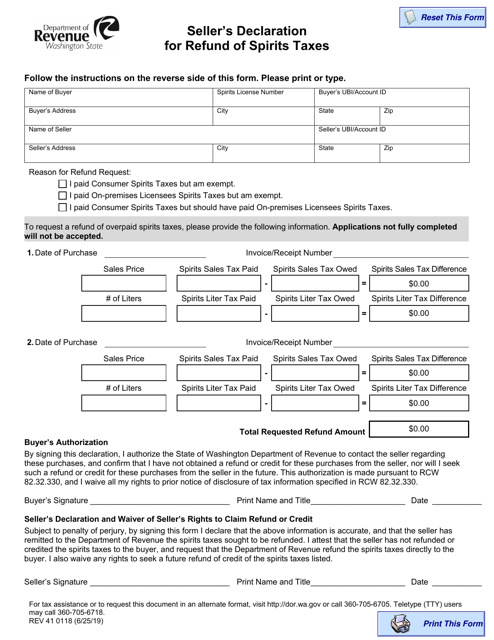

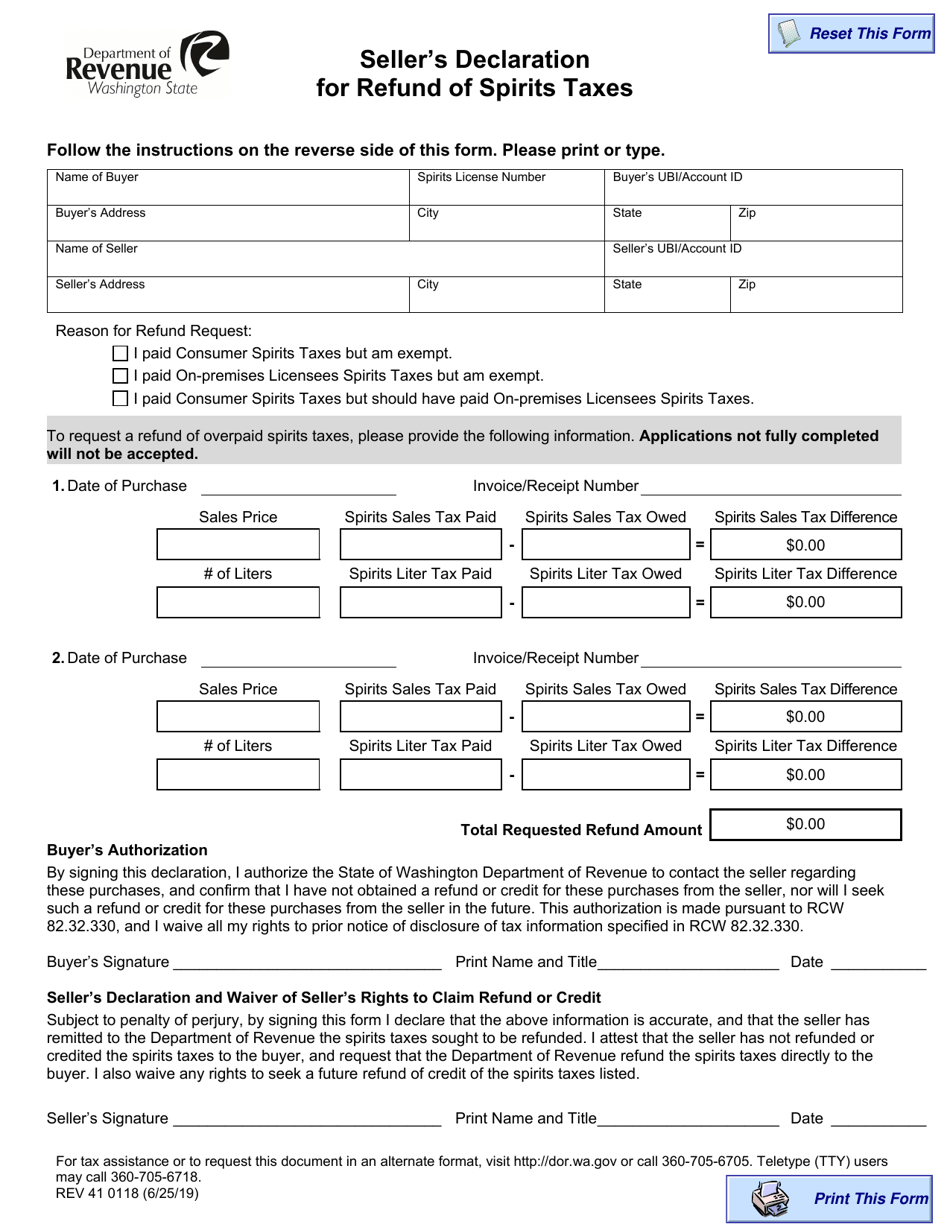

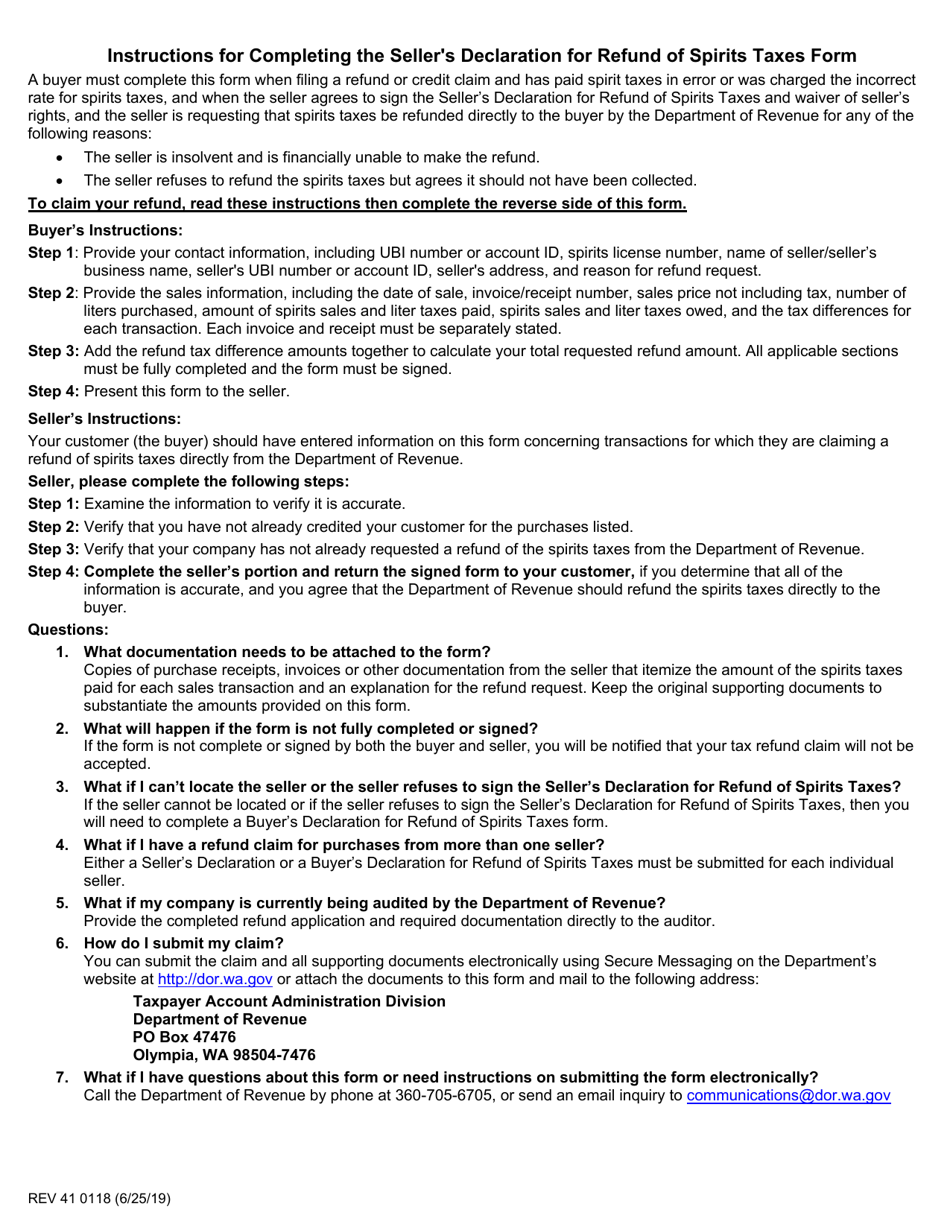

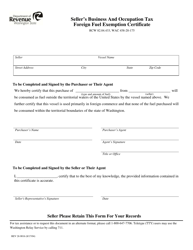

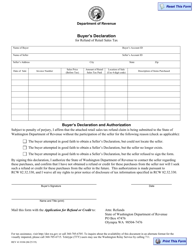

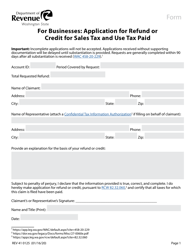

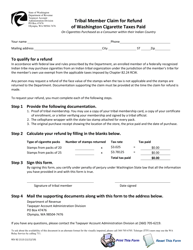

Form REV41 0118 Seller's Declaration for Refund of Spirits Taxes - Washington

What Is Form REV41 0118?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV41 0118?

A: Form REV41 0118 is the Seller's Declaration for Refund of Spirits Taxes in Washington.

Q: What is the purpose of Form REV41 0118?

A: The purpose of Form REV41 0118 is to request a refund of spirits taxes paid by a seller in Washington.

Q: Who needs to fill out Form REV41 0118?

A: Sellers who have paid spirits taxes in Washington may need to fill out Form REV41 0118 to request a refund.

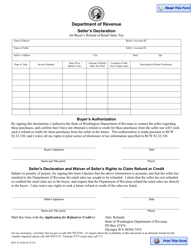

Q: What information is required on Form REV41 0118?

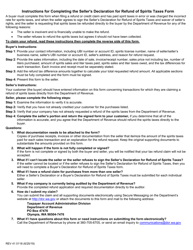

A: Form REV41 0118 requires information such as the seller's name and address, the amount of spirits taxes paid, and proof of payment.

Q: Are there any deadlines for submitting Form REV41 0118?

A: Yes, Form REV41 0118 must be submitted within three years from the due date of the spirits tax return.

Q: Is there a fee for filing Form REV41 0118?

A: No, there is no fee for filing Form REV41 0118.

Q: How long does it take to receive a refund after submitting Form REV41 0118?

A: The processing time for refund requests submitted through Form REV41 0118 can vary, but it generally takes several weeks.

Q: Who can I contact for more information about Form REV41 0118?

A: For more information about Form REV41 0118, you can contact the Washington State Department of Revenue.

Form Details:

- Released on June 25, 2019;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV41 0118 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.