This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form ST-131

for the current year.

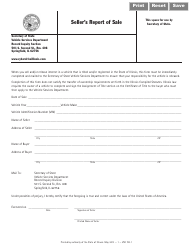

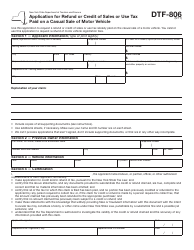

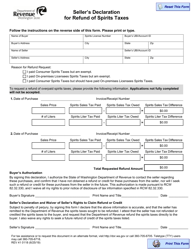

Instructions for Form ST-131 Seller's Report of Sales Tax Due on a Casual Sale - New York

This document contains official instructions for Form ST-131 , Seller's Report of Sales Tax Due on a Casual Sale - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

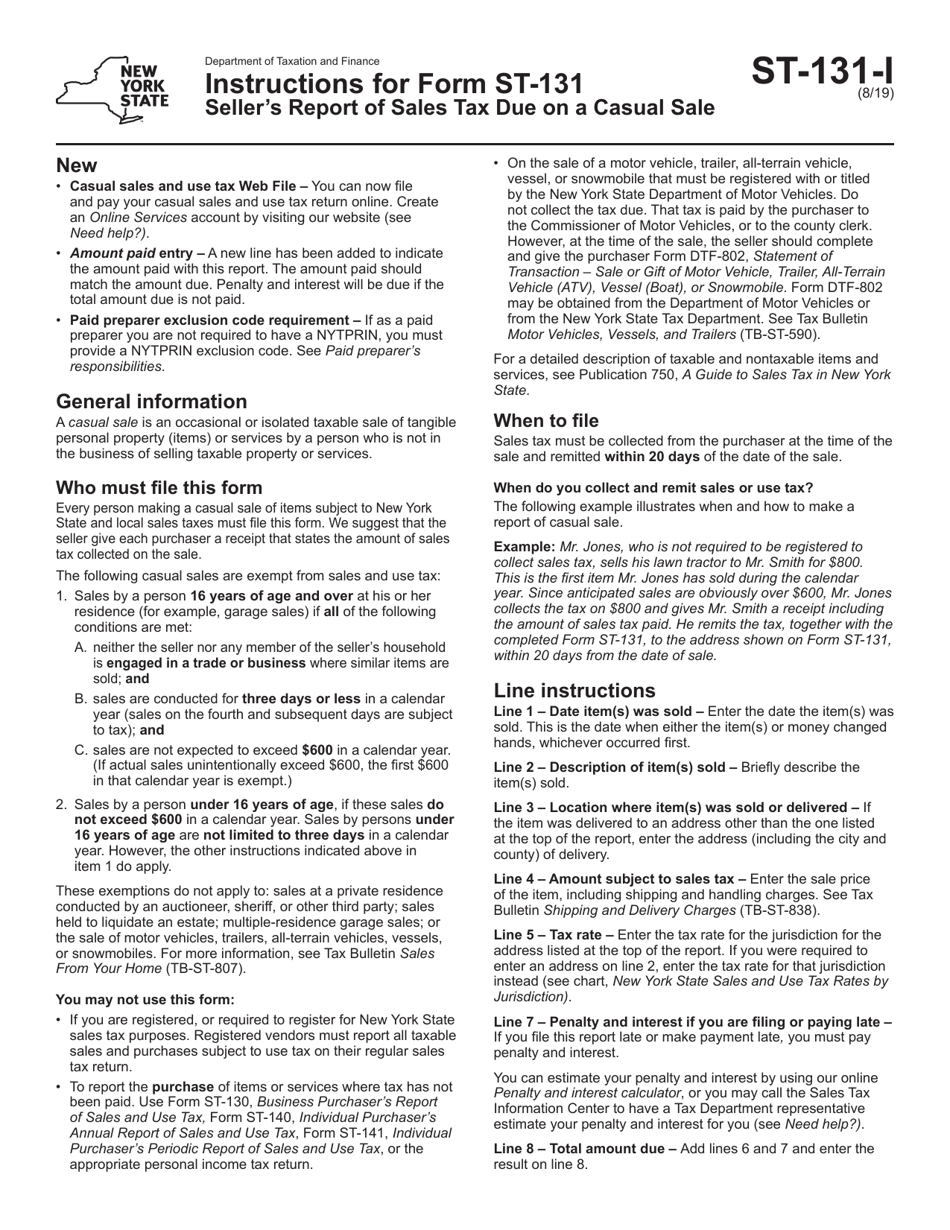

Q: What is Form ST-131?

A: Form ST-131 is the Seller's Report of Sales Tax Due on a Casual Sale in New York.

Q: Who needs to file this form?

A: Individuals or businesses who made a casual sale in New York and collected sales tax need to file Form ST-131.

Q: What is a casual sale?

A: A casual sale is a one-time or occasional sale of tangible personal property, not in the course of regular business.

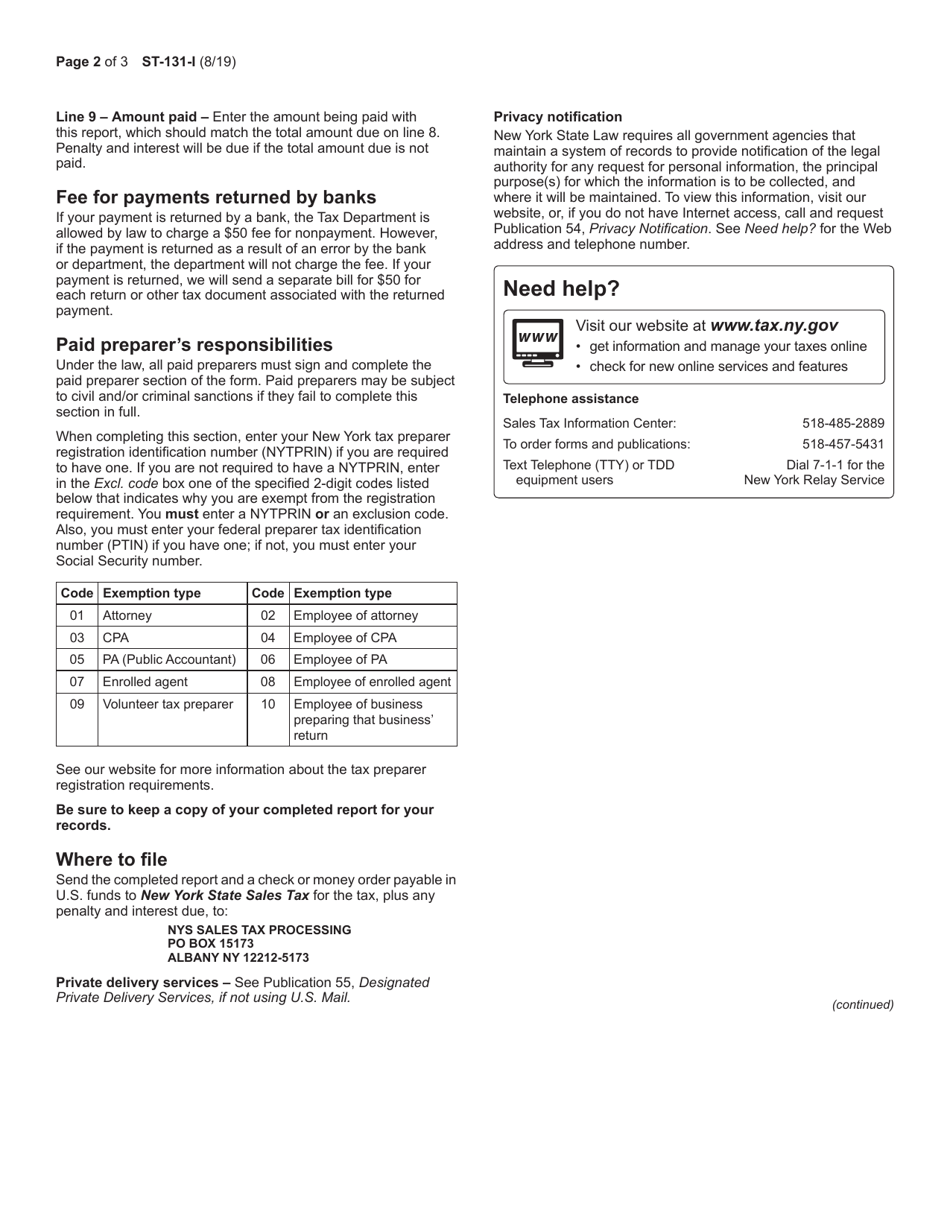

Q: What information is required on Form ST-131?

A: The form requires information such as the seller's name, address, date of sale, description of items sold, and total sales price.

Q: When is the deadline for filing this form?

A: Form ST-131 must be filed within 20 days of the casual sale.

Q: Is there a penalty for failing to file Form ST-131?

A: Yes, failure to file Form ST-131 or underreporting the sales tax due may result in penalties and interest.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.