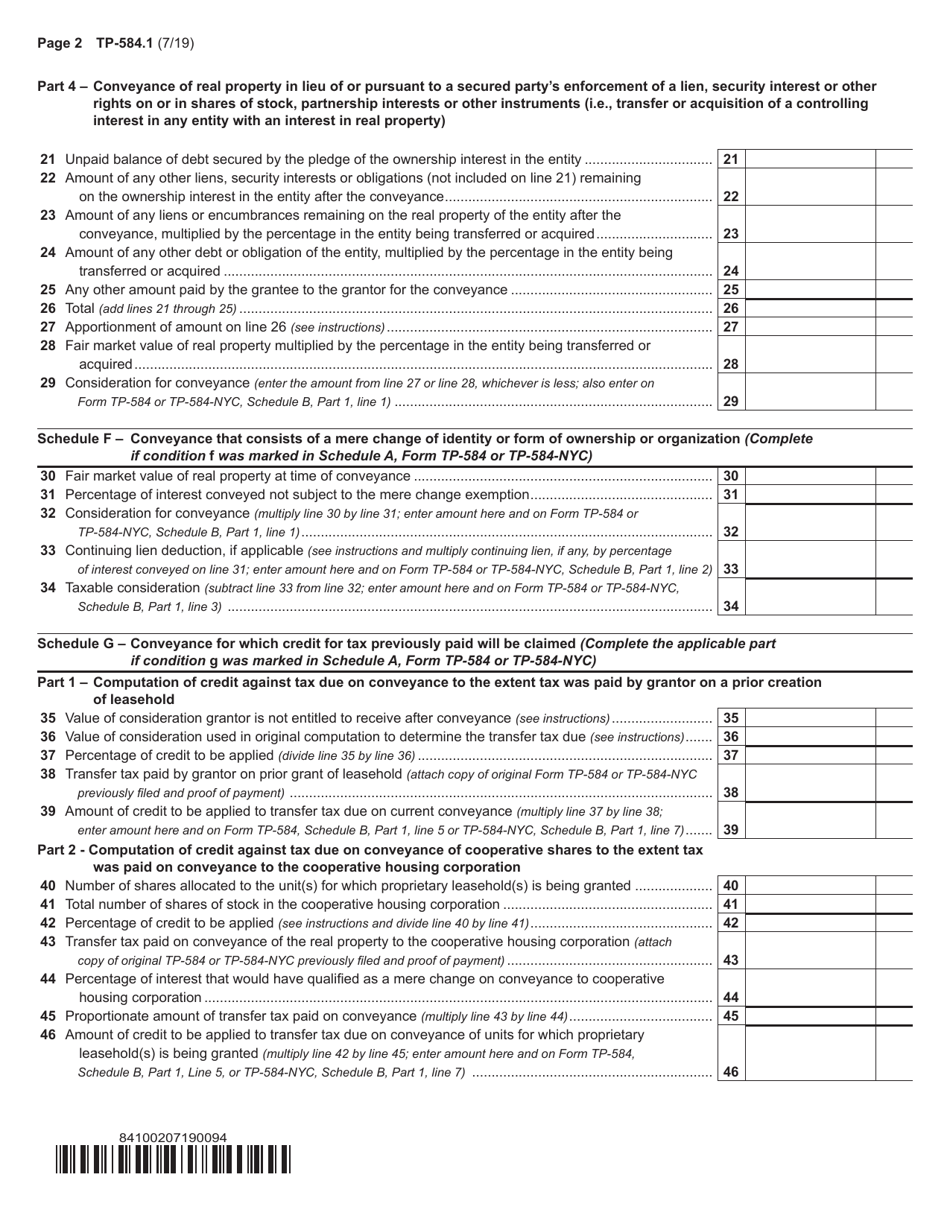

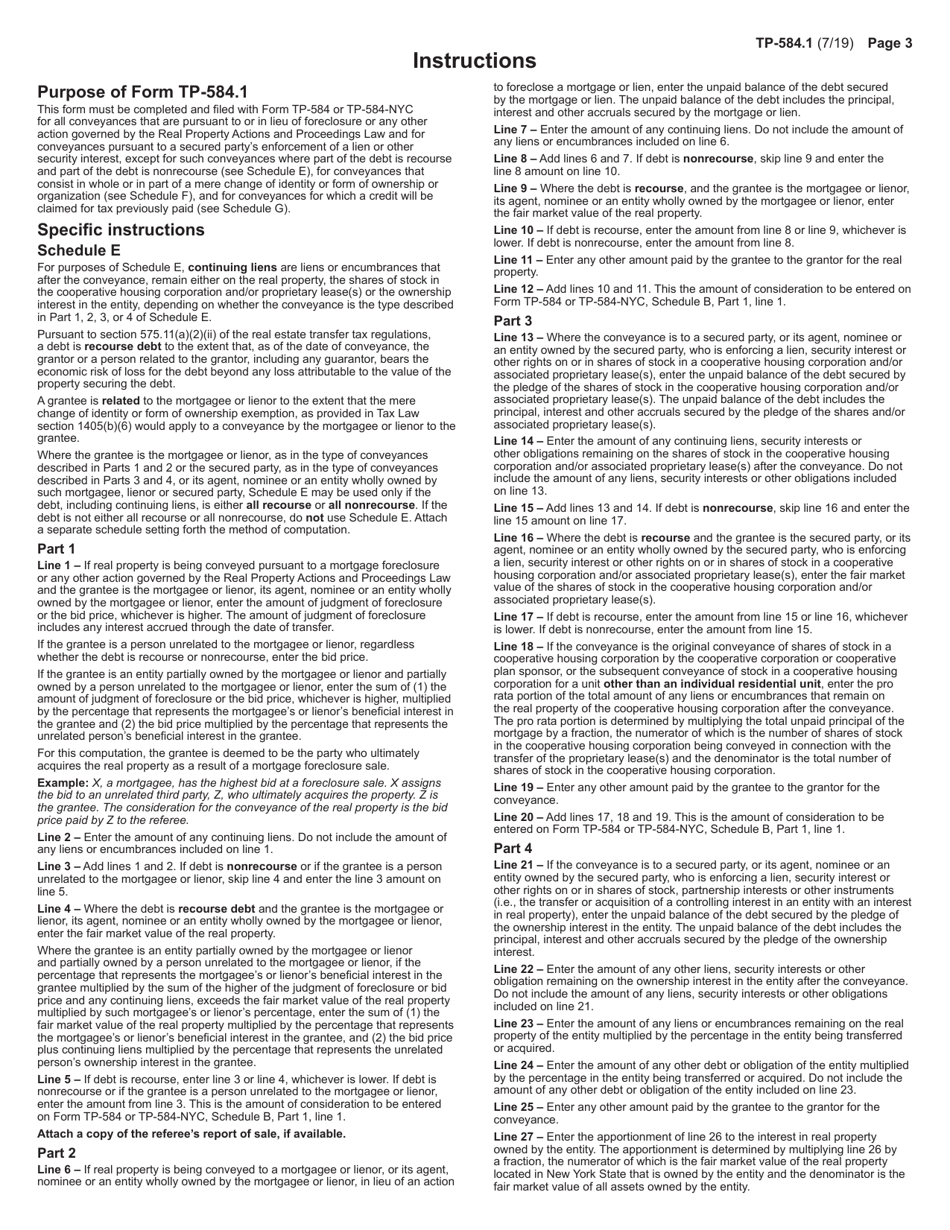

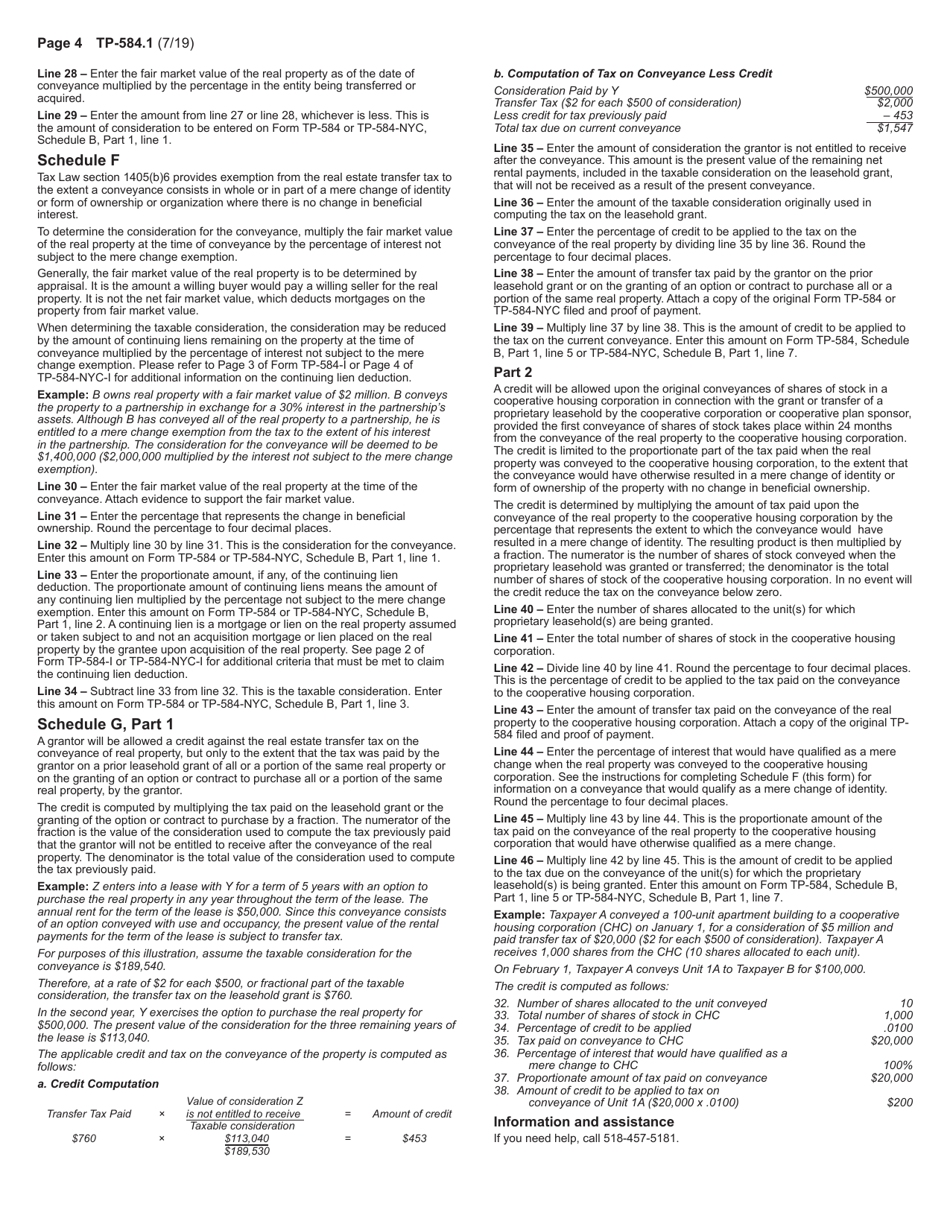

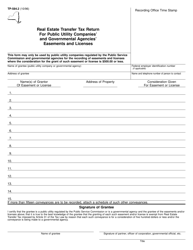

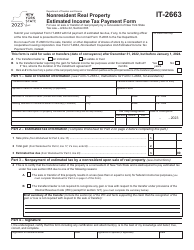

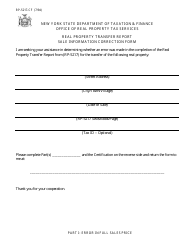

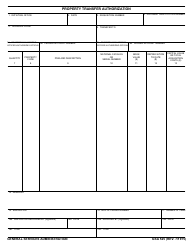

Form TP-584.1 Real Estate Transfer Tax Return Supplemental Schedules - New York

What Is Form TP-584.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-584.1?

A: Form TP-584.1 is a supplemental schedule for the Real Estate Transfer Tax Return in New York.

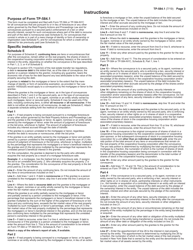

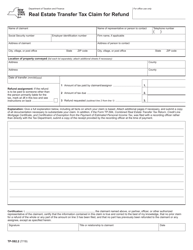

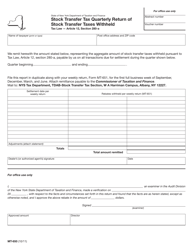

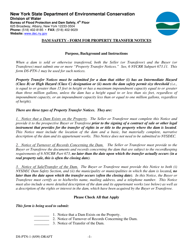

Q: When do I need to use Form TP-584.1?

A: You need to use Form TP-584.1 when filing the Real Estate Transfer Tax Return in New York and there are additional schedules or information you need to provide.

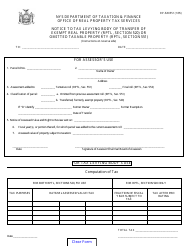

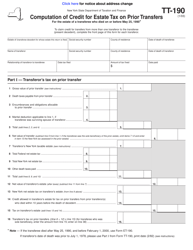

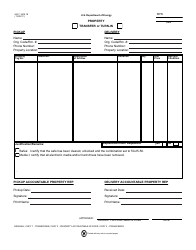

Q: What information is required on Form TP-584.1?

A: Form TP-584.1 requires you to provide details about any exemptions claimed, calculations of taxes due, and any other supplemental information as required.

Q: Is there a deadline for filing Form TP-584.1?

A: The deadline for filing Form TP-584.1 is the same as the deadline for filing the Real Estate Transfer Tax Return in New York, which is generally within 30 days of the transfer of property ownership.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TP-584.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.